361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors

361 Capital Weekly Research Briefing

November 27, 2012

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

“That was awesome! Let’s go again!” (Po, Kung Fu Panda)

I agree with Po. That was 4 days of pure awesomeness as the market bounced from its very oversold condition. The positive week even included TWO 90%+ Up Volume days (Monday & Friday) which is a bit like using Thor’s hammer to set a nail. (Can you tell that the kids had the holiday movies running last week?) While the market move lower was driven and exaggerated by the fiscal cliff worries, the Thanksgiving week bounce was helped by an easing of those same worries. During the holiday week, the talks made little new progress, but it is becoming clear that there will be more capitulation on raising revenues and less on cutting spending. Until the fiscal and monetary cliff deals are done, there could be some more awesome overbought and oversold environments in front of those of us who would like to bank a little extra return before year end.

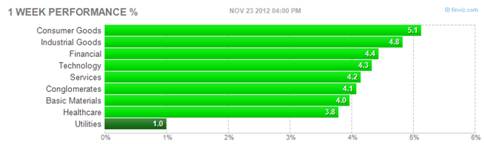

(Bespoke)

Other Market Insights on the Week:

- “The S&P 500 and the NYSE Composite closed above their 200-day moving averages for the fourth session in a row, Winners led losers 5:1” (IBD)

- 30 Dow Stocks: 63.3% of them are above their 200-day moving averages – a sign that the current rally is a broad recovery. (@Ralph_Acampora)

- “Beneath the surface, a few bullish divergences have developed, which if they are able to persist, should bode well for stocks. BBB spreads are stable, the consumer discretionary sector has seen its relative strength accelerate to new highs, small caps continue to improve versus large caps on an equal weighted basis and cyclicals, led by industrials, are slowly working their way higher versus defensives.” (Jeff deGraaf, RenMac)

It was a great week across the market with even the Utility group putting up a gain…

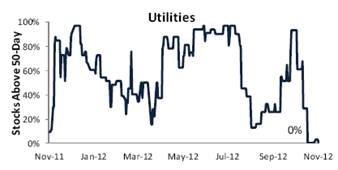

Utility stock charts continued to look like Groupon and Zynga charts last week. When will the selling end?

Contrarians should note that the entire Utility sector is trading below its 50 day moving average…

The Journal even takes note…

The Dow Jones Utility Average has dropped almost 10% since its mid-October high point, roughly double the overall market’s drop. Utilities now offer a dividend yield of 4.2%. At the current 15% tax rate, that implies an after-tax yield of 3.6%. If tax on dividends were to rise too for high-income investors, 43.4%, the after-tax yield would drop to 2.4%. Under that scenario, if dividends didn’t change, the sector’s price would need to drop 34.2% to get back to a 3.6% after-tax yield. In a word: ouch. (WSJ)

Meanwhile, while few are looking or interested, the Nikkei breaks higher…

(RenMac)

The biggest economic event last week was the kickoff to the holiday shopping season which according to the NRF showed a 9% y/y increase in shoppers and a 6% increase in average spend…

According to the survey, a record 247 million shoppers** visited stores and websites over Black Friday weekend, up from 226 million last year. Making sure to take advantage of retailers’ promotions to the full extent, the average holiday shopper spent $423 this weekend, up from $398 last year. Total spending reached an estimated $59.1 billion… The weekend shopping bonanza wasn’t limited to stores; consumers also spent more of their holiday budget online. According to the survey, the average person spent $172.42 online over the weekend, or approximately 40.7 of their total weekend spending, up from 37.8 percent last year. (NRF)

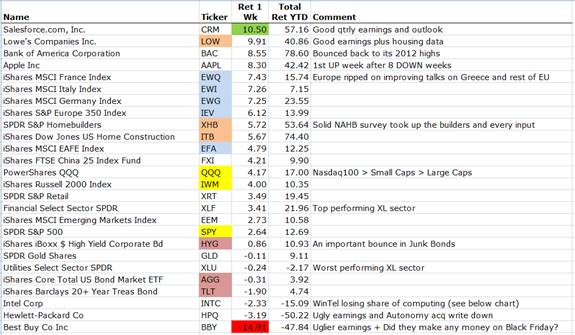

But the market moving economic data came from the NAHB as Home Builder Confidence Rose Five Points in November…

Builder confidence in the market for newly built, single-family homes posted a solid, five-point gain to 46 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for November, released today. This marks the seventh consecutive monthly gain in the confidence gauge and brings it to its highest point since May of 2006. “While our confidence gauge has yet to breach the 50 mark — at which point an equal number of builders view sales conditions as good versus poor — we have certainly made substantial progress since this time last year, when the HMI stood at 19,” observed NAHB Chief Economist David Crowe. “At this point, difficult appraisals and tight lending conditions for builders and buyers remain limiting factors for the burgeoning housing recovery, along with shortages of buildable lots that have begun popping up in certain markets.” (NAHB)

Ed Yardeni (and many others) see the Housing Market driving a ‘Second Recovery’ in the U.S. Economy…

“Our Second Recovery scenario for next year received a lift from November’s Housing Market Index, which was reported yesterday by the National Association of Home Builders (NAHB). It rose to 46 last month, the highest reading since May 2006. It is highly correlated with single-family housing starts. The NAHB’s index of traffic of prospective home buyers was unchanged at a 6½-year high of 35, up 17 points since April.” (BusinessInsider)

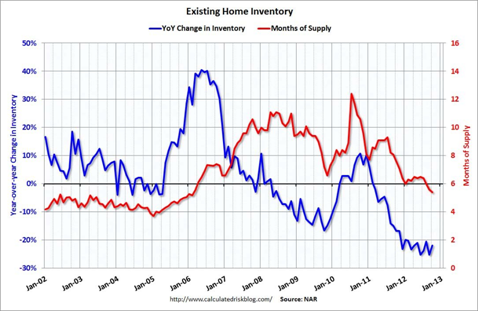

(JPMorgan/National Assoc of Realtors)

Deutsche Bank’s economic team echoes a similar train of thought…

…the homebuilders’ sentiment index is highly predictive of housing starts with a lead on the former of approximately six months. The correlation between the two series is over 90%. Based on history, the current 46 level of the NAHB Index is consistent with annual housing starts of roughly 1.6 million units at an annual rate. This is roughly double the current 0.745 million year- to-date average and still well above September’s 0.872 million rate. Thus, construction activity has significant upside potential even if homebuilder sentiment levels-out, which does not appear likely. If the pace of housing starts increases over the next year by the amount that builders’ sentiment implies, then the contribution from residential construction in the GDP accounts should double, as well. The year-to-date contribution to real GDP has been 30 bps per quarter. This should increase to 60 bps per quarter next year given the scenario highlighted above. Additionally, higher consumption of housing-related services coupled with the indirect effects from home price appreciation (i.e., wealth effects) could easily raise the housing contribution to one full percentage point. In short, housing could provide a meaningful (and critical) lift to overall economic activity at a time when other growth drivers, like exports, are slowing. (BusinessInsider)

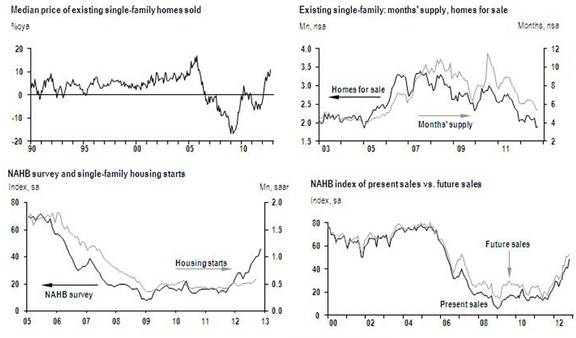

As does Goldman Sachs…

Recent housing market data have been encouraging. Household formation has started to rebound from its post-crisis lows and housing starts have shown notable gains in recent months, surging by 15% in September alone. In light of these encouraging developments, we revisit the homebuilding outlook in today’s comment.

First, we update our model of household formation, which combines projections of the headship rate—defined as the percent of people who are heads of households—with Census population projections. Our analysis suggests that annual household formation will increase from its current 1.0 million rate to 1.2 million in 2013 and 1.3 million in 2014-2016. The improvement in expected household formation is driven by an increasing headship rate among the young, population growth, and the aging population.

Second, we use our household formation projections to forecast housing starts in two steps. We first estimate excess housing supply based on a long-run relationship between the number of houses and the number of households. We then link the estimated excess housing supply to housing starts. Our analysis implies that annual housing starts will increase to 1.0 million by the end of 2013 and 1.5 million by the end of 2016. (BusinessInsider)

ISI Group sees 10 key positives for housing:

- Record-low mortgage rates (helped by Fed MBS purchases)

- Low prices

- Higher rents

- Pent-up demand

- Investment buyers

- Acceleration in household formation

- Employment gains, albeit moderate

- Fence-sitters pushed by rising prices

- Foreign buyers attracted by safe haven and low dollar

- Record-low number of houses for sale normalized for the number of potential buyers

And further proof that the housing market is healthier…

Great news if you are looking to sell a house…

And over in the Commercial Building world… Architecture Billings Index (which leads the economy) posts its highest gain in two years…

“With three straight monthly gains – and the past two being quite strong – it’s beginning to look like demand for design services has turned the corner,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “With 2012 winding down on an upnote, and with the national elections finally behind us, there is a general sense of optimism. However, this is balanced by a tremendous amount of anxiety and uncertainty in the marketplace, which likely means that we’ll have a few more bumps before we enter a full-blown expansion.” (AIA)

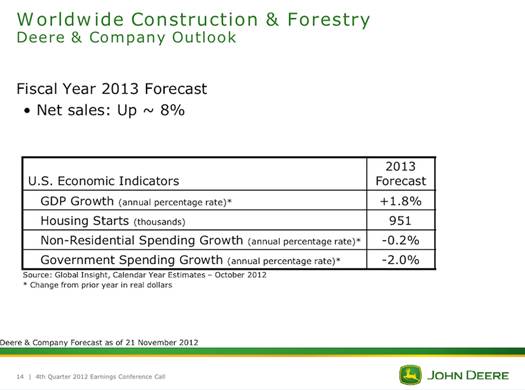

Here are the estimates that John Deere is using to guide its Construction & Forestry Business (which seem conservative given the above data points)…

(Deere)

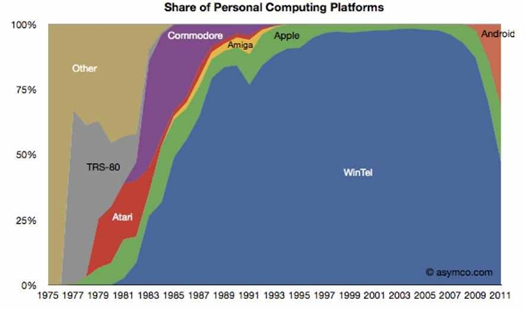

Meanwhile over in the Personal Computing industry…

@levie: Scariest chart in the history of computing (for one company at least):

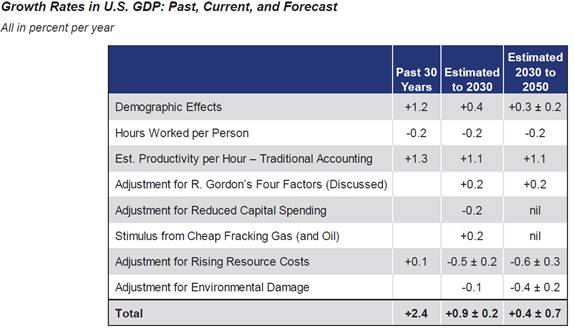

Jeremy Grantham updated his long term GDP outlook last week. If you are a member of Congress, any State Legislature or a Defined Benefit Pension Plan fiduciary, do not read this with any sharp objects or loaded firearms nearby…

“Investors should be wary of a Fed whose policy is premised on the idea that 3% growth for the U.S. is normal. Remember, it is led by a guy who couldn’t see a 1-in-1200-year housing bubble! Keeping rates down until productivity surges above its last 30-year average or until American fertility rates leap upwards could be a very long wait!” (Jeremy Grantham, GMO)

(GMO)

Kenneth Rogoff echoes similar slow growth comments in this weekend’s Barron’s interview…

Again and again, policy makers, Wall Street economists, and world leaders have all been overly optimistic about how fast things are going to go. If you think that we are about to get a V-shaped recovery, then you talk yourself into forbearance. If you think, “My gosh, this is going to last 10 years, but how can we make it last seven years?” you say, “This is really painful, but we’ve got to do it.” But they’ve been very slow coming around to the view that this downturn isn’t ending soon, and they can’t just hold their breath and have it go away. Look at Europe. A lot of policies are directed at keeping European banks afloat, and it is crippling the credit system. You could have said the same about the U.S., where a lot of policies are about recapitalizing the financial system. The policy makers were very, very cautious about breaking eggs. The thinking was, “We just have got to hold out for a year, and it is going to be fine.” (Barrons)

If you know basic arithmetic, then you also know that Illinois’ financial crisis will soon rival Greece’s without a bailout from Washington D.C. To solve the issue, last week it unveiled a new State mascot to encourage others to talk about the problem…

Illinois’ pension system is heading for a meltdown and may now be beyond help. That’s the forecast from a Chicago business group, which told its members last week that the state’s pension crisis “has grown so severe” that it is now “unfixable.” The Commercial Club of Chicago wrote that because the November elections did not bring in lawmakers willing to push real reform, the state’s roughly $200 billion debt now threatens education, health care and basic public services. The problem is worsening so fast that the usual menu of reforms won’t be enough to keep public pensions from sucking taxpayers and whole cities into its yawning maw. If you think Illinois lawmakers aren’t taking the problems seriously enough, just ask Pat Quinn. On Sunday, the Illinois Governor kicked off a “grass-roots” effort to rally the state around pension reform. The Governor hasn’t come up with a plan, but don’t despair: He introduced the state’s new animated mascot, “Squeezy, the Pension Python,” and encouraged voters to talk about the problem over Thanksgiving. (WSJ)

An interesting proposal…”How about Mitt Romney for Treasury Secretary?”

“Romney’s background would make him an almost perfect fit. His private equity chops should help him to identify and eliminate waste from bloated federal budgets. After all, he’s admitted to firing people. And who better to identify the flaws of the tax code than someone who has made a career – and a fortune of hundreds of millions of dollars – exploiting them?” (UBS)

While Hewlett-Packard trades to 10 year lows, it is always good to go back and think about the better times…

HPQ was founded in 1939 by Bill Hewlett and Dave Packard in a 12’x18′ foot garage at 367 Addison Avenue in Palo Alto with $538 of seed capital (from sources such as Lucille Packard’s job as secretary to the Stanford registrar). The company’s first product, an audio oscillator, was built in the garage and one of HP’s first customers was Walt Disney Studios, which purchased 8 oscillators to develop and test a new sound system for the movie Fantasia. The garage, often considered the “Birthplace of Silicon Valley,” was granted California State Landmark status in 1987. (Brian Marshall, ISI Group)

A couple of good quotes on character…

“Ability may get you to the top, but it takes character to keep you there” (John Wooden)

“Nearly all men can stand adversity, but if you want to test a man’s character, give him power” (Abraham Lincoln)

If you are a fan of ‘Outliers’…

@asymmetricinfo: Outline for a thriller: violinist forced to practice 10,000 hours by his Mom comes looking for Malcolm Gladwell –and not to play a sonata.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Here you can find 27343 additional Information on that Topic: thereformedbroker.com/2012/11/27/361-capital-weekly-research-briefing-23/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/11/27/361-capital-weekly-research-briefing-23/ […]

… [Trackback]

[…] Here you can find 79314 additional Info on that Topic: thereformedbroker.com/2012/11/27/361-capital-weekly-research-briefing-23/ […]

… [Trackback]

[…] Here you can find 68675 more Info to that Topic: thereformedbroker.com/2012/11/27/361-capital-weekly-research-briefing-23/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/11/27/361-capital-weekly-research-briefing-23/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/11/27/361-capital-weekly-research-briefing-23/ […]

… [Trackback]

[…] Here you can find 80841 additional Information on that Topic: thereformedbroker.com/2012/11/27/361-capital-weekly-research-briefing-23/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/11/27/361-capital-weekly-research-briefing-23/ […]

… [Trackback]

[…] Here you will find 96582 additional Info on that Topic: thereformedbroker.com/2012/11/27/361-capital-weekly-research-briefing-23/ […]