361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

April 29, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

(MarselvanOosten)

While the Bears fight, the market lifts to near record highs as Central Banks suggest more easing…

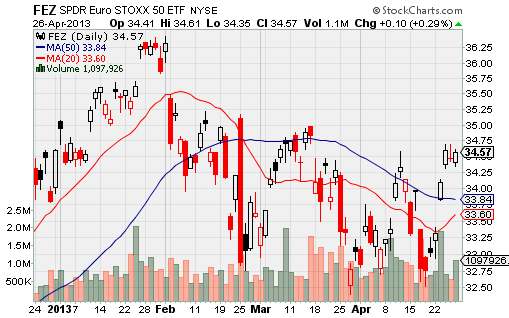

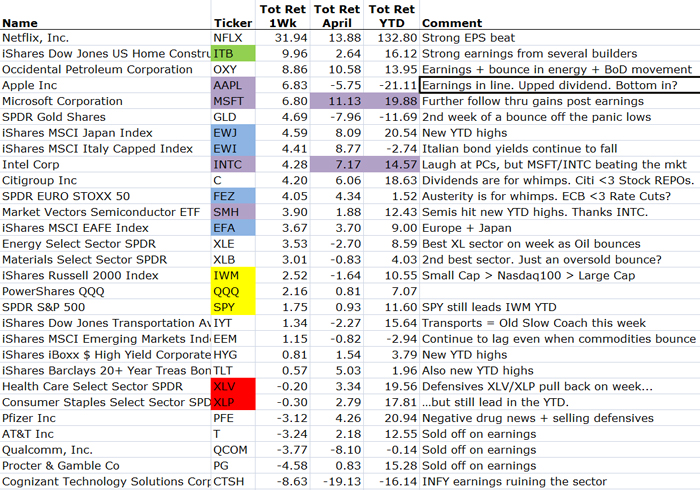

While corporate earnings outlooks and released economic data remained soft, the world moved to declare Austerity a failure and quickly assumed that the ECB could ease further at this week’s meetings. The recent collapse in commodity prices and slowdown in China does put a high card in their hand. With these new thoughts, European equities and bonds both surged on the week…

ISI Group notes the added flexibility given to the ECB…

“German under-performance opens door to ‘Central Bank Hat Trick’ – Ed mentions there is a chance that next week all 3 major central banks (Fed, BOJ, ECB) will be easing. At least judging by the DAX and the Nikkei, economic prospects in Japan are improving relative to Germany. The DAX is virtually unchanged since December while the Nikkei is up +43% (i.e. Volkswagen down 12% since December vs. Toyota +56%). These divergences are putting pressure on Merkel to favor less austerity and perhaps to encourage the ECB to be more aggressive.”

As Credit Suisse notes, the lower commodity prices have multiple cantilevered impacts…

“Impact of lower commodities prices: each 10% off oil adds 0.2% to developed world GDP growth, takes 0.4% off inflation, and thus allows central banks (esp. the ECB) to be more aggressive. It also adds 1.4% to European EPS (1.2% in the U.S.). GEMs in aggregate are hurt by lower commodity prices, but commodity importers like India, Turkey, and Korea benefit.”

Jon Hilsenrath adds that even the Fed gets more legroom now…

Federal Reserve officials are likely to continue their easy-money policies at the central bank’s policy meeting on Tuesday and Wednesday, in part because several recent inflation measures have fallen well below the Fed’s 2% target. With inflation now lower than the Fed wants, officials are likely to conclude their policies show no sign of overheating the economy. That allows them to maintain their $85 billion-a-month bond-buying program, which the central bank is employing to ease credit conditions and spur spending, investment, and hiring. Fed officials after their March policy meeting talked about tapering off the bond purchases later this year if the economy continued to gain strength. But inflation readings have since slipped, and employment numbers have been disappointing.

(WSJ)

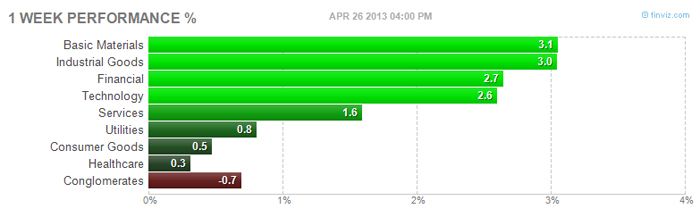

With a potential green light given to further easing, it was a RISKON week as the most Cyclical groups led the move higher…

While it was a RISKON week, these 3 Defensive groups are still the only ones to not break their 50day moving averages during this earnings season…

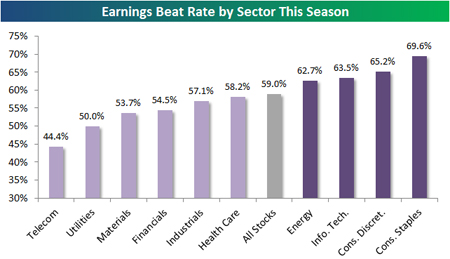

While some investors are concerned over the valuations of the Consumer Staples (XLP) group, the group has had the best earnings performance for this reporting period…

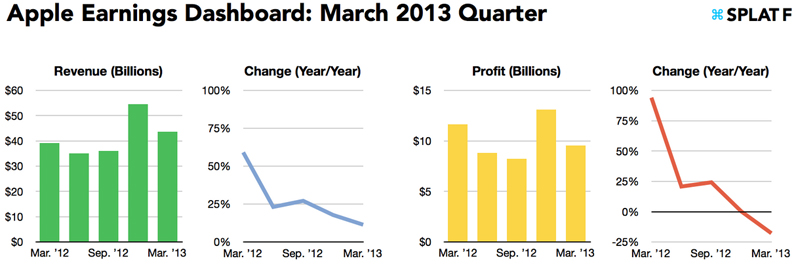

Apple also reported…

As expected, the growth rates continued to slow, but helping the psychology was a dividend increase and announcement of a stock repurchase. So now, do we all go back to worrying about the competitiveness of their new products? Or will the valuation and dividend yield set a floor price for 2013?

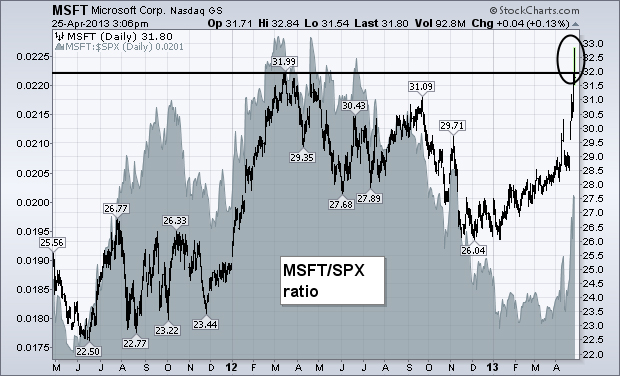

Speaking of mega cap tech, the question that every Large Cap Portfolio Manager will now be dreading:

“Are you over or underweight Microsoft?”

PMs could own AAPL for the $300 point move lower and keep their jobs because everyone also owned it. But what will happen if they miss a BIG upward move in a $265 billion market cap that is a major component in the indexes. Pull up the daily volume chart of MSFT and note the significant institutional buying that has occurred in the last 2 weeks. Some very large institutions are moving their chips to Redmond, WA as the stock is about to take out its 6 year highs.

Investor demand for return is evident in any security that has a yield. Will demand for dividend yields be able to surpass future earnings shortfalls?

The dominant theme in this market is yield: this week, junk bonds, utilities, staples, real estate, and the ETFs for both 10 and 20 year treasuries (IEF and TLT) made new uptrend highs. Junk bond yields are now at a new record low (5.5% vs. 7.2% a year ago). The dividend yield on equities (2.1%) is higher than 10-year treasuries (1.7%), a combination which, in a low volatility environment, supports current prices. Treasury yields are even lower in Germany, the UK, and Japan which, all other things equal, supports continued low yields in the U.S. There is, in short, a dynamic that could support today’s prices.

There are two requirements for this to persist. One is that volatility remains low. Recent jumps in Vix have been short lived and there is a prior history of sustained periods of low volatility.

The other requirement is growth in corporate revenues and earnings. This is a risk we have detailed before. The 1Q13 reporting period is half over. Overall, 1Q13 EPS is trending toward a 2% increase. However, only 35% of the companies beat their revenue estimates, compared to an average beat rate of 62% since 2002. As a result, 1Q13 revenue growth is tracking towards a decline of 0.6%.

More troubling is that negative guidance for FY13 is exceeding positive guidance by a ratio of 14:1, compared to the historical average of 2:1. As a result, estimates for 2Q13 EPS have fallen over the past month from 4.5% to 2.4%.

(TheFatPitch)

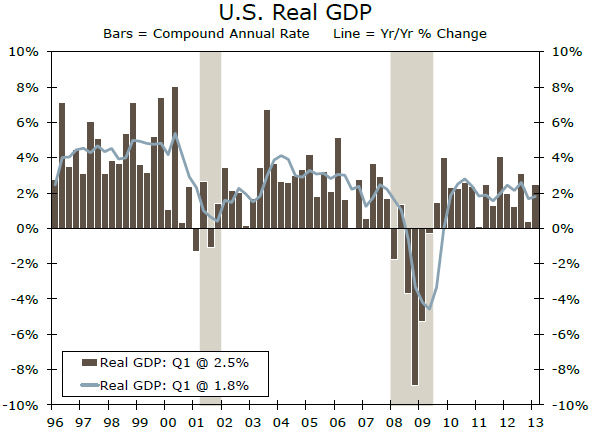

Among the weekly economic data, Housing beat expectations while Q1 GDP came up short…

Q1 GDP came in lighter than expectations, rising 2.5% against a 3.0% consensus estimate. Inventory investment contributed 1.0% to GDP, so real final sales rose only 1.5%. Another confirming read on GDP is MMM which saw Q1 Organic Revenue growth of only +2%.

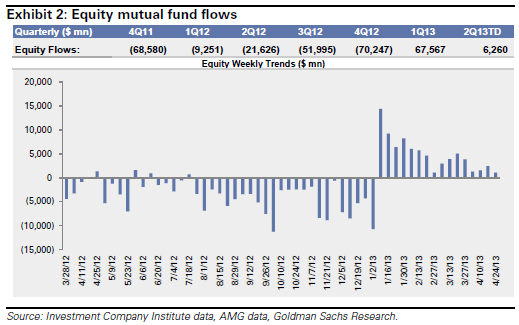

Remember how excited the market was over the January spike in equity mutual fund inflows?

(GoldmanSachs)

The lack of flows is surprising given the EXTREMELY low volatility + POSITIVE outperformance of equities…

@ukarlewitz: 2013 is the first time in 17 years that there hasn’t been even a 5% retrace by May

Bloomberg may have found a soft spot in the fixed income markets: Jumbo Private Mortgage Backed Securities…

Investors’ rekindled passion for sales of private mortgage securities is cooling. Yields on $397.3 million of top-rated securities sold yesterday by Redwood Trust Inc. (RWT) were 175 basis points more than benchmark swap rates, up from 170 basis points on bonds it sold earlier this month, and 97 basis points, or 0.97 percentage point in January. Sales this year of home-loan bonds without government backing have already surpassed the highest annual total since the debt sparked the global financial crisis. “Suddenly, in the last couple of months, the love has dissipated” as investors demand to be paid more relative to so- called agency bonds, said Brad Friedlander, a managing partner at Atlanta-based Angel Oak Capital Partners, which oversees about $2.5 billion.

(Bloomberg)

For your next personal/business move, go out of your way to find a town with Fiber to the Home (FTTH)…

Google is dropping so many futuristic products that industry pundits like Jason Calacanis (and many others) are breathlessly declaring that “Google wins everything” with all these fiber cities, self-driving cars, and Internet-enabled glasses initiatives rolling out lately. Out of all these efforts, however, the Google Fiber initiative really is the killshot move. That’s because these new products will need a large amount of high-availability bandwidth to keep all those cars between the ditches and glasses cranking out real time data in mass. And being the interface to the Internet and digital entertainment in all these homes sure doesn’t hurt their data-driven advertising business model either.

(PandoDaily)

Tweet of the Week…

@GSElevator: #1: After I drink my coffee, I show my empty mug to the IT guy and tell him I’ve successfully installed Java. He hates me.

@KNashSports: Most dangerous selfie ever. That happened. @ Fenway Park

Instagram

And finally, this was sent to us from one of our readers in China…

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] There you can find 69703 additional Information on that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]

… [Trackback]

[…] There you can find 35763 additional Information on that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]

… [Trackback]

[…] Here you will find 22742 additional Information on that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]

… [Trackback]

[…] There you will find 86303 more Information on that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]

… [Trackback]

[…] Here you can find 59486 more Info on that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/04/30/361-capital-weekly-research-briefing-41/ […]