361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor.

361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

August 20, 2012

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

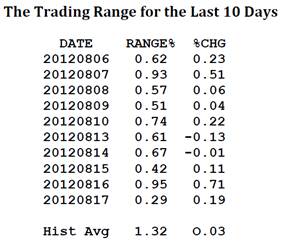

The summer doldrums remain in full force as lack of corporate news and government actions give most financial employees a reason to stay out of the office…

But while most perceive low volumes and volatility to predict future declines in equities, the reverse is actually more evident…

“Possibly somewhat surprising to the casual observer, there have been 44 previous occasions of ten straight sub 1% range days over my 27 year database, about 1.6 a year, not counting repeats (that is, 15 straight days is counted once). The forward S&P performance after such events was not what I normally consider statistically aberrant enough to alter my trading mindset, but the forward quarterly performance did show 35 winners out of 44 cases for a median quarterly gain of 2.69%, slightly better than the normal 2.05% average quarterly gain over the test period available, and probably leaning in the opposite direction of what many a pundit would have surmised.” (WayneWhaley)

Equity volumes continue to remain anemic. Remove HFT and ETF trades and actual volumes are at 10+ year lows which helps to explain the continued shrinking of Wall Street…

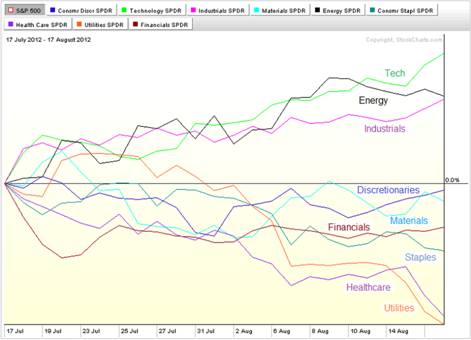

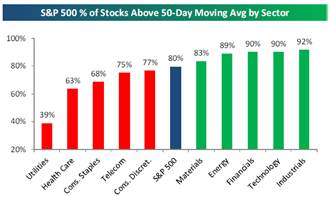

Under the hood of the sluggish market, there has been a significant rotation toward more risk…

Which has pushed some sectors into overbought territory…

(Bespoke)

Stepping back and looking at the year to date figures, most long only equity and debt allocations have done very well…

For the week, investors received better than expected economic data and there is continued hope that the ECB will save the Spanish banks while also providing a mechanism to keep yields low in Europe for the at-risk nations. The most watched Spanish 10 year bond yield has now fallen over 1 full percentage point to 6.4% from its 7.5% peak in July, giving many risk buyers a reason to get longer.

One reason for the retreat in Spanish bond yields? No doubting that they were the only big buyer…

“BlackRock Inc., the world’s biggest money manager, has dipped its toes into Spain’s battered government debt market in recent weeks, but its top fund manager remains cautious about the euro zone’s crisis-racked debt markets.” (WSJ)

And one big reason for the buying in Euro equities is their deep value…

(BofA Merrill Lynch)

JPMorgan’s Thomas Lee raised his targets for U.S. stocks last week…

“We are raising our short-term target for the S&P 500 to 1475 (while maintaining a target of 1430 by YE). 1475 is 13.4X our 2013E EPS of $110 and a 6% discount to the HY P/E ratio of 14.0x (1 divided by 7.13% YTW). Basically, we believe the beta chase underway will be sustained. In terms of timing, we see this high being established before election day (11/6) and that any further gains from that point would be contingent on a Romney victory (Obama win is our base case and thus, drift to 1430 by YE).”

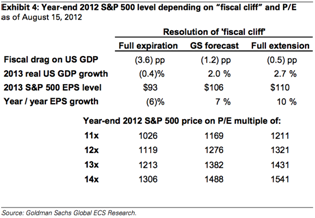

While Goldman reminded investors to be aware of the nearing Fiscal Cliff…

“Assigning a P/E multiple to various ‘fiscal cliff’ and earnings scenarios is difficult because ultimately we expect Congress will address the situation. But investors must confront the risk they may not act until the final hour. Exhibit 4 contains a matrix of potential year-end 2012 S&P 500 Index levels based on different ‘fiscal cliff’ resolutions and multiples. Our 1250 target reflects our ‘fiscal cliff’ assumption and a P/E slightly below 12x. Full expiration with P/E of 12x equals 1120 (-21%). A 14x P/E and full extension implies 1540 (+9%), but the two outcomes are not equally likely in our view.”

As for the markets, here are the most interesting Month-to-Date movers:

- Michael Kors/KORS +26.2% (leading the high end consumer stocks)

- Cisco Systems/CSCO +19.5% (stronger than expected guidance)

- Estee Lauder/EL +17.6% (lipstick indicator turning upward)

- Spain/EWP +12.6% (a big risk taking thermometer)

- Homebuilders/XHB/ITB +11% (data remains favorable)

- Oil/USO +9.0% (good for economic growth but when a consumer worry?)

- Italy/EWI +8.4%

- Apple/AAPL +6.6% (new all-time highs + largest market cap ever)

- Nasdaq100/QQQ +5.4% > Small Cap/IWM +4.3% > Large Cap/SPY +3.0%

- Consumer Discretionary/XLY +4.3% (best XL sector index MTD)

- Energy/XLE +4.2%

- China/FXI +0.2% (remains stuck in the mud…see below)

- Utilities/XLU -2.1% (worst XL sector MTD)

- U.S. TIPS/TIP -2.2%

- U.S. 20+ Yr Treasury/TLT -5.8% (2 years of interest lost in 17 days)

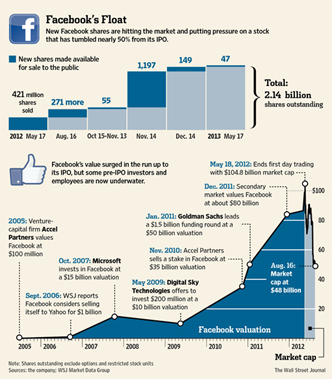

- Facebook/FB -12.3% (much worry about the overhang)

- Groupon/GRPN -28.7% (now 50% the value of Google’s rejected offer)

Cisco lit a fire under the tech stocks last week with their quarterly comments…

“In Q4, with the exception of Federal Government, we saw positive growth and/or up trends, especially in the second half of the quarter. Now I want to say, it is way too early to call this a trend. But if this were to continue through Q1, this would be a solid indicator of potential future market improvement in the U.S.” (John Chambers, CEO)

And housing data points had another strong week…

(Bespoke)

Also helping housing are soaring apartment rents. And it doesn’t get any bigger than NYC…

“The average Manhattan apartment rented for a record $3,459 in July, according to Citi Habitats, which called the price the highest since it began tracking rents in 2002. And with the vacancy rate hovering around 1 percent, landlords aren’t willing to cut deals.” (NYTimes)

Meanwhile, Chinese stocks continue to significantly underperform U.S. stocks…

(S&P500-Black, Shanghai Comp-Orange)

As we have highlighted in the past, the increased float and selling by insiders has impacted the price of Facebook (and many other internet IPOs)…

But if you are an employee of Facebook or long the FB stock, here is a good read from a former Amazon employee…

“Facebook’s stock looks to trade more on financial fundamentals like revenue and profit growth in the near term rather than just user growth or engagement, and that’s actually not a terrible outcome. Feeling like you can control your own destiny is as much as any company should wish for. If Facebook is looking at advertising as its primary revenue stream, it still only has captured a tiny sliver of that market. At Amazon, in 2000, when we looked at our share of retail revenue domestically and internationally and at retail segments we hadn’t even entered yet, the future seemed full of opportunity.” (eugenewei)

We know the Vice President had a tough week, but does he know something about Social Security that its auditors don’t know?

“I guarantee you, flat guarantee you, there will be no changes in Social Security” (Joe Biden, 08/16/12). Earlier in the year, the Social Security Trust Fund reported to Congress that the Social Security Disability Fund will run out in 2015.

Interesting…a Grand Jury is pushing the S.F. pension plan to get much more conservative…

“According to a statement by the jury, the San Francisco Employees’ Retirement System’s use of a high-risk investment policy for the past 28 years ‘creates the possibility of even greater future losses, losses which the City will have to pay for, but which the City can ill-afford to pay.’…The report criticized the system for planning to earn 7.5% returns on its investments in the next 20 years, despite only averaging 4.2% returns over the past five years.” (sfgate)

Meanwhile in Illinois, the State is trying to decide on whether to eliminate COLA increases or Healthcare benefits to keep the pension plan from failing…

“Pension costs in Illinois now account for 15% of a $33.7 billion budget that Gov. Pat Quinn signed in June, compared with 6% a few years ago. All told, the state is on the hook for more than $83 billion in unfunded pension liabilities, the worst of any state in the country…No one in the state denies the crisis at hand. But the protracted fight over how to fix it has been a struggle for Mr. Quinn, a Democrat who is caught between angry unions that helped elect him in 2010 and Republicans asking for deeper cuts as concern grows that bond rating agencies could downgrade the state if a compromise cannot be reached…For months, they have been divided over new legislation to shore up their pension shortfalls. One measure would give state employees a grim choice: keep the current 3% compounded cost-of-living adjustment to their retirement checks each year and lose state-sponsored health insurance, or keep health insurance, but with lesser annual increases.” (NYTimes)

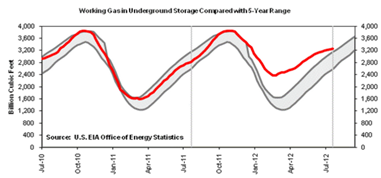

Summer heat pushing natural gas inventories back toward more normal levels…

@SoberLook: The summer heat forced power plants to burn much of the excess natural gas accumulated during warm winter.

Speaking of heat, Moody’s just raised the temperature in the California Treasurer’s office on Friday…

“’As a consequence of the adverse economic and fiscal governance environment, the risk of default on municipal bonds in California is rising,’ said Robert Kurtter, managing director at Moody’s, on Friday. Focusing on Fresno, the state’s fifth-largest city by population, S&P on Friday cut its long-term debt rating by three notches to triple B from A, citing fund imbalances. S&P said the outlook for the city’s credit rating is negative. ‘The negative outlook reflects our view of current budgetary constraints that may limit the city’s ability to cure projected multiyear general fund deficits absent strong revenue growth, which we consider unlikely given current indications that the city will continue to experience a slow economic recovery,’ the agency said.” (FT)

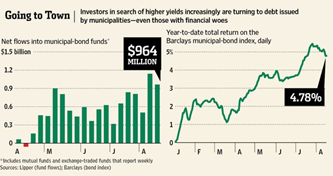

But investors are not slowing their appetite for muni debt…

Progressive Insurance used to be one of the best companies in America, but they really stepped in it here. Not only did they fail their customer and her family, but then they ignored the impact of social media. It will be interesting to see if the Company and the Board of Directors can improve their current situation. (CrossingWallStreet)

A great article on pallets. Seriously.

“Pallets are arguably as integral to globalization as containers. For an invisible object, they are everywhere: There are said to be billions circulating through global supply chain (2 billion in the United States alone). Some 80% of all U.S. commerce is carried on pallets. So widespread is their use that they account for, according to one estimate, more than 46% of total U.S. hardwood lumber production.” (Slate)

Deep thought of the week…

“Charity can only be charity when it is voluntary. Coerced acts, no matter how beneficial or well-intentioned, cannot be moral. If we force people to give to the poor, we have stripped away the moral component, reducing charity to mere income redistribution. And if one really is as good as the other, the Soviets demonstrated long ago that it can be done far more efficiently without the trappings of church and religion.

All people have the moral obligation to care for those who are less fortunate. But replacing morality with legality is the first step in replacing church, religion and conscience with government, politics and majority vote. Coercing people to feed the poor simply substitutes moral poverty for material poverty.” (WSJ)

My name is Blaine, I am a gadget geek, and I am addicted to the Google Nexus7…

I have been using the device for 3 weeks now and it has become my go to device for reading, email, organization, home automation/remote control, music, etc. The form factor and price lead me to take it everywhere and it has very increasingly become my laptop/iPad/cellphone replacement. Apple is soon to introduce its 7” iPad mini which could be an equally great device, but for $199, the Nexus7 is tough to beat. If you must be in the Apple environment, then wait for the 7” tablet. But if you want a great device today and enjoy the Google/Droid environments, then pick one up. And a hat tip to Jeff Bezos for introducing the right form factor, but don’t worry as all of my content still travels thru Amazon. (GoogleNexus7)

As the evening temperatures cool and the kids head back to school, it is time for many to turn their attention toward football. May your team have a good season and enjoy the stadium time together…

And for those who prefer skiing to football, it is predicted to be a much better year…

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Weekly Research Briefing Archive

… [Trackback]

[…] There you can find 82159 additional Information to that Topic: thereformedbroker.com/2012/08/22/361-capital-weekly-research-briefing-11/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2012/08/22/361-capital-weekly-research-briefing-11/ […]

… [Trackback]

[…] There you can find 6060 more Info to that Topic: thereformedbroker.com/2012/08/22/361-capital-weekly-research-briefing-11/ […]

… [Trackback]

[…] Here you can find 13351 additional Information to that Topic: thereformedbroker.com/2012/08/22/361-capital-weekly-research-briefing-11/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2012/08/22/361-capital-weekly-research-briefing-11/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2012/08/22/361-capital-weekly-research-briefing-11/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2012/08/22/361-capital-weekly-research-briefing-11/ […]