361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors

361 Capital Weekly Research Briefing

December 3, 2012

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

And then Washington D.C. decided to ride off the cliff…

On January 1, 2013, U.S. taxes will rise by $5 trillion and spending cuts will be $2 trillion over the following 10 year period. The immediate 2013 impact of $500 billion in tax hikes and spending reductions will most certainly cause another U.S. recession, but at least S&P/Moody’s and our kids and grandkids will be happy that the U.S. government will be borrowing a bit less on its credit card. It is too bad that the two sides cannot come to any sort of middle ground, but I guess it will take more of a crisis than a silly little cliff sucking 2-5% of GDP out of the U.S. economy. Let’s just hope the kids make it to the other side.

(500px)

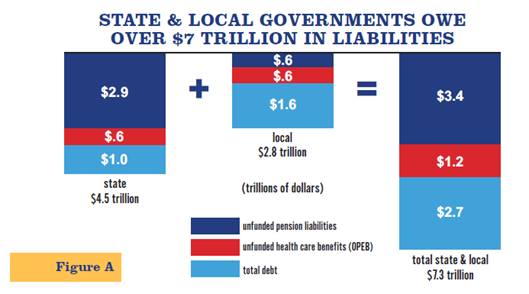

Bill Gross reminds you that $17 Trillion is only the ON BALANCE SHEET figure…

@PIMCO: Gross: WSJ Op-ed confirms PIMCO thesis: U.S. debt is 5 times what it admits to. Inflation ahead.

A good piece of advice from Great Britain to California…

In the 2009-10 tax year more than 16,000 people declared an annual income of more than £1 million to HM Revenue and Customs. This number fell to just 6,000 after Gordon Brown introduced the new 50% top rate of income tax shortly before the last general election. The figures have been seized upon by the Conservatives to claim that increasing the highest rate of tax actually led to a loss in revenues for the Government. It is believed that rich Britons moved abroad or took steps to avoid paying the new levy by reducing their taxable incomes. George Osborne, the Chancellor, announced in the Budget earlier this year that the 50% top rate will be reduced to 45% from next April. Since the announcement, the number of people declaring annual incomes of more than £1 million has risen to 10,000. (Telegraph)

A new Harvard study reminds us that Federal obligations are not the only thing to worry about…

(thestatesproject)

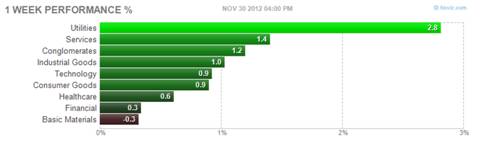

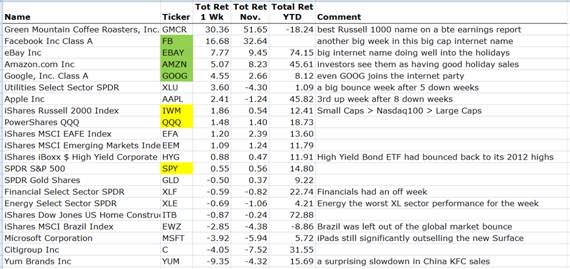

The equity markets had another bounce week, especially if you were a Utility stock…

While the financial markets waited for progress out of Washington D.C. that never happened, it did get good news out of early holiday sales and some near term resolution in Greece. Consequently, the markets floated higher helped by improving European and High Yield credit spreads. If you went long the Utility index or its components last week, congratulations on earning a full year dividend yield in 5 days. With Greece out of the way, the markets movements will be now mostly tied to every Congressional and White House comment/tweet on their negotiations, as well as any corporate earnings comments going into the end of the year.

Being forced to invest new monies at unattractive prices is not a sign of a healthy market…

“It’s my worst nightmare,” says a long-only bond fund manager. “There’s nothing I can do — the checks come in [from clients] every day, and I have to invest it.” (NYPost)

High Yield bonds have seen some recent outflows, so watch the price action closely for a tell on the market’s risk appetite…

(athrasher)

Here is one to stump your clients and co-workers with…

@howardgreenBNN: Germany’s DAX is the best performing major stock market in the world so far this year. Up about 25% year to date.

Also interesting is that the Transports have done nothing all year…

(@stocktiger)

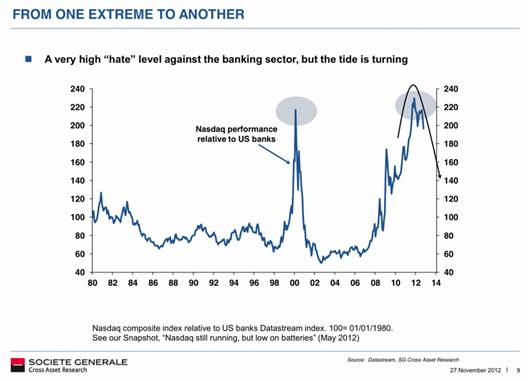

An interesting chart of Banks v Nasdaq. Banks are cheap, but will the government get out of their way and allow them to earn an adequate return on capital?

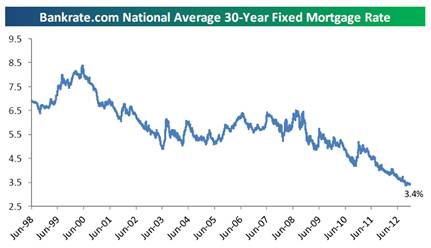

Meanwhile, the continued tailwind to home buyers (and don’t forget auto buyers also)…

As rates head to zero, a respected manager decides to GIVE UP on fixed income…

GMO, the Boston-based asset manager, says it has “given up” on the bond market, deciding to ditch long-dated sovereign debt as investors continue to pour billions into government bonds, including U.S. Treasuries. Ben Inker, co-head of asset allocation for the $104bn group, told the Financial Times it is holding large, high-quality companies in the U.S. but that its main bet is to keep money on the sidelines while it waits for better times… “We’ve largely given up on traditional fixed income,” says Mr. Inker in an interview. He sold what was the last refuge of reasonably priced long-dated debt – Australian and New Zealand bonds – near the start of the year. But his dislike of fixed income does not mean he is a fan of stocks. The most enthusiasm he can muster for equities is an uneasy liking for Japanese stocks: “I wouldn’t want to put all my money in Japan. It looks cheap, but it’s got issues.” Rather, Mr. Inker says that he is waiting for better times; forty percent of a benchmark free asset allocation hedge fund he oversees is in “dry powder”. (FT)

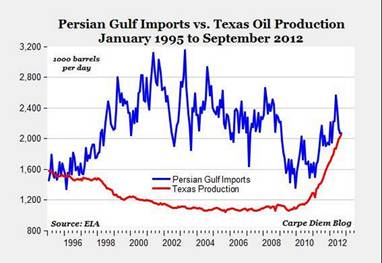

U.S.A. oil independence will become a reality thanks to technological advancements…

@Mark_J_Perry: Amazing Chart: Texas oil output in September almost matched total oil imports from all Persian Gulf countries

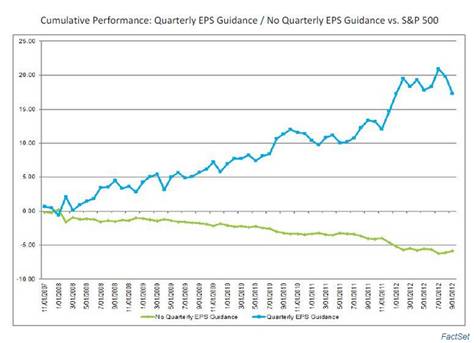

A great study here. I always want to own much less of a stock when they eliminate future guidance. For my 25 years, it has rarely been a good sign…

Over the past five years, companies that issued quarterly EPS guidance outperformed the S&P 500 by just over 17%, while companies that did not issue quarterly EPS guidance underperformed the index by about 6%.

(businessinsider)

Zig Ziglar would have been a fan of our counter-trend algorithms…

“People don’t buy for logical reasons. They buy for emotional reasons.”

Another stumper… The most American made car for 2013 is the Toyota Avalon…

The National Highway Transportation Safety Administration issues a report each year that details the cars that are made in America. The report looks at where the parts, the transmission and the engine come from. According to the latest report, the most “American car” is the Toyota Avalon, which is built in Georgetown, Ky. Eighty-five percent of that car’s parts are sourced from the U.S. and Canada — a higher percentage than for any car made by a U.S.-based manufacturer. (NPR)

The only “Cliff” that I can recommend visiting right now sits along the Cinque Terre…

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/12/04/361-capital-weekly-research-briefing-24/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2012/12/04/361-capital-weekly-research-briefing-24/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2012/12/04/361-capital-weekly-research-briefing-24/ […]

… [Trackback]

[…] There you can find 44062 additional Information to that Topic: thereformedbroker.com/2012/12/04/361-capital-weekly-research-briefing-24/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/12/04/361-capital-weekly-research-briefing-24/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2012/12/04/361-capital-weekly-research-briefing-24/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/12/04/361-capital-weekly-research-briefing-24/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/12/04/361-capital-weekly-research-briefing-24/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/12/04/361-capital-weekly-research-briefing-24/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2012/12/04/361-capital-weekly-research-briefing-24/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/12/04/361-capital-weekly-research-briefing-24/ […]