The below is a guest post from the relatively new blog / tool Pundit Tracker.

Pundit Tracker is looking to quantify the pronouncements and predictions from America’s favorite market strategists and commentators, I’m trying my best to stay on their good side 🙂

Please check out the below awesome take on Apple forecasts and a rabid case of estimate clustering. Enjoy!

– Josh

***

Apple’s stock is expected to rise today after the company surpassed consensus expectations in yesterday’s earnings report. Apple’s reports are quite the spectacle, driving the already frenzied CNBC network into a hyperbolic state. Each financial metric is dissected in real-time, usually with the assistance of financial analysts who presumably are also speed-readers, capable of offering deep insights only five minutes after the report’s release.

A comparable spectacle is the pundit hysteria going into each Apple release, with droves of analysts making predictions on how each product line fared over the past three months. Fortune catalogued all of this quarter’s analyst estimates in a post earlier this week.

What’s most striking about these estimates is just how clustered they were. Take the iPhone, which is Apple’s biggest value driver and arguably the most anticipated metric in the release. The consensus among the 30 Wall Street analysts was that Apple would sell 26.6 million iPhones, which was well shy of the 31.2 million that Apple actually reported. More interestingly, 17 of the 30 estimates were between 26-27 million, while 80% (24/30) were between 24-28 million. (Note: the full range was 23-30 million, which too failed to capture the actual result).

These ranges seem shockingly narrow for a global consumer technology product, particularly one in the volatile smartphone industry. After all, how can all of the analysts’ ‘proprietary channel checks’ yield the same (wrong) answer?

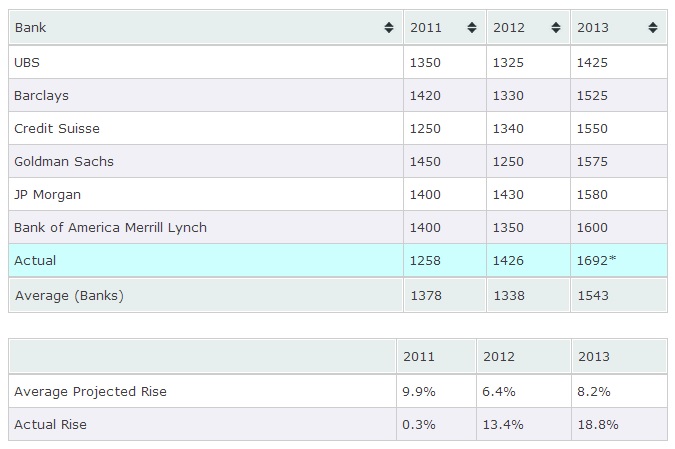

We don’t mean to single out Apple analysts, as most members of the financial pundit class seem to adhere to clustering as well. Consider the S&P 500 Forecasts issued by each investment bank at the beginning of each year. We catalogued three years worth of estimates made by six bulge bracket firms:

Annual S&P 500 Forecasts

The mean S&P estimate was considerably off-target each year: by +960 basis points in 2011, -700 basis points in 2012, and -960 basis points so far this year. As with Apple, the clustering effect was very pronounced, with five of the six analyst predictions each year falling within a 100 point range (1350-1450 in 2010, 1250-1350 in 2011, and 1500-1600 in 2012) – ranges which failed to capture the actual result in every instance.

So what is behind the errant clustering? The biases of anchoring and recency are likely culprits, with analysts anchoring to a baseline (e.g. Apple management’s guidance, S&P’s current level) and extrapolating from recent trends. We believe career risk is also at play: as investor Joel Greenblatt put it, “It’s much safer to be wrong in a crowd than to risk being the only one to misread a situation that everyone else had pegged correctly.”

But how do we reconcile the incentive for pundits to not stray from the consensus – and thus minimize career risk – with the bombastic pundits that we all love to rail on? (See:this guy). Why aren’t they concerned about career risk? Well, here’s the catch:

In punditry, if you are going to be wrong, it pays to be spectacularly wrong.

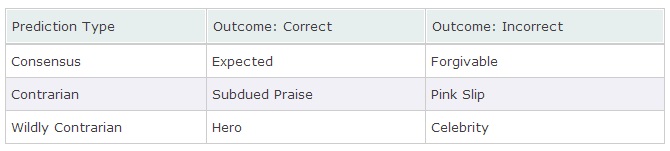

We explain using the following matrix:

Reaction to outcomes by prediction type

The first prediction type (“Consensus”) is greeted with minimal credit when correct and minimal blame when incorrect. As we discussed with the Apple analysts and S&P 500 forecasters, pundits focused on career preservation adhere to this ‘safety in numbers’ approach. The last prediction type (“Wildly Contrarian”) is typically made by pundits who crave media attention. Regardless of outcome, they are able to parlay their provocative predictions and media prowess into cash by writing books, hitting the speaking circuit, and developing a cult-like following. This is how One-Hit Wonders and Broken Clocks are born.

That leaves the middle prediction type, which we refer to as the ‘Bermuda Triangle’ of punditry. These pundits are contrarian enough to create career risk for themselves but not contrarian enough to garner mainstream attention. Correct predictions are greeted with modest praise — say, a pat on the back from a few colleagues — while incorrect predictions draw intense scrutiny. Low reward, high risk.

Our hunch is that the best pundits are stuck in this Bermuda Triangle, quietly amassing first-rate track records but lacking a platform to reach a wider audience. Instead, our professional ranks and airwaves are cluttered with pundits who make Consensus and Wildly Contrarian predictions. Nate Silver is a rare exception, having made the leap from quant to superstar. We would argue that Silver was aided by the criticism leveled at him by conservatives, which created a false perception that his election predictions were wildly contrarian when they were in fact only moderately so.

PunditTracker aims to disrupt the prediction industry by offering a common platform for everyone – including yourself – to make predictions. By leveling the playing field and holding everyone equally accountable, we strive to introduce a much-needed dose of meritocracy into the system.

Source:

… [Trackback]

[…] There you can find 50552 additional Info on that Topic: thereformedbroker.com/2013/07/24/if-you-are-going-to-be-wrong-it-pays-to-be-spectacularly-wrong/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/07/24/if-you-are-going-to-be-wrong-it-pays-to-be-spectacularly-wrong/ […]

… [Trackback]

[…] Here you can find 10146 more Information on that Topic: thereformedbroker.com/2013/07/24/if-you-are-going-to-be-wrong-it-pays-to-be-spectacularly-wrong/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/07/24/if-you-are-going-to-be-wrong-it-pays-to-be-spectacularly-wrong/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2013/07/24/if-you-are-going-to-be-wrong-it-pays-to-be-spectacularly-wrong/ […]

… [Trackback]

[…] Here you will find 78901 more Info to that Topic: thereformedbroker.com/2013/07/24/if-you-are-going-to-be-wrong-it-pays-to-be-spectacularly-wrong/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/07/24/if-you-are-going-to-be-wrong-it-pays-to-be-spectacularly-wrong/ […]