361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

February 4, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

The Market is close to solidly breaking out of its 13 year trading range and the only front page action is on this Barron’s cover?

Are the major newspapers and magazines waiting for Apple to hit new highs before they pick up the front page sharpie? I won’t believe any ‘Bull Market Hysteria’ until the plastic surgery commercials get priced off of CNBC.

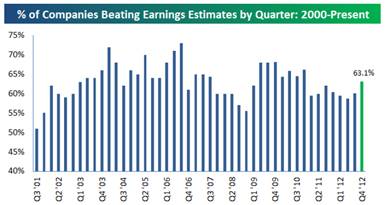

It was a very good week for Corporate Earnings releases…

Not only did Revenues continue to beat analyst estimates, but it flowed through to an increasing number of beats at the bottom line. We knew that estimates had been lowered going into this earnings reporting period so it will be interesting to watch how next quarter’s estimates evolve over the next 2 months.

(Bespoke)

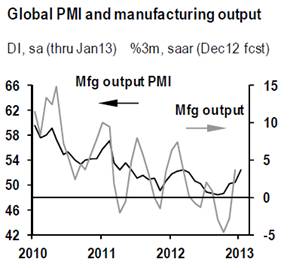

It was also a good week for global economic data and the most important stats did not disappoint…

• PMIs increased in the U.S., the Eurozone, Japan, and China. ISI’s China survey increased again last week. It’s now almost certain that global growth is reaccelerating. (ISI Group)

• “We now expect a rebound in real GDP growth to 2.6% in Q1 as the one-off drags unwind.” (Goldman Sachs)

(JPMorgan)

As a result of better than expected earnings and economic data, bond investors continued to enjoy the company of Jason, Freddy and Leatherface…

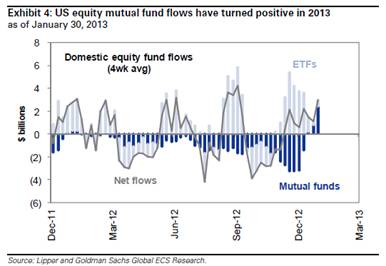

For those investors who don’t enjoy horror movies, Equity Funds are continuing to attract new fans…

But money is not leaving PIMCO’s roof… yet???

“If the ‘Great Rotation’ is happening, it’s not happening at Pimco. What we are seeing the equity funds, the fixed income funds, the commodity funds, is a rotation out of money market funds and out of bank accounts that no longer have complete FDIC insurance. Cash is being pushed into both the equity and fixed-income markets.” (Bloomberg)

Meanwhile another long time bond expert is throwing up a RED flag on fixed income…

“This is the most overbought market I have ever seen in my life in the business,” Fuss, 79, who oversees $66 billion in fixed-income assets as vice chairman of Boston-based Loomis Sayles & Co., said in an interview in London. “What I tell my clients is, ‘It’s not the end of the world, but for heaven’s sakes don’t go out and borrow money to buy bonds right now.’”… “The world is changing,” said Fuss, who started in the investment business when Dwight Eisenhower was U.S. President. “We are coming off a period of very low interest rates because the central banks have been buying the bonds. Interest rates are going to go up.”… “High-yield is as overbought as I have ever seen it,” Fuss said. “This is absolutely, from a valuation point, ridiculous.” (Bloomberg)

And the world’s largest pension fund is considering a shift away from bonds…

Japan’s public pension fund, the world’s biggest manager of retirement savings, is considering the first changes to its asset structure in seven years as a new government pursues policies that could erode the value of $747 billion in local bonds. Managers of the Government Pension Investment Fund, which oversees about 108 trillion yen ($1.16 trillion) in assets, will begin talks in April about whether to reduce its 67 percent target allocation to domestic bonds, Takahiro Mitani, who has been president since 2010, said in a Feb. 1 interview in Tokyo. The fund may increase holdings in emerging market stocks and is evaluating alternative assets, he said…“If we think about the future and if interest rates go up, then 67 percent in bonds does look harsh.” (Bloomberg)

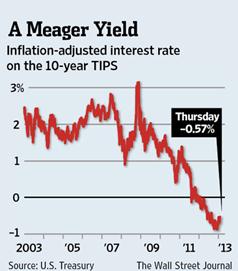

Even the Wall Street Journal is cautioning on TIPS…

The effective interest rates on TIPS have collapsed to record lows. It is mathematically impossible now for investors to earn respectable returns from any of them, and in many cases they are a lock to lose money in real, inflation-adjusted terms… The 30-year TIPS today offers a real return of inflation plus 0.5% a year. For TIPS coming due within the next 10 years, the real return is negative: Your investment is guaranteed to leave you poorer, in real terms, than you are now. A five-year TIPS today locks in an interest rate of inflation minus 1.4% a year. Over the life of the bond, investors will lose 7% in real terms. (WSJ)

Over at UBS, a plan is being discussed to reclassify bond investors as “aggressive” investors…

UBS is planning a mass mailing to many of its brokerage clients alerting them that they have been reclassified as “aggressive” investors following a recent change in its market outlook that some people inside the firm say reflects growing bearishness in the bond market, particularly over the long term, the FOX Business Network has learned… According to brokers inside UBS, new guidelines will reflect a growing belief among the firm’s market strategists that the bull market in bonds has largely run its course, and that those investors who believed they had constructed a “conservative” portfolio by being heavily invested in bonds could be reclassified as “aggressive.” Some also believe the move may be an attempt by the firm to lessen its liability in the event clients who are holding large positions in bonds decide to take legal action against UBS. (FoxBusiness)

At the end of the day, investors might be overweight bonds in their portfolios but equities are now the more favored asset class for the future…

Equities have been in a trading range against Treasuries for two years. But, by end-2015, equities may have outperformed bonds, perhaps by 40%. SPX could gravitate towards 1800 by the end-2015, a 20% gain; 10-year Treasury yields could move towards 4%, a 16% loss. The corollary of this view is that, for this cycle, bond proxies’ outperformance has ended. (ISI Group)

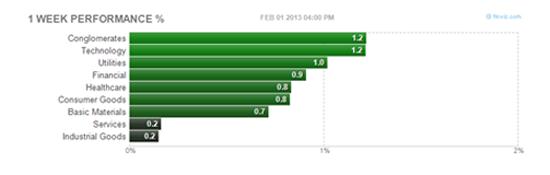

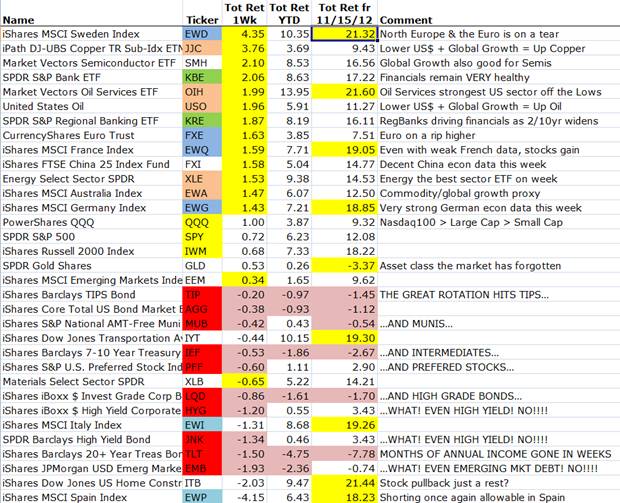

In the equity markets, it was another decent week across the board…

It was a week for LONG exposures to Europe & Commodities and another week to forget any exposures to fixed income. Take note that the negative returns in fixed income are starting to broaden to assets like junk bonds, preferred stocks and municipals. Are fixed income portfolio managers starting to sell their best sectors rather than their worst performing? Are they anticipating investor withdrawals and raising cash in anticipation? Don’t worry as EVERYONE is watching the weekly flows to confirm what many believe will likely occur.

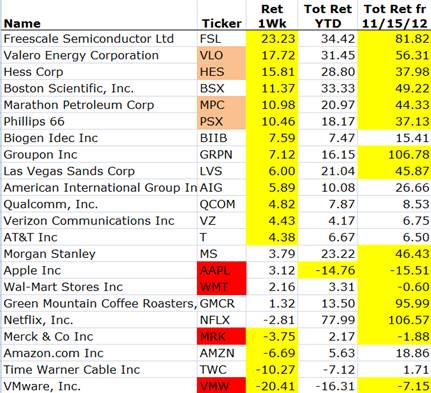

Here are the most interesting Stock returns for the Week and from the 11/15/12 lows in the market. Those managers who are long Energy, Financials and the more speculative names in the market have had a good 2.5 month move. Any manager who has owned Apple, Wal-Mart, Merck, and VMware in size needs a miracle.

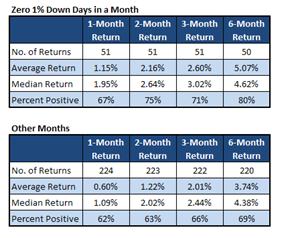

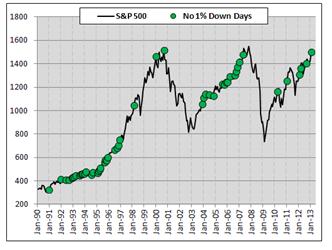

History shows that it pays well to be LONG after a month lacking a down 1% day…

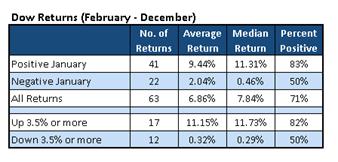

And it pays even better to be LONG after a POSITIVE January…

(@RyanDetrick)

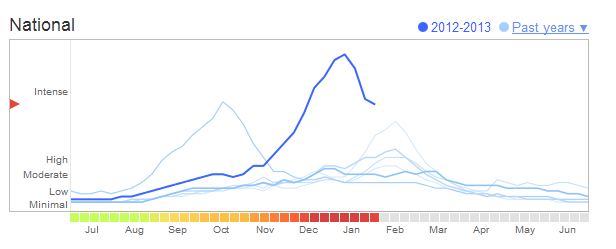

As we suggested 3 weeks ago, once the national flu trends peaked…

…United Healthcare and the HMO’s would see higher prices…

Do Defense Stocks know something about a Government sequestration that we haven’t read about yet?

And Jeep, that was a great USO advertisement during the Super Bowl.

We mentioned Hunter Harrison’s move to the CP Railroad back in December…

The early reception to his plan looks to be on track.

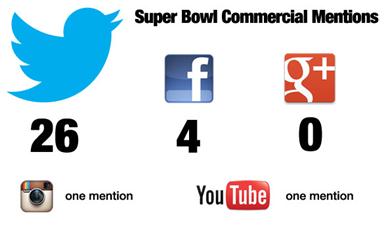

Twitter will likely be going public in 2013. Three examples why you need to pay attention to the offering…

- Twitter was mentioned in 26 of 52 national TV commercials — that’s 50 percent of the spots that aired during CBS’ game coverage… When it comes to second-screen advertising, it’s Twitter’s world now and there’s no close second place. Last year, brands split their focus on Twitter and Facebook with eight mentions each. This year, brands recognize that Twitter is where they need to try to attract the online conversation around one of the world’s biggest events. (Marketingland)

- @twitter: 24.1 million Tweets during #SB47; 5.5 million of that during @Beyonce’s show. Read all about the highlights: (Twitter)

- The very best things we make are the things that allow us to make even better things: tools that create connections and empower creativity. The latest of these is Vine, Twitter’s remarkable new video sharing app. Vine lets people shoot and share six-second looped videos. It sounds boring, I know. It sounds like Socialcam or Viddy or any number of Instagram-for-video attempts. It’s not. It’s fundamentally different. And it’s amazing… What’s most interesting about Vine is what’s not there. There’s no way to edit your footage, no filters, no red “record” button. No play button, even. It’s touch to shoot; scroll to play. That makes it incredibly information-dense, like Facebook’s news feed or Twitter’s stream. Everything is signal or skip. (Wired)

A good read = Amazon, Apple, and the beauty of low margins

Attacking the market with a low margin strategy has other benefits, though, ones often overlooked or undervalued. For one thing, it strongly deters others from entering your market. Study disruption in most businesses and it almost always comes from the low end. Some competitor grabs a foothold on the bottom rung of the ladder and pulls itself upstream. But if you’re already sitting on that lowest rung as the incumbent, it’s tough for a disruptor to cling to anything to gain traction.

An incumbent with high margins, especially in technology, is like a deer that wears a bullseye on its flank. Assuming a company doesn’t have a monopoly, its high margin structure screams for a competitor to come in and compete on price, if nothing else, and it also hints at potential complacency. If the company is public, how willing will they be to lower their own margins and take a beating on their public valuation? (eugenewei)

If you have kids in elementary school, then you now know that the hottest company in the world only has 29 employees…

The company is Mojang AB, a development studio with one of the hottest games on the Internet. The game is Minecraft, a kind of virtual Lego set that has become an obsession for players around the world. Mojang has sold more than 20 million copies of Minecraft, which runs across modern smartphones, Xbox Live and standard PCs. Sales happen digitally rather than through brick-and-mortar stores like GameStop. This has proved very good business for Mojang, located on a side street in Stockholm. Last year the company made about $90 million in earnings before interest, taxes, depreciation and amortization on revenue of $235 million, according to people familiar with the matter and since confirmed by the company. (WSJ)

The Virtual University = The hottest topic in Davos last month…

Sebastian Thrun, a professor at Stanford, for example, posted his Stanford course on artificial intelligence online a couple of years ago – and since then hundreds of thousands of people around the world have completed the course, including many who never previously dreamt of attending a university. Indeed, one of these online students even appeared at last month’s Davos debate: Khadijah Niazi, a 12-year-old Pakistani girl, announced from the stage that she has spent the last two years completing American science courses online, from universities such as Duke and Stanford, in her house in Lahore. “First I studied artificial intelligence from this Stanford professor, but then I discovered physics,” she explained. Or as Thrun noted: “It’s not the number of students [who take my course] that impresses me, but the type of student. If a 12-year-old in Lahore can do my course, then my life is worth living.” (FinancialTimes)

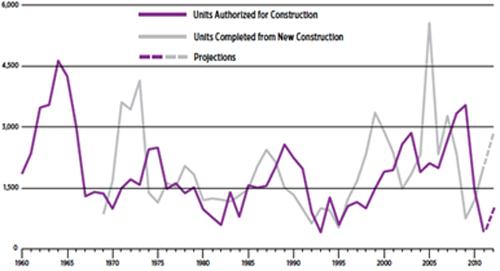

Good news for jackhammers in San Francisco… the Boom is Back.

Halfway into 2012, more than 4,200 residential units were under construction in San Francisco. For context, this is 20 times the number of units that were added in all of 2011. All 4,200 won’t be completed this year, but many will, marking the beginning of a remarkable upswing in new housing construction. An additional 32,120 new residential units have been approved by the Planning Department, and applications for another 6,940 units have been filed for review. (Spur)

Meanwhile in New York City, it is business as usual…

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/02/05/361-capital-weekly-research-briefing-30/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/02/05/361-capital-weekly-research-briefing-30/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/02/05/361-capital-weekly-research-briefing-30/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/02/05/361-capital-weekly-research-briefing-30/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/02/05/361-capital-weekly-research-briefing-30/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/02/05/361-capital-weekly-research-briefing-30/ […]

… [Trackback]

[…] There you can find 95416 more Information on that Topic: thereformedbroker.com/2013/02/05/361-capital-weekly-research-briefing-30/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/02/05/361-capital-weekly-research-briefing-30/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/02/05/361-capital-weekly-research-briefing-30/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/02/05/361-capital-weekly-research-briefing-30/ […]

… [Trackback]

[…] There you can find 29512 more Information on that Topic: thereformedbroker.com/2013/02/05/361-capital-weekly-research-briefing-30/ […]

… [Trackback]

[…] There you will find 83107 additional Information on that Topic: thereformedbroker.com/2013/02/05/361-capital-weekly-research-briefing-30/ […]