I don’t have a great theory on this, other than maybe the online editors are younger and less curmudgeonly? I know that sounds silly…

But yes, it turns out that Barron’s online stock ideas lean more bullish than bearish by a wide margin. The anonymous blogger at Wall Street Rant picked up on this and dug deeper:

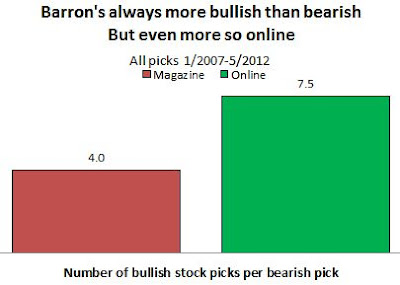

As you can see in the chart below, in Barron’s magazine they wrote about 4 stocks favorably for every 1 stock they wrote about critically. However, online that ratio jumped up to 7.5 to 1.

Since 2007, Barron’s documented 718 stocks which they wrote about in their magazine either “favorably” or “critically” (they categorize them as bullish or bearish). Only 144 were “bearish”. Meanwhile,they documented a total of 782 stocks online…..but only 92 of those were “bearish”. You can see below how this disparity has grown over the last 3 years (only in 2009 was the magazine more bullish than online). Of the 42 online picks since 2011…only 2 were “bearish” and there have been none this year.

Josh here – Do positive stock articles lead to more clicking? Can it be a coincidence? And so what if the picks online are are bullish, what if they’re worthwhile? And what decides whether or not a story makes the print version versus just the site/app?

I don’t have the answers to these questions, haven’t thought much about them either – which is weird because Barron’s is my favorite market-related publication and the only one I pay for.

Source:

Why is Barron’s More Bullish Online Than in Print (Wall Street Rant)

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2012/05/13/why-is-barrons-more-bullish-online-then-in-print/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2012/05/13/why-is-barrons-more-bullish-online-then-in-print/ […]

… [Trackback]

[…] There you will find 24367 additional Information on that Topic: thereformedbroker.com/2012/05/13/why-is-barrons-more-bullish-online-then-in-print/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/05/13/why-is-barrons-more-bullish-online-then-in-print/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/05/13/why-is-barrons-more-bullish-online-then-in-print/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2012/05/13/why-is-barrons-more-bullish-online-then-in-print/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2012/05/13/why-is-barrons-more-bullish-online-then-in-print/ […]

… [Trackback]

[…] There you will find 96816 more Info on that Topic: thereformedbroker.com/2012/05/13/why-is-barrons-more-bullish-online-then-in-print/ […]

… [Trackback]

[…] Here you will find 9401 more Info to that Topic: thereformedbroker.com/2012/05/13/why-is-barrons-more-bullish-online-then-in-print/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/05/13/why-is-barrons-more-bullish-online-then-in-print/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/05/13/why-is-barrons-more-bullish-online-then-in-print/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/05/13/why-is-barrons-more-bullish-online-then-in-print/ […]