361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

July 22, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

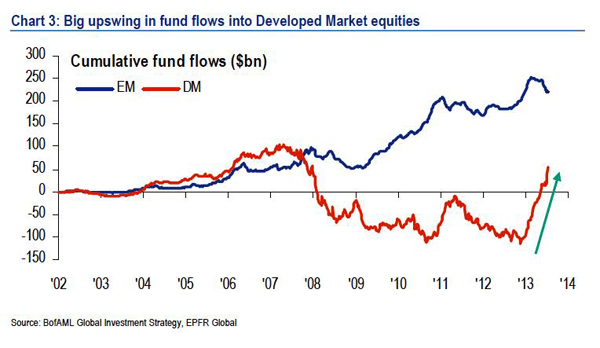

You thought it was hot outside? Wait until you see the weekly cash inflows into U.S. Equities…

Funds that hold only U.S. stocks gained $15.58 billion in new cash, the most since June 2008. ETFs that hold domestic equities attracted $12.45 billion of those gains.

(Reuters)

And the hot week only continues a hotter month for ETFs led by the SPY…

“If you are looking for the source waters of the recent melt-up in U.S. stock markets, look no further than U.S. listed exchange traded funds,” says Nicholas Colas, chief market strategist at ConvergEx Group. “Over the first 12 trading days of the new quarter, investors have added some $24.4 billion of new assets to ETFs which focus on U.S. equities, or over $2 billion per day,” he said in a note Friday. “That’s almost 4x the run rate of the first half of 2013 and simply a torrent of fresh money by even the ETF industry’s go-go standards.”… SPDR S&P 500 has been driving the massive inflows to U.S. equity ETFs. The fund this week broke through $150 billion in assets for the first time. SPY has reeled in $12 billion so far this month, or about $1 billion a day.

(ETFTrends)

The market was focused on Earnings this week. Given the low expectations going into the Q2 results, the results have been to the upside…

According to Bloomberg, 103 of the S&P500 companies have reported. Earnings at 73% of those firms have exceeded Street expectations w/the average beat 2.64%. So far financials are accounting for the bulk of the earnings upside – 80% of financials have exceeded forecasts (w/the average beat over 8%, although it’s important to remember that the ~22% beat at GS, PNC, etc., overstates to an extent the overall quality of those reports). On the revenue front, performance has been very neutral (~53% of the 103 firms saw sales top forecasts while 46% came in below; so far aggregate sales are tracking right inline).

(JPMorgan)

General Electric led the Industrials higher on Friday by posting solid order growth across the board…

“We executed in a business environment that was slightly improved versus the first quarter. Emerging markets remain resilient, and in the U.S. we saw strong growth in orders this quarter. Europe is stabilizing, but still challenged. We expect margin expansion to continue and segment profits to grow in the second half of the year.”

(Chairman and CEO Jeff Immelt)

Maybe Earnings in the Technology sector would have done better if it had more female CEOs…

Bank Stock investors raised the roof for their sector’s earnings beats…

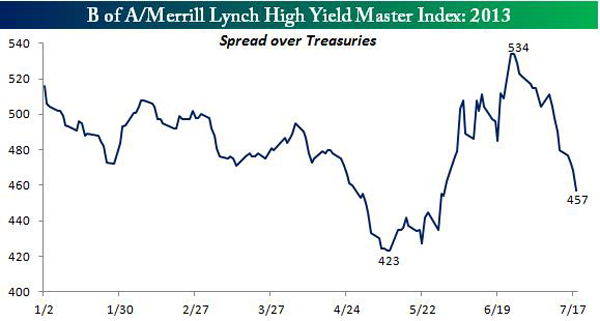

And High Yield bonds continue to mend its May/June breakdown…

Junk is even outperforming Treasuries in this bounce as evident by the collapsing credit spread…

And while the Transports had some negative earnings announcements, the group continues to march to New Highs…

@Ralph_Acampora: Dow Theory: yday DJ Transports scored new closing high–re-confirms the primary bull market – buy!

The big highlight for the bulls on the week was the New High breakout of the Industrial sector…

Thanks not only to GE, but also to all of those other smaller industrials that put up better than expected numbers in a tough environment.

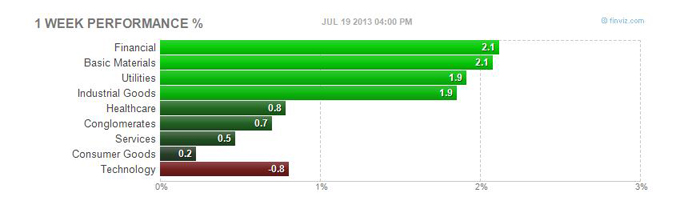

For the week, all sectors finished higher except for the Technology sector which was held back by the male dominated CEO mega caps…

Back to technology stocks, Microsoft received its 2013 report card last week…

If you are a gamer or have kids, you have seen this image in real life. It is the XBox 360 ‘Red Ring of Death’ and was awarded to 1/2 of all 2nd generation XBox-es leading to a 9 figure charge to earnings to exorcise this demonic manufacturing problem and retain their installed customer base. This quarter, Microsoft is taking a near $1b charge to earnings not for a manufacturing problem, but because they missed their customer target market by a few solar systems. (I have yet to see anyone actually using a Surface in the real world?)

I am not sure where the monopoly went wrong. Given their dominance in corporate and consumer operating systems, one would have thought that Microsoft could have succeeded in consumer products, mobile devices, and everything touching the internet. Following their own stock collapse of 11% on Friday, some activist shareholders lit up their very own ‘Red Ring of Death’ on Microsoft’s management team. Your move Microsoft. You had better have Cortana call in the Master Chief ASAP or else your disappointed investors will return as The Flood.

Microsoft and Mega Cap tech disappointments led to the XLK challenging the 50day moving average…

Will it hold? Can the rest of the market work without Mega Cap tech?

In a very contrarian move, Josh Brown is trading in all of his footballs for futebols…

Gun to my head – I had to pick a single non-US stock market to be invested in for the next ten years and I cannot touch the money in between, which one would I pick? I don’t even need to think twice about it, the answer is Brazil.

(TheReformedBroker)

Detroit, Michigan becomes the 1st major American city to fall under the weight of its own liabilities…

Detroit bankruptcy quotes/tweets for the week…

- “For years, Detroit has spent more than it takes in and has borrowed to make ends meet. It is insolvent” Kevyn Orr, Detroit’s emergency fiscal manager.

- @PIMCO: Gross: Mo Town could be Yo Town. Govt mismanagement, overspending AND global competition threaten U.S. cities & corp business models.

- @munilass: I have no idea why anyone would invest in local debt in Michigan at this point. You’d have to be a complete fool.

Detroit’s emergency manager Kevyn Orr laid out all the problems and economic headwinds facing the city. For instance:

- Since 2000, Detroit’s population has declined 26 percent. There are now just 706,000 people in the city, way down from 1.85 million during its industrial heyday in 1950.

- The official unemployment is now 18.6 percent, and fewer than half of the city’s residents over the age of 16 are working. Per capita income is an extremely low $15,261 a year, which means there’s not all that much tax revenue pouring in.

- Low tax revenue, in turn, means that city services are suffering. Detroit has the highest crime rate of any major city, and fewer than 10 percent of crimes get solved. The average response time for an emergency call is 58 minutes. Some 78,000 buildings are abandoned or blighted and there are an estimated 12,000 fires every year. About 40 percent of the city’s streetlights don’t work.

- High crime and blight are driving even more residents out of the city. It’s also driving down property values, which means many residents have stopped paying property taxes. The city collected about 68 percent of the property taxes owed in 2011. Both of those things put a further strain on Detroit’s finances.

- Detroit is sagging under decades of bad governance. “The city’s operations have become dysfunctional and wasteful after years of budgetary restrictions, mismanagement, crippling operational practices and, in some cases, indifference or corruption,” Orr wrote in May. “Outdated policies, work practices, procedures and systems must be improved consistent with best practices of 21st-century government.” (Detroit has been a one-party city run by Democrats since 1962.)

- Meanwhile, Detroit owes around $18.5 billion to its creditors. That includes about $6 billion in health-care and life insurance obligations, plus roughly $3.5 billion in pension costs racked up over the years. Given its ever-worsening economic slide, Detroit was in no position to pay off all its obligations.

As for whether or not Detroit Rock City could be rolling into your town in the future…

“This could be kind of a precedent for other municipalities. Anyone concerned about some other cities like Chicago, cities in California, what this could do is accelerate a trend where states begin to withdraw their support for cities,” said Jack Ablin, chief investment officer at BMO Private Bank in Chicago. “We could potentially see more filings, not on the same scale of Detroit, but certainly some other ones coming out of the woodwork,” he said. Michigan’s reluctance to provide a financial lifeline to Detroit may be establishing a new pattern. “Detroit getting into trouble? Not a surprise. State of Michigan not coming to help? It is a big surprise, and I think I am not the only one to say that,” said Richard Larkin, director of credit analysis at HJ Sims.

(Reuters)

If only State and Municipal politicians would have taken more math in school…

It may sound arcane, but the stakes for the country run into the trillions of dollars. Depending on which side ultimately wins the argument, every state, city, county, and school district may find out that, like Detroit, it has promised more to its retirees than it ever intended or disclosed. That does not mean all those places will declare bankruptcy, but many have more than likely promised their workers more than they can reasonably expect to deliver. The problem has nothing to do with the usual padding and pay-to-play scandals that can plague pension funds. Rather, it is the possibility that a fundamental error has for decades been ingrained into actuarial standards of practice so that certain calculations are always done incorrectly. Over time, this mistake, if that is what it is, has worked its way into generally accepted accounting principles, been overlooked by outside auditors and even affected state and municipal credit ratings, although the ratings firms have lately been trying to correct for it. Since the 1990s, the error has been making pensions look cheaper than they truly are, so if a city really has gone beyond its means, no one can see it.

(NYTimes)

Politicians should also listen to Howard Marks who will tell them to set more realistic investment expectations…

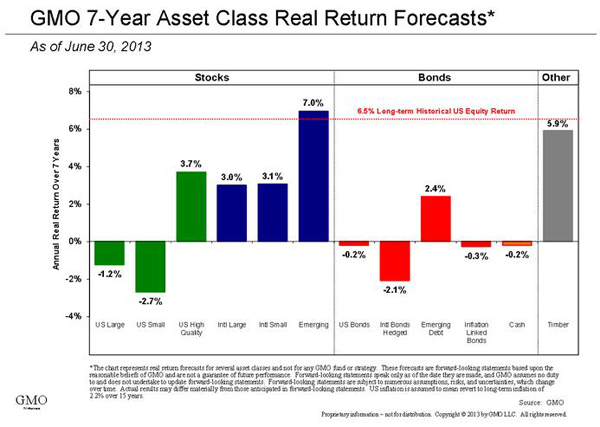

Politicians should also invite Jeremy Grantham to their next Pension board meeting and have an open discussion about whether their strategy can earn 7.5%-8.0% like they have budgeted for the State/City’s most important liability…

Meanwhile, back in Detroit, there is about to be one hell of a garage sale…

The city owns the Detroit Institute of Art, a collection started in 1885 and includes Vincent van Gogh’s “Self Portrait” and Diego Rivera’s “Detroit Industry” mural as well as August Rodin’s famous “The Thinker,” which graces the steps leading to the museum. The museum touts itself as one of the top six collections in the nation, and The Economist recently said it was appraised at $1 billion in 2004. According to the Detroit Free Press, the van Gogh is worth $60 million, an Andy Warhol self-portrait would be would $80 million and Henri Matisse’s “The Window” would be worth $150 million.

Following on the heels off the Detroit banko filing was Moody’s making life much more difficult for the city of Chicago…

Mounting pension liabilities have cost Chicago another cut in its credit standing as Moody’s Investors Service reduced the general-obligation debt rating for the nation’s third-largest city by three steps to A3, citing a $36 billion retirement-fund deficit and “unrelenting public safety demands” on the budget. Moody’s also placed the city’s $7.7 billion in general-obligation bonds under a negative outlook, indicating another cut may be made. The moves follow a review that began in April, when the New York-based rating company said it was reevaluating the credit effects of municipal retirement obligations.

Public pensions nationwide are under significant stress following the longest recession since the depression and the financial crisis that punished asset values. The magnitude of the estimated deficit for all plans ranges from $900 billion to more than $4 trillion, depending on the assumptions used.

“Absent significant growth in the city’s operating revenues, escalating pension funding requirements will increasingly strain the city’s operating budget, as pension outlays compete with other spending priorities, including debt service and public safety,” Moody’s analysts said yesterday in the report. They also cited the political obstacles to meaningful retirement system reform at the state level.

(Bloomberg)

At the other end of the municipal health spectrum are those cities where population growth >> livable space…

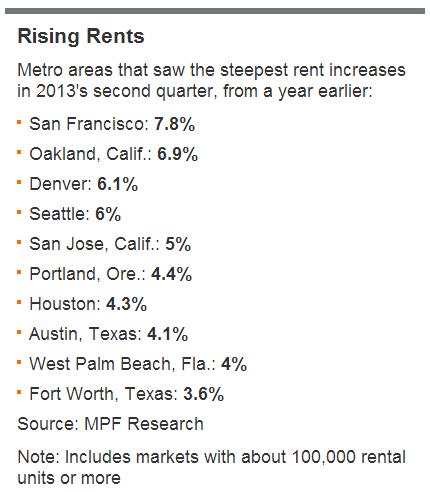

San Francisco led the top-50 U.S. metropolitan areas in average rent growth during the second quarter, jumping 7.8% to $2,498, while Oakland was No. 2 at a 6.9% increase, and San Jose was in fifth place at 5%. The 6.8% increase for the combined San Francisco Bay area was more than double the nation’s 3.1% increase, according to preliminary estimates by MPF Research, a market-research firm in Carrollton, Texas. The rent increases have investors rushing to purchase existing properties. San Francisco-based Ridge Capital Investors, for example, has acquired nearly 500 units throughout the area since 2011, including a 45-unit apartment complex in San Mateo, a city south of San Francisco, for $10.95 million in November. Trevor Wilson, managing director of Ridge Capital, said his company has competed against as many as 30 bidders on multifamily properties in recent months.

Bill Gates, Warren Buffett, Mark Cuban, and the White House are working to flip higher education on its head. This disruption in the world of education will be highly significant. As an example, go look what your kids/grandkids are doing on www.KhanAcademy.com this summer to get ready for their fall classes…

Bill Gates, a Harvard dropout who became the richest man in the world, believes that foundations can step in where markets fail. Higher education should cost less, produce more graduates, and better serve low-income students, the Gates thinking goes. Colleges cannot count on more public money to fix their problems. Instead, better data and openness are part of the solution, to do things like measure the “value” added by each institution. So is technology: Among the foundation’s investments are projects to test how massive open online courses, or MOOCs, could change introductory and remedial classes.

“The education we’re currently providing, or the way we’re providing it, just isn’t sustainable,” Mr. Gates told the Association of Public and Land-Grant Universities last year. “Instead we have to ask, ‘How can we use technology as a tool to recreate the entire college experience? How can we provide a better education to more people for less money?”

(Chronicle)

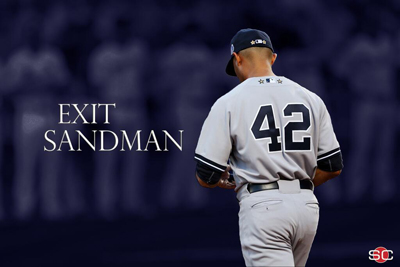

Finally, it was a good week for sports…

“You work for a guy for 21 years, it’s pretty cool when you see him playing the best round of golf you’ve ever seen him play in the last round to win the British Open.” Jim Mackay, longtime caddie for Phil Mickelson

(NYTimes)

(@SportsCenter)

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

The information presented here is for informational purposes only, and this document is not be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/07/23/361-capital-weekly-research-briefing-45/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2013/07/23/361-capital-weekly-research-briefing-45/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/07/23/361-capital-weekly-research-briefing-45/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2013/07/23/361-capital-weekly-research-briefing-45/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/07/23/361-capital-weekly-research-briefing-45/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/07/23/361-capital-weekly-research-briefing-45/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/07/23/361-capital-weekly-research-briefing-45/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/07/23/361-capital-weekly-research-briefing-45/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/07/23/361-capital-weekly-research-briefing-45/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/07/23/361-capital-weekly-research-briefing-45/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/07/23/361-capital-weekly-research-briefing-45/ […]