361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

April 15, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

If you thought the plunge in Gold prices was tough on those long the precious metal, wait until you see the upcoming hit to the April Non-Farm Payrolls in the category of Sign Spinners…

Official bear market in Gold and all the technicals have broken as GLD slices through the 200 day moving average on Sunday night into the $130s…

One of the stoking fear factors for Gold selling was the ECs interest in Cyprus to sell some of their Gold reserves as part of its rescue plan. This quickly led many to conclude that other weak Central Banks could be encouraged to sell Gold reserves…

A European Commission assessment of what Cyprus needs to do as part of its European Union/International Monetary Fund bailout showed Cyprus is expected to sell excess gold reserves to raise around 400 million euros ($523 million).

Other struggling euro area countries may be pushed to take note. Between them, for example, Portugal, Ireland, Italy, Greece, and Spain, hold more than 3,230 metric tons (3561 tons) of gold between them, worth nearly 125 billion euros at today’s prices.

(Reuters)

Given the long term, upward move in the Gold asset class, you will still find it in many portfolios…

This year’s sell-off in gold has been harmful for dedicated gold-bugs like hedge fund manager John Paulson, but it has also hit managers like David Einhorn who is better known for his stock picks than his love of the yellow metal. During the first quarter, however, Einhorn’s Greenlight Capital Management demonstrated just how much he and his investors have riding on gold as he recently listed it as the fund’s third largest position, an investor in the fund said. Only bets on computer maker Apple, a long-time favorite with Einhorn, and General Motors, which he started talking about late last year, outranked his gold position in size.

(Reuters)

Warren Buffett would tell you that the move in Gold is a positive, as the ranks of the fearful should be shrinking…

“What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As “bandwagon” investors join any party, they create their own truth – for a while.”

(BerkshireHathaway)

Warren’s wingman, Charlie Munger, is a bit more direct about Gold owners…

“If you’re capable of understanding the world, you have a moral obligation to become rational. I don’t see how you become rational hoarding gold. Even if it works, you’re a jerk.” (Ritholtz)

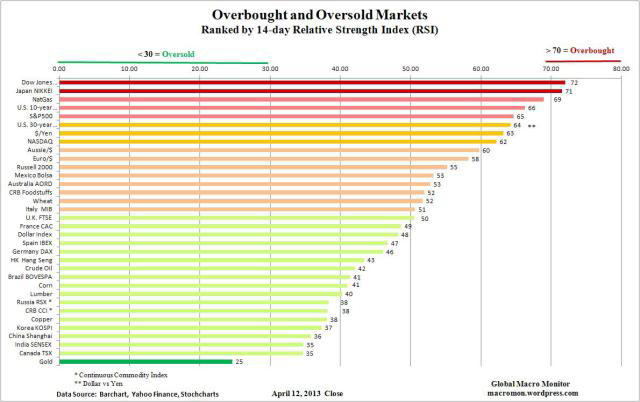

For now, Gold remains the top Oversold major asset class in the World…

(@macromon)

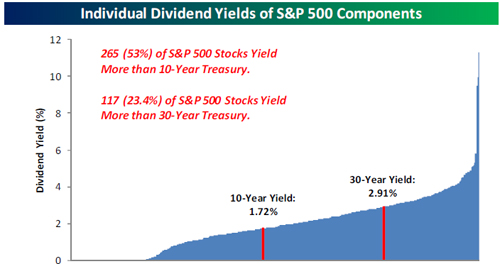

For investors looking for assets that generate income, the quantity of dividend payers exceeding risk-free(?) Treasury Bonds continues to expand…

(Bespoke)

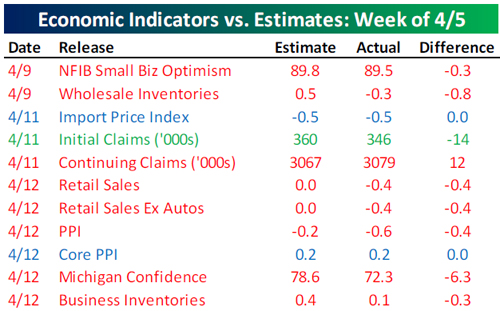

It was another week of lighter than expected data…

(Bespoke)

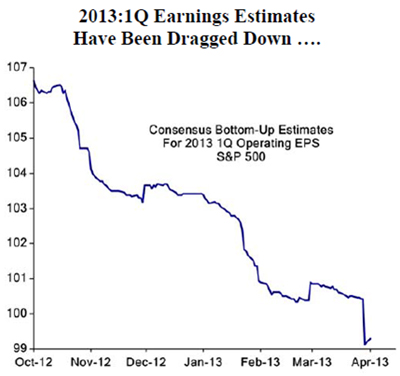

And as the quantity of earnings reports ramps up this week, we will be looking to see if the market lowered estimates too far…

(ISIGroup)

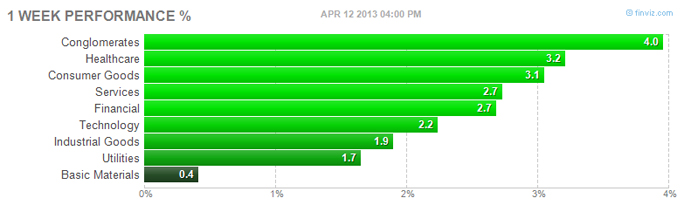

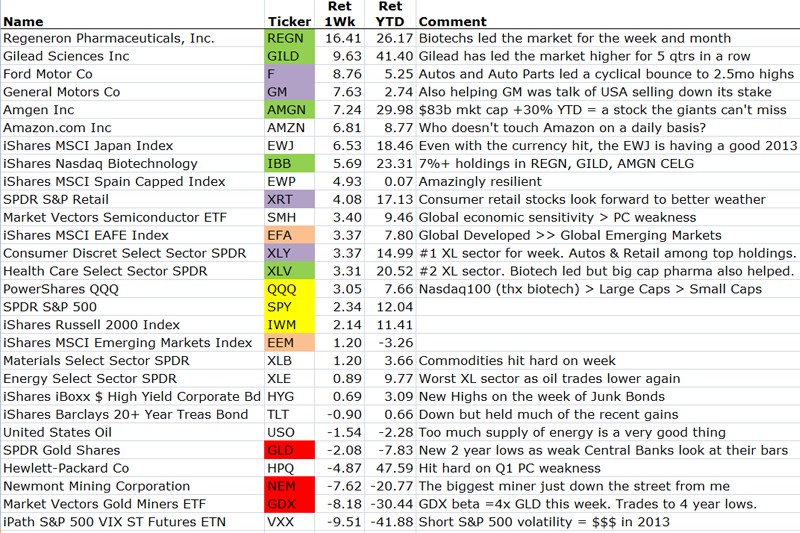

While the market gained in every major sector last week, defensive sectors did a bit better.

Hopefully you were long a slug of Biotech and Consumer stocks…

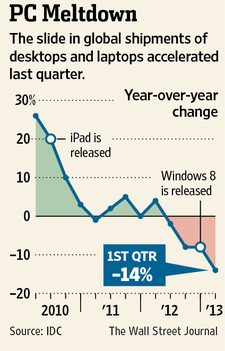

One consumer area that the market is forgetting is the Personal Computer space…

But why pay up for a full Windows PC when a tablet or even a smart phone will do most of the job. As a recent purchaser of a 14″ HP Chromebook for $319, I have to admit that I really enjoy the instant On/Off of the device.

(Amazon)

The personal computer is in crisis, and getting little help from Microsoft Corp.’s Windows 8 software, once seen as a possible savior. Research firm IDC issued an alarming report Wednesday for PC makers such as Dell Inc. and Hewlett-Packard Co., saying world-wide shipments of laptops and desktops fell 14% in the first quarter from a year earlier. That is the sharpest drop since IDC began tracking this data in 1994 and marks the fourth straight quarter of declines.

Speaking of Amazon… Want to save a lot of $$$ and avoid getting shopping cart dinged in the grocery store parking lot?

I get very frustrated trying to compare prices on “paper products” at my local supermarket, Safeway. They have various marketing terms meant to confuse the average consumer, regular, double, mega etc., making it nearly impossible to compare prices on the spot. So, I threw together a little spreadsheet (attached). The price at Safeway was not all that surprising until you compare it to the price for which Amazon is willing to deliver it to your front door. The Amazon Subscribe and Save program is about 30% cheaper than going to the store. Not too bad. If you have Amazon deliver 5 items on automatic delivery, they will take an additional 20% off the entire delivery. A deal any true economist simply cannot pass up. It’s surprising to me that Amazon is willing to deliver to your door for approximately half the price Safeway has on their shelf.

(Freakonomics)

Congrats to North Dakota for planning ahead…

North Dakota’s oil tax fund is nearing $1 billion in assets. The Legacy Fund gets 30 percent of the state’s oil tax collections. None of the money can be spent until 2017, and even then it takes a two-thirds vote of the Legislature to dip into it. March deposits were about $87 million. That brings the fund’s total to $927 million. Oil revenue began gushing into the fund only since September 2011. Analysts initially estimated it would have a $618 million balance when the state’s current two-year budget period ends on June 30.

(SeattlePI)

Shame on most every other municipality for planning by looking in the rear view mirror…

Who wouldn’t want 7.5%-8% returns these days? Ten-year U.S. Treasury bonds are paying 1.74%. There is almost zero probability that Calpers will earn 7.5% on its $255 billion anytime soon. The right number is probably 3%. Fixed income has negative real rates right now and will be a drag on returns. The math is not this easy, but in general, the expected return for equities is the inflation rate plus productivity improvements plus the expansion of the price/earnings multiple. For the past 30 years, an 8.5% expected return was reasonable, given +3%-4% inflation, +2% productivity, and +3% multiple expansion as interest rates plummeted. But in our new environment, inflation is +2%, productivity is +2% and given that interest rates are zero, multiple expansion should be, and I’m being generous, -1%.

(WSJ)

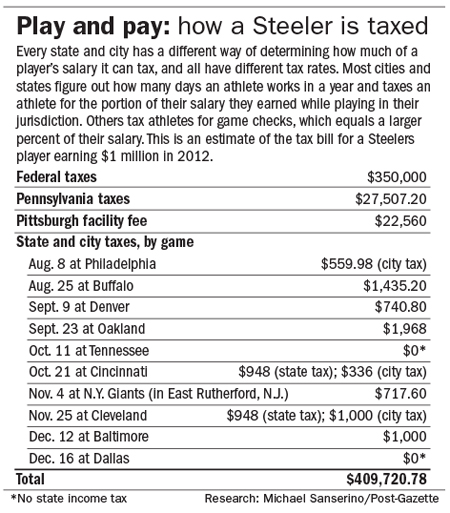

Almost forgot, Happy Tax Day…

Again, why can’t we elect leaders who can just put the whole form on a simple post card?

Just be thankful that you are not a professional athlete, referee, equipment manager, etc.

But be thankful if you are the accountant to any of them.

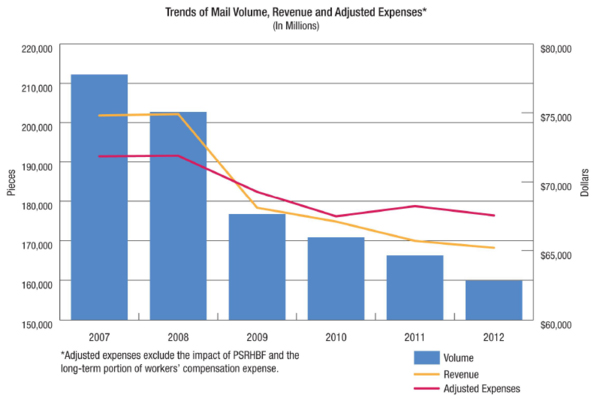

In most industries, when volumes fall 25% in 5 years, capacity is reduced…

Do our elected officials foresee a reversal in the trend away from physical mail?

A look at Moneyball with only 2 weeks of play in the season…

5 MLB teams have payrolls <= $75 million. 2 teams have payrolls > $200 million. After only 12 games, Billy Bean is looking economically efficient. But the Houston experiment will be interesting to watch.

Payroll data at (CBSSports)

Best tweet about a teenage golfer on the week…

@shanebacon: Oh and it’s absolutely ridiculous that 14-year-old Tianlang Guan didn’t have a three-putt this week. Insane.

Best tweet about golfing that they DIDN’T teach you in Business School…

@hedgeygrl: Tip of the Day – How to Make Money Trading Stocks: Play golf with a KPMG audit partner.

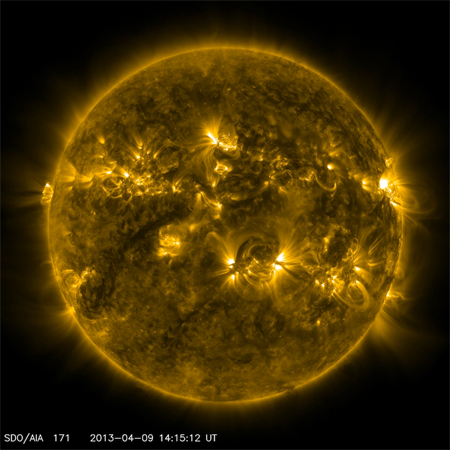

A better picture of Gold to end with…

@wired: Space photo of the day: the “quiet” sun. Mesmerizing. (Wired)

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/04/16/361-capital-weekly-research-briefing-39/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/04/16/361-capital-weekly-research-briefing-39/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/04/16/361-capital-weekly-research-briefing-39/ […]

… [Trackback]

[…] Here you can find 41765 more Information on that Topic: thereformedbroker.com/2013/04/16/361-capital-weekly-research-briefing-39/ […]

… [Trackback]

[…] There you will find 78554 additional Info to that Topic: thereformedbroker.com/2013/04/16/361-capital-weekly-research-briefing-39/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/04/16/361-capital-weekly-research-briefing-39/ […]

… [Trackback]

[…] Here you will find 57553 more Info to that Topic: thereformedbroker.com/2013/04/16/361-capital-weekly-research-briefing-39/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/04/16/361-capital-weekly-research-briefing-39/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/04/16/361-capital-weekly-research-briefing-39/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/04/16/361-capital-weekly-research-briefing-39/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/04/16/361-capital-weekly-research-briefing-39/ […]