361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

July 29, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

For an earnings month, this has been a calm one for the equity markets…

With just three trading days left in the month, July is in the running for the title of least volatile month of the year, with the Standard & Poor’s 500-stock index averaging moves of just 0.39% this month through Thursday’s close. That is lower than the 0.41% and 0.42% averages of January and March, respectively, when stocks were grinding slowly, but steadily higher.

(WSJ)

And the earnings season continues to track generally in line with expectations…

So far this earnings season, 68.3% of reports have beaten expectations, slightly better than the norm around 66%. 2Q earnings should beat consensus by over 2% to around $107.71. With over 50% of the earnings season over, the misses on earnings and revenue are skewed to size. Smaller companies are missing more than larger companies and the average miss is less than the average surprise. 46.2% of the revenue releases are beating estimates and revenue growth is still on track to be up nearly 6% y/y. In fact, revenue growth appears somewhat more than earnings growth this quarter.

(ISI Group)

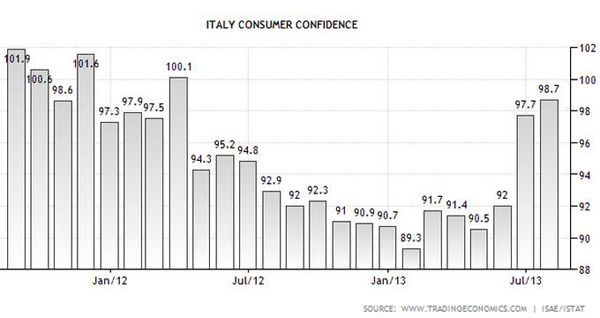

The upside surprises came from European economic data last week…

@RiskReversal: Flash EZ Composite #PMI at 50.4 (June: 48.7). First reading above 50.0 no-change mark since January 2012. 18-month high

Given the low valuations and now upside surprises in Europe, investors will need to make certain that their European investments are correct…

European PMI data this morning was good across the board and Italian retail sales outperformed too. It looks as though the crashing fighter pilot of European growth has started to pull up and is skimming the treetops having managed to avoid disaster. Which is nice for us… Recent German data has already pointed to an increase in intra-European trade and a further decline in external Asian demand will continue to flatten out the economic differences between Germany and the peripherals that in the past have resulted in the stresses within policy unity. So basically, Germany getting “Edward the Seconded” (see glossary) by China/Asia demand is good news for European policy unity and should encourage relative longs of Peripheral equities over German stalwarts.

(MacroMan)

Who let the Ferrari out of the garage?

(@SoberLook)

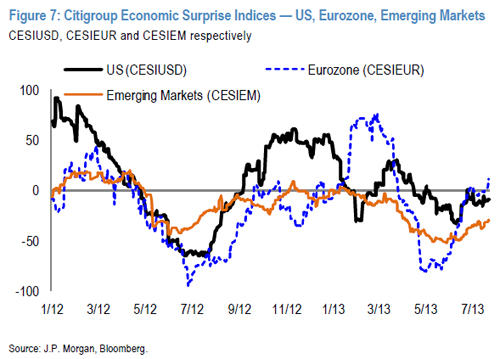

With the break of the Eurozone Surprise Index into positive territory last week, JPMorgan moved quickly to increase its equity targets…

U.S. equity strategy from JPM’s Thomas Lee… raising our SPX ’13 year-end target from 1715 to 1775; raising our ’14 SPX EPS forecast from $117 to $120. One of the positive takeaways from 2Q has been better commentary regarding Euro-area. And this adds to the mosaic of generally improving Euro-area economic data points. With both U.S. and Europe expected to see better growth in 2H, we believe the Street will be in a position to raise 2014E EPS.

(JPMorgan)

One of the sparks to the market last week was talk of the Fed moving to adjust the ZIRP thresholds. But the much more important long term question is “Who will be running the Fed?”

The White House seems to be floating the balloons to support Summers while Congress and investors seem to support Yellen…

- “A person with close ties to the Obama administration said he had reason to believe the president was closely considering Summers…at the same time, sources familiar with thinking inside the Fed say staff and some members of the central bank’s board are concerned Summers’ often blunt manner could be a detriment in shaping policy at the consensus-driven central bank”. (Reuters)

- CNBC has a monthly Fed survey in which they poll “economists, traders and strategists” on Fed issues. In July, they asked who President Obama will pick to replace Ben Bernanke. Seventy percent of the respondents said Yellen, while 25 percent said Summers. Then they asked who Obama should nominate to replace Bernanke. Here, 50 percent said Yellen, and only 2.5 percent — yes, with the decimal point — said Summers. The poll asked respondents to judge Yellen and Summers across 10 qualities, including monetary policy expertise, ability to manage a financial crisis, communication skills, concern about inflation, and respect for financial markets. Yellen won in seven of 10. The most important qualification, according to the respondents, was monetary policy expertise — Yellen’s strongest suit. (WashingtonPost)

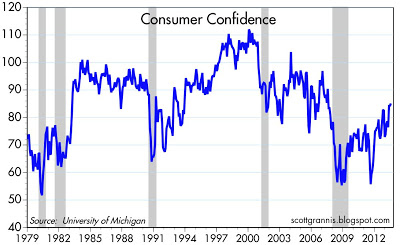

Back to the data, U.S. Consumer Confidence continues to improve, which is not hurting anything in the economy or markets…

Consumer confidence is slowly returning. The University of Michigan measure of consumer confidence reached its highest post-recession level this month. Confidence remains relatively low from a long-term historical perspective, but there is little doubt now that confidence is increasing, and it’s changes on the margin like this that are very important. (ScottGrannis)

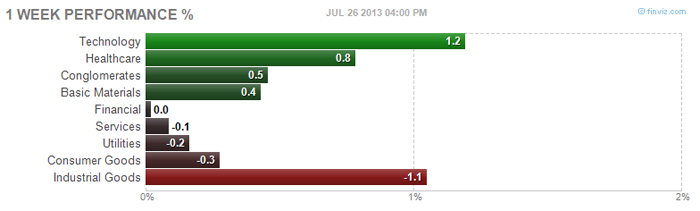

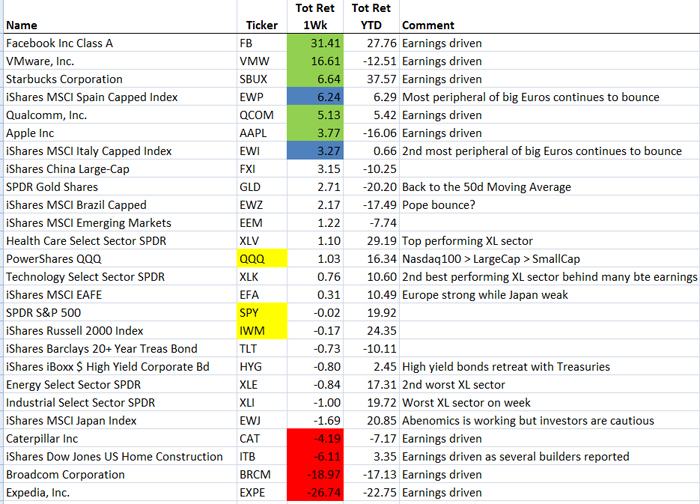

For the week, the equity markets were just mixed ripples even though some stocks had massive earnings related moves…

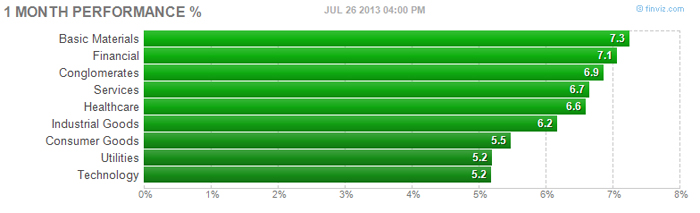

For the month, the markets are still solidly positive across the board…

A closer look at the ETFs and Stocks shows the large earnings surprises and misses. Also, note the continued recovery in the more risky European ETFs…

Investors are having a difficult time with the home builder group and the worries over the rise in interest rates. Some comments from earnings last week…

- Pulte orders fell -12% in 2Q, and D.R. Horton reported there’s “no question” rising rates affected sales. In response to the weaker homebuilder reports yesterday, the homebuilder shares index fell almost -5%. Fortunately, more recently mtg rates have declined -25bp. (ISI Group)

- “We experienced some moderation in our net sales pace in the back half of the quarter after mortgage rates began to increase sharply. While each individual home buyer responds differently to changes in mortgage rates, we typically see some short-term moderation in buyer activity during periods of mortgage rate volatility as potential buyers adjust to the changing rate environment. We expect that most home buyers who slow their purchase decision while rates are volatile will ultimately still buy a house since affordability remains strong and interest rates remain at historically low levels. Over the long-term we believe that demand for new homes is tied more closely to economic indicators in our individual operating markets such as job growth, household incomes, household formations, and consumer confidence” (DRHorton)

We continue to watch Junk Bonds for signs of strength or weakness. Last week it was weaker…

Also watching the leading groups for signs of weakness. Semis have been a good group for the last year so this is discouraging…

@hmeisler: $SOX relative to Naz Composite. Usually a leader.

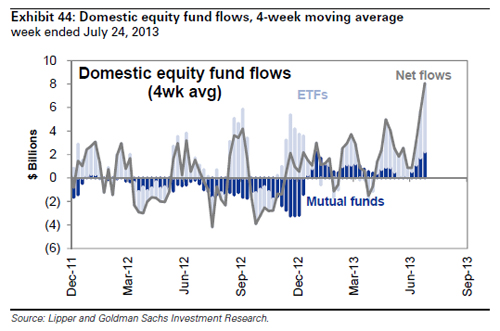

A glance at fund flows shows the 4 week average is still helping U.S. equities…

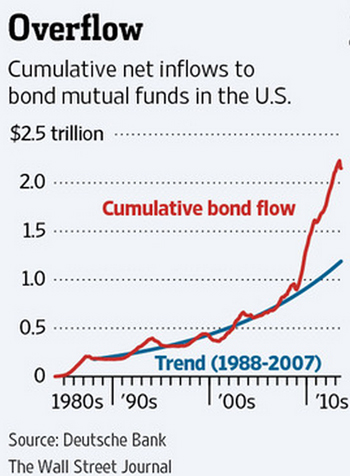

Has the tidal wave into bonds been so strong that it is inevitable that the redemptions could be sharp…

With the Federal Reserve signaling that it will begin reining in its Treasury and mortgage-bond purchases later this year, the fixed-income arena has become a less-than-happy place. Bank of America Merrill Lynch’s index of U.S. corporate and government bonds has fallen 3.8% since the start of May. Investors have noticed, pulling a net $78 billion from bond mutual funds in the seven weeks ended July 17, according to Investment Company Institute estimates. There could be plenty more to come, suggests Deutsche Bank strategist Binky Chadha. From the start of 2008 through May, bond mutual funds saw a massive $1.3 trillion in net new inflows. That occurred as investors responded to an environment where bonds not only seemed like the safer alternative to stocks, but, thanks to the strong returns that bonds were generating, the better way to make money. Net inflows into stock mutual funds stalled during the same period. Mr. Chadha calculates that if bond-fund inflows had hewed to the trend established in the 20 years ended in 2007, inflows would have been a much smaller $400 billion. That points to an environment where many individual investors’ stock and bond allocations are badly out of whack.

(WSJ)

And of course cash available for investment into equities is now running into “The most hated bull market ever”…

I’ve seen and studied many markets in my career, but the behavioral reactions to this most-hated bull market in my lifetime have been fascinating to watch. In many respects this reminds me of an investing buffet, where those participating in the nourishing market are enjoying the spoils of healthy returns, while the skeptical observers on the sidelines are on a crash diet, selecting from a stingy menu of bread and water. Sure, there is some over-eating, heartburn, and food coma experienced by those at the stock market table, but one can only live on bread and water for so long. The fear of losses has caused many to lose their investing appetite, especially with news of sequestration, slowing China, Middle East turmoil, rising interest rates, etc. Nevertheless, investors must realize a successful financial future is much more like an eating marathon than an eating sprint. Too many retirees, or those approaching retirement, are not responsibly handling their savings. As legendary basketball player and coach John Wooden stated, “Failing to prepare is preparing to fail.”

(InvestingCaffeine)

Always interesting to read where David Einhorn or Greenlight is investing his cash…

Long: AAPL, GM, MRVL, VOYA, Greek Banks, OIS, GLD, VOD

Short: GMCR

Threw in the towel on MSFT after 7 years

(GreenlightCapital)

For muni investors, will City and State budgets be affected when Universities begin to pay their athletes?

Last year the NCAA’s revenues were $872m, but the athletics departments of its member colleges together raked in an estimated $11.4 billion, including grants and subsidies of various sorts and fees charged to students. The University of Texas had the highest athletics revenues, at $163m, but most institutions do not earn enough to cover the costs of their sports programs. All would stand to lose large amounts if they had to pay star athletes according to their pulling power.

(TheEconomist)

At Penn, these are the BMOC who are batting .750 versus Cancer. As a survivor, this is an exciting read…

(Doctors at the University of Pennsylvania: David Porter, Bruce Levine, Carl June and Michael Kalos)

Last December, at a medical conference in Atlanta, the team presented its results to a rapt audience. The data boiled down to this: Nine out of the 12 patients, including both of the children, had responded to the therapy. Nine out of 12 had grown the engineered T cells in their bodies. Nine out of 12 had experienced some degree of tumor lysis syndrome and had seen their tumors vanish, either partially or completely. Even more encouraging were the follow-up data on the two early cases of complete remission—patients No. 1, Bill Ludwig, and No. 3, Douglas Olson.

(PhillyMag)

Quote of the week for the voters of Gotham…

“Sometimes the truth isn’t good enough, sometimes people deserve more. Sometimes people deserve to have their faith rewarded.” ― Batman

Finally… Those are some very big baby shoes. Go fill’em George.

@JMichaelsNews: What you didn’t see as the world met The Prince of Cambridge (PHOTO credit: @NMoralesNBC) #RoyalBaby #MediaFrenzy

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

The information presented here is for informational purposes only, and this document is not be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/07/30/361-capital-weekly-research-briefing-50/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/07/30/361-capital-weekly-research-briefing-50/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/07/30/361-capital-weekly-research-briefing-50/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/07/30/361-capital-weekly-research-briefing-50/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/07/30/361-capital-weekly-research-briefing-50/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/07/30/361-capital-weekly-research-briefing-50/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/07/30/361-capital-weekly-research-briefing-50/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/07/30/361-capital-weekly-research-briefing-50/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/07/30/361-capital-weekly-research-briefing-50/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/07/30/361-capital-weekly-research-briefing-50/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/07/30/361-capital-weekly-research-briefing-50/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/07/30/361-capital-weekly-research-briefing-50/ […]

… [Trackback]

[…] Here you can find 17570 more Info to that Topic: thereformedbroker.com/2013/07/30/361-capital-weekly-research-briefing-50/ […]