361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors

361 Capital Weekly Research Briefing

December 10, 2012

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

The only leadership in Washington D.C. this December…

(AP Photo/Patrick Semansky)

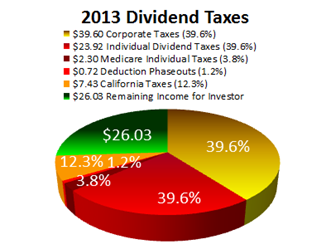

If we do go off the Fiscal Cliff, all U.S. Corporations should stop paying dividends in 2013 and into the future…

If you live in California and own dividend paying stocks, then your dividends are taxed at nearly a 75% rate for the highest bracket before they make it into a taxable brokerage account. Instead of receiving dividends, an equity holder would first prefer a company to reinvest in their business at their targeted return on capital. If adequate returns are not available for internal investment or deleveraging, then all CEOs and Board of Directors should allocate ALL free cash flow toward stock repurchase. Equity returns will then occur in the form of stock price appreciation from stock buybacks and compound tax free until the stock is sold, rather than be taxed each year as dividends at the highest tax rate.

“This year qualified dividends or capital gains are both treated favorably in the tax code. But starting in 2013, qualified dividends will no longer exist. They will not be eligible for a lower tax rate. They will all be taxed at ordinary income tax rates, which can be as high as 44.6%. The top federal tax rate rises from 35% to 39.6%. A 3.8% Obamacare tax and 1.2% more in deduction phaseouts bring the total to 44.6%. California’s latest ballot measure raised its top state tax rate from 9.3% to 12.3%. This puts the marginal personal tax on dividends at 56.9% after corporations have already paid their own 39.6% rate. Doubly taxing dividends means a high-income shareholder might only receive $26.03 per $100 of corporate income. Next year in California the effective top marginal tax rate on corporate dividends rises to 74%.” (Forbes)

It was a decent week for Economic data points with the ISM coming up short, but the Payroll data coming in better than expected…

(Bespoke)

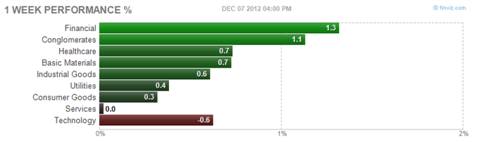

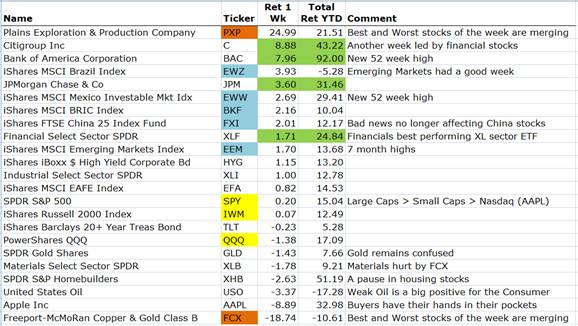

Financial Stocks were the leading sector on the week…

They have also been the #1 or #2 performing sector for the last 1 month, 3 months, 6 months, year-to-date and 1 year time frames. Strength in the financial sector bodes well for the health of the markets, so if you are LONG the market, you get a gold star. And if you are long Financials and short Technology, you get another gold star as Tech has been an underperformer for every one of those time frames.

Goldman Sachs rolled out their 2013 S&P500 outlook…

“Our year-end 2013 S&P 500 target of 1575 suggests a potential price gain of 11% and a total return of roughly 14% including dividends. Our valuation models forecast that by year-end 2013 the forward P/E will have expanded by 5% to 13.8x our anticipated 2014 EPS of $114. If our forecast is realized, it would rank in the 58th percentile of annual returns since 1928.”

As for where to go hunting first in U.S. Equities, Goldman says look to U.S. Large Cap Bank stocks…

“This recommendation is based on several features of our 2013 outlook: (1) a fairly supportive view of the economic and equity market landscape for 2013, particularly in the U.S.; (2) U.S. monetary policy that remains extremely accommodative, focused on MBS purchases and the transmission of its policy through the housing channel; (3) continued improvement in the housing sector in terms of activity and prices, building on advances already seen in 2012; (4) transmission of the housing sector strength into large cap U.S. banks; and (5) the fact that financials have, thus far, lagged improvements seen in other housing-related equities over the last several months.”

Validating Goldman’s choice is the news that finance sector jobs continue to shrink. Head count trends on Wall Street and in the financial sector is the best contrarian signal for future sector outperformance…

London’s financial sector suffered its worst November for hiring since before the financial crisis, a recruitment agency said on Monday, with the number of new jobs created falling by a third year-on-year. Just 1,790 new London finance jobs were created last month, according to financial services recruitment firm Astbury Marsden, down from 2,670 in November last year and 13,000 in November 2007, before the onset of the financial crisis. (Reuters)

Meanwhile at Whitebox, Equities >>> Bonds…

“And yet the world cannot buy enough bonds. Well here is the ugly truth: the best-case scenario for bonds today is the worst-case scenario for stocks. In the worst case for stocks, earnings grow even more slowly than in our example PEs contract, and shareholder capital grows even more slowly with some unpleasant volatility along the way caused by the occasional global crisis. In the best case for bonds, rates rise only modestly and bondholders suffer modest capital losses. The more likely case for bonds is that rates rise significantly; bond markets suffer just that volatility bondholders sought to avoid; nominal capital losses are material; and losses after inflation are devastating. Meanwhile in the high inflation/high rate scenario, nominal earnings rise with nominal GDP; the dominant and best-financed firms in a sector gain competitive advantage over their weaker, more-leveraged brethren; and our blue chips look relatively better than ever.” Andrew J. Redleaf, September 25, 2012 (Marketfolly)

And at Oaktree, Howard Marks tells his investors to keep expectations lower than ever…

Oaktree Capital Group LLC, the world’s largest distressed-debt investor, is telling clients it’s targeting the lowest returns it has ever sought, according to Chairman Howard Marks. “In the distressed strategies, like distressed debt and real estate, we’re aiming to make 15 percent gross,” Marks said today at the Goldman Sachs Financial Services Conference in New York. “The irony is, of course, that today 15 percent sounds like some herculean task. It’s the lowest yield we’ve ever targeted.” Oaktree’s latest flagship distressed-debt fund, which began investing in 2009, had a 13.6 percent gross internal rate of return as of Sept. 30, according to the firm’s quarterly earnings report. Predecessors of the pool have returned as much as 35 percent, the report shows. (Bloomberg)

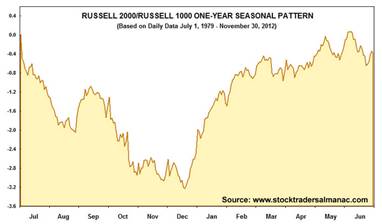

As 2013 nears, don’t forget the very positive seasonal pattern for Small Cap Stocks…

If you are looking for a stock to add to your rainy day watch list, put Canadian Pacific (CP) on it. Hunter Harrison’s initial plans to improve the railroad were well received last week. He knows how to fix broken railroads and made my former Janus fundholders carloads of returns both at Illinois Central and Canadian National…

Canadian Pacific Railway Ltd. is slashing close to a quarter of its work force over four years, as recently arrived CEO Hunter Harrison aggressively carves out costs to create a more competitive railway… The job cuts are the centerpiece of a sweeping restructuring plan that aims to change CP’s reputation as one of North America’s least-efficient railroads. U.S. hedge fund manager Bill Ackman and his company, Pershing Square Capital Management, won a fiercely contested battle this spring to gain control on the railway’s board and install Mr. Harrison, a highly regarded railway manager, as its new chief executive officer. (TheGlobeandMail)

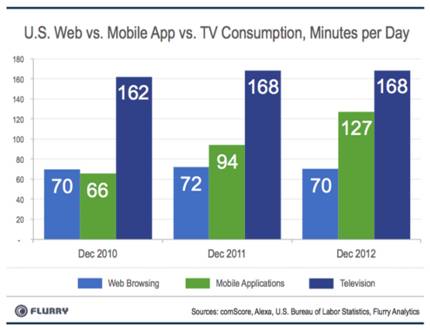

Unless minutes in the day start to increase, one has got to think that Television viewing is about to be challenged…

Between December 2011 and December 2012, the average time spent inside mobile apps by a U.S. consumer grew 35%, from 94 minutes to 127 minutes. By comparison, the average time spent on the web declined 2.4%, from 72 minutes to 70 minutes. By our measurement, U.S. consumers are spending 1.8 times more time in apps than on the web. The chart also shows that time spent in apps already totals 76% of time spent on television. With new content released via thousands of new apps each day, we expect this trend to continue. In fact, we ultimately expect apps on tablets and smartphones to challenge broadcast television as the dominant channel for media consumption. (Flurry)

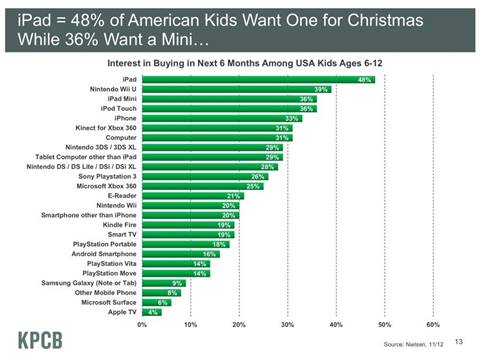

Meanwhile, if you need a gift for a 6-12 year old, the Apple store seems to be your next stop…

California surplus? I already know 3 employed people in 3 weeks who are moving from California to Texas and Colorado…

California’s Legislative Analyst’s Office is projecting a $1bn budget surplus by the 2014-2015 fiscal year, as $6bn of new tax revenue is due to flood into state coffers after voters passed a staggered tax increase on individuals and families earning more than $250,000 and $500,000 a year…But in increasing taxes on the top 1 percent of residents, the state has made itself more susceptible to downturns and economic shocks, according to Ross DeVol, chief research officer at the non-partisan Milken Institute. “The top 1 percent of earners in California accounts for 20 percent of income but pays 41 percent of income taxes,” he said. “After Prop 30 the top 1 percent would pay something north of 50 percent of income taxes. What we have done is accelerate the volatility of the tax base in California. What if there’s a downturn?” (FT)

Of course his take home pay will be much better in a Houston Astros or Texas Rangers jersey…

Three-year-old actor Christian Haupt throws out the ceremonial first pitch prior to the Los Angeles Dodgers’ baseball game against the San Diego Padres, on September 4, 2012, in Los Angeles. (AP Photo/Mark J. Terrill)

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

[…] function setIframeHeight(iframeName) { var iframeEl = document.getElementById? document.getElementById(iframeName): document.all? document.all[iframeName]: null; if (iframeEl) { iframeEl.style.height = "auto"; // need to add to height to be sure it will all show var h = alertSize(iframeName); iframeEl.style.height =h + "px"; } } function alertSize(frameId) { var myHeight = 0; frame = document.getElementById(frameId); if( typeof( window.innerWidth ) == 'number' ) { //Non-IE var getFFVersion=navigator.userAgent.substring(navigator.userAgent.indexOf("Firefox")).split("/")[1]; var FFextraHeight=parseFloat(getFFVersion)>=0.1? 16 : 0; myHeight=frame.contentDocument.body.offsetHeight+FFextraHeight; } else if( document.documentElement && ( document.documentElement.clientWidth || document.documentElement.clientHeight ) ) { //IE 6+ in 'standards compliant mode' innerDoc = (frame.contentDocument) ? frame.contentDocument : frame.contentWindow.document; myHeight= innerDoc.body.scrollHeight + 10; //myHeight = document.documentElement.clientHeight; } else if( document.body && ( document.body.clientWidth || document.body.clientHeight ) ) { //IE 4 compatible myHeight = document.body.clientHeight; } return myHeight; } #split {}#single {}#splitalign {margin-left: auto; margin-right: auto;}#singlealign {margin-left: auto; margin-right: auto;}#splittitlebox {text-align: center;}#singletitlebox {text-align: center;}.linkboxtext {line-height: 1.4em;}.linkboxcontainer {padding: 7px 7px 7px 7px;background-color:#eeeeee;border-color:#000000;border-width:0px; border-style:solid;}.linkboxdisplay {padding: 7px 7px 7px 7px;}.linkboxdisplay td {text-align: center;}.linkboxdisplay a:link {text-decoration: none;}.linkboxdisplay a:hover {text-decoration: underline;} function opensplitdropdown() { document.getElementById('splittablelinks').style.display = ''; document.getElementById('splitmouse').style.display = 'none'; var titleincell = document.getElementById('titleincell').value; if (titleincell == 'yes') {document.getElementById('splittitletext').style.display = 'none';} } function closesplitdropdown() { document.getElementById('splittablelinks').style.display = 'none'; document.getElementById('splitmouse').style.display = ''; var titleincell = document.getElementById('titleincell').value; if (titleincell == 'yes') {document.getElementById('splittitletext').style.display = '';} } Low Interest LoansBo’s housing clips: Improvements in national housing economyFox News warns homeowners of reverse mortgages – BizPac ReviewDesjardins Versatile Line of Credit (HELOC) — Shannon Skinner's Extraordinary Women TVThe Savings of Millions of People are Going to Vanish in Less Than 12 MonthsSolarCity IPO Roadshow Analysis — IPO Candy361 Capital Weekly Research Briefing […]

… [Trackback]

[…] There you will find 18191 additional Info to that Topic: thereformedbroker.com/2012/12/11/361-capital-weekly-research-briefing-25/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/12/11/361-capital-weekly-research-briefing-25/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/12/11/361-capital-weekly-research-briefing-25/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/12/11/361-capital-weekly-research-briefing-25/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/12/11/361-capital-weekly-research-briefing-25/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2012/12/11/361-capital-weekly-research-briefing-25/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/12/11/361-capital-weekly-research-briefing-25/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/12/11/361-capital-weekly-research-briefing-25/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2012/12/11/361-capital-weekly-research-briefing-25/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2012/12/11/361-capital-weekly-research-briefing-25/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2012/12/11/361-capital-weekly-research-briefing-25/ […]