361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

October 1, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

Dumb and Dumber 2: Lloyd and Harry go to Washington…

Congress and the White House must be pretty fired up that D&D2 started filming last week. The new movie might be the only thing more stupid than our elected leaders failing to negotiate and reach a deal. Most everyone either wants to spend our tax dollars like drunken professional athletes or hold our economy and financial markets hostage via a government shutdown and failure to raise the debt ceiling. Both sides need to take a break, read the cover story about the Baby Boom Budget Bomb in Barron’s this week (Barron’s), watch Ray Dalio’s video on how the Economy works (EconomicPrinciples), take some constituent phone calls, and then get back in the back room and trade some horses. This is no way to run a country.

@RebeccaJarvis: During 95-96 govt shutdown, S&P 500 dropped 3.7%. Following month, it jumped 10.5%.

So while most investors grab handfuls of hair over the actions of Washington, we also believe that any shutdown will be temporary and a failure to raise the debt ceiling will be avoided. Previous shutdowns (’95/’96) and dismissed threats (Dec. 2012) led to large bounces. So either you plan for political armageddon or you prepare for the post-budget bounce and own tennis balls. Not only do we know that October is a great month to be long stocks, but it also kicks off an equally good seasonal period for equities. (Q4 has been the best quarter to own stocks for the last 20, 50, and 100 years according to Bespoke.)

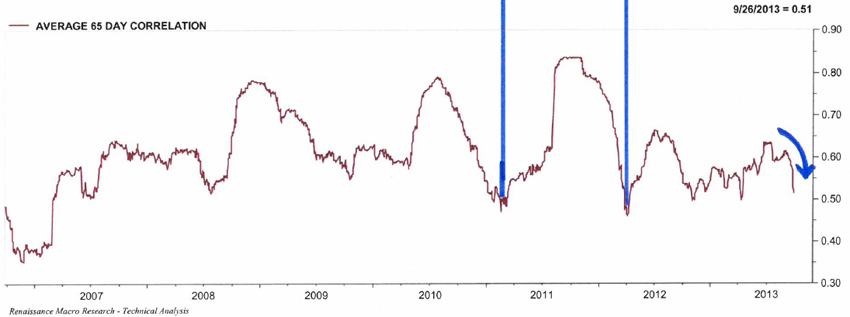

If your stocks are not working this month then you are in the wrong stocks…

Correlations between equities continue to decline. If your stocks aren’t outperforming, hand the reigns to someone else on your team and go take a break. Your style is out of sync and you need to let another stock picker in your firm take over for a while. If you don’t, your shareholders and clients will do it for you.

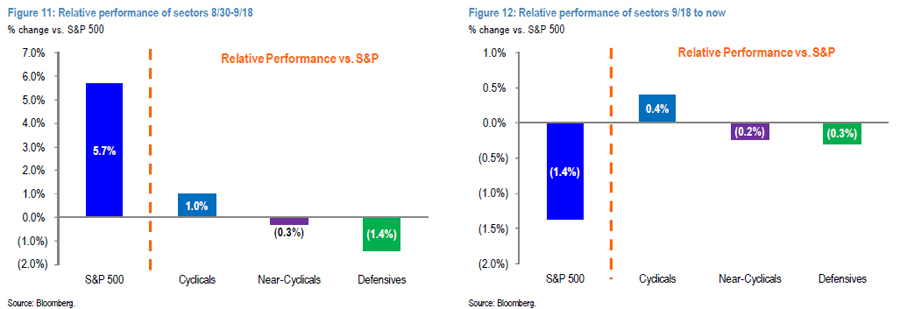

Even with this political noise, the RISKON cyclicals continue to outperform defensive issues…

So expect the cyclicals to be some of your top tennis balls.

(JPMorgan)

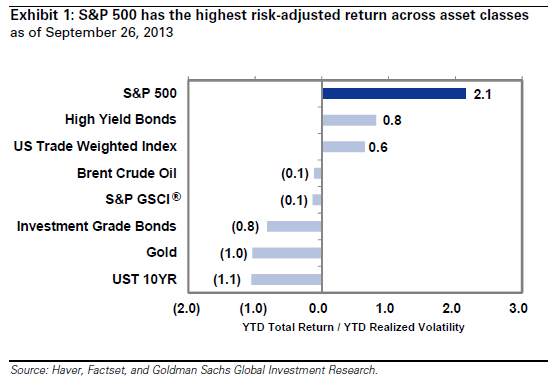

Helping a broader move into equities from other asset classes has been the increasing risk adjusted returns of stocks…

S&P 500 has delivered a 2013 total return of 21% with realized volatility of 9.8%. The resulting Sharpe Ratio ranks in the 98th percentile since 1962. U.S. stocks have beat 10-year Treasuries by 27 percentage points YTD (21% vs. -6%) with only modestly higher realized volatility (9.8% vs. 6.1%). The S&P 500 Information Ratio is tracking at its highest level since 1996. The S&P 500 information ratio considers both relative returns and the standard deviation of excess returns. The Information Ratio equals 1.74 and ranks in the 92nd percentile vs. 10-year Treasuries in the 50 years since 1962. S&P 500 is on pace to return 6.3% in 3Q 2013 with a realized volatility less than 10%. If maintained, those results would mark three consecutive positive return quarters and five straight quarters of below-average realized volatility. In contrast, the 10-year U.S. Treasury bond is on pace for its third consecutive quarterly loss with realized volatility of 8.5% (80th percentile since 1962). Our top recommendation remains to sell bonds and buy stocks.

(GoldmanSachs)

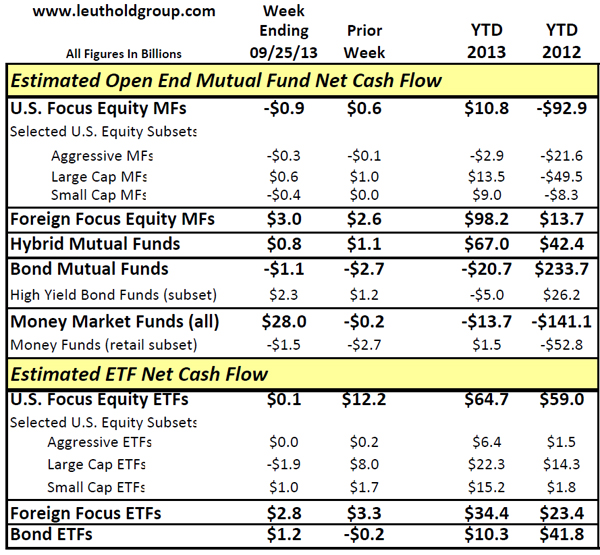

And investors continue to shift to equities at a pace not seen since 2009…

- YTD, bond mutual fund net cash flows are negative for the first time since 2004; this is nearly $255 billion less cash flow on a net basis compared to that recorded this time last year. Only five times over the past 20 years have bond mutual funds experienced annual net cash outflows.

- Domestic equity mutual fund cumulative YTD net cash flows remain positive ‐ this hasn’t been the case since 2009 ‐ and are more than $100 billion higher than this time last year.

- Total equity fund (MF + ETF) net inflows (including hybrids and foreign‐focused) sum to a net $275 billion collected YTD; this is higher than any other reading through late‐September, including the former nominal YTD record levels recorded in 2000.

Even Fidelity is making a significant shift to equities in its Target Date Retirement funds…

Fidelity Investments, the largest provider of 401(k) plans, is putting more stocks into its target-date retirement funds in anticipation that returns for bonds will weaken after a historic bull market. Fidelity is increasing the allocation to equities by as much as 15 percentage points for investors under age 67 and shrinking the amount of fixed-income holdings for retirees, the Boston-based firm said today in a statement. With the change, Fidelity’s asset allocations will be more like those of its primary competitors in target-date funds.

As we enter the seasonally strong 4th quarter for equities, it is helpful to look back at what the market has put together year to date…

Basically a +17% move from January 1st thru the end of May followed by a +3% move thru today. Will the 4 month summer plateau be enough to steady the market for a year end launch?

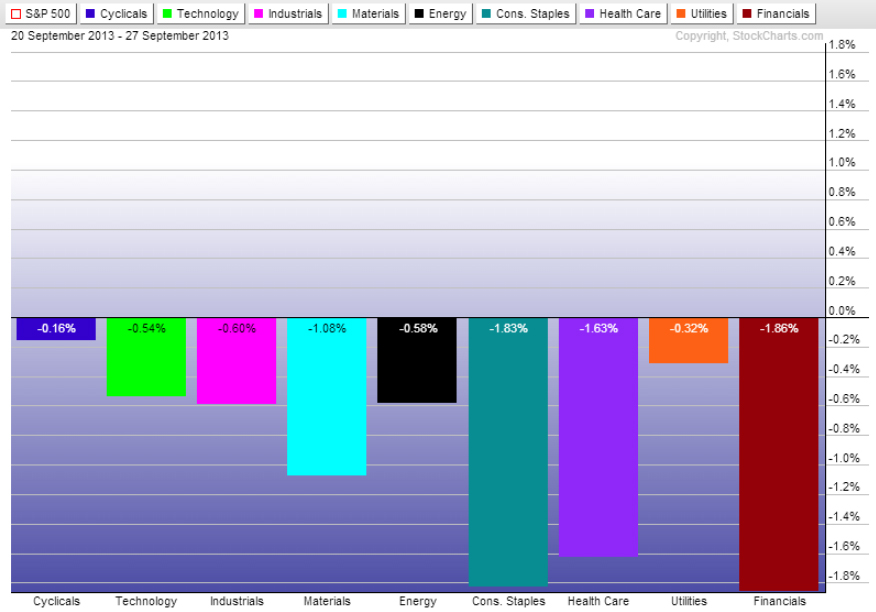

For the week, all XL sectors declined with RISKON outperforming RISKOFF…

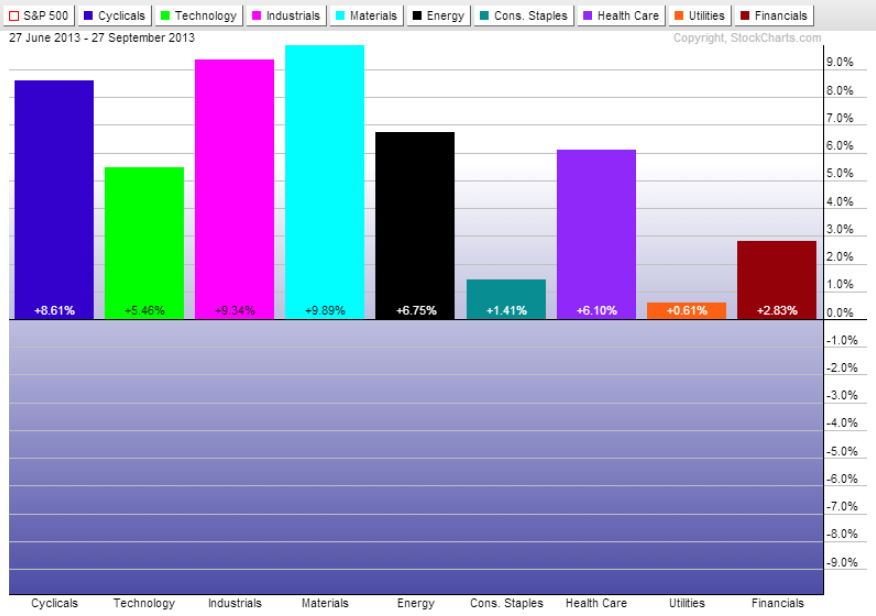

Also helpful to look at the Q3 sector returns where RISKON also outperformed RISKOFF…

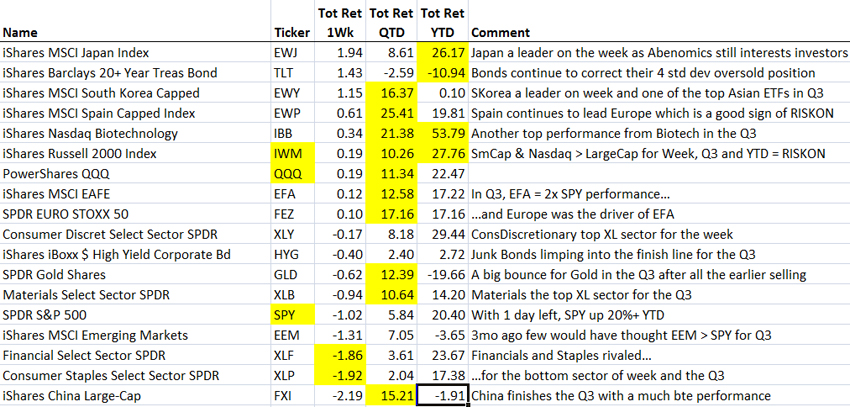

ETF performance breakdown shows Europe, Biotech, Small Caps, & China posting the best returns = RISKON…

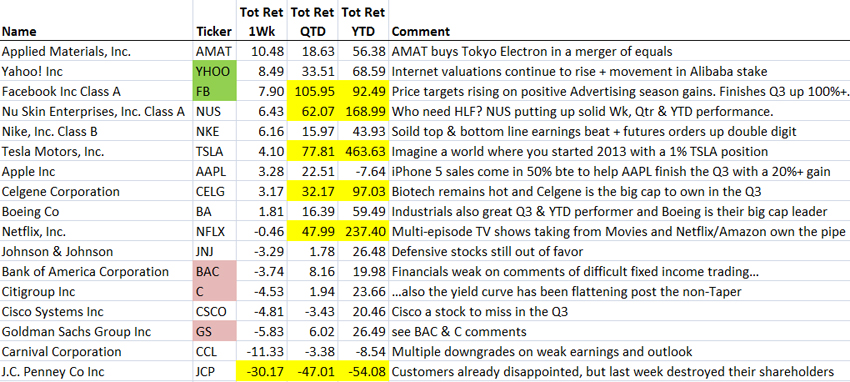

Stock performance highlighted several larger cap names with large gains even with the political battles…

October will also bring the Q3 earnings reporting season…

And if you are long equities, you would prefer to see the expectation bar falling into the earnings dates.

(ISI Group)

Last week we highlighted falling natural gas and electricity prices. Now here is the falling chart of gasoline…

Imagine what the U.S. economy could be like if fracking did not lead to millions of jobs created and lower energy prices for the last 5 years.

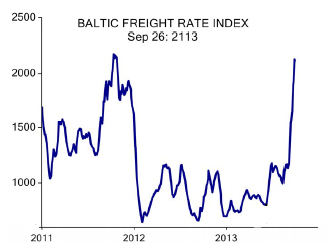

Meanwhile, Maersk calls bottom of global trade cycle…

The world’s biggest container shipping line is calling the bottom of the global trade cycle, saying that demand should increase in the next two years, writes the FT’s Richard Milne in Copenhagen. Maersk Line said demand for global containers should grow by 4-6 percent in 2014 and 2015, up from its current forecast of 2-3 percent for this year. “We believe we’ve reached the bottom of the cycle,” Jakob Stausholm, Maersk Line’s chief financial officer, told investors and analysts in Copenhagen on Thursday. Maersk is one of the best corporate indicators of global trade as it carries 15 percent of all seaborne containers. In recent years it has been weighed down by the weakness of Asia-Europe trade.

(FinancialTimes)

Which continues to spike global shipping rates…

(ISIGroup)

Speaking of Global Trade and Investments… Happy Oktoberfest as your German investments just hit a 5 year high…

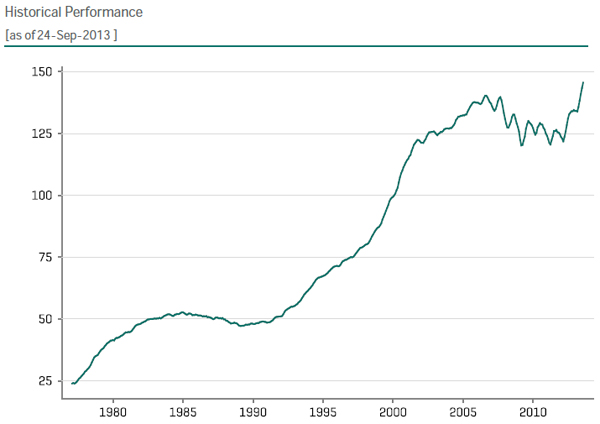

BlackRock, PIMCO, Goldman Sachs, & 361Capital… Thanks to Investment News for including us in your cover story…

“Who will be alts’ best in show?”

The demand for liquid alternatives has never been higher, and it is drawing in a pack of money managers who are all vying to be leaders of the pack.

(InvestmentNews)

If you still have a Blackberry, Gartner is telling you to either change fruits or go Droid…NOW!

“Gartner recommends that our clients take no more than six months to consider and implement alternatives to BlackBerry,” said Gartner analyst Bill Menezes in an email interview on Friday. “We’re emphasizing that all clients should immediately ensure they have backup mobile data management plans and are at least testing alternative devices to BlackBerry.”

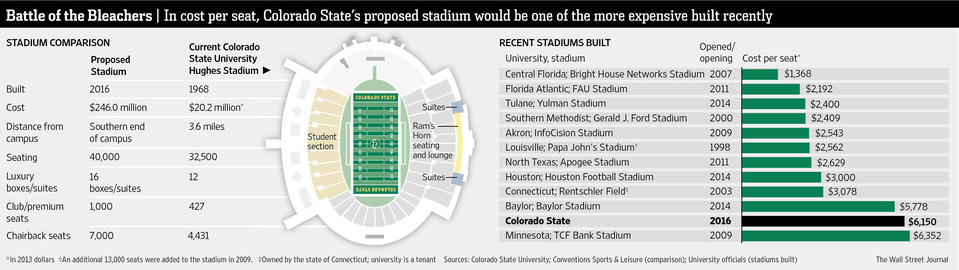

Since when do high school kids make a lifelong University commitment based on a college football ranking?

So let me get this straight:

- Colorado State University is likely to lose 10% of their State funding due to state level fiscal issues…

- They want to spend $246m to build a new, on campus stadium ($8,200 per student)…

- So that they can try and be more attractive to out of state students who pay 3x what in state students pay ($23,300)…

- They have Oregon Duck envy, but lack a billionaire donor who created the largest athletic company in the world.

Fort Collins is a great college town that often ranks as one of the top cities to live in the U.S. In the face of rising college costs, tighter student loan conditions, slowing university enrollments, football head injury litigation, and colleges needing to pay their athletes, why even pick up and throw these dice?

Then, there is that small issue that today’s college kids don’t go to their college football games…

Declining student attendance is an illness that has been spreading for years nationwide. But now it has hit the Southeastern Conference, home to college football’s best teams and supposedly its most fervent fans, giving athletics officials reason to fret about future ticket sales and fundraising. As it turns out, Georgia students left empty 39% of their designated sections of Sanford Stadium over the last four seasons, according to school records of student-ticket scans. Despite their allocation of about 18,000 seats, the number of students at games between 2009 and 2012 never exceeded 15,000. Winning isn’t even necessarily a solution. The average student crowd to see last year’s Georgia team—which finished the season ranked No. 5—was almost 6,000 short of maximum capacity. Even at Alabama, 32% of student seats went unused by students between 2009 and 2012, when the Crimson Tide won three national championships.

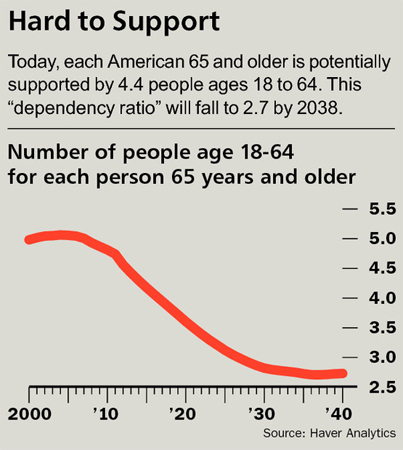

Also if Congress doesn’t solve the long term fiscal issues, there won’t be any kids sticking around to study in the U.S…

The math is pretty straightforward. Retiring baby boomers are pushing up the cost of elder-care entitlements. Mainly as a result, spending will rise much faster than revenues. Deficits will therefore be incurred every year, adding to the debt. That the federal government can no longer be expected to balance its budget, however, is not in itself the reason the CBO calls the trend unsustainable. The trend cannot be sustained because yearly deficits will be so large that the debt will grow faster than the economy’s ability to pay for it. Because most standard projections extend just 10 years, however, the media has helped stoke complacency about the budget, ignoring repeated warnings from the CBO about the misleading nature of the 10-year outlook. The CBO’s new 25-year projections should again make the message clear: The next decade is the relative calm before the coming storm. Any short-term improvement in the budget during the recent upswing in the business cycle is negligible when measured against looming long-term shocks.

Good news for our many Denver readers and real estate owners…

The Denver home price index broke out to new highs last month. It now joins Dallas as only the 2nd top 20 city to break out to new highs.

And finally, soon there will be no reason to keep a physical copy of any reading material in your carry-on bag…

A federal advisory committee is set to tell the Federal Aviation Administration that many aircraft flying today are largely ready to handle passengers using their electronic devices during all phases of flight, including takeoffs and landings, a committee member said. The committee limited its recommendations to electronic devices that are not connected to the Internet, said two people familiar with the report. If the FAA follows the recommendations, fliers could read e-books, listen to music or watch movies during takeoffs and landings if the content is saved on their devices.

361 Capital Research Briefing Archive

The information presented here is for informational purposes only, and this document is not be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/10/01/361-capital-weekly-research-briefing-58/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/10/01/361-capital-weekly-research-briefing-58/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/10/01/361-capital-weekly-research-briefing-58/ […]

… [Trackback]

[…] Here you can find 98312 additional Information on that Topic: thereformedbroker.com/2013/10/01/361-capital-weekly-research-briefing-58/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/10/01/361-capital-weekly-research-briefing-58/ […]

… [Trackback]

[…] Here you will find 36735 additional Information on that Topic: thereformedbroker.com/2013/10/01/361-capital-weekly-research-briefing-58/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2013/10/01/361-capital-weekly-research-briefing-58/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/10/01/361-capital-weekly-research-briefing-58/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/10/01/361-capital-weekly-research-briefing-58/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/10/01/361-capital-weekly-research-briefing-58/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/10/01/361-capital-weekly-research-briefing-58/ […]