Before reading another word, please ask yourself if you’re capable of being an adult and not just blindly trading based on what’s written here. Nothing on this site should ever be considered a blanket inducement to make investments.

OK, now that the children are gone, we can continue.

Last night on Fast Money, I mentioned Cameco (CCJ) for the Final Trade segment. It’s a fairly big name but many of my friends on The Street pinged me to say they’d never heard of it.

Last night on Fast Money, I mentioned Cameco (CCJ) for the Final Trade segment. It’s a fairly big name but many of my friends on The Street pinged me to say they’d never heard of it.

I’m going to give you some insight into why I’ve gotten extremely bullish on the Uranium Trade for 2011. Please keep in mind that any opinions expressed here are subject to change without notice and that I’m not your advisor or broker – I am simply giving you some background on a theme I’m very excited about.

Before I talk stocks, I want to give you some background on the supply/demand picture for uranium itself, because the setup here is delicious. We’ll let Barron’s Roundtable legend Felix Zulauf do the talking first, this excerpt comes from his 2011 outlook in which uranium played a starring role:

My next recommendation is in energy, because the rise of emerging economies also leads to rising energy demand. Electricity demand probably will double in emerging markets in the next 20 years. I would buy uranium. It is used to power nuclear plants, and it is used for medical diagnoses and research. There are 441 nuclear reactors operating in the world. They require 185 million ounces of uranium per year. There are 331 proposals to build new reactors. Fifty-eight new reactors are under construction, up from 52 a year ago, and 148 reactors are planned, including 110 that will come onstream in the next 10 years. Twenty reactors will be shut down. The demand side looks solid for many years.

Uranium production is growing, but slowly. Annual production is 47,000 tons. It meets only 60% of demand; the rest is met from utility stockpiles or decommissioned nuclear weapons. Production will increase over time, but it could take 10 years or more until it is sufficient to meet demand.

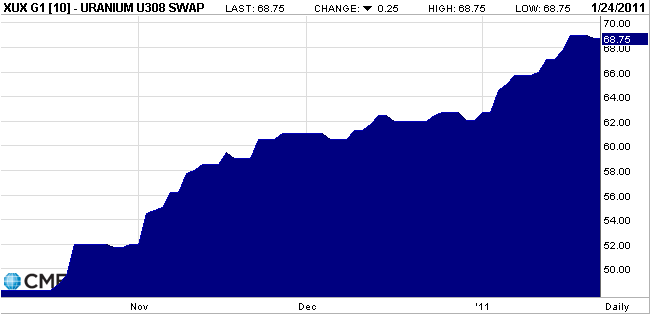

Uranium prices have soared to the $68 per pound level on the recognition of a few things…

1. China is poised to become the biggest nuclear power nation in the world, taking out about a third of the world’s uranium supply this year. India is expected to be very close behind.

2. Most of the major suppliers of uranium went out of business or disappeared in the 90’s and 00’s. This sets up remaining miners in a similar position as the steel companies found themselves in at the middle of the last decade – poised to see explosive demand growth for whatever they could put out.

3. Uranium still has a long way to go price-wise versus many other commodities that are at or near all-time highs right now. UXC spot prices hit 138 (double the current price) in 2007.

4. For years, uranium demand has been sated by a combination of mining and the purchase of HEU atomic material from old Russian nukes. That supply source is petering out just as traditional production costs are rising rapidly.

For these reasons, spot uranium prices are up something like 70% since June of last year. Have a look at the February uranium contract over just the last 90 days:

Now here’s the fun part:

Most of the analysts who cover uranium companies are not energy analysts, they are metals and mining analysts, so they don’t necessarily see what’s coming – this is our edge as generalists who are watching all the pieces moving from 5000 feet in the air.

There are very few pure-plays. There are about ten public companies/vehicles I’ve identified that may work. One of them is a relatively new (November 2010) ETF called Global X Uranium, the ticker is $URA. It is not very diversified because of how narrow the field of names is that it has to work with. It does manage to have exposure to almost all of them, however.

The company that I will highlight here is Cameco ($CCJ) – sometimes referred to as The Saudi Arabia of Uranium. If you’re interested in the space, you’ll want to get to know this company before looking at the little guys, if only to learn more about the industry. Cameco is one of the two largest producers of uranium in the world. They own and operate the world’s two richest mines in Saskatchewan. They are also one of the only companies that can buy the Russian stuff and degrade it down for power plant use.

CCJ is a $15 billion market cap, pays a modest dividend and is looking to do over $2 billion in revenues this year. The earnings estimate consensus is around $1.40 or so up from 94 cents in 2010.

The catalyst for Cameco is that as prices rise and the company’s long-term supply contracts expire, their buyers will re-up at higher prices for uranium. This could expand margins and, by extension, profits. In the meantime, Cameco’s irreplaceable assets remind me a lot of what Potash ($POT) has had all these years – I love wide moats and this moat is downright radioactive.

Technically-speaking, CCJ is in somewhat of a no-man’s-land right now (see 3-year chart with 50 day moving average and support/resistance lines above). The stock broke out at 32, ran into resistance in the low 40’s and backed off a bit. It is not necessarily at support but could certainly make another run at the 42-44 resistance level. This is a long-term resistance line so if taken out, the action could get very interesting. That said, I am also aware that there could be a pullback and retest at 32, so I am giving myself room to add at those levels if necessary.

There are smaller companies that are even more highly levered to both the price of uranium and the increase in usage/plant construction. I’m nibbling at a few but Cameco is my preferred method to get exposure until I’ve done more work on these names.

There are many factors that will move these stocks including macroeconomic data and the volatility of energy prices. You are advised to do your own homework before plunging in here.

[…] My 2011 Uranium Trade The Reformed Broker […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2011/01/27/my-2011-uranium-trade/ […]

… [Trackback]

[…] Here you will find 14907 more Information on that Topic: thereformedbroker.com/2011/01/27/my-2011-uranium-trade/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2011/01/27/my-2011-uranium-trade/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2011/01/27/my-2011-uranium-trade/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2011/01/27/my-2011-uranium-trade/ […]

… [Trackback]

[…] Here you can find 4606 additional Info on that Topic: thereformedbroker.com/2011/01/27/my-2011-uranium-trade/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2011/01/27/my-2011-uranium-trade/ […]