The below is an amazing and true story written by Bryan Taylor, Ph.D. and Chief Economist for Global Financial Data. I’ve asked one of the site’s proprietors, Ralph Dillon, to allow me to guest-post it here on TRB.

The tale you are about to read weaves together a fascinating and obscure financial scandal with the death of JFK, I hope you enjoy it!

– JB

***

Fifty years ago, John F. Kennedy was assassinated on Friday, November 22, 1963 in Dallas, Texas. The assassination not only shocked the nation, but shook the stock market as well. However, very few people have heard about The Great Salad Oil Swindle which nearly crippled the New York Stock Exchange that weekend. Officials at the NYSE took advantage of the closure of the exchange to keep the crisis caused by the swindle from spreading further. Here is what happened at the NYSE while the nation focused on the President’s funeral.

Salad Oil, Cornered and Quartered

The Great Salad Oil Swindle was carried out by Anthony “Tino” De Angelis, who traded vegetable oil (soybean oil) futures which was an important ingredient in salad oil. De Angelis had previously been involved in a swindle involving the National School Lunch Act and the Adolph Gobel Co. When it was discovered that he had overcharged the government and delivered over 2 million pounds of uninspected meat, he ended up bankrupt. Con-men don’t stop being cons, they just try to learn from their mistakes and make more money the next time around.

Tino de Angelis had learned that government programs were a way to make easy money, so he started the Allied Crude Vegetable Oil Refining Co. in 1955 to take advantage of the U.S. Government’s Food for Peace program. The goal of the program was to sell surplus goods to Europe at low prices. Initially, De Angelis sold massive quantities of shortening and other vegetable oil products to Europe, and when this worked, he expanded into cotton and soybeans.

By 1962, De Angelis was a large enough player in commodity markets that he thought he could corner the soybean oil market, allowing him to make even more money. Always the schemer, De Angelis’s plan was to use his large inventories of commodities as collateral to get loans from Wall Street bank and finance companies. Buying soybean oil futures would drive up the price of his vegetable oil holdings, which would increase both the value of his inventories and allow him to profit from his futures contracts. De Angelis could use these profits not only to line his own pockets, but to pay his staff, make contributions to the community, and in one case, pay the hospital bill of a government official.

American Express had recently created a new division that specialized in field warehousing, which made loans to businesses using inventories as collateral. American Express wrote De Angelis warehouse receipts for millions of pounds of vegetable oil, which he took to a broker and discounted the receipts for cash. This proved to be an easy way to get money, so De Angelis began falsifying warehouse receipts for vegetable oil he didn’t have.

American Express sent out inspectors to make sure that De Angelis had the vegetable oil that acted as collateral, but what they didn’t know is that many of the tanks were filled mostly with water with a minimum of oil floating on the top to fool the inspectors, or that some of the tanks were connected with pipes to other tanks so the oil could be transferred between tanks when the inspectors went from one tank to the other.

If American Express had done their homework, they would have realized that De Angelis’s reported vegetable oil “holdings” were greater than the inventories of the entire United States as reported by the Department of Agriculture. Unsatisfied with the American Express loans, De Angelis was able to get additional loans from Bunge Ltd., Staley, Proctor and Gamble, and The Bank of America. By the time the swindle collapsed, De Angelis had gotten loans from a total of 51 companies.

No Salad Today

As a result of attempted bribery, delivery mistakes, and other factors, the inspectors were eventually tipped off about De Angelis’s fraud. Allied Crude was supposed to have $150 million in vegetable oil as collateral, but only had $6 million. When the inspectors found water in the tanks, and not oil, the gig was up.

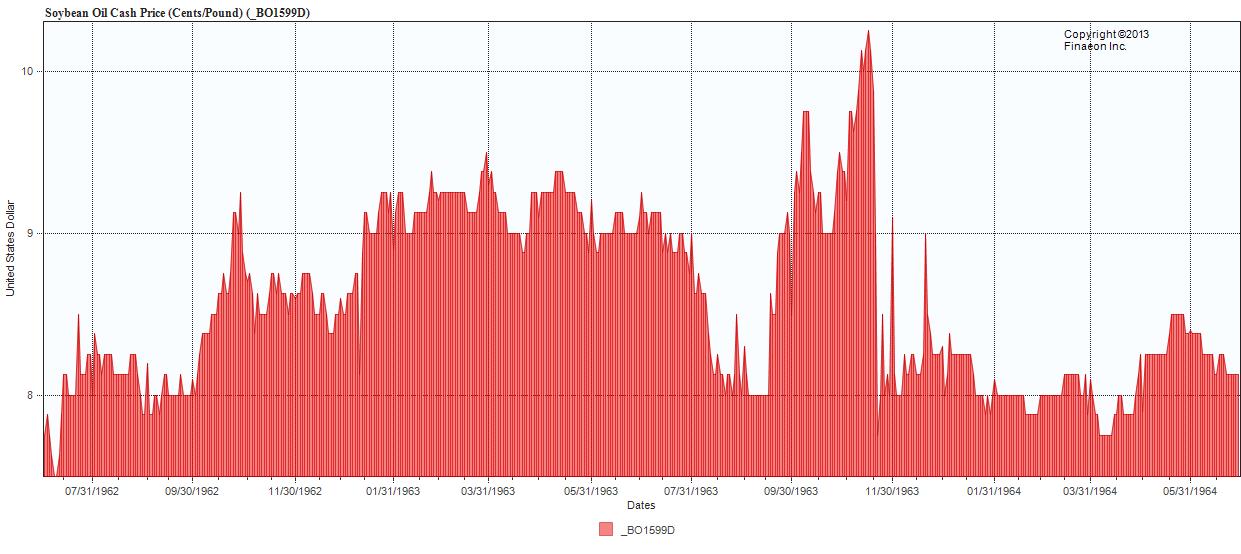

The futures market crashed. Soybean oil closed at $9.875 on Friday, November 15, at $9 on Monday and $7.75 on Tuesday, November 19, wiping out the entire value of the De Angelis loans. As you might guess, De Angelis’s company had been losing money all along, and the loans were used to cover these mounting losses. De Angelis’s goal was to sell out at the top and cover all of his losses, but of course, his plan didn’t work out that way. The crash of the soybean oil market in November 1963 is shown below.

On November 19, the Allied Crude Vegetable Oil Refining Co. filed for bankruptcy. No one should be surprised that millions of dollars were never accounted for. Fifty-one companies were stuck with bad loans from Allied Crude. Two of the brokerage houses whom De Angelis had used, Williston & Beane and Ira Haupt & Co. (which had been part of the famous Park & Tilford Distillers Corp. whiskey dividend scandal of 1946) were suspended from trading by the NYSE. These brokerages’ customers became desperate because they didn’t know if they would get back the money in their accounts.

A Nation Shocked, a Market Shaken

On Friday, November 22, the NYSE organized a bail out of Williston & Beane, and the firm was allowed to reopen at noon on Friday. Ira Haupt & Co. was a bigger problem. It collectively owned $450 million in securities and owed various banks over $37 million that it could not pay.

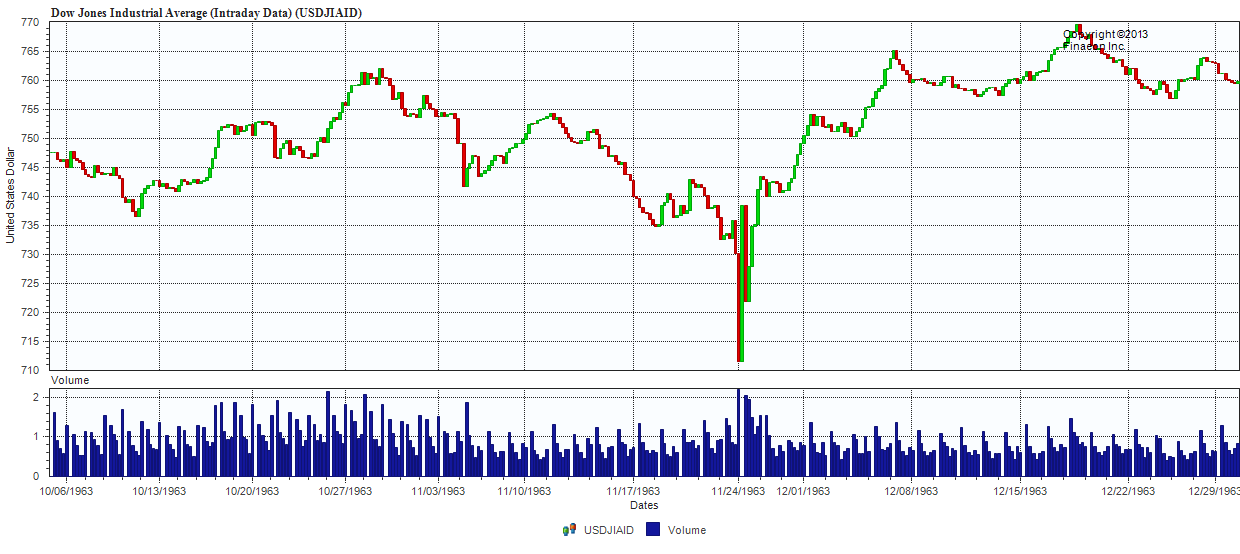

At 1:41 pm, word that JFK had been shot flashed on the floor of the New York Stock Exchange (NYSE) at 1:41 pm, and stocks began to sell off. The Dow Jones Industrials, which was recorded at hourly intervals in 1963, had been at 735.87 at 1 pm on November 22, and fell to 730.18 by 2 pm. Over the next seven minutes, the market traded 2.2 million shares and lost an additional nineteen points, erasing around $11 billion in capitalization, before NYSE officials halted trading at 2:07 pm to stop the panic selling. The market rested, and the next day, JFK’s body lay in repose at the White House.

On Sunday JFK’s was taken to the rotunda of the Capitol for public viewing. Over 250,000 people viewed the casket as a line stretched for 40 blocks, or 10 miles. Some people waited over 10 hours in the freezing cold to pay their last respects. On Monday, the casket was transferred to the National Cathedral where his funeral mass was broadcast to a stunned nation. Kennedy was buried in Arlington Cemetery, and the eternal flame was lit over his grave.

The stock market remained closed on Monday and reopened on Tuesday, November 26, when the market traded over 9 million shares, closing the day at 743.52, moving up 4.5% from the previous day’s close. The table below provides the hourly performance of the DJIA on November 22 and 26, 1963:

|

11/22/1963 |

10:00 AM |

733.35 |

|

|

11/22/1963 |

11:00 AM |

733.61 |

1.46 |

|

11/22/1963 |

12:00 PM |

732.78 |

1.3 |

|

11/22/1963 |

1:00 PM |

735.87 |

0.86 |

|

11/22/1963 |

2:00 PM |

730.18 |

0.81 |

|

11/22/1963 |

2:07 PM |

711.49 |

2.2 |

|

11/26/1963 |

10:00 AM |

738.43 |

|

|

11/26/1963 |

11:00 AM |

721.96 |

2.04 |

|

11/26/1963 |

12:00 PM |

727.92 |

1.94 |

|

11/26/1963 |

1:00 PM |

734.91 |

1.49 |

|

11/26/1963 |

2:00 PM |

735.17 |

1.06 |

|

11/26/1963 |

3:00 PM |

741.26 |

1.26 |

|

11/26/1963 |

3:30 PM |

743.52 |

1.53 |

The chart below, based upon hourly, intraday calculations of the DJIA between October 1 and December 31 of 1963, shows both the panic sell off on November 22, the full recovery on November 26, and the move to new highs that ultimately followed.

The closure of the NYSE gave the exchange some breathing space to address the problems De Angelis had created. If the NYSE didn’t resolve this problem, not only would the collapse discourage investment by small investors, but the U.S. Securities and Exchange Commission would intervene, reducing the NYSE’s power. The NYSE solved the problem by imposing a $12 million assessment on exchange members and used the money to make Ira Haupt & Co.’s customers whole. Creditors were not as lucky. American Express and other lenders lost millions. For the first time, the NYSE had assumed responsibility for a member firm’s failure. When the stock market reopened on Tuesday, it quickly recovered and moved up for the rest of the year.

Although Allied Crude was bankrupt, De Angelis wasn’t since he had stashed half a million dollars in a Swiss bank account; however, this lead to charges of contempt because he had claimed he was bankrupt. De Angelis also couldn’t explain the large cash withdrawals he had taken from Allied’s accounts. For his fraud, De Angelis received a seven-year jail term. When he got out in 1972, he got involved in a Ponzi scheme involving Midwest cattle, but this effort collapsed before it really got going. This shows that a swindler will always be a swindler.

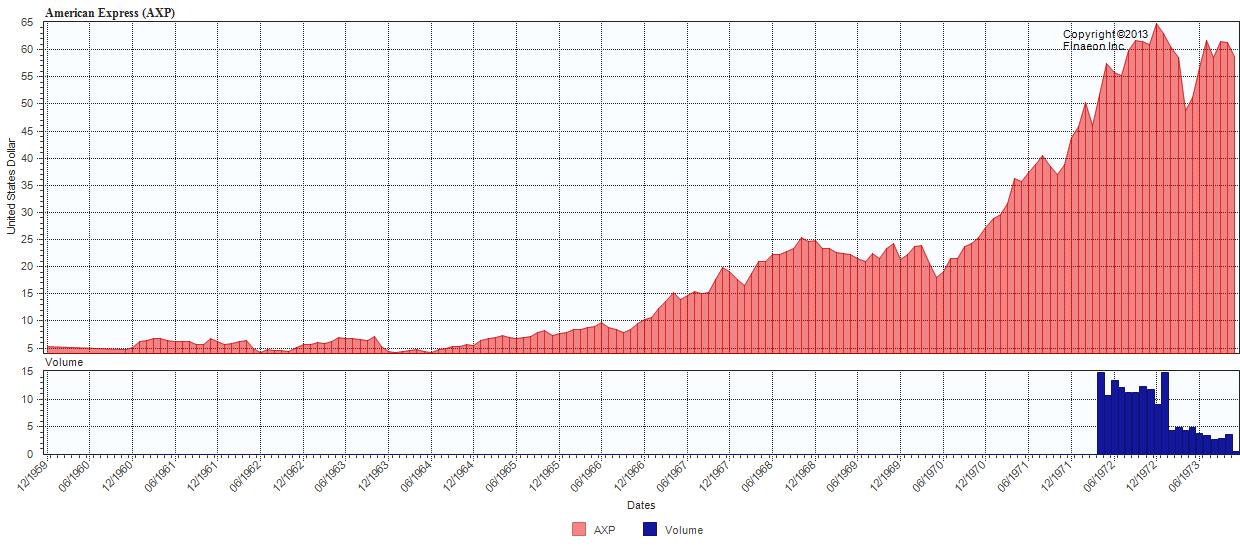

Warren Buffett Gets a Ten-Bagger

And what about Warren Buffett? As a result of the losses American Express suffered from funding De Angelis, American Express stock, fell in price from 65 in October 1963 to 37 in January 1964. Believing this was temporary. Warren Buffett began buying shares and established a 5% stake in American Express for $20 million. As indicated by the chart below, American Express made a ten-fold move between 1964 to 1973. American Express was one of the first of the many successful investments Warren Buffett made.

The differences between swindlers and investors are illustrated by Toni De Angelis and Warren Buffett. Toni De Angelis was a swindler and a con-man. He was good at cheating other people and cheating the system, but not at making an honest profit. He took advantage of government subsidies and programs, provided uninspected goods, cheated on his contracts, falsified reports, covered losses, embezzled money, and so forth. At every step he was trying to beat the system, and getting something for nothing, but as with any swindler, his scams eventually caught up with him. He went bankrupt twice, caused financial losses for thousands, and ended up in jail.

Contrast this with an insightful, aggressive market player like Warren Buffett. The position he took in American Express was typical of the investing strategy that served him well for the next fifty years. He chose a well-established company whose stock price had temporarily declined. He took a sizeable position in the company, held onto it for many years, and profited. The Buffett method worked in 1963, and it continues to work in 2013 for savvy investors.

***

Source:

[…] The cautionary tale of the Salad Oil Swindler (November 1963) | Global Financial Data Con-man Anthony “Tino” De Angelis of Allied Crude tried cornering the soybean oil market, to boost his business holdings in positively correlated vegetable oil. He used his commodity stockpiles as collateral for margin & bank loans, then redoubled his leverage by falsifying inventories with fake warehouse receipts & diluting storage tanks with water. In reality, he has only $6mm worth of oil vs $150mm professed, which would’ve been more than the entire US inventory. Soybean oil futures crashed from $9.875 to $7.75 on the news; regulators shut down the NYSE (down >3%), exacerbated by JFK’s assassination. American Express ($AXP) was one lender left holding-the-bag for Allied Crude’s defaulted loans & its stock fell 43% over the subsequent months, when Warren Buffet opportunistically bought a stake that appreciated 10x over the next decade. […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/11/20/warren-buffett-vs-the-salad-oil-swindler-november-1963/ […]

… [Trackback]

[…] Here you will find 92604 more Info on that Topic: thereformedbroker.com/2013/11/20/warren-buffett-vs-the-salad-oil-swindler-november-1963/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/11/20/warren-buffett-vs-the-salad-oil-swindler-november-1963/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2013/11/20/warren-buffett-vs-the-salad-oil-swindler-november-1963/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/11/20/warren-buffett-vs-the-salad-oil-swindler-november-1963/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/11/20/warren-buffett-vs-the-salad-oil-swindler-november-1963/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2013/11/20/warren-buffett-vs-the-salad-oil-swindler-november-1963/ […]

… [Trackback]

[…] There you can find 48719 more Info to that Topic: thereformedbroker.com/2013/11/20/warren-buffett-vs-the-salad-oil-swindler-november-1963/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2013/11/20/warren-buffett-vs-the-salad-oil-swindler-november-1963/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/11/20/warren-buffett-vs-the-salad-oil-swindler-november-1963/ […]

… [Trackback]

[…] Here you can find 41750 more Information on that Topic: thereformedbroker.com/2013/11/20/warren-buffett-vs-the-salad-oil-swindler-november-1963/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/11/20/warren-buffett-vs-the-salad-oil-swindler-november-1963/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/11/20/warren-buffett-vs-the-salad-oil-swindler-november-1963/ […]

fastest delivery of generic cialis

Health