Last week I updated my Investment Fads and Themes chart to include 2011. You can see it here:

Investment Fads and Themes, 1996-2011

I’ve been asked to look out into 2012 and offer some ideas as to what may become the dominant themes of 2012. Here are three themes that I think could be big ones for investors next year…

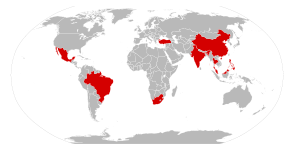

The Return of EM – Emerging Markets (EM) stocks have been slaughtered in 2011, the MSCI EM index is down 22% versus a flat S&P. Some of this weakness can be attributed to European-driven slowdown fears (investors fled what they believed to be riskier markets), some attributed to tighter interest rate and lending policies as EM  countries worked to stave off inflation. EM stocks are now trading at a 35% discount to their mean price-to-earnings ratio going back 15 years. Weak holders have been wiped out and so have valuation premiums. EM countries from China to Brazil are now back in easing mode, with an interest rate cutting cycle just begun. The last three times EM countries began to cut (2003, 2005, 2008) represented incredible opportunities to get long. In 2012, big money will say, “let me get this straight, I can buy stocks in countries with higher growth rates and better fundamentals and pay the same multiples as I do for crumbling, past-their-prime developed market stocks? Where do I sign up?”

countries worked to stave off inflation. EM stocks are now trading at a 35% discount to their mean price-to-earnings ratio going back 15 years. Weak holders have been wiped out and so have valuation premiums. EM countries from China to Brazil are now back in easing mode, with an interest rate cutting cycle just begun. The last three times EM countries began to cut (2003, 2005, 2008) represented incredible opportunities to get long. In 2012, big money will say, “let me get this straight, I can buy stocks in countries with higher growth rates and better fundamentals and pay the same multiples as I do for crumbling, past-their-prime developed market stocks? Where do I sign up?”

What to Expect: A scattered emerging markets investing environment in which investors put the BRICs concept on ice. Instead, the focus will be at the country level rather than just blindly owning the “Big Four” of Brazil, Russia, India, China. MENA will make a comeback just as almost all of the investment banks have pulled back on research in the Middle East/North Africa region. Eastern Europe will substantially outperform Western (or old) Europe. Latin American markets will begin trading more on their own internal fundamentals and less on the influence of the Chinese economy.

***

Actively Managed ETFs – The next big thing for the ETF industry will be the new wave of actively managed ETFs. There is a new crop of exchange traded funds that allow investors to simply buy a manager or strategy, whether it’s a proven asset allocation specialist or a manager known for making macro bets or someone who is actively hedging on the portfolio’s behalf. The biggest actively managed ETF comes from Meb Faber who runs the Cambria Global Tactical ETF (GTAA), it’s already raised $170  million in its first year giving traditional actively managed mutual funds a run for their money. You’ll know I have this call right when we see large mutual fund companies bring versions of their active strategies to an ETF wrapper. Pimco has already filed to do so for their Total Return fund – the largest mutual fund in the world ($300 billion in AUM). The mutual fund wrapper will die as active ETFs become the lower-cost and easier to buy and sell weapon of choice, this is the year the barbarians break down the walls of Rome.

million in its first year giving traditional actively managed mutual funds a run for their money. You’ll know I have this call right when we see large mutual fund companies bring versions of their active strategies to an ETF wrapper. Pimco has already filed to do so for their Total Return fund – the largest mutual fund in the world ($300 billion in AUM). The mutual fund wrapper will die as active ETFs become the lower-cost and easier to buy and sell weapon of choice, this is the year the barbarians break down the walls of Rome.

What to Expect: Active ETF leader AdvisorShares launches a plethora of new products into the market place as larger ETF companies jump in to the space with new offerings of their own. Large mutual fund families rush to market with ETF versions of their own active funds, reluctantly at first. “Celebrity” funds begin to roll out; don’t be surprised to see a Mad Money ETF run based on Jim Cramer’s buys and sells, for example.

***

Income Worship – There were two main trends playing out in 2011, risk on risk off (wherein investors sought to time the market based on currency moves or Euro headlines) as well as dividend stocks (where investors discovered that if they were to accept a bit more volatility in their porttolios, they could supplement the paltry yield on  bonds with the tax-advantaged dividend income of defensive stocks). I believe that the big lesson of the past year is that market timing, for most investors, was a fools game. With almost daily 200-point swings in both directions, many investors who chose to get in and out ended up doing little more than whipsawing themselves in the end. The market ended flat after months of persistent, record volatility and now investors are watching as many dividend-paying stocks break out to new multi-year highs, regardless of political turmoil here and abroad. A portfolio of unsexy but high-yielding utilities (up 14% year-to-date) and consumer defensives (up 11.3% year-to-date) trounced the market and investors are now paying attention. The lesson they will take away into 2012 is that you can buy and hold, but only if some kind of current income (in the form of MLP distributions or common stock dividends) is part of your return expectations.

bonds with the tax-advantaged dividend income of defensive stocks). I believe that the big lesson of the past year is that market timing, for most investors, was a fools game. With almost daily 200-point swings in both directions, many investors who chose to get in and out ended up doing little more than whipsawing themselves in the end. The market ended flat after months of persistent, record volatility and now investors are watching as many dividend-paying stocks break out to new multi-year highs, regardless of political turmoil here and abroad. A portfolio of unsexy but high-yielding utilities (up 14% year-to-date) and consumer defensives (up 11.3% year-to-date) trounced the market and investors are now paying attention. The lesson they will take away into 2012 is that you can buy and hold, but only if some kind of current income (in the form of MLP distributions or common stock dividends) is part of your return expectations.

What to Expect: A host of marketing campaigns and new product launches geared toward dividend seekers. A larger focus on dividends by cash-rich public company managers as opposed to the buyback mania of 2011. Companies that pay dividends and are capable of raising their payouts going forward begin to earn a premium multiple over companies that cannot. Microsoft, Intel and Cisco outperform Apple and Google, as proof of this concept.

***

What do you think the big trends of 2012 will be?

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2011/12/11/three-investment-themes-for-2012/ […]