361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

January 14, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

And the markets move toward their highs…

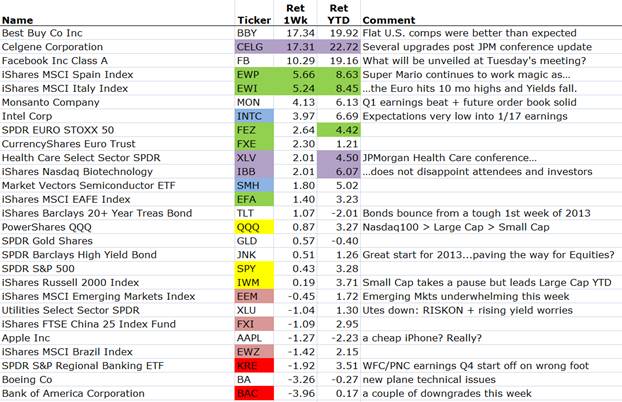

Equity investors can thank Super Mario Draghi and the lack of negative news/economic data for a float to the highs last week. We all expected a drift pullback which of course means it didn’t happen. Some tried to sell, but where the market fell on a BankAmerica downgrade, a worry over Wells Fargo/PNC earnings, or another broken Boeing Dreamliner, it moved higher on Nokia and Infosys earnings, Danaher and Seagate guidance, and whatever the heck Facebook is up to. The 2 week crush of earnings starts this week so we will get lots of data points to react on. Meanwhile in Washington, investors will be watching: How the debt limit will be fixed now that the Trillion Dollar coin machine has been melted down? Is the President up for another fight on spending? Also, will Ben Bernanke clarify the recent disagreements over Fed Policy?

The market’s gains have been broad as supported by the rising Adv/Dec line…

Continued breadth suggests future pullbacks will be shallow.

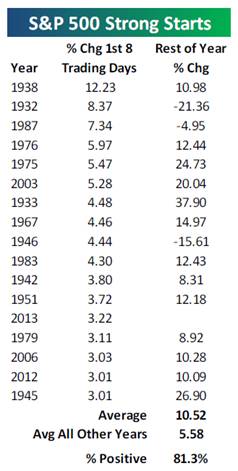

And strong starts to the trading year often leads to continued gains…

(Bespoke)

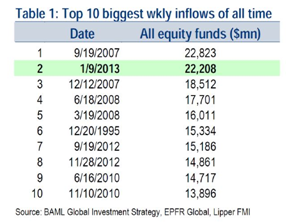

One item that caught the market by surprise was a $22.2b inflow into equities for the week…

Investors this week poured the most money into equity funds in more than five years, as global shares surged and a compromise deal on the U.S. fiscal cliff boosted confidence. Net inflows into equity funds monitored by EPFR, the funds research company, hit $22.2bn in the week to January 9 – the highest since September 2007 and the second highest since comparable data began in 1996. Record inflows into emerging market and world funds drove much of the expansion. The figures capped a week during which global equity indices hit multiyear highs, encouraging speculation about a “great rotation” this year out of safe, recession proof assets, such as government bonds, and into equity markets. (FinancialTimes)

East of the Atlantic, bond buyers pushed Spanish bonds below 5% and Italian bonds toward 4%…

Very few investors would have thought this 6 months ago.

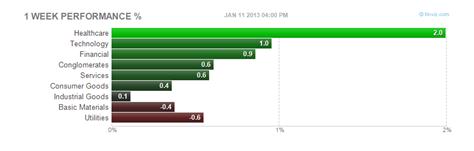

Health Care stocks were the biggest winners on the week thanks to the pent up news flow released at the JPMorgan Healthcare Conference. Financials also led the market higher even without the help of the regional banks.

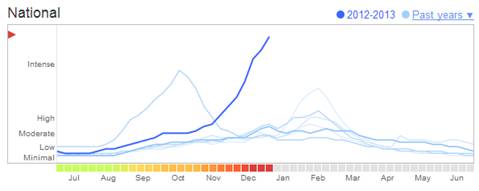

Keep an eye on this Google flu-related search chart for when it peaks, United Healthcare might stop underperforming the market…

Goldman is optimistic on U.S. equities in 2013…

We expect a stable S&P 500 in 1Q and then a rise to 1575 by year-end. Three events will likely constrain S&P 500 from advancing beyond its current 3% YTD rise until the end of 1Q: debt ceiling; resolution of the ‘sequester’; and 4Q12 earnings season. However, a strengthening U.S. economy, rising earnings, and modest starting valuation should lift the Index to a new all-time high of 1575 by end-2013, reflecting a gain of 8%. Stocks should beat Treasuries; cyclicals should beat defensives; companies with high BRICs revenues should outperform those with high domestic sales; and Earnings and Price Sharpe Ratio stocks should outperform. (Goldman Sachs)

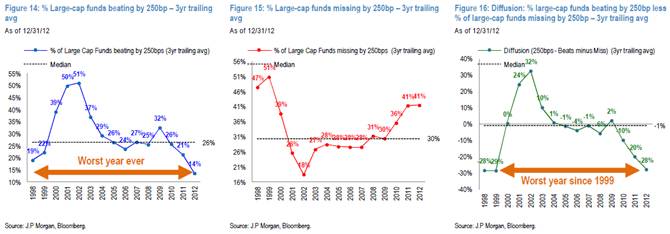

JPMorgan highlights the difficult year for active, long only equity managers…

Meet your newest neighbor who is buying homes as fast as they can…

Blackstone Group LP (BX), the largest U.S. private real estate owner, accelerated purchases of single-family homes as prices jumped faster than it expected. Blackstone has spent more than $2.5 billion on 16,000 homes to manage as rentals, deploying capital from the $13.3 billion fund it raised last year, said Jonathan Gray, global head of real estate for the world’s largest private equity firm. That’s up from $1 billion of homes owned in October, when Blackstone Chairman Stephen Schwarzman said the company was spending $100 million a week on houses. “The market is moving much faster than anybody thought possible,” Gray said during an interview in Blackstone’s New York headquarters. “Housing is much stronger than people anticipated.” …Blackstone is buying in Atlanta, Chicago, Las Vegas, Phoenix, Northern and Southern California; Miami, Orlando and Tampa, Florida — where prices fell so far that they “overshot,” said David Roth, managing director at Blackstone overseeing single-family home rentals. (Bloomberg)

Another great read by Credit and Risk expert Howard Marks (with comments directed more at fixed income investors than equities)…

In 2004, I stated the following conclusion: “There are times for aggressiveness. I think this is a time for caution.” Here as 2013 begins, I have only one word to add: ditto. The greatest of all investment adages states that “what the wise man does in the beginning, the fool does in the end.” The wise man invested aggressively in late 2008 and early 2009. I believe only the fool is doing so now. Today, in place of aggressiveness, the challenging search for return should incorporate goodly doses of risk control, caution, discipline and selectivity. (oaktreecapital)

2012 may have felt like a volatile year, but actually it was a rather very calm year for extreme moves…

Count triggers if daily range or close is 3%+ from previous day close. (FTAlphaville)

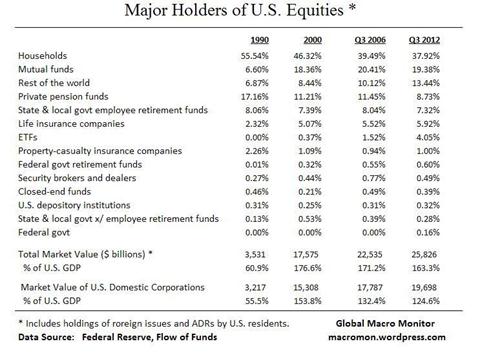

I often get asked for data on who owns U.S. stocks. Here is an updated chart from the Federal Reserve…

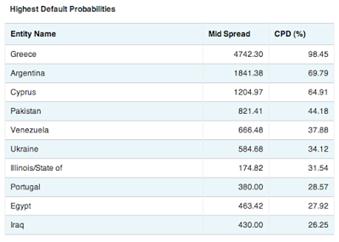

Fitch warns on Illinois State debt and CMA rates Illinois debt as riskier than Portugal, Egypt and Iraq…

Fitch Ratings has placed the ‘A’ rating on the general obligation (GO) bonds of the State of Illinois on Rating Watch Negative. The rating action affects approximately $26.2 billion in outstanding GO bonds of the state. Ratings linked to the state GO rating, listed at the end of this release, have also been placed on Rating Watch Negative. The Rating Watch Negative reflects the ongoing inability of the state to address its large and growing unfunded pension liability, most recently through the failure to pass pension reform in the ‘lame duck’ portion of the 97th general assembly legislature that ended on Jan. 8. Fitch believes that the burden of large unfunded pension liabilities and growing annual pension expenses is unsustainable. (fitchratings)

About that $500 Apple stock price… here is the phone that the geeks, your kids, and LeBron all want…

But no matter how smoggy Beijing might get, you can still find the Apple store…

@shannonfagan: Beijing: Smog Apple.

7 years ago I used to consume 5 daily newspapers (Local, WSJ, FT, IBD, NYT) and 20-30 weekly/monthly mags. Now 100% of my news comes via Twitter links…

Magazines had a rough year on the advertising front in 2012, with ad pages dropping 8.2% for the year, according to data released today by the Publishers Information Bureau. That was worse than last year, when ad pages only dropped 3.2%, and brings the total drop in ad pages since 2008 to 32%. (WSJ)

OFFICIAL WHITE HOUSE RESPONSE TO: Secure resources and funding, and begin construction of a Death Star by 2016…

The Administration shares your desire for job creation and a strong national defense, but a Death Star isn’t on the horizon. Here are a few reasons:

• The construction of the Death Star has been estimated to cost more than $850,000,000,000,000,000. We’re working hard to reduce the deficit, not expand it.

• The Administration does not support blowing up planets.

• Why would we spend countless taxpayer dollars on a Death Star with a fundamental flaw that can be exploited by a one-man starship?

If you bought a CD on Amazon in the last 15 years, the music has now been put in your Amazon Cloud Player. Next up, video & books?

Amazon is today introducing a new service called Amazon AutoRip, which automatically gives customers free MP3 versions of any CDs they’ve purchased from Amazon since the launch of its Music Store back in 1998. The digital music is being placed in users’ Amazon Cloud Player accounts, the company’s answer to Google Music, iTunes Match, Rdio, and other services that store users’ own music collections in the cloud. (techcrunch)

And if you are interested in Jeff Bezos’ march toward global domination, this is a good presentation…

Amazon.com: the Hidden Empire, faberNovel, May 2011 (scribd)

Chris Rock’s simple solution to gun control…

“I honestly believe you should have a mortgage to buy a gun. No one with a mortgage has ever gone on a killing spree. … That’s a serious thought! A mortgage is a real background check. They don’t just give mortgages out, you know! If you go to jail for 30 years, you still have to pay your (expletive) mortgage.”

Next time in Moscow, take the train… (YouTube)

(hat tip to Grant Williams, Things that make you go Hmmm…)

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/01/15/361-capital-weekly-research-briefing-28/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/01/15/361-capital-weekly-research-briefing-28/ […]

… [Trackback]

[…] There you will find 37634 additional Information on that Topic: thereformedbroker.com/2013/01/15/361-capital-weekly-research-briefing-28/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/01/15/361-capital-weekly-research-briefing-28/ […]

… [Trackback]

[…] There you can find 9274 additional Information on that Topic: thereformedbroker.com/2013/01/15/361-capital-weekly-research-briefing-28/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/01/15/361-capital-weekly-research-briefing-28/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/01/15/361-capital-weekly-research-briefing-28/ […]

… [Trackback]

[…] There you will find 74957 more Info on that Topic: thereformedbroker.com/2013/01/15/361-capital-weekly-research-briefing-28/ […]