361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

May 27, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

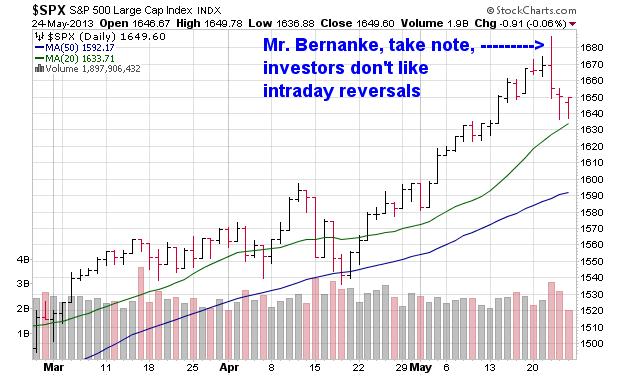

Mr. Bernanke’s opening statement was just what the market wanted to hear…

“Premature tightening of monetary policy could lead interest rates to rise temporarily but would also carry a substantial risk of slowing or ending this economic recovery and causing inflation to fall further”.

But then he started talking and all hell broke loose in the financial markets…

Makes perfect sense to me, but the financial markets are anything but perfect…

@bespokeinvest: What’s positive about a sell-off on fears of an earlier than expected taper is that it ensures there is no earlier than expected taper. $$

Meanwhile over in the bond pits, traders were equally schizophrenic…

@govttrader: BREAKING NEWS: The exit door is only 36 inches wide….please form a single file line…and don’t forget….1-800-GET-ME-OUT

China is not waiting to see if Treasury yields move higher…

China’s currency-reserves manager has set up a New York operation to invest in private equity, real estate, and other U.S. assets, according to people with knowledge of the move. The move by the State Administration of Foreign Exchange, or SAFE, which oversees the world’s largest stockpile of foreign-exchange holdings, comes as it steps up diversification away from U.S. government debt, the people said… A large chunk of the Chinese agency’s $3.4 trillion foreign-exchange portfolio is parked in U.S. government bonds. China won’t say how it invests its foreign-exchange reserves, which have grown rapidly over the past decade, but the latest data from the U.S. Treasury Department show that China slightly reduced its holdings of U.S. government debt in March by 0.1%, to $1.25 trillion… “The likely Fed exit from QE makes it more urgent for SAFE to branch out beyond its traditional role of mainly investing the foreign-exchange reserves in U.S. Treasurys,” said Peng Junming, a former SAFE official who now runs his own investment-management firm in Beijing, Empire Capital Management LLP.

(WSJ)

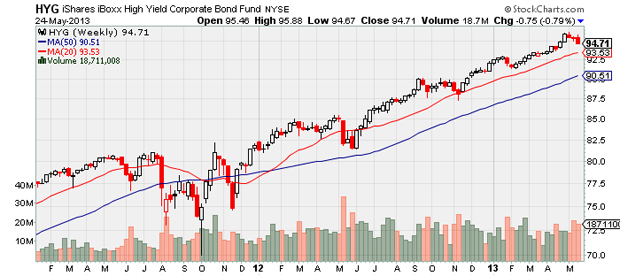

Junk Bonds suffered the dual fate of being related to both bonds and stocks…

3rd down week in a row has not happened since November 2011. And yes, you now have all of our attention.

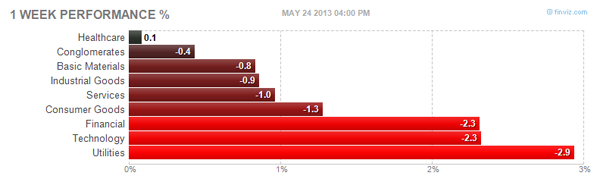

Utilities are suffering an equally damaging fate by being called ‘Yield Stocks”…

Note the volume… This group is either setting up a great long trade for a contrarian manager or is going to ruin an income investor’s 2013.

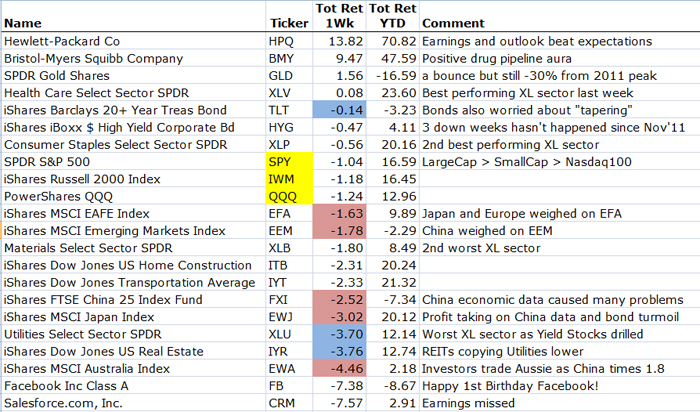

Healthcare squeaked out a win last week, but every other U.S. sector went red…

And in looking at the broader ETFs, the global markets were even worse…

It was a decent week for economic data in the U.S. ending on Friday with a strong Durable Goods number…

The durable goods report was better than expected as durable goods orders rose 3.3% in April (1.5% expected) after plunging -5.9% in March. Most, though not all of the strength, was aircraft. But even excluding aircraft, durable goods orders were up sharply. (ISI Group)

And you like to see the Car Companies giving their employees more hours during the summer…

“US auto makers are canceling some summer factory shutdowns to boost output in response to strong demand.”

Over in Japan on Thursday, there was a near panic as the Nikkei broke the 20day MovAvg…

Will the world end if the Nikkei runs thru the 50day MovAvg? Would you discount it if you knew that SAC Capital was just taking 1/2 of its chips off a great performing Japanese bet to pay for some redemptions? Remember that BULL markets have the sharpest 1 day declines while BEAR markets have the sharpest 1 day gains. Nothing wrong with a little profit taking on a 60% YTD move, so chalk me up in the camp that sees higher prices in Tokyo.

Back to the U.S. markets, interesting piece showing the top market seers are bullish while the worst are bearish…

The best are bullish; the worst are not. That’s the upbeat news emerging from my review of the best- and worst-performing stock-market timers tracked by the Hulbert Financial Digest. Regardless of whether “best” and “worst” are defined in terms of short- or long-term performance, the timers who have done the best job in the past of navigating the market’s ups and downs are currently very bullish on equities—not only in their own right, but also in contrast to those whose timing advice has been awful. Furthermore, this bullish contrast between the best and worst timers has shown no sign of diminution in recent weeks, even as the stock market has surged into new all-time high territory. This doesn’t guarantee that the bull market will continue, needless to say. Nor does it provide assurance that there won’t be a correction along the way. Nevertheless, this best-versus-worst contrast means that, to be bearish right now, you have to believe that the market timers who in the past got it most wrong will suddenly get it right—and that those who have been most right in the past will now get it wrong. That’s always possible, but is that how you want to bet?

(Barrons)

Earlier in the week, Goldman Sachs raised their S&P500 target to 1750 for year-end 2013. Their reasoning…

- End of U.S. economic stagnation suggests S&P 500 P/E expansion:

In advanced economies, P/E multiples expanded by an average of 15% during the year before GDP growth returned to trend. Our year-end 2013 implied forward P/E of 15x would represent a 13% increase vs. 2012.

- Our S&P 500 forecast reflects a one P/E multiple point premium:

Reasons for P/E expansion include confidence in the medium-term outlook for U.S. economic growth and the wide gap between equity and persistently low bond yields that we assume will be closed more by stocks than bonds.

- We expect dividends will rise by 30% between 2013 and 2015:

We forecast dividend growth of 11% in both 2013 and 2014 and 9% in 2015. Our EPS forecasts remain unchanged, but we have lifted our payout ratio assumptions after surprisingly large 1Q year/year dividend growth of 12%.

- Further multiple expansion possible if rates stay low, growth improves:

If interest rates stay low despite better growth then upside to S&P 500 may be greater than we currently forecast. Monetary easing by Fed, BOJ, and ECB keeps sovereign yields low and would support this potential outcome.

(Goldman Sachs)

JPMorgan agrees that increased returns of capital has benefitted equities…

The number of companies listed on U.S. exchanges announcing a dividend increase rose this year to the highest level since 2004. The total yield, the sum of dividends and announced share buybacks divided by equity market value, currently stands at 4.4% for U.S. equities vs. 3.7% for Global equities. Around 2.5% of the $15tr universe of U.S. non-financial equities is currently withdrawn per year due to share buybacks, boosting EPS and other equity ratios. The fall in the S&P500 Index Divisor has helped the earnings picture in the U.S. Had the Divisor remained constant since Q3 2011, the 4-quarter rolling S&P500 Operating Earnings-Per-Share would have only risen by $1.50 instead of the reported $3.70 increase. (JPMorgan)

Case in point, look at the outperformance in Merck on their return of capital last week…

Merck (MRK) – (Buy, $46 PT) – Accelerated $5Bn share repurchase announced…we view this positively – (Mark Schoenebaum) – At MRK’s current share price, the 99.5M shares are worth essentially $5Bn. The entire 99.5M shares will be taken out of MRK’s share count immediately. We don’t have consensus share count post-Q1 earnings to quantify the impact of the accelerated repurchase, but we believe this is a positive sign of MRK attempting to create shareholder value. (ISI Group)

Bill Ackman of Pershing Square Capital could also be looking at better returns on his capital in Procter & Gamble as A.G. Lafley returns to the corner office…

Returning CEO Lafley made my Janus Fund holders a LOT of money during his reign. Talk to your analyst and do some homework on PG as it could be worth your time.

P&G brings back veteran AG Lafley as chief.

Procter & Gamble embattled chief executive Bob McDonald is stepping down and will be replaced by his predecessor AG Lafley after a period of weak performance that left investors unhappy. P&G, the world’s largest consumer goods maker by sales, announced late on Thursday that Mr. McDonald would “retire” at the end of June after nearly four years in the role. The return of Mr. Lafley, chief executive from 2000 to 2009, caught Wall Street by surprise. The shares rose 0.5 per cent in after-market trading in New York.

(FT)

And some good thoughts from HBR on the return of the former PG CEO…

I would hazard a guess that the Lafley return is an effort to accelerate progress on things already underway in McDonald’s plan, although Lafley could certainly add creative twists, and that Lafley won’t stay very long, just long enough to ensure investor and customer confidence, strategic priorities, and a good succession plan.

(HarvardBusinessReview)

Biotechs don’t have much in the way of dividends or free cash flow for buybacks, but the strength in the group is another sign of a very healthy market…

One of Wall Street’s riskiest equity bets is back. In a quest to find the next big medical breakthrough, stock market investors have poured $725m into 10 biotechnology flotations that are attempting to create drugs for illnesses including multiple sclerosis and hepatitis C. The resurgent mood in the U.S. equity market has proved a boon for these companies, usually ranked among the most speculative investments, as they try to come up with the next medical miracle. The result has been that small biotechs, which struggle to generate interest from credit investors since they lack cash flow, are pursuing U.S. initial public offerings at the fastest pace in nearly a decade.

Looks like Mr. Bloomberg has his next job lined up…

New York City mayor Michael Bloomberg told the head of a taxicab fleet that he plans to “f@#%*&g destroy” the city’s taxi industry when he leaves office on January 1. Bloomberg’s frustration with New York’s yellow cabs and their drivers’ stems from their unwillingness to adopt new technology such as accepting electronic passenger hails from smartphones, and their resistance to one of the mayor’s pet projects, a redesigned Taxi of Tomorrow. There aren’t a lot of people who can credibly threaten to upend an entire micro economy. The mayor is a billionaire, though, and he might just have the wherewithal to make it happen.

(Quartz)

If you want to bet on Mr. Bloomberg in this fight, then you had better double check your clients’ portfolios for TAXI…

Medallion Financial Corp. is comprised of a unique combination of businesses. First and foremost, the Company holds a leading position in the origination and servicing of loans to finance the purchase of taxicab medallions. In New York City, the country’s largest market, taxi medallions sell for more than $225,000 each and the value of all taxi medallions exceeds $3.0 Billion! Medallion has an estimated 25% market share of this market, and is rapidly expanding into other major metropolitan areas.

(Medallion Financial)

Quotes of the week:

- “I’m offended by a $4 trillion government bullying, berating and badgering one America’s greatest success stories,” the Kentucky Republican told the committee. “Tell me what Apple has done that is illegal?”… “If anyone should be on trial here, it should be Congress,” he insisted. “I frankly think the committee should apologize to Apple. I think that the Congress should be on trial here for creating a bizarre and Byzantine tax code that runs into the tens of thousands of pages, for creating a tax code that simple doesn’t compete with the rest of the world.” (Sen. Rand Raul) (Raw Story)

- “The expiration of the payroll tax cut, the enactment of tax increases, the effects of the budget caps on discretionary spending, the onset of sequestration, and the declines in defense spending for overseas military operations are expected, collectively, to exert a substantial drag on the economy this year,” he said. The Federal Reserve can offset some bad economic policy coming out of Congress, but not this much bad economic policy coming out of the Congress. “Monetary policy does not have the capacity to fully offset an economic headwind of this magnitude.” (Ben Bernanke, Fed Chairman)

And if you want to get more excited about your Natural Gas wells…

The day UK had six hours of gas left – Britain came within six hours of running out of natural gas in March, according to a senior energy official, highlighting the risk of supply shortages amid declining domestic production and a growing reliance on imports.

(Financial Times)

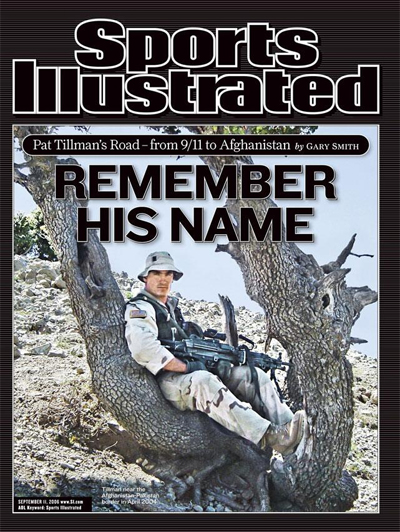

And if you are looking for a read on this Memorial Day, this is a great one…

Thanks to everyone who has made the sacrifice for our country.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/05/28/361-capital-weekly-research-2/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2013/05/28/361-capital-weekly-research-2/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/05/28/361-capital-weekly-research-2/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/05/28/361-capital-weekly-research-2/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/05/28/361-capital-weekly-research-2/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2013/05/28/361-capital-weekly-research-2/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/05/28/361-capital-weekly-research-2/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/05/28/361-capital-weekly-research-2/ […]

… [Trackback]

[…] There you can find 40755 additional Information on that Topic: thereformedbroker.com/2013/05/28/361-capital-weekly-research-2/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/05/28/361-capital-weekly-research-2/ […]

… [Trackback]

[…] There you will find 72813 additional Information on that Topic: thereformedbroker.com/2013/05/28/361-capital-weekly-research-2/ […]

… [Trackback]

[…] Here you will find 15049 more Information to that Topic: thereformedbroker.com/2013/05/28/361-capital-weekly-research-2/ […]

buy cialis online generic

SPA