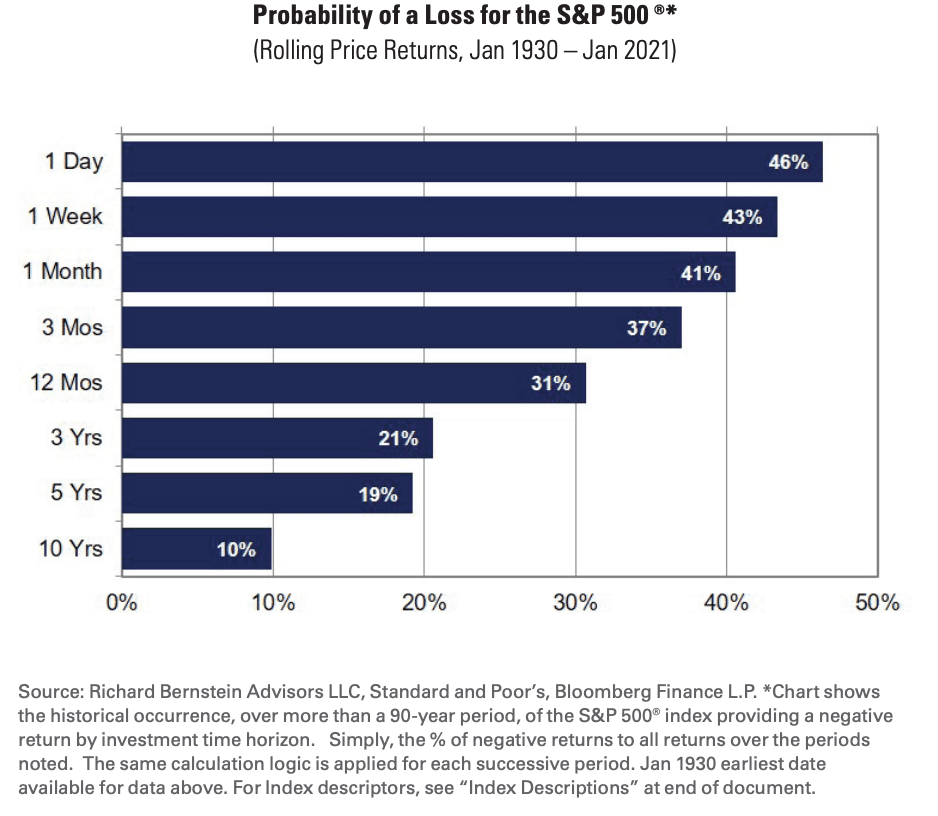

Trading the S&P 500 each day gives you only a 54% chance of making money. That’s a 46% chance of losing. Basically a coin flip.

Extending this time frame from holding stocks one day to holding them for a full year reduced your chances of losing by 15 percentage points (46% down to 31%).

And holding stocks over a ten year period reduces your odds of losing money to only 10% historically. That’s a 90% chance of winning over all rolling ten year periods back to 1991!

On this week’s episode of The Compound Show, Josh talks with veteran market strategist Rich Bernstein of Richard Bernstein Advisors about why long-term investors have a probabilistic advantage over short-term traders and why his firm focuses on top-down economic themes when constructing portfolios.

Tony Isola of Ritholtz Wealth stops by to talk about the kind of happiness and success that cannot be measured in numbers.

Be sure to leave us a rating and review if you’re enjoying the show, it goes a long way!

More from Rich Bernstein here.

You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

Listen here: