361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

March 4, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

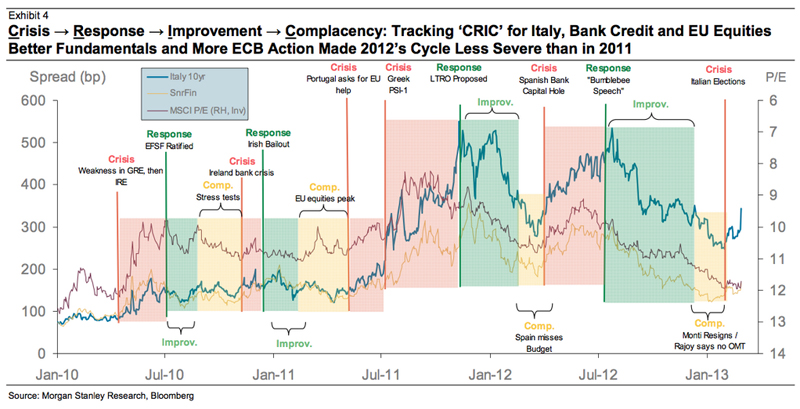

Just when you thought it was safe to delete your ‘European Politics’ Internet Bookmarks…

Italians vote against austerity and for political chaos and their 10 year bond opens up the RISK spigot for the entire world.

As a result, Morgan Stanley (and most of the investment houses) move to play defense…

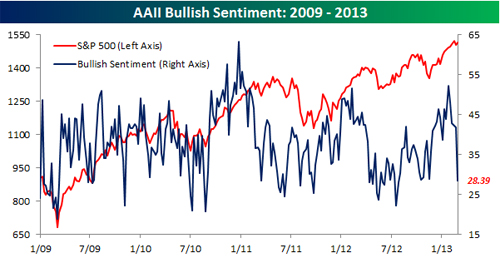

Even the Bulls run for the hills as the market posts TWO 90% DOWN Volume days…

Monday’s negative reversal in the S&P 500 and the subsequent sharp decline acted as a further knock to bullish sentiment. According to the weekly sentiment survey from the American Association of Individual Investors (AAII), bullish sentiment plummeted from 41.79% down to 28.39%. This was the largest weekly decline since November 2010, and it was the lowest weekly reading since last July. (Bespoke)

Some confirming RISK-OFF charts in the form of Copper…

…and Crude Oil…

…and 10 Yr Bond Yields which had its biggest weekly fall in almost a year…

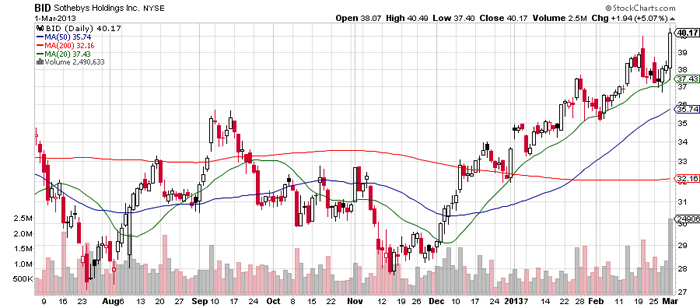

But not confirming the RISK-OFF move is the chart of Sotheby’s, which is near a 52 week HIGH and is a good thermometer of global wealth…

So the Sequester happened and the world did not end. Imagine a world where the private sector absorbs the downsized hours of the public sector, Gov’t spending shrinks and U.S. debt is upgraded to AAA…

“You can only cry wolf once—maybe twice. They are stuck now with over-inflating the effects and now they have a significant credibility problem,” said Lanny Davis, an attorney who specializes in crisis management and a former special counsel to President Bill Clinton. (WSJ)

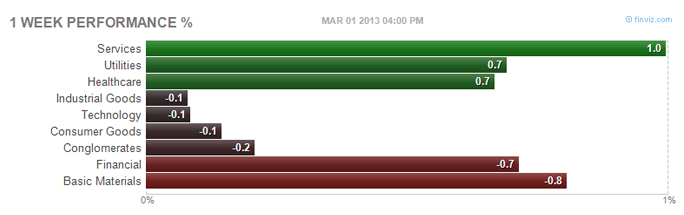

Is this RISK-OFF move the beginning of something new? Financials lead lower on the week along with Small Caps. Volumes on down days are leading volumes on up days. Will the market setup for a lower high followed by a lower low? Stay tuned for now, but I’d guess the trading desks will be quiet until more data points are digested.

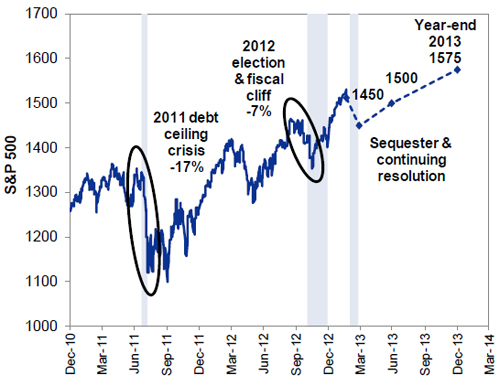

Before the ‘Rumbles in Rome & Milan’, Goldman presented a target of 1575 on the S&P500 by year end 2013 driven by accelerating earnings growth and inflows into U.S. equities. Sees cyclicals and BRICs outperforming…

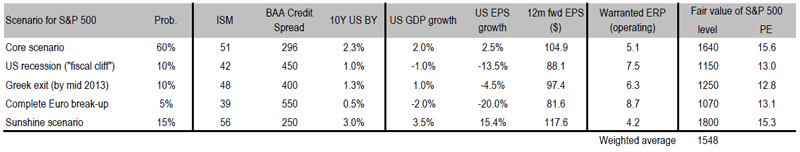

And over at Credit Suisse, their scenario analysis put their 2013 S&P500 target at 1548…

(Credit Suisse)

And financial advisors are moving clients into great Equity and Alternative exposures…and less Fixed Income…

It’s finally starting to happen: After five years of extraordinarily defensive investing, the nation’s largest wealth-management firms are growing wary of bonds and more upbeat on stocks. On average, the wealth managers are recommending that investors put 29% of their money in fixed income, down from 34% a year ago, according to an annual survey by Penta. The managers and their clients are increasingly worried that interest rates will start to rise, a development that would hurt bond values. At the same time, wealth managers are recommending an average allocation to stocks of 48%, up from 45%, reflecting increased optimism about the U.S. and beyond. Many expect to step up their equity allocations still further as the year progresses. “The world hasn’t collapsed, and there’s a beginning of a normalization in the way we look at the markets,” says Chris Wolfe, chief investment officer at Merrill Lynch Wealth Management.

(Barron’s)

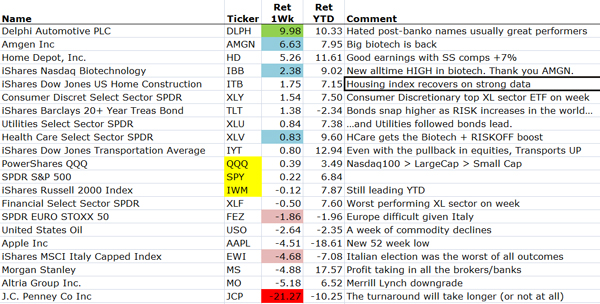

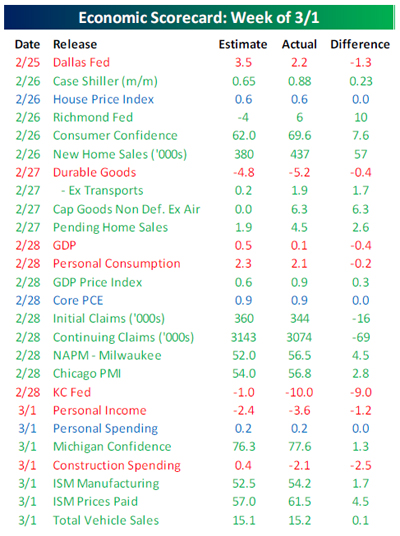

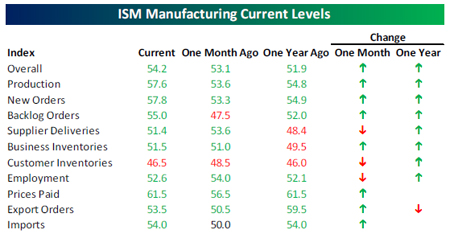

On the week, the U.S. data came out on the strong side with Housing, Durable Goods and the ISM leading the way…

(Bespoke)

The ISM data points are important because they are well-followed by CFOs and those planning production…

(Bespoke)

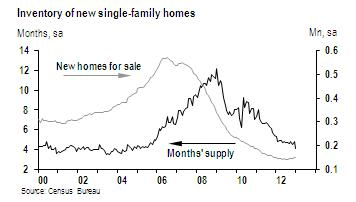

As for New Home Sales, up and to the right with a +15.6% gain in January new home sales…

…which leads to a big drop in the supply of new homes (from 4.8 to 4.1 months)…

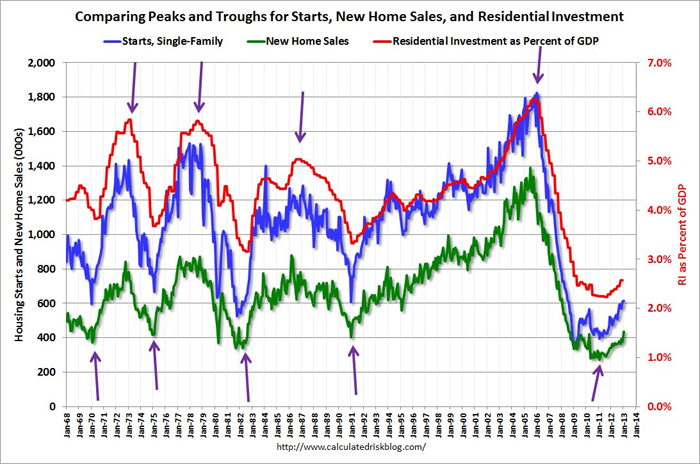

Housing has a big move higher if it can only get back to 3.0-3.5% of GDP…

Now you know why Warren Buffet is turning Berkshire Hathaway into a mega cap play on housing.

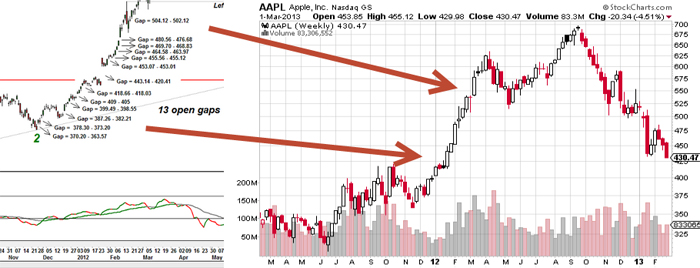

The Apple stock chart is working on a most amazing series of gap fills right now…

I saved the below chart because of the string of gaps that Apple left in its wake a year ago on its way to becoming the largest stock in the market. While it was not difficult to be impressed by the string of products and earnings that the company was generating, I am also a believer that eventually excitement does catch up with itself and gaps in a chart get backfilled. It is always healthier for any stock chart if the gains are slowly digested over time rather than inhaled all at once. So I kept the AAPL gap chart in my Evernote as a recent reminder to myself that the market can be completely wrong about valuation and that a mega cap stock price can gap up repeatedly.

Given the 52 week low in Apple registered on Friday, I dug the old gap up chart for a review. It appears that AAPL has now filled 1/2 the gaps that it made from Dec. ’11 to Feb. ’12 and is working on the huge gap post the Jan. ’12 earnings release. I don’t know if AAPL will make it all the way down to 363 to fill the lowest gap, but I will be again reminded by Apple that stock chart gaps are meant to be filled no matter how special a company it might be.

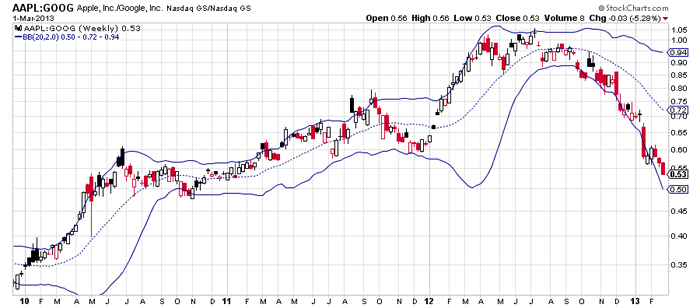

Apple v. Google…

In case you were wondering, the perfect hand off for mega cap growth stocks happened in June ’12. Since then, Google has gained 40%+ while Apple has fallen 25%. But don’t forget that AAPL pays a dividend.

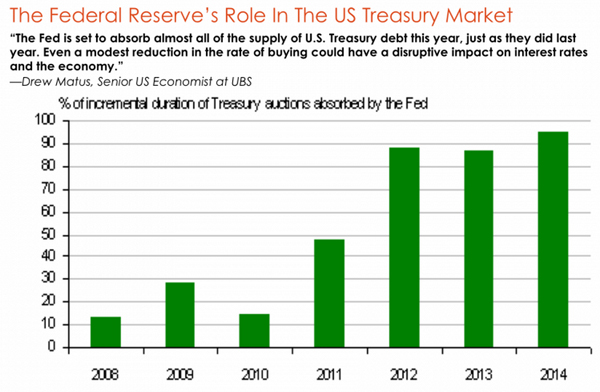

An often asked question is what will happen to U.S. interest rates when the 900 lb. gorilla puts down his paddle?

And Marty Feldstein writes this weekend that foreign investors don’t need to buy our bonds…

Large portfolio investors don’t put all of their funds in a single currency. They diversify their funds among different currencies and different types of financial assets. If they perceive that the dollar and dollar bonds have become riskier, they will want to change the distribution of assets in their portfolios. So, even if the dollar is still regarded as the safest of assets, the demand for dollars will decline if its relative safety is seen to have declined.

When that happens, exchange rates and interest rates can change without assets being sold and new assets bought. If foreign holders of dollar bonds become concerned that the unsustainability of America’s situation will lead to higher interest rates and a weaker dollar, they will want to sell dollar bonds. If that feeling is widespread, the value of the dollar and the price of dollar bonds can both decline without any net change in the holding of these assets. (ProjectSyndicate)

Meanwhile, Ken Heebner is making a big bet. This time going long U.S. Economic growth and short U.S. Treasuries…

Money manager Kenneth Heebner, convinced that a growing U.S. economy will eventually prompt the Federal Reserve to boost interest rates, has bet 21 percent of his CGM Focus Fund (CGMFX) on a decline in U.S. Treasuries. The $1.44 billion fund, which Heebner uses to make concentrated wagers on stocks, had sold short $300 million of U.S. Treasury bonds at the end of last year, according to a filing yesterday with the U.S. Securities and Exchange Commission. That is up from $190 million at the end of the third quarter and $80 million halfway through last year… “We established a significant short position in U.S. Treasury bonds in anticipation of what we believe will be a stronger U.S. economy going forward,” Heebner said in a Jan. 2 letter included in the filing. (Bloomberg)

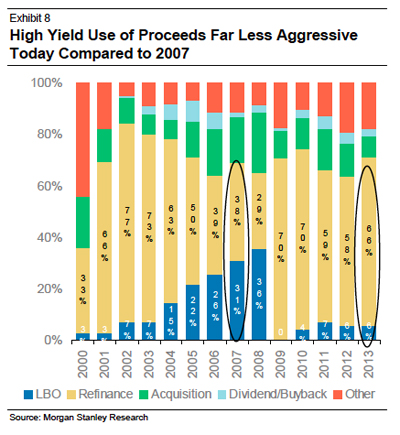

As for High Yield Bonds and their big move, we are far from the silly season in the uses of Junk Debt…

Most of the proceeds are being used to refinance existing debt. The high yield market will look less stable when the proceeds are being used for LBOs and M&A. While we have some of those deals starting to occur, go back and look at the M&A news in 2007 and 2008.

A new energy study reads very positive for American energy independence…

U.S. natural-gas production will accelerate over the next three decades, new research indicates, providing the strongest evidence yet that the energy boom remaking America will last for a generation. The most exhaustive study to date of a key natural-gas field in Texas, combined with related research under way elsewhere, shows that U.S. shale-rock formations will provide a growing source of moderately priced natural gas through 2040, and decline only slowly after that.

(WSJ)

As a result, Niall Ferguson says to go LONG the U.S. Dollar…

“I am long U.S. dollar, which is somewhat a contrarian position,” he said today in Abu Dhabi. “The benefits of the shale gas type oil revolution are still being underestimated by most observers and I think there’s a lot more upside to come in the United States than most people anticipate.” The U.S. is poised to become a net exporter of liquefied petroleum gases for the first year ever as shale-based energy production jumps, prompting new orders for specialized ships to haul propane and butane. The boom in natural gas and oil production helped the U.S. meet 84 percent of its energy needs in the first 10 months of last year, on pace to be the highest annual level since 1991, EIA data show. “If you think about what the shale gas type oil story means for the current account it has to be positive,” Ferguson said later in an interview. “It has to be reducing it, so that’s another dollar positive force,” he said. (Bloomberg)

I was fortunate enough to be a bank stock analyst in the early 90’s when the industry generated excess capital…

@moorehn: $JPM CEO Dimon’s big investor day prediction: ‘all banks’ll have too much capital in 2.5 yrs and won’t know what to do with it.’ Hmm

The poacher goes poaching and leaves his patch of grass behind…

HighTower, an independent advisor-owned financial services firm, announced on Wednesday that it had added former Morgan Stanley senior vice president and branch manager Thomas New to its Kelly Wealth Management practice in Baltimore. In an ironic turn, New originally tried to recruit Kelly Wealth Management’s Leo Kelly for Morgan Stanley but was so impressed by the HighTower model that he decided to join the firm instead.

(AdvisorOne)

“Want to play a Game?

@Bill_Gross: “A child’s Playstation today is more powerful than a Military Supercomputer from 1996.” -Erik Brynjolfsson at #TED2013

(War Games, 1983)

Was the U.S. Treasury a bidder at the Hostess bankruptcy auction last week?

The white icing machines for the cupcake tops could easily be recycled into the U.S. Mint.

Tweet of the week…

@jonsticha: When asked for comment, IKEA’s head chef stated: “Aweenda shmure da hoorsy. Yur puurt thuur nay-nay airn der bewl. Bork, bork, bork!”

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Here you can find 51930 more Info on that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]

… [Trackback]

[…] There you can find 7260 more Information to that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]

… [Trackback]

[…] There you can find 16353 additional Info to that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]

… [Trackback]

[…] There you will find 28618 additional Information to that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]

… [Trackback]

[…] There you will find 94814 more Information on that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/03/05/361-capital-weekly-research-briefing-35/ […]