Josh here – I’ve known Brendan Ahearn for almost five years now and when he joined the ETF firm Kraneshares, last year I was really excited to hear about their plans.

The general idea behind Kraneshares was to launch innovative and exciting products related to the massive investment opportunities of China. While the majority of US investors had been getting their exposure to China through traditional indexes, they were missing a lot of what made the trade so alluring. The typical mutual fund or ETF weighting to the Chinese market involves either Hong Kong-traded equities or shares in the gigantic state-owned enterprises that aren’t very representative of the opportunity at all. Brendan and his partners at Kraneshares have been rolling out ETFs with a variety of different China index exposures that they believe to offer a superior vehicle for playing the theme.

This winter, Kraneshares launched a first-of-its-kind fund that seeks to emulate the Chinese money market funds that have been so popular with investors in-country. Unlike here in the US (and around most developed countries), Chinese investors actually get a return on their money market funds. As a possible solution for the near zero-yield returns that US investors are seeing on their cash, Kraneshares launched the first-ever commercial paper ETF under the ticker symbol KCNY on the NYSE. It’s a highly unique product that requires some due diligence to understand, of course, and it may not be for everyone. Because I find this stuff fascinating and I’m always writing about new trends within asset management, I’ve given Brendan and his partner Aaron Dillon some room below to introduce the fund. Please bear in mind that this post is for informational purposes and in no way does it constitute an advertisement or solicitation for readers to buy or sell any securities.

Here’s the firm on why they’ve launched the KraneShares E Fund China Commercial Paper ETF :

***

You’re only making 0.01% a year on your brokerage account’s cash…Chinese investors are getting 4.90%+.

All major brokerage and custodian firms sweep uninvested cash into a bank deposit program or money market fund on a nightly basis. These cash sweep options are intended to “put your cash to work” and generate incremental yield for your account on cash that would otherwise earn 0%. Unfortunately, in today’s low interest rate environment bank deposit programs and money market funds generate annual yields closer to 0.01%.

Below is a chart highlighting the annual percentage yield for bank deposit programs at several major brokerage firms. KraneShares estimates that there is over $1.0 trillion invested into these firm’s bank deposit programs.

Bank deposit program annual percentage yield for a $50,000 cash allocation

| Firm | Annual % Yield |

| Fidelity | 0.07% |

| Schwab | Not disclosed |

| TD Ameritrade | 0.01% |

| Pershing | 0.01% |

| Morgan Stanley | 0.01% |

| Merrill Lynch | 0.01% |

| Wells Fargo | 0.01% |

| UBS | 0.01% |

* Source: brokerage firm websites

All investors have some amount of cash in their portfolios. A very low return on cash sweep options is a problem for all investors regardless of risk appetite.

Chinese investors don’t have this same issue. China’s money market funds have delivered 4.90%+ total returns over the past year. [Notable…TianHong is partially owned by Alibaba and is the money fund behind their Yu’E Bao program.]

Top 5 China money market funds by AUM with 1 year total return as of Nov 2014

| AUM Rank | Fund Name | 1yr Total Return |

| 1 | TianHong Income Box Money Market Fund | 4.96% |

| 2 | ChinaAMC Cash Income Money Fd A/E | 5.01% |

| 3 | ICBC Credit Suisse Money Market Fd | 4.98% |

| 4 | China Southern Cash Income Fund B | 5.36% |

| 5 | ChinaAMC Fortune Money Market Fd | 5.79% |

* Source: Morningstar Direct

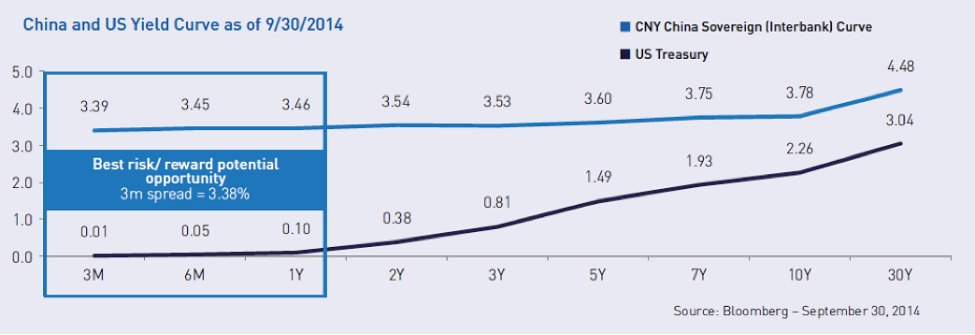

China’s high money market fund returns are driven from the country’s high risk free rate. China’s yield curve is also very flat and delivers attractive yields relative to US treasuries. A 3mo China government bond delivers 3.39% vs a 3mo US government bond at 0.01%…that’s a 3.38% spread.

One way to capture the yields coming out of China is to invest into China commercial paper. Last week the first China commercial paper ETF was listed on the New York Stock Exchange. The KraneShares E Fund China Commercial Paper ETF (NYSE:KCNY) invests 100% of its assets into investment grade China commercial paper. KCNY attempts to replicate a China money market fund.

KCNY is a solution to the low yield cash sweep options currently available in the market today. KraneShares believes that investors should diversify their cash outside of the US to generate superior yields and similar stability versus a pure money market fund or bank deposit program cash allocation.

ETF.com’s Denise Hudachek called the fund “groundbreaking”. “There is currently no other ETF focused exclusively on commercial paper,” said Hudachek. Hudachek highlighted that KCNY is not only the first China commercial paper ETF but also the first U.S.-listed commercial paper ETF.

Five minute webinar introducing KCNY

KraneShares proposes that investors should allocate 25% of their brokerage account’s cash allocation to KCNY. Over the past 12 months, a 25% KCNY / 75% money market fund portfolio would have returned 1.49% vs money market only at 0.04%.

***

Thanks guys. Once again, I would urge anyone who would like to learn about Kraneshares and its products to visit the firm’s site and read up on both the possible opportunities and the potential risks. Visit Kranshares.com for more.

A 3mo China government bond delivers 3.39% vs a 3mo US government bond at 0.01% #YieldSpread #Seriously?

http://t.co/nzY4IRmb0W

how china investors avoid low yields on cash http://t.co/if529y18iX

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/12/22/how-china-investors-avoid-low-yields-on-cash/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/12/22/how-china-investors-avoid-low-yields-on-cash/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2014/12/22/how-china-investors-avoid-low-yields-on-cash/ […]

… [Trackback]

[…] There you will find 97316 additional Information on that Topic: thereformedbroker.com/2014/12/22/how-china-investors-avoid-low-yields-on-cash/ […]

… [Trackback]

[…] Here you will find 30384 additional Information on that Topic: thereformedbroker.com/2014/12/22/how-china-investors-avoid-low-yields-on-cash/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2014/12/22/how-china-investors-avoid-low-yields-on-cash/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/12/22/how-china-investors-avoid-low-yields-on-cash/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/12/22/how-china-investors-avoid-low-yields-on-cash/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2014/12/22/how-china-investors-avoid-low-yields-on-cash/ […]

… [Trackback]

[…] There you can find 10789 additional Info to that Topic: thereformedbroker.com/2014/12/22/how-china-investors-avoid-low-yields-on-cash/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/12/22/how-china-investors-avoid-low-yields-on-cash/ […]

… [Trackback]

[…] Here you will find 28819 additional Info to that Topic: thereformedbroker.com/2014/12/22/how-china-investors-avoid-low-yields-on-cash/ […]