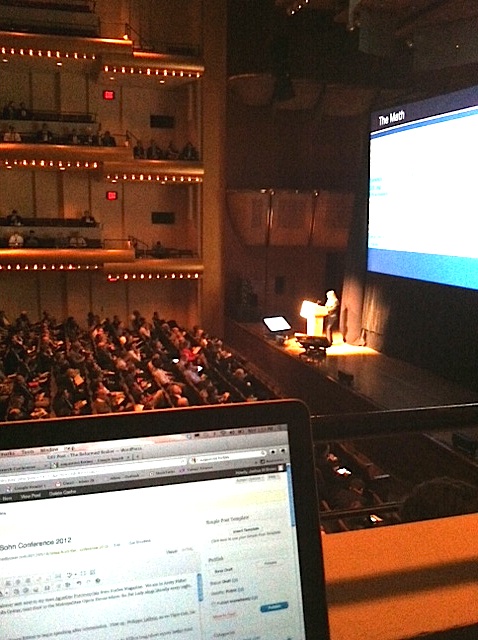

As I write, I am sitting in a balcony seat next to my man Agustino Fontevecchia from Forbes Magazine. We are in Avery Fisher Hall at the magnificent Lincoln Center, next door to the Metropolitan Opera House where the Fat Lady sings literally every night. Check out Daddy’s view:

So I got here just in time for the heavy hitters to begin speaking after intermission. My notes below encompass the afternoon session. I’ll be gone before the evening speakers go on so hit me with links below if you find any good coverage.

First up, Philippe Laffont, an ex-Tiger Cub, his official bio here:

PHILIPPE LAFFONT is the founder and portfolio manager of Coatue Management, a $5 billion long/short equity hedge fund focused on the global technology, media and telecommunications industries.

His first idea is Equinix (EQIX), a datacenter play. He explains how the web is simply too slow, one example is that a 1 second delay on the Amazon shopping cart at checkout means $5 billion in lost revenue.

Equinix has the equivalent of “beachfront property” in terms of where thier datacenters are geographically located.

$1.5 billion in revenues, should double in the next few years and a triple in EBITDA.

This company is solving the problem at the core of the internet.

Now the problem at the edge of the internet – our homes…

The bandwidth is clogged with movies, online games, multiple users on the same WiFi connection. This will only get worse with HD movies and more downloads, streams and devices.

The pick is Virgin Media – 22 a share, $6 billion market cap. Cable is the best for bandwidth.

Hitting the S-curve now in terms of broadband users.

Virgin ($VMED) has 20% ROE. The thesis is that the company will have the capacity to buyback almost all of their shares based on its balance sheet. VMED will generate have the ability to generate the FCF to take out the entire public float.

***

Next up, energy maven and turnaround artist John Wilder:

JOHN WILDER is Chairman of Bluescape Resources, a company with investments as well as energy operations in the US and Italy. Mr. Wilder’s prior achievements include spearheading two of the energy industry’s most successful financial and operational turnarounds (TXU and Entergy).

John has an adorable Texas drawl and he’s here to talk about natural gas. His slides have an insane amount of data packed in on them, I’m cross-eyed.

“What’s happened to demand?” 25 years ago, demand for natural gas was 55bcf a day, now 60 bcf a day. Flatline.

Nat gas is the least correlated to GDP of all the energy commodities.

The price of nat gas should recover to coal substitute pricing in the next 3 years and possibly even a premium.

Marcellus Shale is soaking up any of the depletion value that would normally occur as conventional wells dry up.

132,650 locations are high yield gas plays – “the next ten years of supply is taken care of already.”

What are the implications? Nat gas vehicles will never make a material impact in nat gas prices, infrastructure takes forever in the energy industry. Investments should be made based on long-term low nat gas prices, even at today’s prices it is still overvalued relative to supply.

***

I just want to take a quick break to say that I can’t remember the last time my hair was this bangin’ –

***

Here’s Gundlach! I’ve watched, blogged and internalized almost every one of Jefferey’s presentations over the last year or so, so I have a pretty good idea of what we’re in for here…

JEFFREY GUNDLACH is the CEO and CIO of DoubleLine Capital, named the “Fastest growing Start-Up Company in 25 years” by Strategic Insight. Mr. Gundlach oversees over $25 billion in assets at the firm and is recognized as a leading expert in mortgage-backed securities and asset allocation.

Gundlach opens with a massive portrait of Karl Marx behind him. Pink tie, pocket square, like a bawse.

Bull markets are about cooperation. But non-cooperation is the order of the day.

The buildup of debt worldwide took place over years, now the market has decided that this is a problem in real-time.

He hints at the potential for revolt by the unemployed youth in Spain.

Trainwreck pictures in his slides, The Scream painting, this is a shitshow! He says Munch, who painted The Scream, lived next to an insane asylum at the time.

Geithner is gibberish.

“The French want change but only under the condition that nothing changes for them.”

He goes off on the advertising in the media, cigarette ads, the American Dream, credit cards, parallels to the message from politicians. People are laughing their asses off.

Anti-Obama slide draws a standing ovation. This place is 6 grand a ticket, y’all know what’s up.

Debt ceiling has been turned into a gimmick. Curve of the limit and the amount of debt identical, not a coincidence.

Jeffrey’s Longs: IBEX, 1 Year Libor 10X, Nat Gas, Hundred $ Bills

Jeffrey’s Shorts: SPX, Nordstroms, Apple, 2 Year Swaps 50X

Abusing TV talking heads: They did pole vaults on how high Apple can go, did the limbo about how low nat gas can go (one guys said Zero).

Charts of the S&P 500, JW Nordstrom’s “look like death”

***

And now, the most anticipated speaker of the day, you know him and love as the Man Who Almost Owned the Mets, the unraveler of the Lehman Brothers Empire, the Destroyer of Green Mountain Coffee – David Eeeeeeeeiiiiiiiinhorrrrrrn:

DAVID EINHORN is president of Greenlight Capital, Inc., which he co-founded in 1996. Greenlight Capital is a value-oriented investment advisor whose goal is to achieve high absolute rates of return while minimizing the risk of capital loss.

Martin Marietta ($MLM): A strange stock, cyclical business. At a 35 PE, market is wrong to pay up. The company is trying to buy Vulcan, it’s not going well. CEO is a megalomaniac, losing his mind.

France is a mess, huge exposure to Italy and Spain. CDS and bonds are mispricing how risky France is. “A return to the Franc is not out of the question.

Inexplicably, Einhorn just pulled out a magic wand and chanted something Norwegian like a spell.

Norway looks rock solid.

Cairn (based in Scotland)- trading at a discount to its global holdings. Drilling in Greenland, potential could be huge. 20% discount right now.

China: Culture gap and knowledge gap. Greenlight visited China. China views western investors as marks. Chinese infrastructure overbuilt based on overly bullish projections, the roads are empty, the houses are unsold.

There is not enough money coming into the Chinese banks, they are becoming illiquid and money is moving out. “I’m not missing out by not investing in China.”

Japan is now a D-List Country, adult diapers outsold baby diapers this year for the first time ever. The Yen could be in big trouble.

Japanese retail investors own 9% of US REITS, they are desperate for yield. He sees a big problem brewing for US REITs as Japanese money stops coming in, they are expensive.

Facebook gets panned on valuation.

Then an offhanded dig at Green Mountain’s unsold inventory levels.

On Amazon: Operating profits haven’t grown at all, they’ve taken $30 billion in profitless revenues away from other retailers.

Dick’s sporting goods is in big trouble with Amazon’s new push into the category.

On US Steel: Lost money in 9 of the last 13 quarters. Slowing Chinese economy and iron ore supply growth means big trouble for $X

On Apple: Hedge funds own less than 5% of Apple’s shares. THEY ARE UNDERWEIGHT. There is no reason why AAPL can’t become a trillion dollar market cap. There is no prohibition.

Apple is a software company, not a hardware company. They capture customers, making them worth a higher multiple than traditional hardware stocks. Still penetrating the market, gaining share, most cellphones are not yet smartphones. How could this stock have a below market multiple?

He wants $AAPL to launch a preferred class to pay high income. It’s a very new idea the way he’d structure it.

***

That’s it for me, hope this was helpful/interesting!

[…] The Ira Sohn Annual Investment Conference usually is interesting. You can read a summary of the major presentations here. […]

… [Trackback]

[…] Here you can find 28555 more Information on that Topic: thereformedbroker.com/2012/05/16/notes-from-the-ira-sohn-conference-2012/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/05/16/notes-from-the-ira-sohn-conference-2012/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/05/16/notes-from-the-ira-sohn-conference-2012/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/05/16/notes-from-the-ira-sohn-conference-2012/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2012/05/16/notes-from-the-ira-sohn-conference-2012/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2012/05/16/notes-from-the-ira-sohn-conference-2012/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2012/05/16/notes-from-the-ira-sohn-conference-2012/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2012/05/16/notes-from-the-ira-sohn-conference-2012/ […]

… [Trackback]

[…] There you can find 92652 additional Info to that Topic: thereformedbroker.com/2012/05/16/notes-from-the-ira-sohn-conference-2012/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/05/16/notes-from-the-ira-sohn-conference-2012/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2012/05/16/notes-from-the-ira-sohn-conference-2012/ […]