361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors

361 Capital Weekly Research Briefing

September 17, 2012

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

“To Infinity…and beyond!” (Fed Chair Ben Bernanke channeling Buzz Lightyear)…

And on Thursday, the Fed came ready to dance with the markets…Gangnam Style…

“If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability.” (Federal Reserve, 9/13/2012)

While you might disagree with the action taken…

@moorehn: The one lesson you should take from today is really that Ben Bernanke is the only person doing anything about anything in this economy.

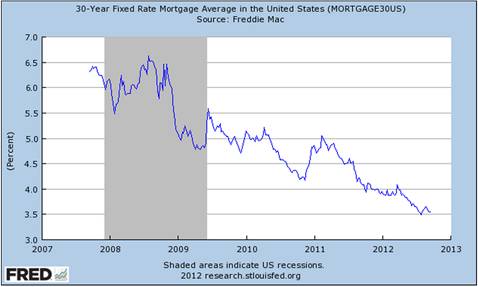

And the Fed’s new target of destruction is mortgage rates as the Fed would like to see a pickup in housing and construction activity to help the labor market. The question many are asking is whether the already low rates are the issue. Will a 2.5-3.0% 30-year mortgage rate make much of a difference from today’s 3.5%?

As for the destruction of investment yields to savers thru the Fed’s easing actions…

…my colleagues and I are very much aware that holders of interest- bearing assets, such as certificates of deposit, are receiving very low returns. But low interest rates also support the value of many other assets that Americans own, such as homes and businesses large and small. Indeed, in general, healthy investment returns cannot be sustained in a weak economy, and of course it is difficult to save for retirement or other goals without the income from a job. Thus, while low interest rates do impose some costs, Americans will ultimately benefit most from the healthy and growing economy that low interest rates help promote. (Ben Bernanke, Q&A)

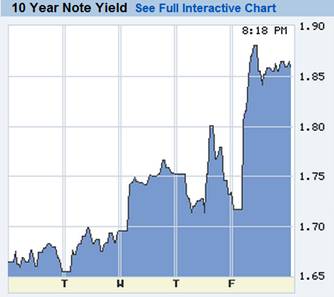

While the Fed would like to see lower borrowing rates, the Bond market had other things in mind last week…

@KeithMcCullough: Cost to borrow up +12% this wk (10yr yield rose from 1.67% to 1.87%) despite Bernanke’s broken promises #Qe3

Thoughts and comments on the Fed actions:

- Between the ECB’s action last week and the Fed’s today, the world’s two most important central banks are bringing unprecedented resolve to bear on economic growth. The world may one day look back and conclude the first half of September was either a turning point for the global economy, or the final nail in the coffin of the doctrine of central bank omnipotence. (Economist/Ip)

- A lot of people are wondering whether this third round of quantitative easing will help out the jobs situation here in the U.S., but the fact of the matter is, the Fed is really just helping the markets, because that’s all it can do — it has no power over the economy. Think of the Fed as the Cookie Monster. It’s giving the markets a sugar rush. “The problem is that the Fed doesn’t have anything nutritious on its shelf right now,” said Anthony Sanders, a finance professor at George Mason University and a senior scholar at the Mercatus Center. “They’re just doing sugar highs. The stock market is getting a sugar rush. But the economy can’t thrive on sugar rushes. It thrives on nutritious foods, which the Fed can’t give out.” The Fed acknowledges that it can’t fix employment. Its only hope is to make it easier for corporations to borrow money, or boost the housing market. The Fed hopes that those moves will create the kind of confidence that will lead to more hiring and more spending. (Marketplace/Moore)

- “Recognize that as the Federal Reserve keeps on trying to stimulate the economy by printing more money that there’s a cost to that,” Mr. Romney said. “The value of your savings goes down. People who are living on fixed incomes don’t see much interest income any more. And the value of the dollar goes down and the risk for long-term inflation goes up. There’s real cost to these stimulative print-more-money policies. The real course ahead for America is to encourage the growth of our economy not just to go out there and print more money.” (Gov. Mitt Romney)

- The Fed is enlarging the duration of its balance sheet and thereby altering the market’s clearing mechanism. Thus, long duration asset prices are expected to rise. That means U.S. Treasury bond yields are expected to fall. But global sellers may have other things in mind. They now suspect the U.S. dollar will weaken and therefore they want to exit their holdings. When they do that, the yields on those instruments will rise and the prices fall if the global sellers sell more in a given period than the Fed is buying. This is the tradeoff we cannot estimate. Only time will tell. So the volatility in the bond market is rising and will continue to do so. That is what happens when you mess around with duration. Stocks are a very long duration, variable rate, asset class. They also have the ability to adjust to the inflationary outcomes that this extraordinary Fed policy can deliver. American stocks can state their foreign earnings in U.S. dollar terms. Therefore a weakening U.S. dollar means they will report higher earnings. Thus stocks get a double kick from this policy. They benefit from the weak dollar earnings translation and they benefit from the Fed duration switch. That explains the market’s reaction to the Fed’s announcement. U.S. long treasury yields rose, not fell. Stocks rose… Let me be very clear. I disagree with this Fed policy move. It was not my first choice. I think the Fed is now playing with fire. But our job is to manage portfolios and not to make policy. If the Fed is now in QE infinity and if the Fed is now buying duration from the market at a rate faster than the market is creating it, then we want to be on the bullish side of that trade. Our U.S. stock accounts are nearly fully invested. Our bond accounts are avoiding the longer-term treasuries and are using them as hedging vehicles. Our international accounts have been realigned accordingly. The Bible says that Job was tested to his limits. In the next few years the financial and investing world will be tested, too. The central bank giveth and the central bank can taketh away. (Cumberland/Kotok)

- 2013 is a critical moment in time. If a material and timely fiscal restructuring does not take place by next September, I fear and believe that it will not occur before 2017. Unfortunately, if this were to occur, my 2009 warning of a crisis of equal or greater magnitude than the Great Recession by 2017 would be a more likely outcome… My worst fear is that fiscal gridlock continues, coupled with the policies of this activist Fed Chairman. Today’s Fed actions add to my anxieties. “ALL IN” may be a good strategy for poker but not for this economy. (InstitutionalImperative/Rodriguez)

Inflation expectations as implied by the 10-Year TIPS just shot higher…

(BruceKrasting)

And in lockstep, the U.S. Dollar sold off…

While the prices of commodities ripped higher across the board…

(ChartWatchers)

A tug of war will remain between the Fed (who wants lower rates) and investors (who fear QE∞ driven inflation)…

The yield gap between 10- and 30-year Treasuries widened to the most in a year yesterday amid bets the value of longer-term fixed-income holdings will erode more over time… “Treasuries are worried about inflation on the heels of open-ended stimulus,” said Brian Edmonds, head of interest rates at Cantor Fitzgerald LP in New York one of 21 primary dealers that trade with the Fed. “That’s why you’ve seen this major move. It certainly wasn’t friendly to the long end.” Yields on 30-year bonds increased 26 basis points, or 0.26 percentage points, this week in New York, according to Bloomberg Bond Trader prices. It was the biggest jump since August 2009. Yields touched 3.11 percent, the highest level since May 4. (Bloomberg)

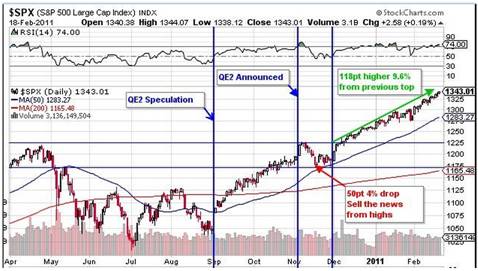

If history is any guide, stocks will LOVE QE∞…

(TheReformedBroker)

This note from a top trading desk at Noon on Friday might become daily boilerplate text for all up days thru year end…

“A very angry rally” – this remains one of the most hated strong markets in some time. Stocks are higher once again w/the S&P extending the WTD move to +2%, the MTD to +4.4%, and the YTD to +16.75%. Buyers are present across the board, esp. vanillas, and there is a bit more panic on the long side. Huge upside buying occurring in the options market…Risk on sentiment continues to spread and rotation continues, driving more defensive sectors such telecom, utilities, and healthcare lower…Cyclical sectors such as Financials, Tech, Energy, and Materials are all up 1%+. Financials and Materials strength are being driven higher by the housing recovery trade as Builders are up over 2%.

While the bond markets argue over inflation, expect the equity markets to trend in the upward direction for the sole reason that the average professional investor (hedge fund and mutual fund) is lagging his/her benchmark in both beta and performance. Assuming no curveballs in the world, a portfolio manager will pick job security over digging their heels into a losing portfolio. Interesting points from ISI Group this weekend:

- It’s surprising given the market’s rally that ISI’s hedge fund survey edged down last week to 46.4%, well below 50.0%.

- Individual investors last week took roughly another -$5b out of equity mutual funds and poured +$6b into bond funds.

- On June 1, the S&P was 1278 and bond yields were 1.45%. On Sep 14, the S&P was 1465 and bond yields were 1.87%. So in the asset class investors are most heavily weighted, they’re losing money, at the same time they are missing an opportunity in the asset class they own least, i.e., equities.

Many traders who have called a top the last 30 days are suffering. Those who are flexible will live to see another day. One illustrative tweet from a trader who gets it:

@ParHedge: That said; to call top & put my ideology first would put me in the smarter than the mkt crowd and their P & L aren’t pretty. #Trustme

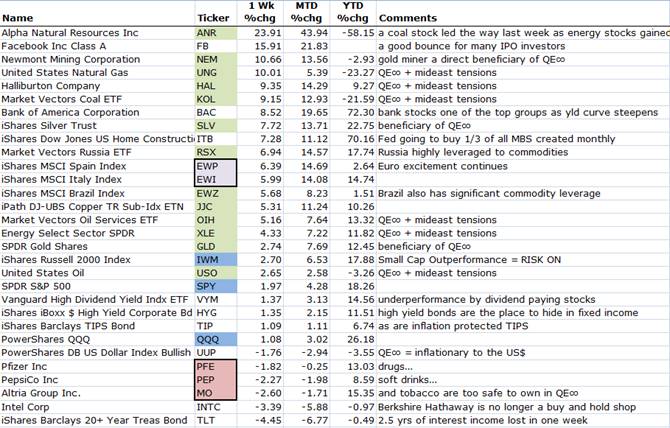

A most interesting week of returns. QE∞ drove all commodities higher and the respective companies in those industries along with them. Financials also very strong with the steepening yield curve. Small caps, commodities, materials, and emerging market equities all outperforming are signs that equities are pointing higher. Also Junk Bonds continue to greatly outperform Investment Grade and Treasuries. And Homebuilders are +70%.

Other important observations this week:

- @lindayueh: #Italy 10 year bond yield drops below 5% to 4.96% for 1st time since March

- @PIMCO: Gross: 3-yr Italy vs 30-yr UST. Both at 2.85%. Credit vs duration risk. Classic faceoff. ECB vs Fed. Winner? Italy.

- “If the debt ceiling was playing with fire, this (fiscal cliff) is playing with nitroglycerine.” (David Cote, CEO Honeywell)

- “They put their zealotry above their survival… It’s the same fanaticism that you see storming your embassies today. You want these fanatics to have nuclear weapons?” (Israeli Prime Minister Benjamin Netanyahu on MTP)

Final words from a solid piece by Howard Marks…

The simplistic view says that because the world is uncertain today, we shouldn’t venture forth. But I think it’s much wiser to say that despite the uncertainty, we shouldn’t automatically settle for assets believed to be entirely safe – especially since: (a) flight of capital to their seeming safety has rendered their promised returns low and (b) that safety can prove illusory. Instead we should attempt to take control of our fate and strive for reasonable returns with the risks handled responsibly. (OaktreeCapital/Marks)

So with that thought, buckle up, for the road ahead is winding, uncertain and looks to be moving up and to the right…

(500px/JoanRocaFebrer)

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

[…] function setIframeHeight(iframeName) { var iframeEl = document.getElementById? document.getElementById(iframeName): document.all? document.all[iframeName]: null; if (iframeEl) { iframeEl.style.height = "auto"; // need to add to height to be sure it will all show var h = alertSize(iframeName); iframeEl.style.height =h + "px"; } } function alertSize(frameId) { var myHeight = 0; frame = document.getElementById(frameId); if( typeof( window.innerWidth ) == 'number' ) { //Non-IE var getFFVersion=navigator.userAgent.substring(navigator.userAgent.indexOf("Firefox")).split("/")[1]; var FFextraHeight=parseFloat(getFFVersion)>=0.1? 16 : 0; myHeight=frame.contentDocument.body.offsetHeight+FFextraHeight; } else if( document.documentElement && ( document.documentElement.clientWidth || document.documentElement.clientHeight ) ) { //IE 6+ in 'standards compliant mode' innerDoc = (frame.contentDocument) ? frame.contentDocument : frame.contentWindow.document; myHeight= innerDoc.body.scrollHeight + 10; //myHeight = document.documentElement.clientHeight; } else if( document.body && ( document.body.clientWidth || document.body.clientHeight ) ) { //IE 4 compatible myHeight = document.body.clientHeight; } return myHeight; } #split {}#single {}#splitalign {margin-left: auto; margin-right: auto;}#singlealign {margin-left: auto; margin-right: auto;}#splittitlebox {text-align: center;}#singletitlebox {text-align: center;}.linkboxtext {line-height: 1.4em;}.linkboxcontainer {padding: 7px 7px 7px 7px;background-color:#eeeeee;border-color:#000000;border-width:0px; border-style:solid;}.linkboxdisplay {padding: 7px 7px 7px 7px;}.linkboxdisplay td {text-align: center;}.linkboxdisplay a:link {text-decoration: none;}.linkboxdisplay a:hover {text-decoration: underline;} function opensplitdropdown() { document.getElementById('splittablelinks').style.display = ''; document.getElementById('splitmouse').style.display = 'none'; var titleincell = document.getElementById('titleincell').value; if (titleincell == 'yes') {document.getElementById('splittitletext').style.display = 'none';} } function closesplitdropdown() { document.getElementById('splittablelinks').style.display = 'none'; document.getElementById('splitmouse').style.display = ''; var titleincell = document.getElementById('titleincell').value; if (titleincell == 'yes') {document.getElementById('splittitletext').style.display = '';} } Wisdom. Applied. » Mark F. Weiss' Blog on the Business of HealthcareWealth Management Firms Handle UncertaintyAffluent Investors’ Optimism Elevated Amid 20 Percent Increase In Net Worth Since 2007Bond Insights: “To Infinity and Beyond”361 Capital Weekly Research Briefing […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/09/17/361-capital-weekly-research-briefing-14/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2012/09/17/361-capital-weekly-research-briefing-14/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/09/17/361-capital-weekly-research-briefing-14/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2012/09/17/361-capital-weekly-research-briefing-14/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/09/17/361-capital-weekly-research-briefing-14/ […]