361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

February 11, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

(Streaking Stars Over The Elk Mountains, Aspen)

“Since the crisis, one by one, the stars came into alignment, and it was only a matter of time before you had a week like we just had,” said James B. Lee Jr., the vice chairman of JPMorgan Chase.

(DealBook/NYTimes)

U.S. companies have spent $219 billion on mergers and acquisitions so far in 2013, a sharp increase from 2012, when firms spent just $85 billion during the same period. And U.S. firms are on pace to have the biggest year in M&A activity since 2000. (Time)

And just as predicted, Corporate M&A went WILD last week, just in time for Valentine’s Day. Just look at the announced and in process sizeable deals this month…

- Berkshire Hathaway/3G Capital + Heinz for $28b

- AMR + USAirways for $11b

- Icahn buys 13% of Herbalife and says he could tender for the whole company

- The DELL LBO for $24b

- Liberty Global + Virgin Media for $16b

- Comcast buying NBCUniversal from GE for $16.7b

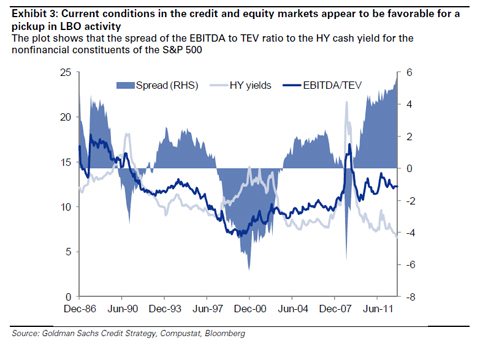

Deals are happening now and will continue to occur because the Cost of DEBT is very cheap to the value of EQUITY being received…

Any believer in efficient markets would have seen the M&A wave predicted in the stock price of Goldman Sachs for the past 3 months…

With all the layoffs on Wall Street the past 5 years, the few firms left will get the transaction fees on the growing book of M&A deals. Expect Goldman Sachs to be front and center for most every deal.

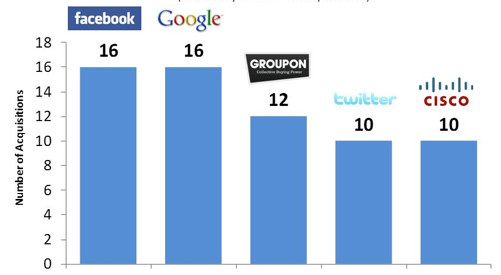

Even in an industry not reliant on cheap debt financing, M&A is happening at a rapidly increasing rate…

2012 was the biggest year for private tech company acquisitions since 2009… in 2012, 2,357 private technology companies were bought for a combined total of $84 billion, which is up 22% from 2011.

So while Corporate Boardrooms are feeling better about the economy and taking on RISK via M&A, Bridgewater’s global research is telling them to BUY more RISK in the financial markets…

Bridgewater Associates LP, the $140 billion hedge fund founded by Ray Dalio, is betting on global stocks and oil as it expects money to move into equities and other assets amid increased economic confidence. Bridgewater, the world’s biggest hedge fund, is bullish on stocks, oil, commodities, and some currencies as it expects cash to shift to riskier assets, co-chief investment officer Bob Prince said on a client conference call on Jan. 23. “You want to be borrowing cash and hold almost anything against it,” Prince said, according to a transcript of the call obtained by Bloomberg News. “We are at a possible inflection point right now with respect to the pricing of economic conditions in markets and then the actual conditions that are likely to occur.”

(Bloomberg)

While many aggressive investors are fleeing Gold…

At one point on Friday, gold futures were down over two percent, briefly dipping below $1,600 for the first time since last August. Quarterly hedge fund disclosures showed big withdrawals from various gold ETFs by George Soros and Louis Bacon, among other, although the filings indicate John Paulson maintained his position in gold. (TTN)

Some large investors are attempting to SHORT the big move in credit spreads…

Some of the world’s most sophisticated credit investors have been ramping up their bets against junk bonds even as retail investors have been pouring money into the asset class. The list of junk-bond bears includes GSO, the credit arm of Blackstone; Apollo Global Management; Centerbridge Partners; Oaktree Capital; and a host of credit and so-called “macro” hedge funds, according to executives familiar with the firms’ investment activities.

(FinancialTimes)

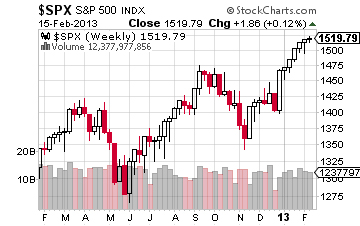

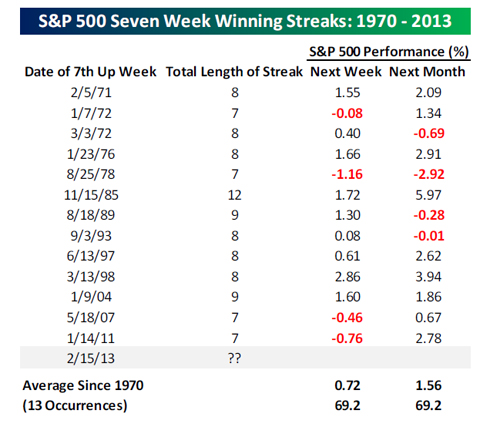

Much of the interest in BUYING RISK is reflected in the equity markets as the S&P500 notched its 7th straight week of gains…

And while the majority of investors want to call a top, history shows that a near term pullback may not be in the cards…

(Bespoke)

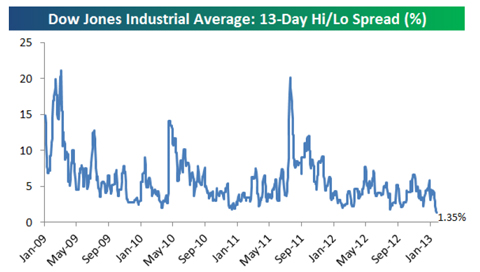

Also important to note, the tight coiling of the market as intraday moves fall to record lows. It has been my experience that this resolves itself to the upside…

Equities have been in bull mode so far in 2013, but it is hard to classify the recent activity as raging. In fact, watching paint dry may be more riveting than the daily moves of the DJIA. Earlier this week, we noted that the difference between the Dow’s intraday high and intraday low over the prior thirteen trading days was just 1.35%. This marks the lowest hi/lo spread for the Dow over a 13-trading day period that we’ve seen throughout this entire bull market (since 3/9/09). In fact, it’s the lowest 13-day hi/lo spread since December 1986! It’s been more than 25 years since the Dow has had a tighter range over a 13-trading day period. (Bespoke)

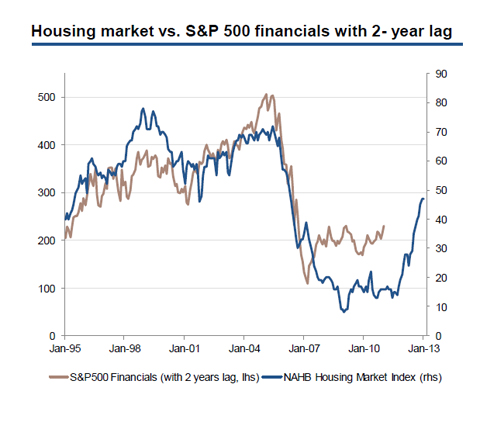

Meanwhile, one of the market’s bedrock groups, the Financials, moves to a 4 year high…

And a great chart here is showing why housing will take the Financials (and Market) higher…

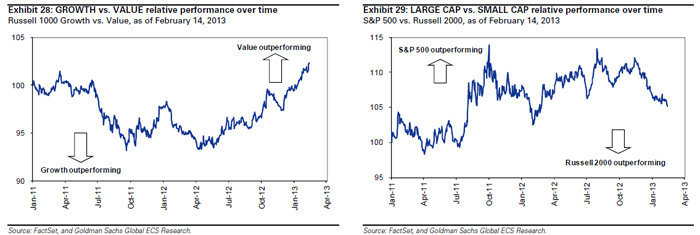

Two other important market internals showing the economy getting better are Value > Growth & Small Cap > Large Cap…

Regarding the economy, Wal-Mart’s internal emails hit the market midday on Friday. Investors will be looking this week for more evidence that consumers are being impacted by the 2013 payroll tax hike…

“In case you haven’t seen a sales report these days, February MTD sales are a total disaster,” Jerry Murray, Wal-Mart’s vice president of finance and logistics, said in a Feb. 12 e-mail to other executives, referring to month-to-date sales. “The worst start to a month I have seen in my ~7 years with the company.”… “Have you ever had one of those weeks where your best-prepared plans weren’t good enough to accomplish everything you set out to do?” [Cameron Geiger, senior vice president of Wal-Mart U.S. Replenishment] asked in a Feb. 1 e-mail to executives. “Well, we just had one of those weeks here at Walmart U.S. Where are all the customers? And where’s their money?”

(Bloomberg)

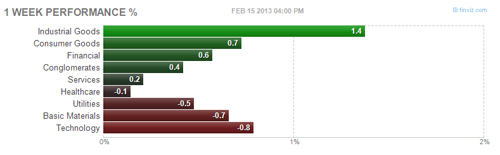

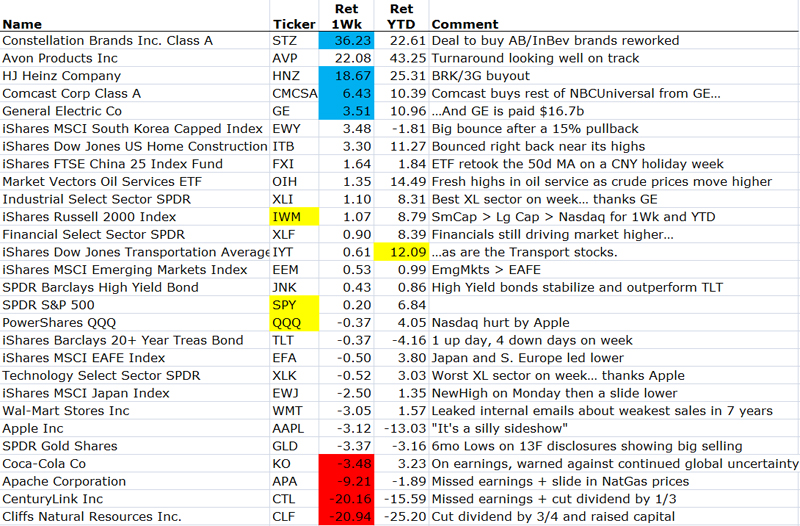

A mixed week for the markets with a bit over half the sectors gaining. M&A excitement was rewarded to both the sellers and buyers which will cause even more interest in deals. Industrials and Financials led while Tech was again held back by Apple and the lack of excitement by the CEO’s presentation at the Goldman Sachs conference. And dismissing Greenlight Capital’s interest as a “silly sideshow” probably did not win many new shareholders.

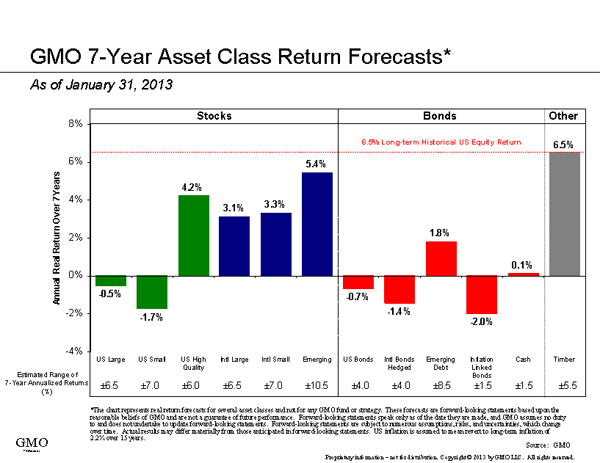

GMO has updated their LT forecasts for the asset classes…

As expected, after 3 months of solid equity returns, they have reduced expectations for all equity classes except for U.S. High Quality stocks. The firm still prefers inflation oriented assets over fixed income.

(GMO)

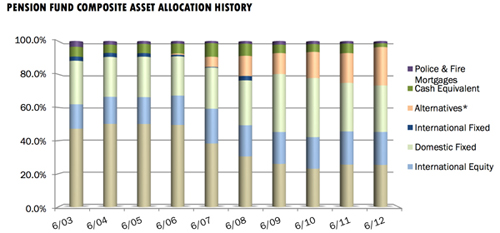

An updated allocation of the $70b NJ State Pension Plan shows a decrease in Fixed Income holdings and an increase in Alternatives which sounds spot on for the current environment…

As a fan of the X PRIZE Foundation, here is my Tweet of the Week…

@badbanana: Let’s spur innovation. Send the next Mars rover up with a $10 billion coin. First person to bring it back can keep it.

Quote of the Week…

“My grandkids always beat me at Rock Band. And I say, Listen, you may beat me at Rock Band, but I made the original records, so shut up.” (Paul McCartney)

(NYTimes)

If you are a geek, you know or own a Nest thermostat. If you are an investor, keep an eye on this company and its impact to everything that it touches…

Nest says that a home with its product will save $173 per year in electricity and heating costs compared to a home with an unprogrammed thermostat, depending on local climate and other factors—allowing it to pay for itself in under two years… Clearly, Nest’s thoughtful engineering could be applied elsewhere in the home, and its founders acknowledge that they plan to build more than just thermostats. “We have one of the best teams in the industry,” says Rogers—meaning Silicon Valley rather than the HVAC business. “They’re here for more than just one product.”

Florida = No State or City Income Tax, No Estate Tax, Lower Cost of Living, Better Weather and only 2.5 hours to NYC…

Edward Lampert is one of the wealthiest people in America. He is the chairman of Sears Holding Corporation and the founder and CEO of ESL Investments, a hedge fund that is estimated to be worth more than $10 billion. Up until last year, he brought most of his wealth to Greenwich, Connecticut. That changed as soon as the state raised its taxes. “When they did that, it forced out one of their wealthiest residents,” said Evan Rapoport, CEO of HedgeCo Networks. “Eddie Lampert was, I think, the fifth wealthiest person in Connecticut. He’s worth about $3 billion.”

(HedgeCo)

Byron was a good friend of Janus’ Founder, Tom Bailey, so I used to get to see him a couple of times a year in Denver or NYC…

My favorite story of his was that he said he had the most expensive kitchen in Manhattan. This was because he sold his Cisco stock in the mid 1990’s to pay for the renovation. Anyway, Happy Birthday to Byron who turned 80 this month. Here is a great list of life lessons learned by him…

(Blackstone)

If the Internet and Twitter would have existed in 1985, New Coke would have never made it to its first grocery store shelf…

“Since we announced our decision last week to reduce the alcohol content (ABV) of Maker’s Mark in response to supply constraints, we have heard many concerns and questions from our ambassadors and brand fans. We’re humbled by your overwhelming response and passion for Maker’s Mark. While we thought we were doing what’s right, this is your brand – and you told us in large numbers to change our decision.

You spoke. We listened. And we’re sincerely sorry we let you down.

So effective immediately, we are reversing our decision to lower the ABV of Maker’s Mark, and resuming production at 45% alcohol by volume (90 proof). Just like we’ve made it since the very beginning.”

(MakersMark)

And I thought geese were a pain…

@SWeissmanESPN: First Black Widow spiders… Now kangaroos in the fairway! The LPGA Australian Open is dangerous.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/02/19/361-capital-weekly-research-briefing-33/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/02/19/361-capital-weekly-research-briefing-33/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2013/02/19/361-capital-weekly-research-briefing-33/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/02/19/361-capital-weekly-research-briefing-33/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/02/19/361-capital-weekly-research-briefing-33/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/02/19/361-capital-weekly-research-briefing-33/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2013/02/19/361-capital-weekly-research-briefing-33/ […]

… [Trackback]

[…] There you will find 52189 additional Information on that Topic: thereformedbroker.com/2013/02/19/361-capital-weekly-research-briefing-33/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/02/19/361-capital-weekly-research-briefing-33/ […]