361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

February 11, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

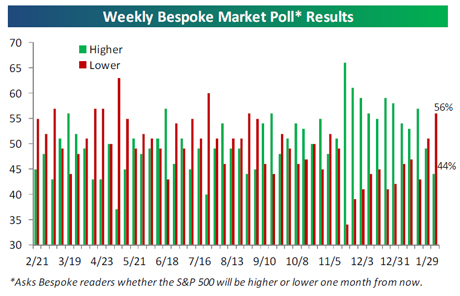

Really, big investors still want to fade this market and expect lower prices?

Seriously, fess up. Who was the Thursday midday seller of $15 billion in notional S&P500 futures? Was it an asset reallocation or a hedge? I am asking for a friend.

Jeff deGraaf does great work and knows how to make money…

Most investors we talk to are waiting for a pullback, including 2/3 of those at lunch this week that thought the next 50 points on the SPX would be down. The weekend papers reflected this also. BUT deGraaf says the risk to February is to the upside. February typically digests January’s gains, but with this January the 15th strongest in the past 107 years, history says that 70% of the time, February has positive gains as well. Also, cyclicals outperforming defensives, small cap over large, value over growth, etc. (RenMac)

Bespoke reader survey found similar results…

(Bespoke)

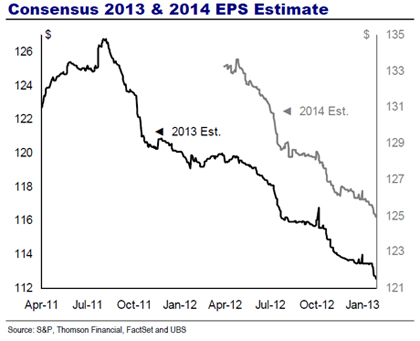

Peak margins and uncertain top line demand remain a worry for stock buyers. But is this already priced into the market?

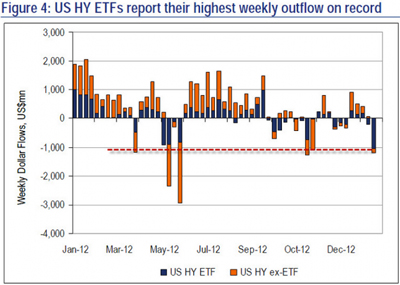

One area of disconnect to Equities, which is visible, is in the pullback in Junk Bonds…

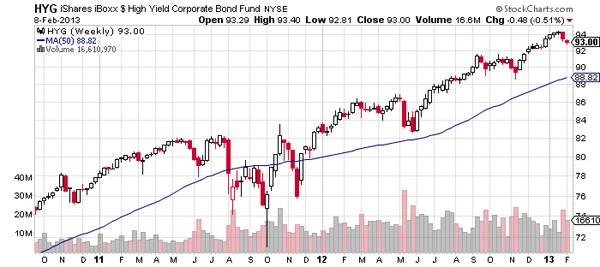

As junk yields have narrowed to historic lows, investors are taking profits from the asset class…

(BofA Merrill Lynch)

It is easy to get anxious when the asset hasn’t seen a decent pullback in 14 months…

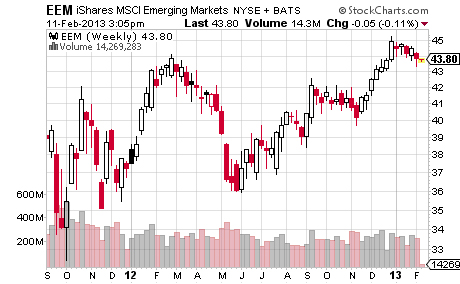

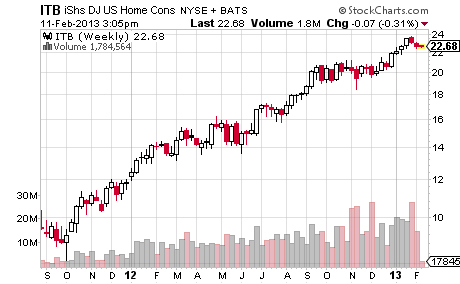

2 other recent weak areas of the market have been in Emerging Market and Housing stocks…

So, is it just a bit of profit taking or the start of some new trends in the market? Away from the few charts, various economic data points remain strong…

- From Microchip Tech’s earnings call…”We are starting to see exceptionally strong bookings and expedite activity” (MCHP is an analog semi and microcontroller company that supplies a very wide range of end markets.)

- The U.S. trade deficit narrowed much more than expected in December, plunging by over $10b to a three-year low of $38.5b. About half of this decline came from the petroleum sector, where the volume of imports fell sharply and the volume of exports jumped. This result could add around 0.8 points to revisions to U.S. Q4 GDP.

- @MandyCNBC: Vehicle sales in China in January rose 46.4% from a year earlier…vs 7.1% rise in December. #crikey

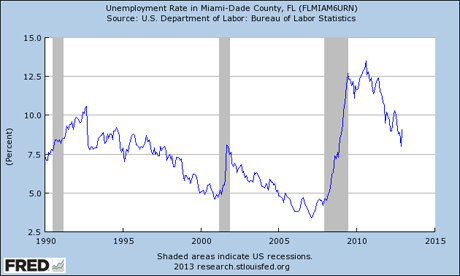

Miami’s economic recovery looks as strong as their University’s record against North Carolina basketball teams…

@TheStalwart: The unemployment rate is dropping very quickly in Miami-Dade

Don’t forget that Florida’s employment was crushed by the downturn in housing. Miami now benefiting from the upturn?

Despite the tax increases, ISI’s homebuilders survey has surged +9.2 over the past five weeks to a very strong 64.4 and up +22.8 over last year and +32.7 over two years. This is a major plus for employment in particular. (ISI Group)

(5 Things You Didn’t Know About Miami Vice)

Even Dubai’s markets show the strong recovery of wealth (rising global GDP => rising energy prices => improved Middle East confidence)…

Dubai’s benchmark stock index rallied to the highest level in more than three years, led by Emaar Properties PJSC on investor optimism. A real estate recovery in the emirate is set to continue this year. Emaar, the developer of the world’s tallest skyscraper which had its price estimate raised at HSBC Holdings Plc, surged 5.7 percent… Dubai stocks gained 16 percent in January, their best start to a year since the exchange started operations in 2000, according to data compiled by Bloomberg and the bourse. The city’s property market is recovering as tourism, hotel, and restaurant industries grew after a 2008 crash sent home prices tumbling more than 65 percent. The economy may have expanded 5 percent in 2012, the fastest pace since 2007, the government forecasts.

(Bloomberg)

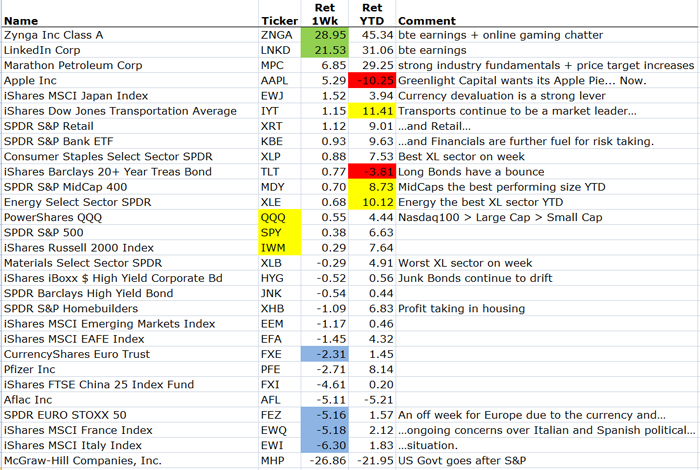

Another up week for the indexes in the U.S. More difficult to find gains overseas due to the currency moves. Apple finally waking up helped the Nasdaq100 to its first winning week against the S&P500 and Russell2000. A bounce in fixed income except for junk bonds.

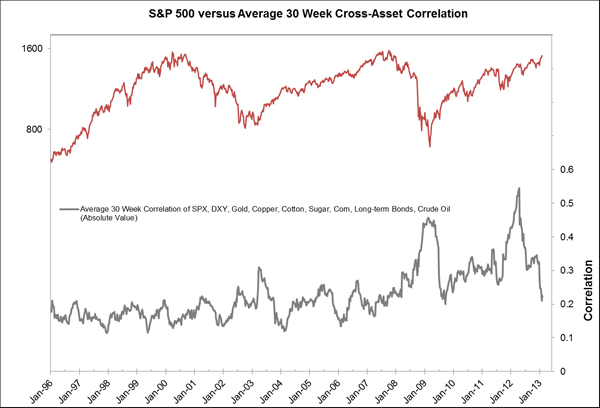

A Global Macro Hedge Fund managers delight…

(RenaissanceMacro)

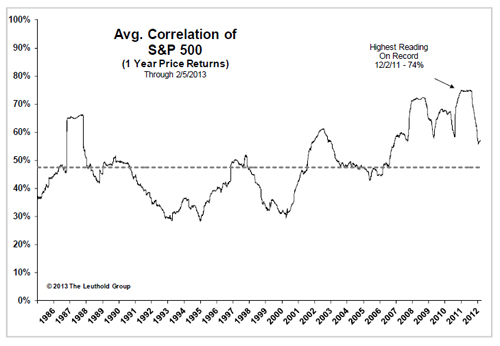

And an Equity Stock pickers delight…

(Leuthold Group)

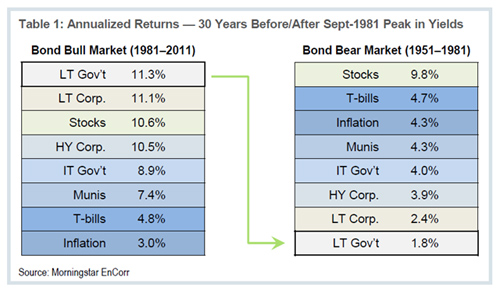

Great chart of the long term returns of the Bond Bull and Bear Markets…

(O’Shaughnessy/The Most Difficult Environment for Generating Income in 140 Years)

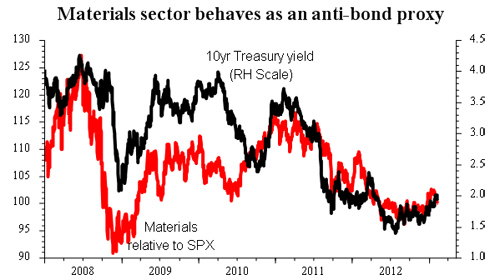

If you are afraid of the previous chart and want to fade the Bond market, consider equities from the XLB…

The Materials sector’s relative performance has a high correlation with U.S. Treasury yields. It is an anti-bond proxy sector and so ought to be over-weighted in a period of rising bond yields. (ISI Group)

Another way to invest in higher rates remains in the bank stocks…

For banks, flat-lining is better than free-falling. Banks have been ground down the past two years by super low interest rates. These have slowly but surely cut into net-interest margins, or what banks make by borrowing money from depositors and then lending or investing it. The problem is banks have little room to maneuver on near-zero deposit costs, while lending and investing rates have continued to fall. The recent rise in government-bond yields could at least stabilize margins. Although it may take time and a far larger increase in rates to foster a significant improvement, this is still better than the relentless pressure seen through 2012… Although rising rates can typically cause losses in longer-dated debt, the big banks appear to have positioned themselves so that the average duration of their securities portfolios tends to be about two to three years in length. As a result, they will likely see gains as rising rates allow them to reinvest maturing securities in higher-yielding ones and lend at higher rates. In its third-quarter securities filing, J.P. Morgan said it could expect a gain of $2.2 billion in pretax net-interest income due to an immediate one-percentage-point increase in all rates.

(WSJ)

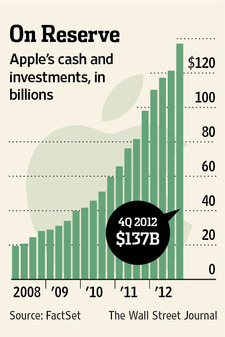

One big Apple shareholder has had enough of the stock price decline and wants Apple to unplug the bottom of the PIGGY bank…

Mr. Einhorn, whose firm Greenlight Capital Inc. and its affiliates own about $610 million worth of Apple stock, argues that Apple should distribute a “perpetual preferred” stock that could pay a dividend yield of 4%. The shares would return cash to shareholders by paying a bigger yield than Apple’s regular shares, which currently carry a 2.3% dividend yield, according to FactSet. The preferred stock dividends would only require Apple to pay out small amounts over time, rather than tapping its cash reserves to spend a large sum at once in the form of a special dividend or stock buyback. “It’s a unique solution to a problem that’s been intractable—how does Apple reward its shareholders?” Mr. Einhorn said in an interview. “This idea allows them to keep their cash and yet enables shareholders to recognize value.”

(WSJ)

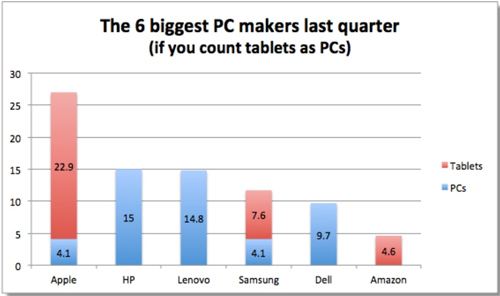

Apple’s CEO, Tim Cook, will deliver the keynote at the Goldman Conference on Tuesday at 4:15pm. Expect him to address the PIGGY bank. This would also be a good chart for him to lead with…

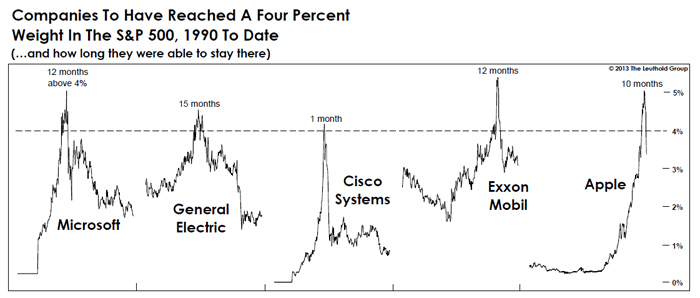

While we are looking at Apple, here is what has happened to the past market MEGA, MEGA caps…

(Leuthold Group)

We used to love buying high quality spinoffs when I was at Janus. Typically the units, which were well known to us as analysts, weren’t well known to the market and were discarded at low prices. Zoetis/ZTS was the recent animal health unit spun out of Pfizer. Expect it to show up in the portfolios of several smart fundamental investors.

The Bloomberg Spin-Off Index, which tracks the stocks of hived-off corporate divisions, is up 41% in the past year, compared with about 12% for the Standard & Poor’s 500 Index. This ripping gain was particularly pronounced, but the outperformance of spun-out stocks was no fluke. In the 10 years through Dec. 31, an actively managed institutional spinoff strategy of asset manager Horizon Kinetics outpaced the market return by more than seven percentage points annually. A Credit Suisse study last year found that over the prior 17 years, spinoffs beat the S&P 500 by some 13 percentage points in the year following their liberation.

Name-brand spinoffs of the past year or so include time-share business Marriott Vacations Worldwide Corp. (VAC) out of Marriott International Inc. (MAR), up more than 140% since it began trading; online travel portal TripAdvisor Inc. (TRIP) from Expedia Corp. (EXPE), up 66%; energy refiner Phillips 66 (PSX) from ConocoPhillips (COP), up 82%; and cereal maker Post Holdings (POST) from Ralcorp Holdings (RAH).

(YahooFinance)

“The math doesn’t add up” Tweet of the Week…

@DLeonhardt: Typical married couple pays $88,000 in Medicare taxes by retirement. Gets $387,000 in benefits.

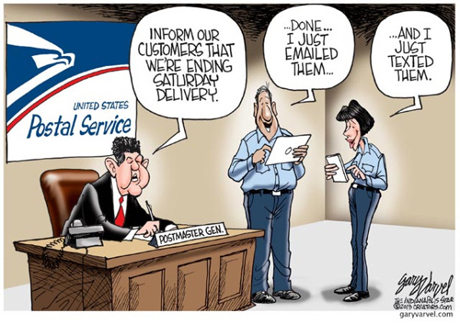

To help pay for rising Health Care costs, the U.S. Government just ended Saturday postal delivery…

(@IndyStar)

The best idea yet for Greece and other financially broken entities…

At this point, Greece’s financial problems are insurmountable, and each solution applies a small Band-Aid to a fatally-wounded patient. Selling assets has proven futile as they would garner just a small fraction of the $400 billion Greece needs. But there is a radical answer, one with roots as old as the means Greeks are using to cope… Selling land between states is an old tradition and not much practiced in the 20th century, but the precedent has been well established for hundreds of years. The United States doubled in size with the Louisiana Purchase in 1803 and Russia sold Alaska to the U.S. in 1867, partly to escape economic difficulties. Russia’s problems in the 1850s pale in comparison to Greece today. The value of Rhodes alone could be more than $50 billion dollars (a generous $10 million an acre). Including compensation to the people living in Rhodes of $200 billion dollars (a generous $2 million a person, plus whatever land/housing they own). Selling just one island could free a generation of Greeks from penury.

(Quartz)

The cost of education just notched lower… Coursera now offering college credit for 5 classes from UC Irvine, Duke, and Penn…

The five courses approved for college credit recommendation include four undergraduate credit courses:

Pre-Calculus from the University of California, Irvine

Introduction to Genetics and Evolution from Duke University

Bioelectricity: A Quantitative Approach from Duke University

Calculus: Single Variable from the University of Pennsylvania

And one course approved for developmental math vocational credit recommendation:

Algebra from the University of California, Irvine

(Coursera)

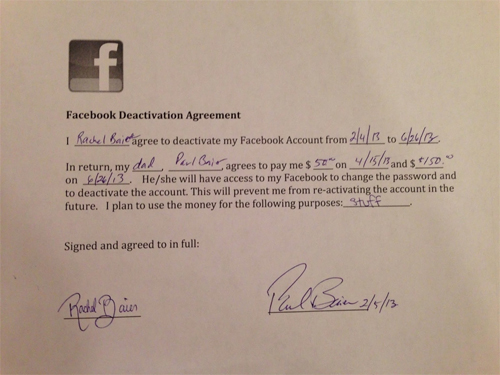

And finally, an interesting proposal for any kid that needs to get focused on school as the school year heads into the final stretch…

Paul Baier, a vice president for Boston energy firm Groom Energy Solutions, drafted up a legal agreement for his 14-year-old daughter Rachel. The contract agrees to award Rachel $200 if she can stay off Facebook for six months. She gets $50 in April and another $150 in June. The funniest part is that it was her idea. She wanted to get a job and focus more on school.

(BuzzFeed)

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/02/12/361-capital-weekly-research-briefing-32/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/02/12/361-capital-weekly-research-briefing-32/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/02/12/361-capital-weekly-research-briefing-32/ […]

… [Trackback]

[…] Here you will find 21807 more Info to that Topic: thereformedbroker.com/2013/02/12/361-capital-weekly-research-briefing-32/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/02/12/361-capital-weekly-research-briefing-32/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/02/12/361-capital-weekly-research-briefing-32/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2013/02/12/361-capital-weekly-research-briefing-32/ […]

… [Trackback]

[…] There you can find 82269 additional Information to that Topic: thereformedbroker.com/2013/02/12/361-capital-weekly-research-briefing-32/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/02/12/361-capital-weekly-research-briefing-32/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2013/02/12/361-capital-weekly-research-briefing-32/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/02/12/361-capital-weekly-research-briefing-32/ […]