361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor.

361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors

361 Capital Weekly Research Briefing

September 10, 2012

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

________________________________________

Draghi’s bazooka caused the bears to run for the hills and rewarded risk investors with a great week of performance…

Mario Draghi said the ECB will make unlimited purchases of distressed EU sovereign debt. It will not be senior to other debt and will be sterilized. The goal is to lower the cost of borrowing for Spain and Italy and raise the yield on German sovereign debt modestly. This should help both regions. For the peripheral countries, the fiscal contraction will not have to be any more severe than needs be. For Germany (who already has sovereign yields more than 100 bps below what fundamentals would suggest) a steeper yield curve will help their banks further recapitalize. (ISI Group)

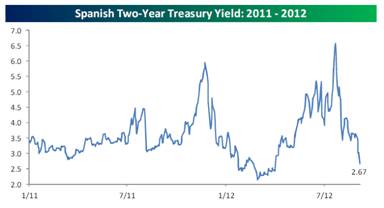

The Spanish 2 year yield collapses…

(Bespoke)

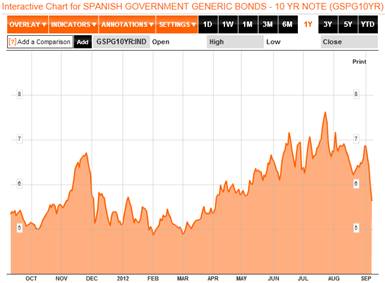

As does the Spanish 10 year yield…

(Bloomberg)

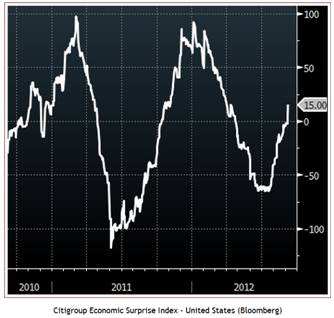

Meanwhile in the U.S., the economic surprises continue to edge positive…

(SoberLook)

Friday’s jobs data was disappointing but now guarantees more Fed stimulus in September…

• The unemployment rate dropped to 8.1% from 8.3%, but in this case with declines in both the labor force (-368,000) and the household-survey measure of employment (-119,000). With labor force participation falling back to a new cycle low of 63.5%, the drop in the unemployment rate should not be reported as good news.

• The jobs report for August was disappointing, with nonfarm payrolls expanding by only 96,000. Earnings were flat, and the average number of hours worked ticked lower. The unemployment rate fell to 8.1%, down from 8.3% in July, but it fell for the wrong reason– a decline in labor force participation. The jobs data appears roughly consistent with our forecast of a 1.5% annualized growth rate in third quarter GDP. For the Fed, that does not represent the “substantial and sustainable improvement” in activity they say is necessary to head off further monetary accommodation. Given Fed Chairman Bernanke’s dovish comments in his recent Jackson Hole speech and the disappointing jobs report, we now see a 70% chance that the Federal Open Market Committee (FOMC) will announce a third round of unsterilized quantitative easing (QE3) at its meeting on September 13. (UBS)

• “Today’s number increases our conviction in our existing Fed call which looks for the FOMC to engage in further asset purchases and to push back rate guidance at next week’s meeting…The weak pace of labor income growth will likely limit the pace of consumer spending, which in turn means continued unsatisfactory GDP growth.” (JPMorgan)

• We now expect the Fed will announce plans for a third round of asset purchases (colloquially known as “QE3”) at the FOMC meeting on September 12-13th. Previously they forecast QE3 late in 2012 when the current maturity extension program (“Twist 2”) was completed. However, comments by Chairman Bernanke at the Jackson Hole conference and weak ISM (49.6) and employment (96,000 jobs) data prompted a forecast change. The QE is anticipated to take the form of an open-ended asset purchase program of roughly $50 billion per month. We also expect the FOMC will adjust its forward guidance for the first hike in the Fed Funds rate from the “late 2014” to mid-2015 or beyond. (Goldman Sachs)

• In August, “more people went on the food-stamp program (173,000) than those who managed to find a job (96,000)” (Barron’s)

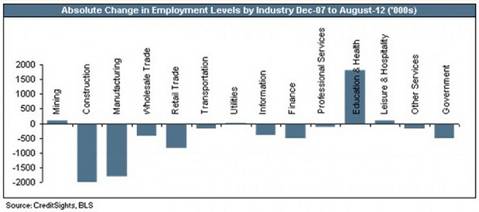

For the last 5 years, 90% of the job creation has been in the Education & Health sectors…

Adding fuel to central banks easing fires are disappointing outlooks by these 2 global players:

• Intel Corporation today announced that third-quarter revenue is expected to be below the company’s previous outlook as a result of weaker than expected demand in a challenging macroeconomic environment. The company now expects third-quarter revenue to be $13.2 billion, plus or minus $300 million, compared to the previous expectation of $13.8 billion to $14.8 billion. Relative to the prior forecast, the company is seeing customers reducing inventory in the supply chain versus the normal growth in third-quarter inventory; softness in the enterprise PC market segment; and slowing emerging market demand. The data center business is meeting expectations.

• FedEx lowered 1Q13 EPS guidance to $1.37-$1.43 from $1.45-$1.60 vs. street $1.56, with the explanation that “weakness in the global economy constrained revenue growth at FedEx Express more than expected in previous guidance.” (Bloomberg)

All this stimulus talk is music to the ears of Gold bugs…

With central banks remaining very accommodating, investors are pushing the risk envelope…

Yields on “junk”-rated corporate bonds reached their lowest point on record, according to Barclays. The Barclays High-Yield Index, a benchmark of below-investment-grade bonds that goes back to 1983, fell to a record low 6.6073% at Thursday’s close, marking a 0.13 percentage point drop in the past week. (WSJ)

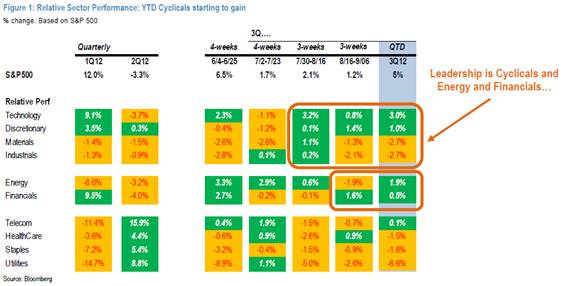

And in the equity markets, investors are diving for cyclicals which is a clear RISK ON move…

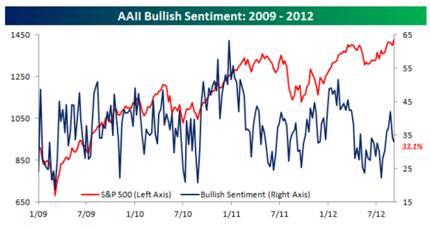

The scramble for equity risk has occurred as retail investors have been too defensive…

(Bespoke)

And Wall Street strategists (plus Hedge Funds) have been even more cautious…

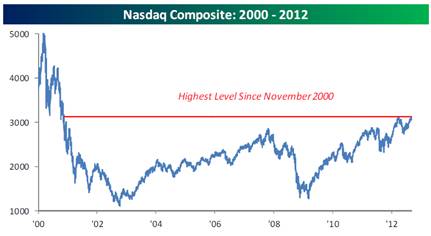

Climbing the ‘Wall of Worry’ has led the Nasdaq to a 12 year high…

From the financial crisis lows, $8 trillion in wealth has been recovered…

(ISI Group)

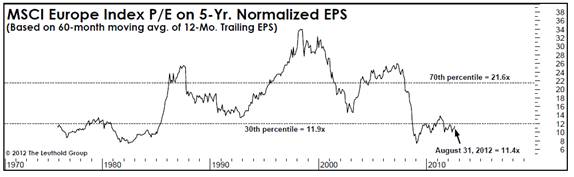

Assuming Draghi/ECB is successful in keeping the bears away from Spain and Italy, Europe looks cheap and will likely become the next hunting ground for large, global investors…

(The Leuthold Group)

Interesting ETF and Stock movers for the week…

Capacity continues to leave the banking industry. Difficult news for London & New York City…

One senior headhunter said many large investment banks will have “at least 20 percent” fewer staff in capital markets and M&A advisory business in Europe by the end of the year compared with late 2011. “It [the market] has never been as bad as this. Bankers have long lost confidence in their banks but now they are also losing their self-confidence, their mojo,” a senior advisory banker said. The Centre for Economics and Business Research will soon revise upwards its previous forecast that 25,000 jobs in the City of London will be cut this year, according to the consultancy’s economist Rob Harbron. This would take the number of banking jobs in Europe’s main hub for investment banks below 255,000, a level last seen in 1996. (FinancialTimes)

Stanford University is doing its best to eliminate the future student lending crisis…

Sixteen courses and two new platforms for interactive learning will highlight Stanford’s free online offerings this fall, with more to follow during winter and spring quarters. From cryptography to science writing, technology entrepreneurship, finance and a crash course in creativity, the courses are open to anyone with a computer, anywhere. As the number of Stanford online courses has grown, so too has the range of fields, which now include computer science, mathematics, linguistics, science writing, sociology and education. (NewsStanford)

While many parents and students ask themselves this question…

Promotional literature for colleges and student loans often speaks of debt as an “investment in yourself.” But an investment is supposed to generate income to pay off the loans. More than half of all recent graduates are unemployed or in jobs that do not require a degree and the amount of student-loan debt carried by households has more than quintupled since 1999. These graduates were told that a diploma was all they needed to succeed, but it won’t even get them out of the spare bedroom at Mom and Dad’s. For many, the most tangible result of their four years is the loan payments, which now averages hundreds of dollars a month on loan balances in the tens of thousands. (Newsweek)

A small town in R.I. leaves bankruptcy, but here is the impact:

• City employees now total 116, down from 174.

• The city’s only community center was shut, cutting 32 positions.

• The library was also closed, reopening later under nonprofit management.

• While positions were cut, base salaries rose. On average, city employees made $41,650 annually before the bankruptcy. Today, Central Falls employees earn an average base salary of $47,500. And they’ll get annual 2.5 percent raises for at least the next five years, said Gayle Corrigan, the receiver’s chief of staff.

• The city’s 133 retirees had their pensions cut by up to 55 percent, with pensioners now getting an average of $16,626 a year.

• …with the annual 4 percent property tax hikes through 2017, Central Falls expects its revenue collections to grow from $16.6 million in fiscal 2013 to $19.8 million in 2017.

(HuffingtonPost)

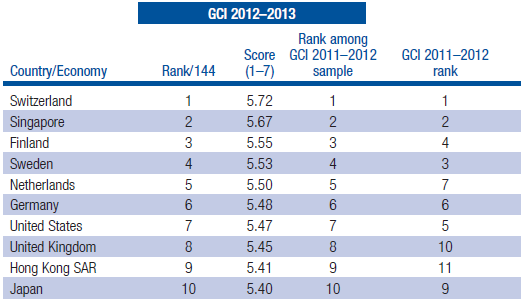

The U.S. continues its slide in global competitiveness falling 2 places to #7 in the newest World Economic Forum study…

U.S. Fiscal problems increasingly becoming the world’s problem…

U.S. tax increases and spending cuts set to take effect by the beginning of next year pose one of the biggest risks to the global economy, International Monetary Fund Managing Director Christine Lagarde said today. While Lagarde has warned about the U.S. fiscal situation before, this time she took her case directly to leaders attending the Asia-Pacific Economic Cooperation Summit in Vladivostok, Russia. She said the fiscal cliff was one of “three key risks” — the other two being the euro crisis and medium-term public financing. (Bloomberg)

Even the comedians are taking notice…

@denisleary: National debt now equals $160,000 per American family. Do you know what that means? Time for Ice Age 5, 6 and 7.

Found: football season inflation of 72%…

@darrenrovell: Buffalo Wild Wings is paying nearly $2 per pound for wings vs $1.16 a year ago (via @jonathanmaze). Chain doesn’t lock in prices.

Several memorable quotes from the DNC in Charlotte last week…

• “The American dream is not a sprint, or a marathon, but a relay.” (Julian Castro, Mayor of San Antonio)

• “Being asked to pay your fair share isn’t class warfare. It’spatriotism” (Newark mayor Cory Booker)

• “Success isn’t about how much money you make, it’s about the difference you make in people’s lives.” (Michelle Obama)

• “Never again will taxpayers foot the bill for Wall Street excesses.” (Chicago Mayor Rahm Emanuel)

• “President Obama started with a much weaker economy than I did. No president, not me, not any of my predecessors, could have repaired all of the damage he found in just four years.” (Former President Bill Clinton)

• “You elected me to tell you the truth. And the truth is, it will take more than a few years for us to solve challenges that have built up over decades.” (President Barack Obama)

The ‘Amazon Doctrine’ as explained by Jeff Bezos…

“We want to make money when people use our devices, not when they buy our devices.” (GeekWire)

For your inner geek…

“We definitely win the coolest job contest at cocktail parties,” said John Wright, 56, a Curiosity driver who had reported to work in a baseball cap, a T-shirt and shorts. “What do you do? Oh, you’re an investment banker? Isn’t that special,” Mr. Wright continued. “I drive on Mars.” (NYTimes)

Remember the first time that you met your hero?

@thecutch22: The look on this kids face reminds me to never take this game for granted. I Live For This (Pittsburgh Pirates outfielder Andrew McCutchen)

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] There you will find 5371 additional Info on that Topic: thereformedbroker.com/2012/09/11/361-capital-weekly-research-briefing-13/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2012/09/11/361-capital-weekly-research-briefing-13/ […]

… [Trackback]

[…] Here you can find 87253 additional Information on that Topic: thereformedbroker.com/2012/09/11/361-capital-weekly-research-briefing-13/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/09/11/361-capital-weekly-research-briefing-13/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/09/11/361-capital-weekly-research-briefing-13/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2012/09/11/361-capital-weekly-research-briefing-13/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/09/11/361-capital-weekly-research-briefing-13/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/09/11/361-capital-weekly-research-briefing-13/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/09/11/361-capital-weekly-research-briefing-13/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2012/09/11/361-capital-weekly-research-briefing-13/ […]

cialis soft tablet

Health

buy cialis with paypal

American health