361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

April 8, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

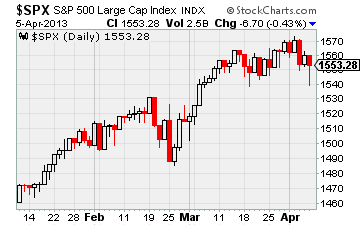

Did the weak economic data spook the market? Or is the weak market telling us that the economy is going too slow?

Conspiracy theory economists would say that the Government fudged the data weaker so that it could help sell $60-70 billion in U.S. debt this week. Whatever the outcome, last week we had a perfect storm of high expectations for the data + very below average March weather + the payroll tax hike impact + the upcoming sequester worry. Economic data will move violently from month to month, but unfortunately last week, it was mostly in the WEAKER THAN EXPECTED direction and investors did not hesitate to bring pain on risk assets. Then if you really want to spice up the worries last week, toss in some North Korean nuclear missile threats and a dash of Asian bird flu strain.

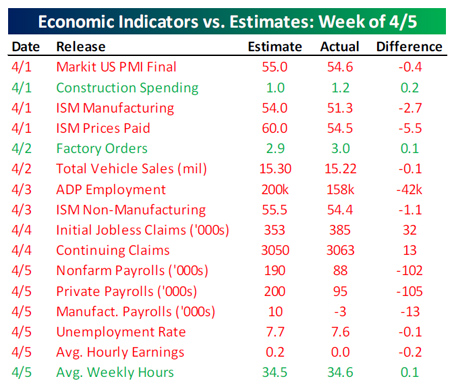

About the economic data, the trend of Weaker-Than-Expected continued for a 3rd week in a row…

(Bespoke)

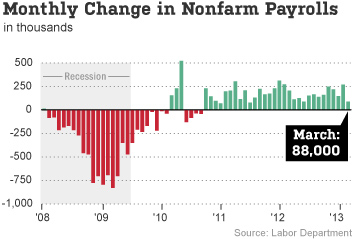

And the week of data was capped off by a very large 100k+ miss in Nonfarm Payroll growth…

March nonfarm payrolls came in at 88K versus the 192K expected by the Briefing.com consensus. The prior reading was revised up to 268K from 236K. Nonfarm private payrolls added 95K against the 210K consensus. The unemployment rate was reported at 7.6%, better than the Briefing.com consensus which expected the rate to remain unchanged at 7.7%. Hourly earnings were unchanged while the Briefing.com consensus expected an uptick of 0.2%. Average workweek was reported at 34.6, which was slightly ahead of the 34.5 expected by the Briefing.com consensus. (Briefing.com)

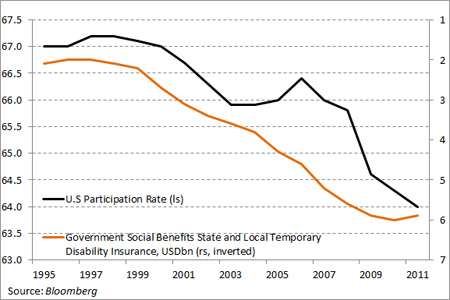

Much talk about the continued decline in the labor participation rate. This graph could suggest that the decline is self-inflicted…

(@M_McDonough)

Due to the weak string of data, Treasury Bonds had their best week since the November election as the 10 year yield broke its rising trend line to hit 1.70%…

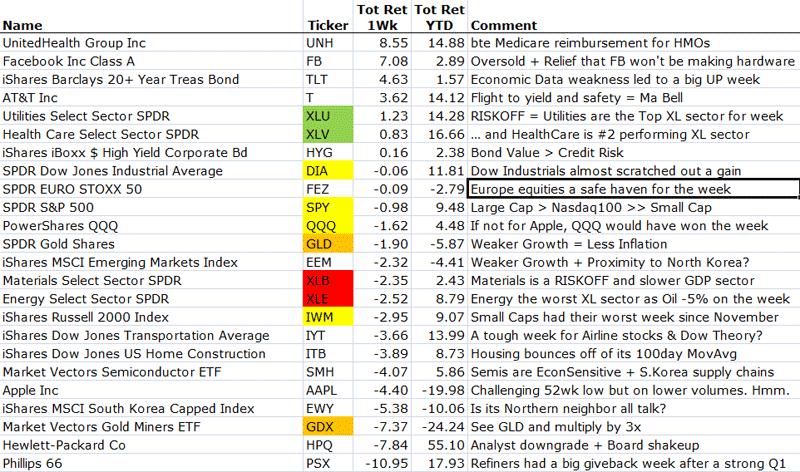

Most interesting performance in RISK assets was the significant underperformance in Small Cap equities…

We saw other underperformance in Cyclicals and Emerging Market equities, but the pullback in the IWM made several of us look up from our desks.

If you were LONG risk and looking for warm milk and a blanket, the semi-stability in the 2 year yield was one place to look…

As was the continued stability in Junk Bonds…

Even RISKON debt overseas held its ground, like the Italian 10 year bond yield…

(Bloomberg)

So maybe the markets in the U.S. are just quickly adjusting to what Commodities, Emerging Markets and this relative chart of Caterpillar have been saying for a while… Growth might be improving in the U.S., but it is still difficult to find in the rest of the world.

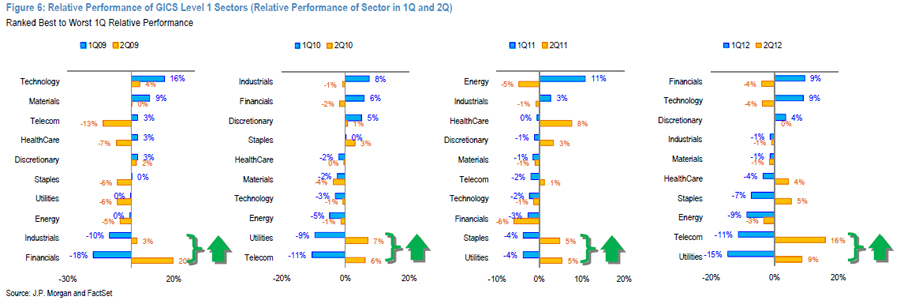

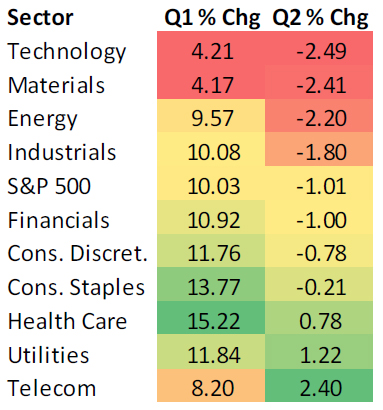

If you are looking for equity performance in the Q2, JPMorgan highlighted that for the past 4 years, the worst performing groups in the Q1 have been top performers in the Q2…

…following on JPMorgan’s work, Materials and Tech were the worst performers in the Q1. So if the 4 year pattern repeats itself, last week set you up with even lower prices…

(Bespoke)

Speaking of reversion trades…

@SamMamudi: After closing up yesterday the S&P 500 closed down today, its 12th straight day of alternating directions. That’s never happened before.

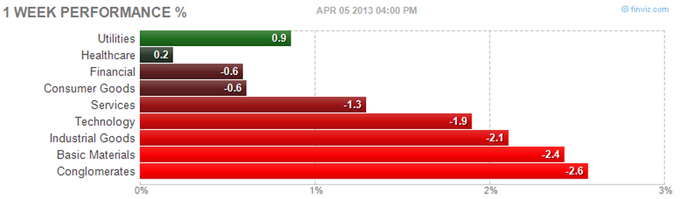

Sectors showed a RISKOFF week with only Utilities and Healthcare gaining…

It was interesting to see the outperformance in Europe even as RISK assets were generally sold across the board. On the flip side of outperformance was Gold and Gold Miners which only have one direction…

Want to study a few thousand economic data points over the next 3 weeks? Time to bring on the 2Q Earnings Reporting Season!

2Q earnings season kicks off next week with nine firms representing 3% of the S&P 500 equity cap scheduled to release results. Firms reporting include Alcoa (AA), Family Dollar Stores (FDO), Constellation Brands (STZ), Fastenal (FAST), Progressive (PGR), JPMorgan Chase (JPM) and Wells Fargo (WFC). (Goldman Sachs)

As the earnings season starts, here is a good contrary opinion to keep in mind from Byron Wien…

One of my biggest concerns is that earnings are going to be disappointing. In a market where the S&P 500 was up 16% (total return) last year and 10% so far this year, that could be meaningful. The consensus is for operating earnings for the index to be $110 in 2013, up from about $100 in 2012. I think earnings could be flat to down, which is clearly a contrary view… The foundation of my thesis is that corporations have worked exceedingly hard to squeeze every bit of profitability out of their existing operations. As a result, from the recession trough, profits for the S&P 500 improved faster than sales for the first time ever in the post-war period. A recent Smithers & Co. study showed profit margins before depreciation, interest and taxes as a percentage of output were at 36%. That hasn’t happened since World War II. Nominal economic growth for the U.S. economy is only likely to be 4%–5%. That is not strong enough to provide revenue increases large enough to offset margin pressure. The first quarter earnings season is upon us and it will be important to see how the results come in. If shortfalls dominate, the animal spirits in the market may cool down.

(ByronWien/Blackstone)

Speaking of earnings reporting season, the SEC just added a few billion dollars to the valuation of Twitter…

In a ruling that portends changes to how companies communicate with investors, the Securities and Exchange Commission said Tuesday that postings on sites such as Facebook and Twitter are just as good as news releases and company websites as long as the companies have told investors which outlets they intend to use… “An increasing number of public companies are using social media to communicate with their shareholders and the investing public,” the SEC said in its report Tuesday. “We appreciate the value and prevalence of social media channels in contemporary market communications, and the commission supports companies seeking new ways to communicate.”

(WSJ)

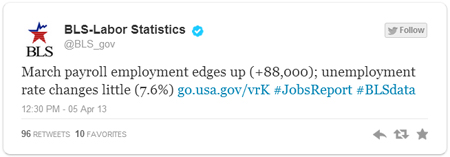

…of course the top Bond and Equity traders already know that the news happens first on Twitter. On Friday, the BLS release confirmed it…

Every month, when the U.S. jobs report is announced, journalists race to tweet the number as fast as they can. Many investors, meanwhile, pay lots of money for fast access to the data, so they can trade on the reaction. Today, though, they all appear to have been scooped by a tweet from the custodian of American employment data, the U.S. Bureau of Labor Statistics. This tweet was sent at exactly one second past 8:30 a.m. EDT, when the number is officially released:

And not wasting anytime, Bloomberg is now adding a Twitter page to its terminals that will even be @KimKardashian free!

Until this week, many Wall Street bankers and traders had no access to Twitter. Despite the fact that Twitter is now where lots of breaking news (including today’s jobs day numbers) happens first, most big banks shut off access to social networks on their systems for compliance and security reasons. But that’s all changing. Yesterday, Bloomberg LP announced that its terminal, the subscription data service (price: more than $20,000 a year) that is used by more than 300,000 Wall Streeters to look up all kinds of financial information, will include a Twitter feature. The TWTR terminal feature doesn’t allow users to tweet, but it does let them read the tweets of certain news services, financial writers, economists, and bloggers selected by Bloomberg’s terminal team. Being on Bloomberg’s VIP list isn’t just a meaningless status symbol. (Although it is that, too.) It’s tantamount to being able to broadcast your thoughts into every firm on Wall Street, and each person on the list gets more than 300,000 silent followers, who may or may not be trading millions of dollars based on their 140-character musings.

(NYMag)

In the 1990’s, it was easy to recruit Wall Street to come to Colorado. 20 years later, it is Utah that has become the Rocky Mountain home to global finance companies…

Utah, already home to 5 percent of Goldman Sachs workers, is gaining momentum in its bid to be Wall Street of the West. State economic development officials say they are in advanced talks with three major banks on projects that would bring an additional 1,000 securities jobs to Salt Lake City. For finance companies, the strategy is a classic arbitrage trade. The state offers real estate and labor well below the rates demanded in the concrete canyons of New York or other finance hubs. And, in part because a high percentage of the Salt Lake City population has completed the Mormon Church’s two-year missionary program, foreign language skills are abundant. More than half of Goldman’s Salt Lake workforce is fluent in a second language. Utah is also sweetening deals with major incentives, offering credits of up to one-quarter of corporate tax bills. That means Goldman will receive $47 million in Utah rebates by 2029, provided it keeps about 1,100 workers in the state and hits certain investment hurdles. Four years after signing that deal, Goldman has already met the first target. It has 1,500 Utah workers and is still making a strong Salt Lake sell in its recruiting materials… The state has also notched smaller recruiting victories of late. Morgan Stanley has expanded its Utah operations three times in the decade since it opened an office there. In November, Royal Bank of Scotland committed to hiring 310 workers in the state, in exchange for $5.3 million in tax credits. Granted, another 1,000 jobs won’t change the industry. But in a smaller city like Salt Lake, those jobs are significant, and over time, those zeros add up.

(BusinessWeek)

Returning cable network series tweet of the week…

@ReformedBroker: Should do a Mad Men reunion in the 1980’s when they’re all dying of emphysema, syphilis. Soundtrack would be dope.

As a Colorado Buffalo, I only saw red in Nebraska football. But as a cancer survivor watching this video, all I can think is “Nice Job Cornhuskers”…

@SI_PeterKing: Highlight of the weekend, and of the year… Heck of a job, Nebraska.

And finally, if you are a fan of Malcolm Gladwell’s Outliers, you will be interested to see the outcome for a 31 year student of “The Price is Right”…

@ToddSullivan: Best Contestant On The Price Is Right Ever

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/04/09/361-capital-weekly-research-briefing-38/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/04/09/361-capital-weekly-research-briefing-38/ […]

… [Trackback]

[…] Here you can find 44204 additional Information on that Topic: thereformedbroker.com/2013/04/09/361-capital-weekly-research-briefing-38/ […]

… [Trackback]

[…] Here you will find 83906 additional Info to that Topic: thereformedbroker.com/2013/04/09/361-capital-weekly-research-briefing-38/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/04/09/361-capital-weekly-research-briefing-38/ […]

… [Trackback]

[…] There you will find 82449 more Information on that Topic: thereformedbroker.com/2013/04/09/361-capital-weekly-research-briefing-38/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/04/09/361-capital-weekly-research-briefing-38/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/04/09/361-capital-weekly-research-briefing-38/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/04/09/361-capital-weekly-research-briefing-38/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2013/04/09/361-capital-weekly-research-briefing-38/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/04/09/361-capital-weekly-research-briefing-38/ […]