361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

April 22, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

Motorcycle Rider: Motorcycle as Equities: Earnings

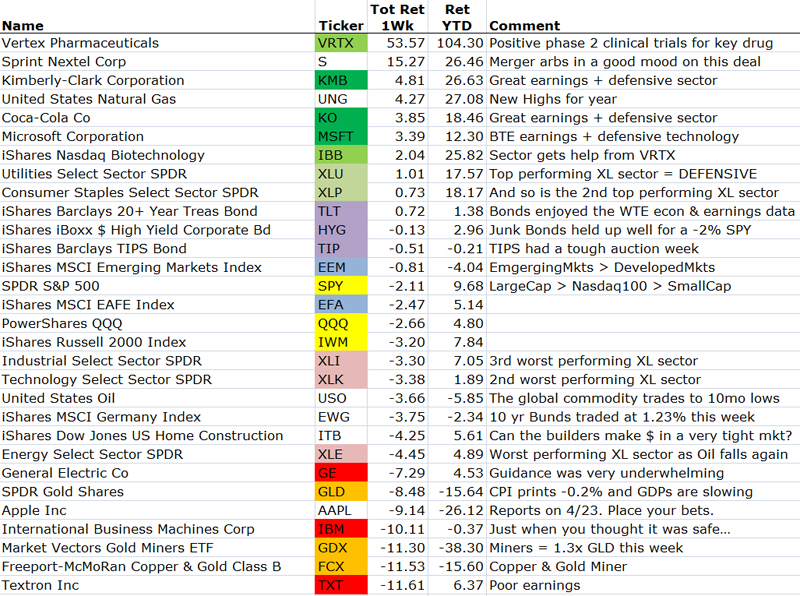

Earnings hit the market like a ton of bricks this week. It wasn’t that the reported numbers were a disaster, but that the new data points did not change the trajectory of the current buying and selling patterns. Investors rewarded the defensive earners (bought more Coca-Cola, Johnson & Johnson, and Microsoft) and sold their shares in more cyclical stocks (Industrials, Semis, and Oil Services). Financial stocks survived the week, but few owners went home Friday feeling better about their bank names than at the start of the week. Homebuilder stocks might be the tell this week as many are reporting, along with some new housing data. If they fail to perform on expected good earnings, it could dictate as we head into summer.

Adding to the sour taste of earnings was a Collapse in gold prices, Additional weak global economic data, and Continued defensive buying of U.S. and German bonds…

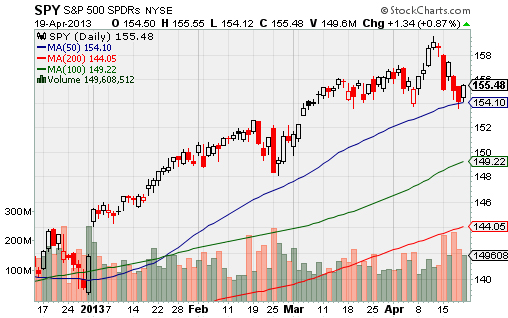

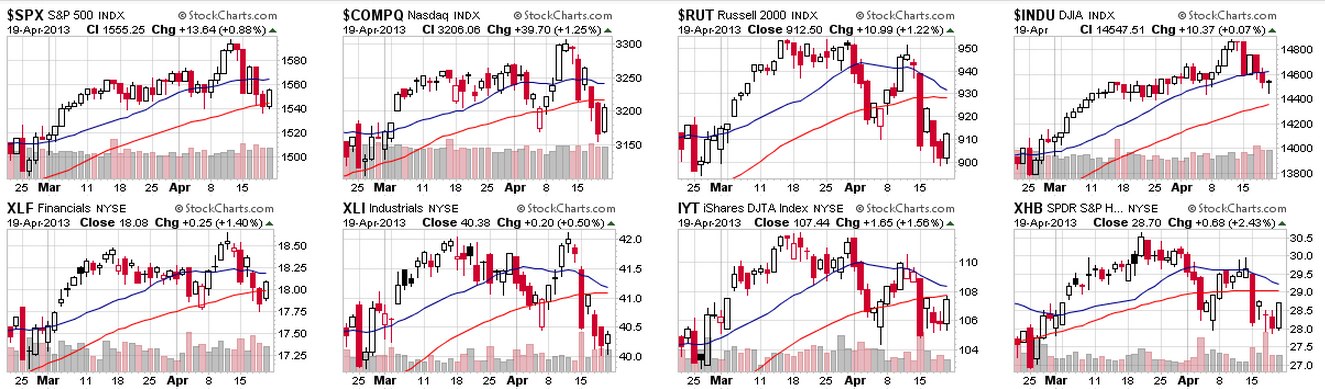

Equity worries can be seen in the daily chart of the S&P500 which shows clear selling distribution. The spikes in volume are all on down days. Keep an eye on buying/selling volumes this week as another heavy round of earnings and economic data will hit the market. For the market to mend itself, a few +1% days on elevated volume are in order.

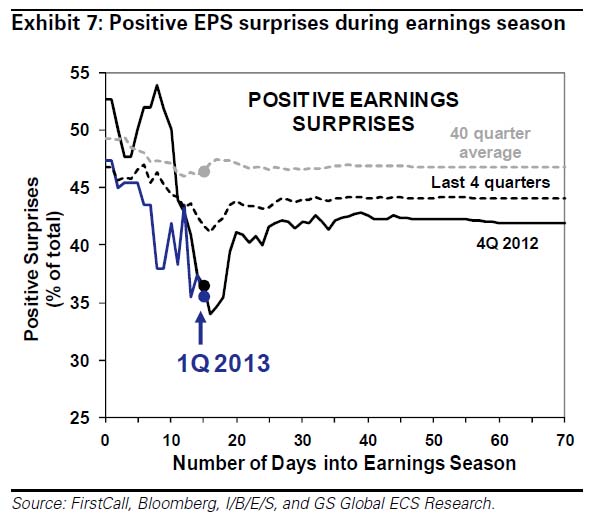

As shown by Goldman Sachs, the number of Positive Earnings Surprises is tracking slightly below last quarter’s…

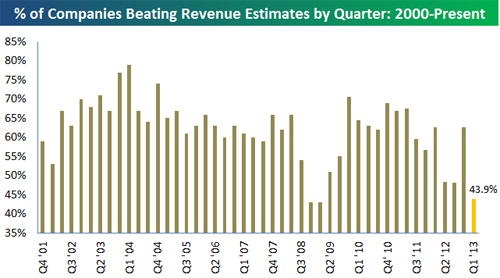

More worrisome is the number of companies that are missing the top line…

…as well as the disappointing guidance and confidence being expressed on the Q1 earnings calls. Margin gains will be tough to get if unit volumes do not surprise on the upside.

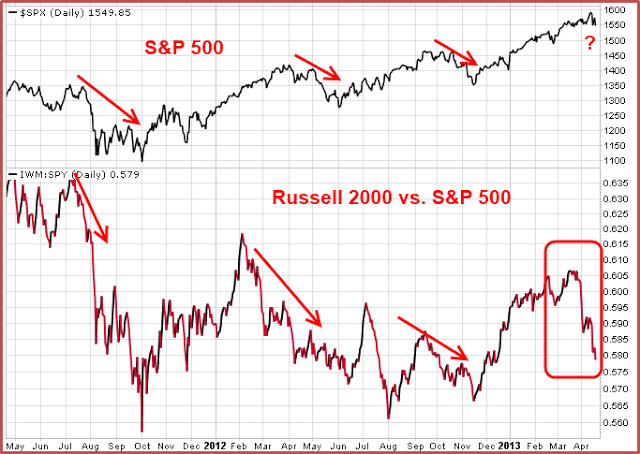

The market is worried about equity risk, which is evident in the underperformance of Small Caps…

Once Small Caps started to underperform beginning 4 weeks ago, risk has left the market like air out of an untied balloon. Keep an eye on the IWM. If equities are going to put in a spring/summer rally, they will need help from the riskiest market caps.

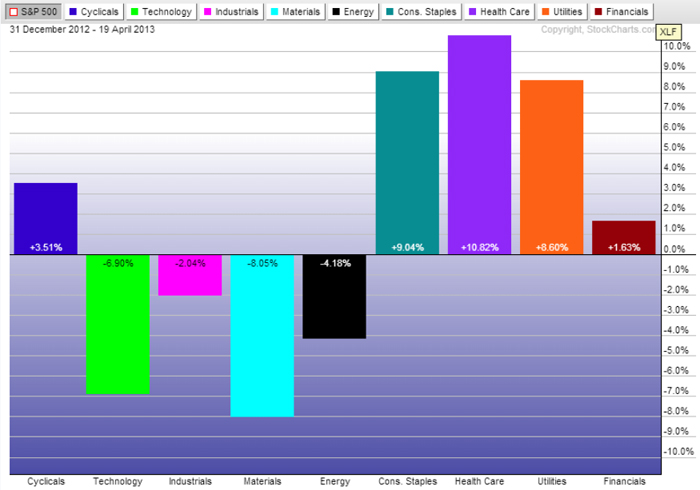

For another sign of a clear RISKOFF market, just look at the leading sectors YTD…

Health Care, Consumer Staples, and Utilities are the 3 most risk adverse sectors in equities. This is where Portfolio Managers are crowding to protect capital and make their 2013 bonuses.

The race between Cyclicals and Defensive is not even close YTD…

Like small caps, 4 weeks ago, everything looked perfect and then the worse than expected economic data and earnings revisions started to click higher.

Only the Dow Industrials has been able to safely stay above its 50 day moving average…

The S&P500 and Financial indexes are toying with the 50 day, but the Nasdaq100, Russell2000, Industrials, Transports, and Housing have all lost theirs.

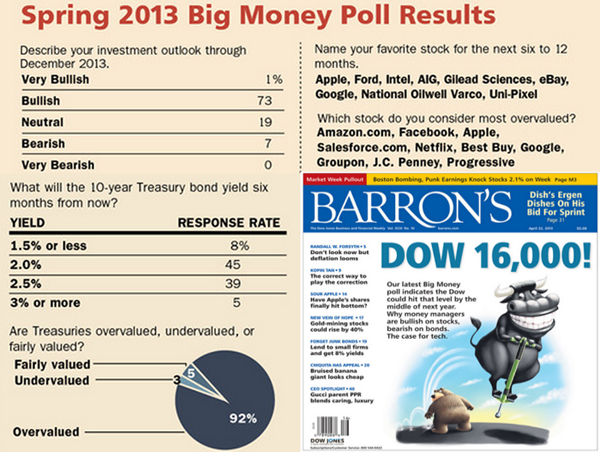

Contrarians will be taking note that Institutional Investors LOVE Equities and HATE Bonds…

Also, how long has Apple been the most favorite and Amazon the least favorite stock?

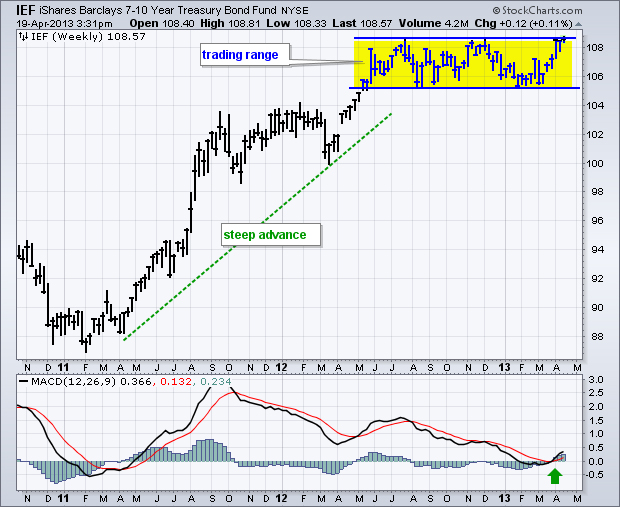

Institutional Investors might think Bonds are overvalued, but if the IEF breaks up through this trading range, it could get ugly for those SHORT Bonds real quick…

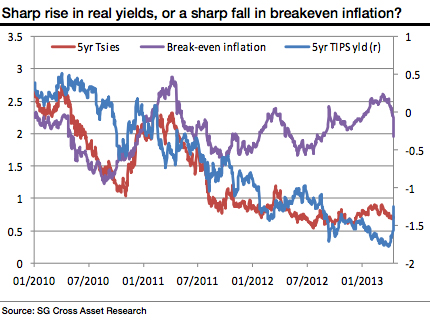

One area of the fixed income market which is not participating is TIPS…

A good read in the Financial Times last week about the current disconnect and worries running through the Inflation Protected Securities market.

Back to Institutional Investors’ most favorite stock in the market right now, Apple Inc…

The company reports earnings on Tuesday the 23rd after the market close. The stock is 23% lower than it was before the last earnings report. Could Barron’s update their favorite stock poll on Wednesday the 24th?

Wall Street is 0-3 on calling AAPL’s post earnings trading direction, so it may be better to look at Wired for an earnings preview…

If there was ever a time for Apple CEO Tim Cook to throw investors a bone it’s now. Ahead of Apple’s quarterly earnings tomorrow, shares of the world’s most fawned over company have slid from an all-time high of $705 last September to about $391 as of Friday’s close. Apple stock is the lowest it’s been since the death of Steve Jobs in 2011. You can argue whether Apple’s peak was ever rational, but what investors are looking for now is a sign that will help them decide if the Apple blood-letting has gone far enough, or if the stock has further to fall. Here are five things investors will be keeping an eye on…

(Wired)

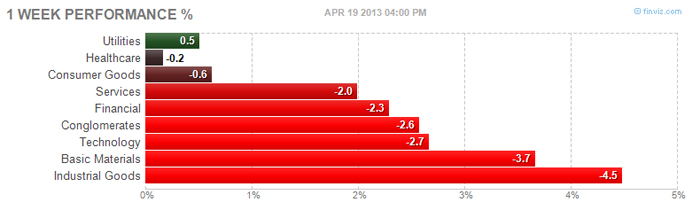

As noted, it was a difficult week for the cyclicals…

The only buying was in the defensive sectors and news specific names like several biotechs.

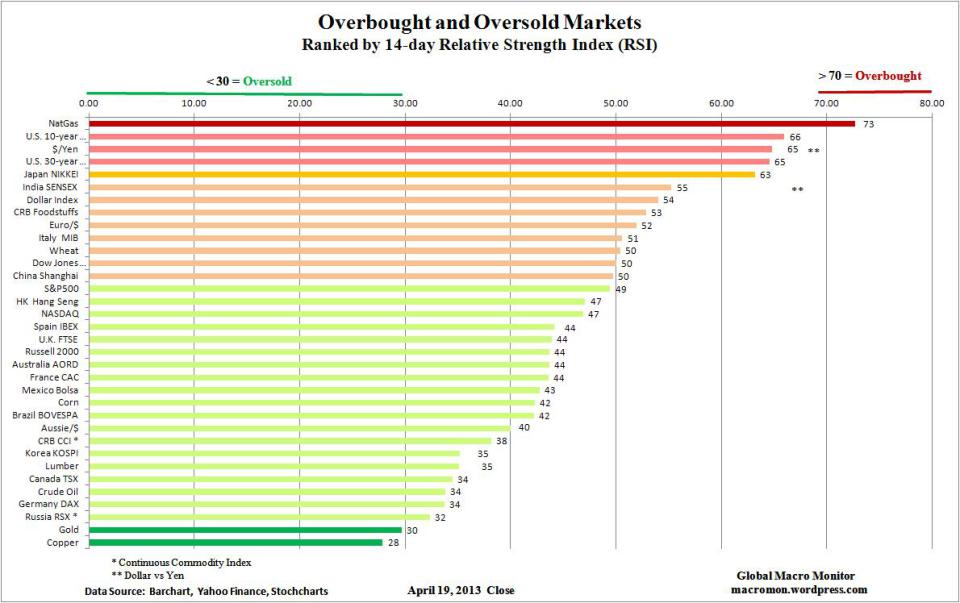

Surprising to see Natural Gas bounce to new highs for 2013…

Great news for America’s fastest growing industry.

And even better news for anyone looking for a job in North Dakota…

@Mark_J_Perry: Help Wanted: $15 per Hour at Taco John’s in Williston ND, That’s 2X the Minimum Wage

If you own real estate in Provo, UT, congratulations. If you are a recent/upcoming college grad, move there.

Google on Wednesday said that Provo will become the third Google Fiber city. The announcement comes just one week after Google said it was expanding the superfast network to Austin, Texas and two years after designating Kansas City as the first Google Fiber city. In a blog post, Google Fiber general manager Kevin Lo noted that Utah already is “home to hundreds of tech companies and startups.” Many of these firms are based in Provo. In fact, to set up Google Fiber, the company has agreed to acquire iProvo, which already built an existing fiber-optic network owned by the city of Provo. “We believe the future of the Internet will be built on gigabit speeds, and we’re sure the businesses and residents of Provo already have some good ideas for what they’d build with a gig,” Lo wrote.

(Market Watch)

It was a very difficult week for old media. Not only were the major news outlets 20 minutes late to reporting on the Boston Marathon bombing, but also their many misreports became the joke of late night talk hosts and bloggers…

NEW YORK (The Borowitz Report)—In a sweeping format change that marks the end of an era for the nation’s first cable news outlet, CNN announced today that it would no longer air breaking news and would instead re-run news stories of the past “that we know we got right.” The rebranded network, to début nationwide on Monday, will be called “CNN Classic.”

(NewYorker)

And Twitter likely grabbed another few billion dollars in future market cap away from the national and local networks…

“The evening news has become men in suits and women in pearls reading Twitter to your grandparents. Twitter is faster than print media, more in depth than television, and compared to the traditional newswire, its real time reaction to events news and headlines.” (Josh Brown, @ReformedBroker)

Twitter has become the “new” news wires. It has supplanted AP, Dow Jones and Bloomberg for breaking news. Even the Boston police confirmed “at least 22 injured, two dead” — by Tweeting it at 4:05 p.m. This “Twitter Effect” is now common. Seal Team Six killing Osama bin Laden broke on Twitter. The uprisings of the Arab Spring were first covered via Twitter. So, too, was the death of former British prime minister Margaret Thatcher. More and more, it seems that the first word we get about major events comes from the microblogging service.

(WashingtonPost)

“Strong earnings from IBM and Google help stocks regain some losses” – Headline in a top 50 major newspaper on Saturday

If you want to see why local paper readership is evaporating, consider that IBM was down 8% on Friday and suffered its worst earnings move in over a decade. So I am guessing that the computer algorithm that writes my local paper’s headline from the AP Newswire has some bad code in it and replaced the word ‘Microsoft’ with ‘IBM’ because it fit the space better?

(DenverPost)

@russian_market: A runner at today’s London marathon.

(@londonmarathon)

A new reason to get out, get active, and help your heart out…

A new study, published in Heart, suggests that a higher resting heart rate is an independent predictor of mortality — even in healthy people in good physical condition… After controlling for physical fitness and many other health and behavioral factors, they found that the higher the resting heart rate, the greater the risk for death. Compared with men with rates of 50 beats a minute or less, those at 71 to 80 beats had a 51 percent greater risk. At 81 to 90 beats, the rate of death was doubled, and over 90 it was tripled.

(NYTimes)

Last but not least, don’t mess with Bostonians…

@BestMovieLine: “I’m not afraid. I’m angry.” -Christian Bale, The Dark Knight Rises, 2012

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/04/23/361-capital-weekly-research-briefing-40/ […]

… [Trackback]

[…] There you can find 17186 more Information to that Topic: thereformedbroker.com/2013/04/23/361-capital-weekly-research-briefing-40/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/04/23/361-capital-weekly-research-briefing-40/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/04/23/361-capital-weekly-research-briefing-40/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/04/23/361-capital-weekly-research-briefing-40/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/04/23/361-capital-weekly-research-briefing-40/ […]