361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor.

361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors

361 Capital Weekly Research Briefing

June 18, 2012

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

The financial markets are betting on a Fed action this week, but will it be enough?

The economic data points and individual company commentaries are showing a June slowdown. Europe is clearly weakening, the U.S. seems to be having another Q2 growth problem, and the emerging markets are definitely slowing. The China Daily reported, “China’s GDP could drop below 7%, according to a government advisor.” And India’s growth slowdown is so severe that the term ‘BRIC’ might lose its ‘I’. As for the Greece vote this weekend, it is a minor event as to whether or not a new coalition government decides to remain in the Euro. Spain and Italy are the most important issues on the table and the EU and ECB should spend all of their global goodwill and capital making certain that neither of them fall. Meanwhile, if you want any sign of health in the U.S. equity markets, look no further to the fact that this might be the first June in 35 years without an IPO. In other words, the appetite for risk has started to evaporate.

A quick glance at ETF performance for the Q2 to date tells much about the market…

- 20+ year Treasury/TLT +13.1%

- Utilities/XLU +6.4%

- Consumer Staples/XLP +1.5%

- Large Cap/SPY -4.2%

- Small Cap/IWM -6.8%

The positive moves in Utilities and Consumer Staples tell the whole story…the market is scared and acting defensively.

The chart we are watching the closest = Spanish 10 year bond yield.

A move through 7% typically means a move to the double digits. If that happens, Italy will be next on deck and then the Euro could become a collector’s item.

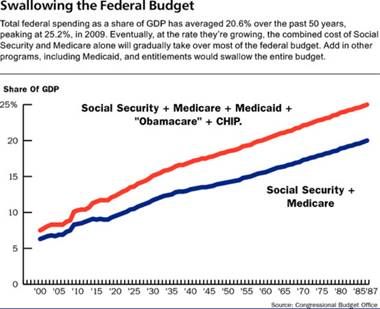

And as Barron’s highlighted this week, Washington D.C. is on a path to follow Athens…

The Fiscal Cliff is a molehill compared to the mountain of debt that is growing past 2012. But as Jamie Dimon of JPMorgan reminded everyone on the Senate Finance Committee this week, the U.S. fiscal cliff is less than 200 days away and that the markets will not wait until a January resolution before they place their bets on the future. The longer the delay, the more uncertain and destructive the markets will become to government planners. He suggested Simpson/Bowles as a good place to start the talks and sooner rather than later on the timing of this action. (Barrons)

U.S. economic data continued to soften, especially at week’s end…

(Bespoke)

This headline did not help the market psychology this week…

UTX SEES SIGNIFICANT SLOWDOWN IN CHINA ECONOMY. (United Technologies = Elevators, HVAC and Aircraft Engines)

Also the Brookings/FT index is showing more weakness…

The global economic recovery is stalling, according to Tracking Indices for the Global Economic Recovery, the Brookings Institution-Financial Times index of the world economy. Brookings’ senior fellow and index creator Eswar Prasad said: “The engines of world growth are running out of steam while the trailing wagons are going off the rails. Emerging market economies are facing sharp slowdowns in growth while many advanced economies slip into recession. “ (FT)

As all data weakens, Moody’s warns on their June jobs estimates…

Our forecast for June employment, which currently calls for a net 150,000 payroll increase and an 8.1% unemployment rate, may be too upbeat and will need to be revised unless next week’s data on unemployment insurance claims and readings from upcoming business surveys improve. (Economy.com)

And Goldman places stacks of chips on Federal Reserve action this week…

We expect the Federal Open Market Committee (FOMC) to ease monetary policy at next week’s scheduled meeting. Our baseline is a new asset purchase program that involves an expansion of the balance sheet, but an extension of Operation Twist and/or a further lengthening of the short-term interest rate guidance in the FOMC statement beyond the current “late 2014” formulation are also possible. Though our expectation for more easing next week sets us apart from most U.S. economic forecasters, financial market participants have begun to embrace this view in recent weeks following weaker-than-expected economic data, heightened tension surrounding the Eurozone financial and debt crisis, and news reports suggesting the possibility of coordinated action by central banks in coming days. (Goldman Sachs)

Maybe it should all be decided on the soccer field?

Greece defeats Russia 1-0 on Saturday to advance toward playing Germany in the next round.

Thoughts from the most typical German citizen on Greece… “We can’t go on funding the Greeks, they’re beyond help,” Angelika Hoerner, 50, said as she served customers from behind a glass counter of her family’s butcher shop in the town of 21,000 in western Rhineland-Palatinate state. “It’s better to have an end with horror than horror without an end.” While nationwide polls show Germans are swinging against helping their poorer southern euro partner, opinions in Hassloch underscore a warning for Chancellor Angela Merkel as Greeks prepare for a second shot at electing a government on June 17. The town has been used since 1985 by market-research company GfK SE as a miniature Germany to test products ranging from Unilever NV (UNA)’s Dove soap to Ferrero Spa Rondnoir chocolates before they are rolled out across the country. (Bloomberg)

Some good news for U.S. jobs…Starbucks Turns to Ohio, Not China, for Coffee Mugs

Last month, Starbucks announced it would build a factory in Augusta, Ga., that would employ 140 people and make the company’s Via instant coffee and the ingredients for its popular Frappuccino drinks. About half of Starbucks’s new employment overall will come in the United States, the rest internationally. “We are on the hunt for other domestic opportunities for products we sell and other things we do,” said Howard D. Schultz, chief executive of Starbucks. “There has to be a sense of urgency about action, and since we’re not likely to find it in Washington between now and the election, it’s time for companies and businesses to step up and find a balance between profitability and responsibility.” The effort is not all altruistic. Chinese labor has become more expensive, and Starbucks and other companies are looking at their supply chains more holistically. American Mug can deliver to Starbucks in four days, while Chinese suppliers may take three months. (NYTimes)

U.S. rental prices continue to far outpace for-sale home prices…

A new housing report released by HotPads finds that rental prices continue outpacing for-sale home prices across a composite of 45 major U.S. cities. Comparing weighted average listing prices of two bedrooms in March, April, and May 2011 against the same period in 2012, rental prices grew 14.4% and for-sale prices are up 4%. Popular cities like San Francisco (+20%), Chicago (+16%), Miami (+15%), and Boston (+12%) had the highest rental price growth while Detroit (-11%), Baltimore (-13%), and Pittsburgh (-18%) experienced noticeable rental price declines. (Hotpads)

And more signs of real estate strength in Florida from one of their largest lenders…

(BB&T CEO Kelly) King said that Florida’s economy is improving across the board – excess condos have been absorbed, often by money from outside the U.S. Negatively, Mr. King said that Atlanta isn’t improving, as there is excess residential and undeveloped property that will take 2-3 years to digest. He went on to say that the Carolina coasts have stabilized and inland areas of the Carolinas and Virginia are improving. (ISI Group)

Even the Nobel Prize foundation can’t meet their return hurdles…

Thanks to a sluggish economy and unstable financial markets, the Nobel Foundation is being forced to tighten its belt a bit, announcing Monday it would pare down cash prizes awarded to Nobel Prize winners. The foundation, which awards the prestigious Nobel Prize in numerous academic fields and for humanitarian work, will slash prize winnings by 20 percent to around $1.1 million, the Associated Press reported, the first time the organization has done so since 1949. Prize winnings, awarded in Swedish Kronor, were the equivalent of about $1.4 million last year. The organization cited concerns about maintaining adequate funds in the long term for the pullback in prize winnings, saying returns on the foundation’s investments had fallen short of operating expenses in recent years. The foundation’s investments, which totaled about $419 million as of the end of last year, were down about 8 percent year-over-year, according to an analysis by Catherine Rampell of the New York Times. (USNews)

But one of the world’s billionaires is using the weakness in global returns to add to his investments…

Carlos Slim, one of the savviest investors in the world, announced stakes last week in YPF, Argentina’s largest oil & gas company, KPN, a Dutch telecom, and Telekom Austria.

As asset classes and securities increase their correlation to global events, many asset managers are returning assets and going on sabbatical…

“I don’t have an edge on Greek elections, the Spanish banking system, what the European Central Bank, the International Monetary Fund, the Chinese government, Angela Merkel, or the U.S. Federal Reserve will do…” (Bloomberg)

Something to watch out for your income oriented clients over the next month… Citigroup, JP Morgan and SunTrust Bank are planning to redeem more than $15 billion of trust preferred securities next month, following the U.S. Federal Reserve’s release of new capital rules last week. (Reuters)

Strong but accurate words from Fareed Zakaria of Time/CNN…

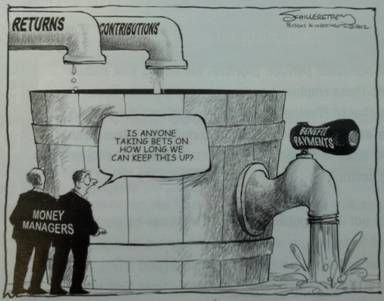

The accounting at the heart of government pension plans is fraudulent, so much so that it should be illegal. Here’s how it works. For a plan to be deemed solvent, employees and the government must finance it with regular monthly contributions. The size of those contributions is determined by assumptions about the investment returns of the plan. The better the investment returns, the less the state has to put in. So states everywhere made magical assumptions about investment returns. David Crane, an economic adviser to former California governor Arnold Schwarzenegger, points out that state pension funds have assumed that the stock market will grow 40% faster in the 21st century than it did in the 20th century. In other words, while the market has grown 175 times during the past 100 years, state governments are assuming that it will grow 1,750 times its size over the next hundred years. (Time)

4.4% just isn’t enough…

According to an analysis by Christopher Brightman, head of investment management research and Research Affiliates, as of late 2011, the 10-year expected return for the equity market is 6%, the 10-year bond yield is 2%, and the expected return for a 60% equity/40% bond portfolio is 4.4%… The prospect of low investment returns obviously must concern pension executives as baby-boomer retirements begin to suck assets out of the funds. Returns of 4.4% annually – even if boosted by a third by alternative investments – would still lead to growing unfunded liabilities. If they are to meet their obligations, pension executives must find ways to boost returns, generally by taking more risk, or they will have to reduce benefits or increase contributions. (Pension & Investments)

And so to try and meet more aggressive return targets, plans are taking on more risk…

U.S. pension-plan managers are pouring cash into debt from the smallest speculative-grade borrowers, seeking to meet targeted 8 percent returns at a time when average yields are at about record lows… Fund managers that oversee retirees’ health and pension benefits are seeking the debt of smaller junk-rated borrowers, pushed toward riskier investments as the Federal Reserve pledges to hold interest rates near zero through 2014… “The strategy is definitely getting traction,” said Frank Barbarino, a consultant with NEPC LLC, an investment adviser. “It’s that magic 7 to 8 percent number that institutions are shooting for at the plan level. Many are willing to lock up their capital for a few years in order to add strategies that help them get there.” (Bloomberg)

Tough statistics on the change in average family wealth during the 2008 financial crisis…

A hypothetical family richer than half the nation’s families and poorer than the other half had a net worth of $77,300 in 2010, compared with $126,400 in 2007, the Fed said. The crash of housing prices directly accounted for three-quarters of the loss. Families’ income also continued to decline, a trend that predated the crisis but accelerated over the same period. Median family income fell to $45,800 in 2010 from $49,600 in 2007. All figures were adjusted for inflation. (NYTimes)

Will it become flag football or will all players be wearing those giant inflatable sumo suits in the future?

As of 6/15/12…There are now 91 concussion-related lawsuits, which include more than 2,450 former players. “Alzheimer’s disease or similar-memory related diseases occur ‘vastly’ more often than the national population – including a rate of 19 times the normal rate for men ages 30-49.” (NFL Concussion Litigation)

Quote of the week…

“I think that no matter how good you are, how competent you are, never ever get complacent in risk” (Jamie Dimon, JPMorgan CEO on lesson learned)

Unreal shot of the Ukraine v. Italy game…at night…illumination by lightning.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

(361 Capital Research Briefing Archive)

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2012/06/20/361-weekly-research-capital-briefing/ […]

… [Trackback]

[…] There you will find 69544 additional Info to that Topic: thereformedbroker.com/2012/06/20/361-weekly-research-capital-briefing/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2012/06/20/361-weekly-research-capital-briefing/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/06/20/361-weekly-research-capital-briefing/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/06/20/361-weekly-research-capital-briefing/ […]

… [Trackback]

[…] Here you will find 62064 additional Information to that Topic: thereformedbroker.com/2012/06/20/361-weekly-research-capital-briefing/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2012/06/20/361-weekly-research-capital-briefing/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/06/20/361-weekly-research-capital-briefing/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2012/06/20/361-weekly-research-capital-briefing/ […]