In the second quarter of this year, share buybacks among S&P 500 companies grew to $112 billion as corporations finished with a record $1.03 trillion in cash sloshing around on their balance sheets. This buyback amount represented a 30% jump over Q1. In contrast, S&P 500 corporations paid out just $70 billion in cash dividends during the same period, an 11% growth rate over the prior quarter.

This preference for financial engineering over hiring, expansion, M&A, or dividend issuance has been in force for a while now.

And quite frankly, nothing could be less productive.

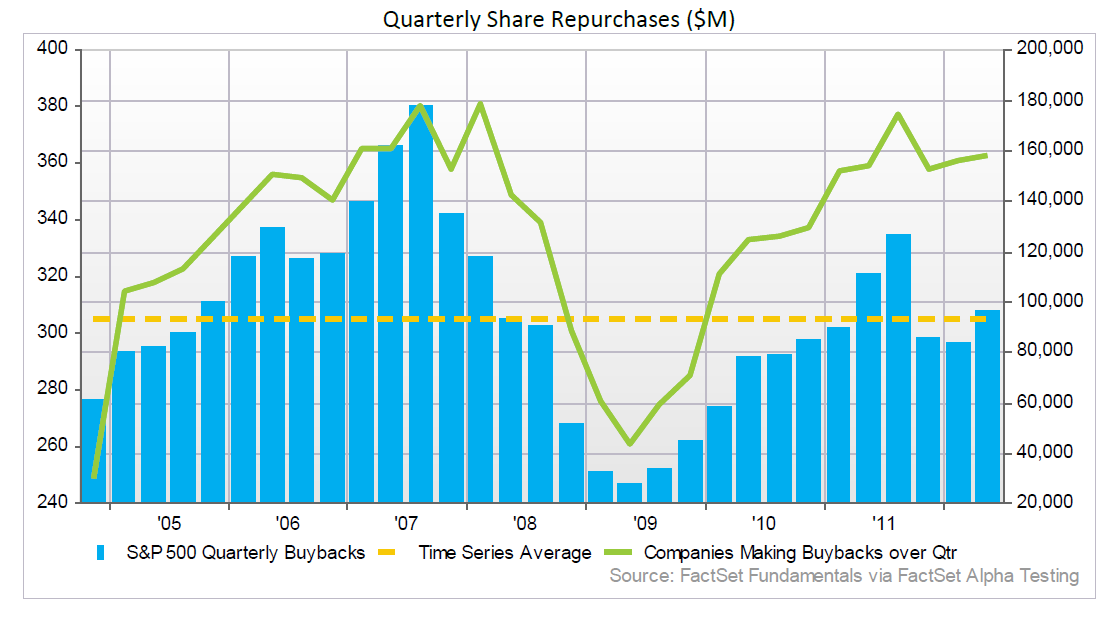

First, some perspective from FactSet:

Tom Keene had Fortuna Advisors’ Greg Milano on Bloomberg Radio this morning to get some straight answers about the lack of business investment occurring against the backdrop of corporate balance sheets brimming with cash. “Why aren’t the advisors to these companies telling them to reinvest all this cash?” Tom asked. Milano explains that you can “grow earnings per share” by simply having less shares to spread the profits among, so why not do that when there’s so much uncertainty? No one will fault you.

Of course, this is perfectly true and a tragic squandering of resources and opportunity. Because in climates of certainty, buybacks are a terrible waste of shareholders’ capital – in the feel-good atmosphere of certainty during 2007, US corporations spent half a trillion dollars buying their own shares back at all-time highs. We know how that looked a year later…

As to why the advisors are recommending buybacks over dividends, he explains that they get paid by their corporate clients to execute ongoing buybacks (presumably the shares are bought by the brokerage side of the advisor’s firm – long live the bulge bracket). An increased dividend pays the advisor’s firm zero dollars, hence the bias.

Share buybacks also reaccelerated in the 2nd quarter, coinciding with the first sense that business growth was starting to slow down. This should not be surprising – executives get paid and bonused based on many factors, profitability measures being chief among them. And so when organic profit becomes harder to come by, you see buybacks stepped up to take the pressure off. Eighty companies in the S&P 500 have reduced their outstanding shares by 4% or more through buybacks so far this year, according to S&P.

One other thing – executives use buybacks to offset compensation, they issue themselves shares or options, and then get the board to approve a stock buyback to counter the effect of dilution. If you’re asking yourself “wait, so buybacks can be used as a tool to transfer shareholder money to the executives?” then you’ve got it figured out, that’s exactly what they can be used for. And they often are.

No one should be surprised that cash-rich corporations (and their executives) are being risk-averse or thinking about short-term profit-boosting and self-gratification. Corporations are people, too, remember?

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/10/12/the-buyback-epidemic/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2012/10/12/the-buyback-epidemic/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2012/10/12/the-buyback-epidemic/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2012/10/12/the-buyback-epidemic/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/10/12/the-buyback-epidemic/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2012/10/12/the-buyback-epidemic/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/10/12/the-buyback-epidemic/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2012/10/12/the-buyback-epidemic/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2012/10/12/the-buyback-epidemic/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/10/12/the-buyback-epidemic/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/10/12/the-buyback-epidemic/ […]

… [Trackback]

[…] There you can find 9094 more Information on that Topic: thereformedbroker.com/2012/10/12/the-buyback-epidemic/ […]