I sat out the morning session of the Value Investing Congress for a combination of reasons, but primarily because I’m always swamped on Mondays with client service issues and the speakers I was excited about were coming later anyway. The shot above is of Whitney Tilson himself, taken from the press balcony in the Broadway Ballroom at Marriott Marquis. They parked us media types up here so we could clack away at our keyboards without disturbing the “beautiful minds” in attendance below.

Anyway, it’s 2pm, so let’s get into it…

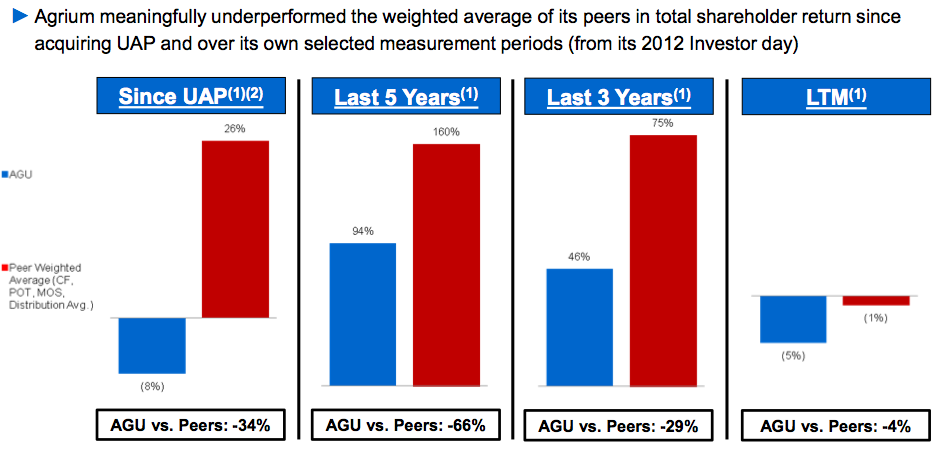

First up is Barry Rosenstein of the activist hedge fund JANA Partners. He’s pitching Canadian phosphate and nitrogen giant Agrium (AGU). First, although the stock has done well over the years, Barry reminds us that it’s underperformed a weighted average of its peers substantially.

From JANA’s presentation slide:

The basic problem here, according to JANA is that 30% of AGU’s business is retail, selling fertilizers and products in stores, versus the wholesale business which is 70%. AGU wants to remain a conglomerate, keeping both facets of the company together.

JANA argues that the retail side of the company is misunderstood by the non-retail oriented analysts who cover it and that this accounts for the lack of respect for the shares. They believe there is a ton of room for upside once these two businesses are separated. In particular, they see the retail business as a crown jewel if managed correctly and allowed to realize its full potential. “Despite spending billions to add scale, Retail has failed to achieve operating leverage promised from synergies, and has actually experienced negative operating leverage.”

Agrium has hired an investment banking team from Morgan Stanley to defend the company’s conglomerate structure. JANA dismisses this on the grounds that this exact same team of bankers made the opposite argument while working for CF Industries, a fertilizer rival, years ago. We are reminded of the words of Buffett – “an investment banker can be paid to say anything.” This should have been a laugh line but the crowd here is very stiff. Value guys, lol.

Rosenstein repeats that there is no commonality between the retail and wholesale business here, no benefits or synergies worth speaking of.

The most brutal data point is about JANA has estimated an excess of $700 million in mismanaged, misallocated working capital throughout the company’s structure. “lax working capital oversight encourages managers to risk shareholder capital on speculative ‘heads I win, tails you lose’ bets, where they can receive significant incentive compensation when inventory bets go right, and shareholders are the ones left holding the bill when bets go wrong.”

The bottom line is that retail discount needs to be addressed or a spin-off should happen. Also, the way this company spends money and allocates working capital must change and should be a lot more accountable to shareholders. JANA pegs the improvement to the stock price that would result as upwards of $50 per share. With the stock currently trading around $100 per share, that would be nothing to sneeze at.

For investors who want the whole dissection of why JANA wants Agrium broken up now, here’s their presentation:

***

Next up – Mick McGuire of four-year-old Marcato Capital Management. He’s pitching Alexander & Baldwin, Gencorp and Brookfield properties. Here’s Mick’s bio real quick:

Founder and Managing Member of Marcato Capital Management. Marcato manages a select number of passive and activist investments across all industries with a primary focus on opportunities in middle-market public equities. Prior to forming Marcato, Mick was with Pershing Square Capital Management. Mick has spent his entire career in private and public equity investing and holds an MBA from Harvard Business School and a Bachelor’s degree in Economics from Princeton University. He was also recently named by Institutional Investor as one of its 2012 Hedge Fund Rising Stars.

ALEX is a big real estate owner, specifically in Maui and throughout Hawaii. Mick notes that they’re carrying millions of square feet at an original cost basis dating back to the 1800’s!

He thinks the real estate held by the company – between mainland and on Hawaii – should be worth 13.50 per share ($900 million). This is roughly half the market cap currently, just in land and RE holdings – the stock is selling for $28.50 today. ALEX owns 20% of the land mass of Maui and 15% of the island of Kauai!

Bottom line: Maguire believes that ALEX is worth somewhere between $43 and $47 per share when you factor in the true value of their properties – a 50% return from these levels if realized.

Maguire also likes GenCorp (GY), a 9 dollar aerospace stock that happens to own 12,000 contiguous, developable acres around Sacramento, Calfornia, originally purchased in the 1950’s!

He also likes the business of GenCorp itself as well as many tax-advantaged aspects of its capital structure. On a free cash flow yield basis, he thinks the stock is worth 145% of its current value – $22 per share versus today’s 9!

His third and final stock idea is Brookfield Properties (BRP), also a play on raw land. Brookfield develops raw land which it then sells to homebuilders who build on it. The thesis is that homebuilding levels are still at unsustainably low levels, at a certain point, building must pick up and Brookfield’s land will have to appreciate. “Recent home starts have been very encouraging” but we are still far below historical levels.

Also, Brookfield’s Canadian properties (15% of their asset base) could be a huge kicker – 80% of their land in Canada is in and around oil-rich Alberta province.

Maguire notes that Brookfield has a longer “inventory runway” than other developers – 30 years worth. This means more flexibility with their capital, they don’t have to replenish at unfavorable prices. Also, it’s mostly raw land that they hold and old land at that, held at much lower carrying costs.

BRP is a straight up book value story, the older and lower-cost basis land will eventually be valued at higher levels, which will extend to the share price.

That’s it for the afternoon session, back later with the evening presentations!

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2012/10/01/notes-from-the-value-investing-congress/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/10/01/notes-from-the-value-investing-congress/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/10/01/notes-from-the-value-investing-congress/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2012/10/01/notes-from-the-value-investing-congress/ […]

… [Trackback]

[…] Here you can find 19686 more Information on that Topic: thereformedbroker.com/2012/10/01/notes-from-the-value-investing-congress/ […]