361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

May 13, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

Last week was a VERY GOOD one for the Equity Markets…

I left the office each day thinking that I just saw another walk off game winning home run by the S&P500. The bears were given their chance in April with the weak economic data and slightly less than exciting earnings, but they just couldn’t break it. In return, the employment data was a bit better, the global central banks came out swinging (ECB, Australia, and South Korea), then the markets broke the Yen, Bonds, and Gold, and the Bulls absolutely skinned the Bears.

It is tough to see anything on the horizon this summer that will set back Equities. We all know that the FED will need to back off the liquidity injection at some point. With inflation slim to none right now, they expect to proceed at a measured retreat. Meanwhile the market expects this to begin late this year or early next. As long as the economy is continuing to grow while the FED backs off the pedal, equities should not be troubled.

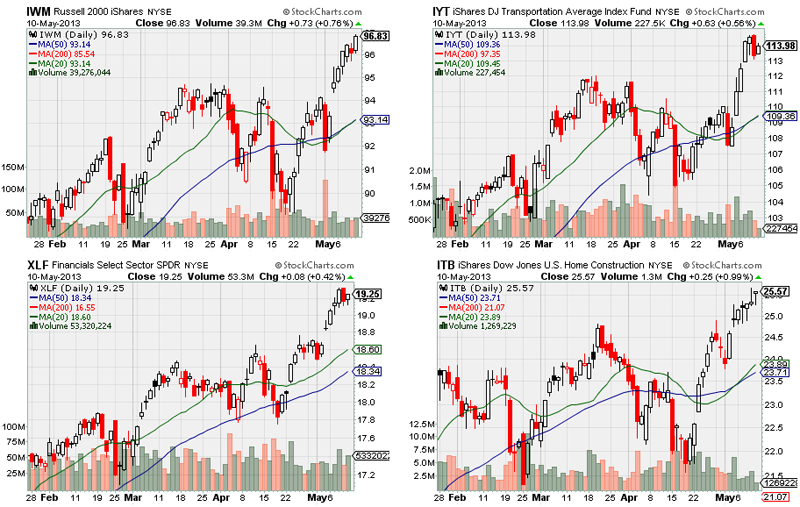

Most all of my worries in the equity market were also skinned last week. As the charts below show, the markets put in VERY IMPORTANT new highs in 1) Small Caps, 2) Transports, 3) Financials, and 4) Housing. If you are long risk and equities, you could not have asked for more.

Now if Apple could only make a new high, I’d expect to see DOW 16,000 and a petition started in Illinois to rename their football team to match their basketball team…

Hey Barron’s, congrats for sticking your neck out…

Speaking of a great week, I count 23 names in the Russell 1000 UP 10%+. Many of the names below had GINORMOUS short interest ratios as of the last monthly record date. Another sign of a runaway male bovine.

Fun with charts… The Dow Industrials has not had 3 straight down days in 2013…

Once again, just nothing is standing in the way of this freight train. Shorts might as well go to Vegas and bet it all against the Miami Heat. At least they would get a free drink out of it.

If you are in the need of finding PAIN in the financial markets, let’s take a closer look at Bond Bulls…

Over the last 6 trading days, the 10-year yield has had its biggest positive move since March 2012 (BespokeInvest via @ritholtz)

Even the Largest Bond Fund Manager in the World called the top last week…to the exact day even…

@PIMCO: Gross: The secular 30-yr bull market in bonds likely ended 4/29/2013. PIMCO can help you navigate a likely lower return 2 – 3% future.

So a well-deserved toast to the end of the 32 year old Bull Market in Treasury Bonds…

“Okay, who is going to tell Leo that we are down to the last 2 cases of Moët & Chandon?”

Federal Reserve officials have mapped out a strategy for winding down an unprecedented $85 billion-a-month bond-buying program meant to spur the economy—an effort to preserve flexibility and manage highly unpredictable market expectations. Officials say they plan to reduce the amount of bonds they buy in careful and potentially halting steps, varying their purchases as their confidence about the job market and inflation evolves. The timing on when to start is still being debated. The Fed’s strategy for how and when to wind down the program is of intense interest in financial markets. While the strategy being debated leaves the Fed plenty of flexibility, it might not be the clear and steady path markets expect based on past experience. Officials are focusing on clarifying the strategy so markets don’t overreact about their next moves.

(WSJ)

While rising long yields are bad for bond investors, the widening spread between the 2yr and 10yr Treasury yields is great for Bank stocks and those with large money market funds like Charles Schwab…

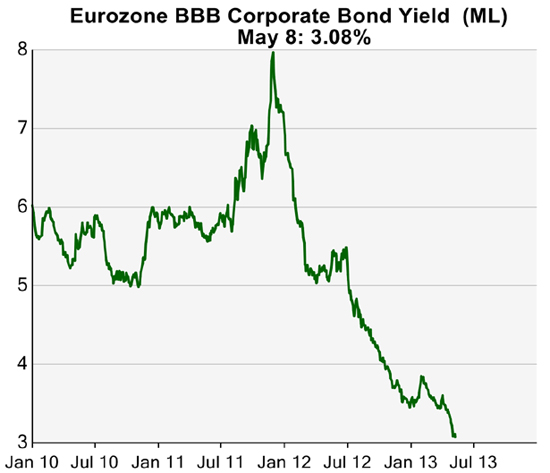

Rising risk free yields continue to push investors into risk fixed income. This collapse in Euro corporates is incredible…

(CornerstoneMacro)

Also joining the party, U.S. High Yields set record low yields last week…

The U.S. Corporate High Yield Index fell to a record low of 4.97% Tuesday, marking the first time the benchmark tracking debt issued by weaker U.S. companies dropped below 5%. On Wednesday, it fell to 4.96%. The yield on the Index has lost more than a percentage point this year. Issuance of high-yield bonds hit records in 2012. This year has started in the same vein, with high-yield volumes rising at the fastest-ever clip. So far this year, more than $150 billion in high-yield bonds have been issued in the U.S.

(WSJ)

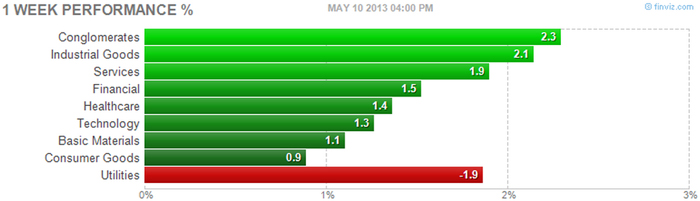

For equities; it was a great week as long as your stock didn’t convert fossil fuels to electricity…

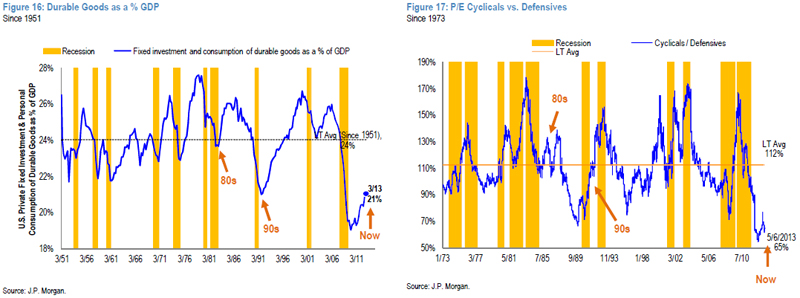

If you are looking to allocate capital to equities, how do you not focus in on the cyclicals?

As Tom Lee’s team at JPMorgan highlights, not only has the U.S. significantly underspent on Capex the past 5 years, but the Capex Manufacturers are also trading at historic lows versus Defensives.

Other insights on where to invest from some proven market seers:

Ned Davis: Ned notes that “Companies hold a near-record $3.8 trillion in cash and short-term instruments.” He cites Dan Sanborn’s statement that “Low rates combined with high cash levels have put upward pressure on market multiples.” Ned adjusts the S&P 500 P/E multiple for those heavy cash positions, and that reduces the multiple to 13.1, “which is below the long-term average of 15.4.” Ned concludes that the “multiple may have room to expand further.”

(via Cumberland Advisors)

Stanley Druckenmiller: “The standard talking head on CNBC says they like the market long-term but think there’s a correction short-term. My view is I like the market short-term and I hate it long-term.” He hates QE2 and everything after it. “Gun to my head, I’d guess melt-up rather than melt-down. No correction until a change in Fed policy.”

(via The Reformed Broker)

Hugh Hendry: Consider the plight of a conservative investor: concerned about the risks to the global economy and hence cyclical equities; fearful of financial repression in Treasuries; trapped (possibly unfairly) by the prejudice of the ten-year bear market in US dollars; scared that governments may have to haircut his savings account in the bank; and now terrified by the sudden price collapse in gold. It could be argued that for such an investor all roads lead to the safest, least volatile, most liquid consumer non-discretionary blue chips on Wall Street, which provide a 3% dividend income payable in dollars.

The second of our major investment themes is the likely durability of the US economy relative to the rest of the world, and the impact this may have on the US dollar. Unlike the rest of the world, America has dealt with the overhang of bad debts from the housing bubble through a vicious house price correction and resulting bust and the recapitalisation of its banking system. Wages have come down sharply relative to Asia, the shale gas boom means energy is now far cheaper as well, and the resulting lower cost base is allowing the US to reclaim market share within the global economy. As such, US real GDP is 3.3% above the pre-crisis high of Q2 2008, whereas the European economy is still languishing 3.1% below the all-time high recorded in Q1 2008.

(via BusinessInsider)

Steve Eisman: Steve Eisman made his reputation with his short bet against subprime mortgages prior to the credit crisis and for identifying abuses in for-profit education three years ago when Wall Street loved the sector. Eisman, founder of Emrys Partners, said the U.S. housing recovery is in its early stages and offers plenty of investment opportunities. He noted that some of the strongest housing markets, including California, Arizona, Nevada, and Florida, were formerly among the weakest. Low housing inventories are fueling a boom in land prices in these markets; some have had 30% gains since the end of 2012.

(Barron’s)

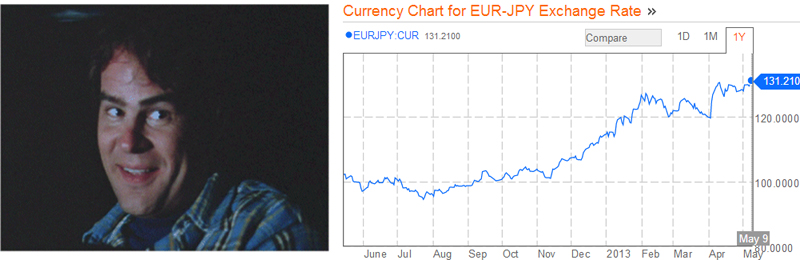

Hey Germany… you wanna see something really scary?

The Euro is now 30% more expensive then the Yen a year ago. Both Germany and Japan are industrial heavyweights. This move in the currency will shift global business from Europe to Japan. And for your personal affairs, if you are looking at a new luxury car purchase in the U.S., a Lexus/Infinity is going to be looking much more attractive over than that Audi/Porsche.

Speaking of autos, maybe President Obama should have picked Elon Musk to be the Car Czar in 2009…

4/3/13 – @SteveRattner: Tesla ($TSLA) battles the shorts — I’m betting on the shorts

Tesla Model S Scores 99 Out Of 100 In Consumer Reports Test

The Tesla Model S takes everything you know about cars and stands it on its head. It’s a very agile, super-quick electric luxury sedan (with a hatchback!) that seats seven and gets the equivalent of 84 mpg. Got your attention yet?

(BusinessInsider)

Marissa Mayer, Portfolio Manager Slayer?

@ericjackson: Was asked to pitch $YHOO yr ago to bunch of PMs at some firm. 1 guy said: “I never use Yahoo anymore. It’s a dinosaur.” He was fired last wk.

Yahoo has 280 million email users. If the new CEO can continue to find ways to extract value from that large user base and YHOO is another $10 higher at year end, she will continue to remove the heads of Large Cap Portfolio Managers that don’t own her stock.

As we head into the summer travel season, hotel forward bookings are looking tight so double check your leisure sector weighting and plan ahead for your vacation…

Several hoteliers reported to HotelNewsNow.com that advanced bookings are up dramatically year over year, backing up a new forecast by STR that predicts strong performance metrics for June, July and August. STR is the parent company of HotelNewsNow.com. Not only is demand up, but most hoteliers said pricing power has returned and they are finally able to push rate without experiencing consequential declines in occupancy. According to STR, average occupancy at U.S. hotels for June, July, and August combined is expected to be 70%, up 1% from last year. Average daily rate is expected to be $112.21, up 4.4% from 2012, and revenue per available room is expected to be $78.50, up 5.4% from 2012.

(HotelNewsNow)

We highlighted Leuthold Group’s LONG Airline call in our year end note. If you listened to them, you are +80% in your DAL and now it is going to pay you a dividend and try to buyback your shares…

Delta Air Lines will start paying a quarterly dividend and buy back some of its shares — investor-friendly moves that are common in other industries but rare for airlines. Delta said on Wednesday that it will pay a quarterly dividend of 6 cents per share starting Sept. 10 for people who own the stock on Aug. 9. A quarterly dividend of that size would yield 1.3 percent per year compared with Tuesday’s closing stock price. The airline also plans to buy back $500 million of its stock by mid-2016. Buybacks have the effect of returning cash to shareholders because the remaining shares they own represent a bigger slice of the company and its profits. Of the large U.S. airlines, only Southwest Airlines Co. pays a dividend — it is one penny per share per quarter.

(NYTimes)

Following on our note from Midland, TX last week, another reader wrote in with some more amazing stats…

About Midland…we have an office there and the landlord is raising rent 80% next year. There are lots of jobs and business, but nowhere to live even remotely close to the city. I hear they are finally building some new buildings. A mid-sized energy company here in Denver, has a big office there and is expanding. The Controller is a neighbor and he said they have to build their own building. Heard also that a new hotel is being build 30+ miles away and one of the large oil companies in Midland has already booked 70% of the availability in the future.

Expanding Price, Volumes and Margins drive business valuations higher. The valuation of Colleges is not expanding right now.

Private U.S. colleges, worried they could be pricing themselves out of the market after years of relentless tuition increases, are offering record financial assistance to keep classrooms full. The average “tuition discount rate”—the reduction off list price afforded by grants and scholarships given by these schools—hit an all-time high of 45% last fall for incoming freshmen, according to a survey being released Monday by the National Association of College and University Business Officers. “It’s a buyer’s market” for all but the most select private colleges and flagship public universities, said Jim Scannell, president of Scannell & Kurz, a consulting firm in Pittsford, N.Y., that works with colleges on pricing and financial-aid strategies. It is likely that some private colleges will be forced to be even more generous with discounts this fall. As of the May 1 deadline for many high-school seniors to commit for their freshman year of college, early reports suggest some non-top-tier schools fell 10% to 20% short of enrollment targets, said Mr. Scannell.

(WSJ)

Finally, a great shot of the new horizon in Lower Manhattan…

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/05/14/361-capital-weekly-research-briefing-43/ […]

… [Trackback]

[…] Here you will find 44349 more Info to that Topic: thereformedbroker.com/2013/05/14/361-capital-weekly-research-briefing-43/ […]

… [Trackback]

[…] There you can find 1280 additional Information to that Topic: thereformedbroker.com/2013/05/14/361-capital-weekly-research-briefing-43/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2013/05/14/361-capital-weekly-research-briefing-43/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/05/14/361-capital-weekly-research-briefing-43/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/05/14/361-capital-weekly-research-briefing-43/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2013/05/14/361-capital-weekly-research-briefing-43/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2013/05/14/361-capital-weekly-research-briefing-43/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/05/14/361-capital-weekly-research-briefing-43/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/05/14/361-capital-weekly-research-briefing-43/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/05/14/361-capital-weekly-research-briefing-43/ […]

… [Trackback]

[…] There you can find 10050 additional Info to that Topic: thereformedbroker.com/2013/05/14/361-capital-weekly-research-briefing-43/ […]