361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors

361 Capital Weekly Research Briefing

September 24, 2012

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

That rectangle box = iPhone5 = 1/4 of China’s Q3/2012 GDP growth rate…

(Picture of a FedEx major artery on Thursday night)

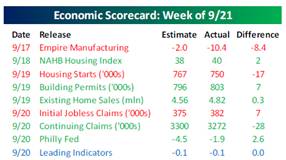

After 2 weeks of very big Central Bank movement and market reaction, last week returned to looking at the economic data points. And the reported data continues to throw us good and bad pitches. Housing remains one of the brighter lights in the U.S. economy…

(Bespoke)

Even the U.S. commercial real estate building data points are improving…

The American Institute of Architects reported that the August Architecture Billings Index increased to 50.2 for August from 48.7 in July, climbing into positive territory for the first time in five months.

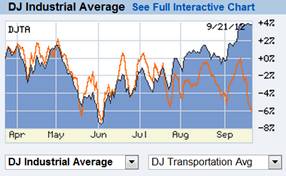

But something is lurking among the transportation companies:

First FedEx…

- “We see the [U.S.] economy not improving from here,” FedEx Chief Financial Officer Alan Graf said Tuesday. He noted that its outlook for growth in U.S. gross domestic product next year has been given “a significant haircut” — to 1.9%, from an anticipated 2.4% just three months ago. Its forecast for global GDP growth next year was cut to 2.7% from 3% previously.

And then Norfolk Southern…

- Norfolk Southern Corporation announced that third quarter 2012 earnings are expected to be in the range of $1.18 to $1.25 per diluted share, primarily due to volume declines in certain markets and lower revenues from fuel surcharges.

Dow Industrials outperforming the Dow Transports by 1000bp in the last 3 months. Dow Theory anyone?

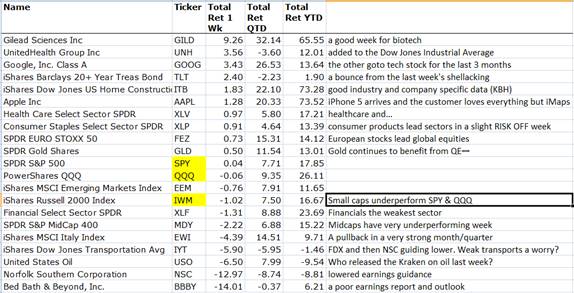

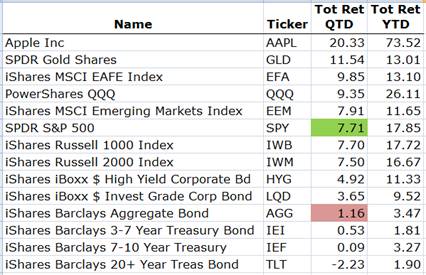

After 2 big up weeks for equities, stocks took a breather last week while bonds caught a relief rally. Defensive sectors performed better (healthcare and consumer products) while small caps and financials gave back a portion of their big September gains.

With this being the last week of the Q3, expect both window dressing and tactical portfolio reallocations. With the S&P 500 leading the AGG Bond Index by 650bps in the Q3, expect large plans to sell equities for reallocation into bonds.

Who doesn’t like a floating up market with no big declining days? History suggests the future will be even more profitable for your long positions…

(Bespoke)

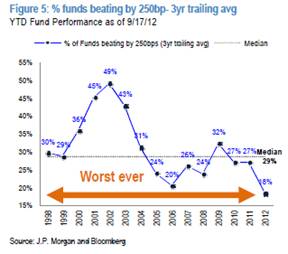

Unfortunately, most Portfolio Managers have not enjoyed this recent, upward glide in the indexes…

S&P 500 has surged 11% since June and the Index has now advanced 18% YTD as of September 20th. However, most investors lag the benchmark. The average large-cap core mutual fund has returned 16.3% since the start of the year and 29% of these funds have outperformed the Index. The rising equity market has presented an even greater challenge for hedge funds, which by their very nature have some short exposure. The typical levered investor has returned 6.7% YTD through September 14 and only 8% of hedge funds have outperformed the S&P 500 on a year-to-date basis.

(Goldman Sachs)

In fact, 2012 is looking to become a disastrous year for mutual fund managers…

Adding to the mutual fund industries worries is the increasing arrival of hedge fund managers to their long only turf…

Profit-starved hedge fund managers, best known as masters of the financial universe, are turning to an unlikely place for their next windfall: the unglamorous world of long-only asset management. Amid volatile markets, constraints on the capacity of their main trading strategies and an ever more conservative investor base, some of the industry’s biggest names are focusing on raising money for pared-back versions of their main portfolios, eschewing leverage and short selling in pursuit of assets and stability. Hedge fund managers see big opportunities in bringing their skills – and the higher fees they charge – to an increasingly passive long-only investment world. “There is a trend now to grow [long-only funds run by hedge funds] quite aggressively, the main attractions are that you diversify your fee base and expand your investor universe,” said Daniel Caplan, European head of global prime finance at Deutsche Bank. “In addition, you may not face the same capacity constraints that you do with a hedge fund product.” (FT)

And fun and games over in the world of Bonds as Bill Gross kicks sand on Vanguard and iShares…

Speaking at IndexUniverse’s inaugural Inside Fixed Income conference in California this week, Mr. Gross told financial advisers to switch their clients into his actively managed ETF, known as BOND. Mr. Gross said “If you have clients in [Vanguard’s] BND or [iShares] AGG, get them over [to BOND]”… Both BND and AGG have large holdings of U.S. Treasury bonds which Mr. Gross pointedly criticized. “Their universe is basically a 40 percent Treasuries universe yielding 90 basis points. You can’t produce a return out of that type of yield. I say, ‘Are these people crazy?’ Where is this $30bn and why isn’t it immediately being transferred into BOND?” Pimco’s BOND ETF carries a total expense ratio of 55bp so it is more expensive than iShares’ AGG (20bp) and Vanguard’s BND (10bp). But Mr. Gross dismissed the gap in expenses, telling the audience: “I don’t care about the fees. Just bring them over because you’ll be helping them out. I can’t guarantee it … but I think it’s a pretty good bet.” (FT)

Meanwhile, within his portfolio, Bill Gross is placing stacks of chips on Munis…

@PIMCO: Gross: 10-year AA munis sell at 115% of UST. If/when tax rates go up, munis become more valuable still. The PIMCO Total Return Fund (mutual fund) has slowly been increasing its holdings in municipal bonds. Municipal bonds currently make up 5% of the PIMCO Total Return Fund’s assets. However, the ETF version of the mutual fund, which is both smaller and nimbler than its parent, has 9% of its assets in municipal bonds. (LearnBonds)

On another beach, Schwab kicks sand on Vanguard and Blackrock…

Charles Schwab (SCHW) president and chief executive Walt Bettinger touted his company’s commitment to low-cost investing the morning after the company cut ETF fees across its line of 15 products, and pledged that the company is “not going to stop here.” The cuts included lowering two broad equity ETFs to an industry-low cost of four basis points, or 0.04%. The cuts, which were effective as of Thursday, shrink the cost of Schwab’s products to the lowest in their Lipper categories, company executives said on a Friday morning conference call… Until this week, the lowest-cost product in the ETF industry had been the Vanguard S&P 500 ETF (VOO), at five basis points a year, or 0.05%. The low-cost crown now goes to the Schwab U.S. Broad Market ETF (SCHB) and the Schwab U.S. Large-Cap ETF (SCHX). Each were cut to 0.04% from 0.06%. (Barrons)

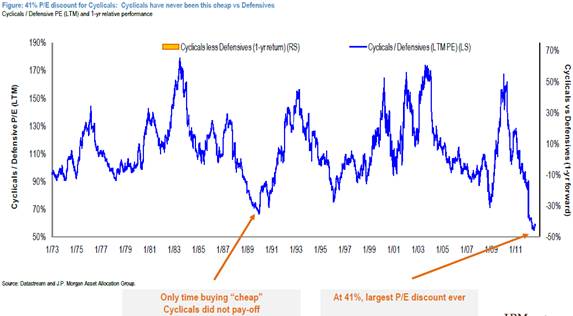

Returning to where to make money in Equities, JPMorgan says “Cyclicals”…

And UBS is raising their target on the S&P500…

Raising 2012 year-end price target to 1,525. Over the past two months, the Fed and ECB’s promises of “forever” and “unlimited” have surprised even the market’s most optimistic participants. Based on stock performance following other major central bank announcements, we believe the S&P 500 will drift higher over the near term. As such, we’re raising our year-end price target from 1,375 to 1,525. Over the short run, we believe that the “risk on” trade will continue, with a rotation into the most volatile and economically sensitive stocks. At the industry group level, we believe that early-cycle cyclicals, such as Energy, Materials, Autos, Homebuilders, and Diversified Financials will continue to outperform. (UBS)

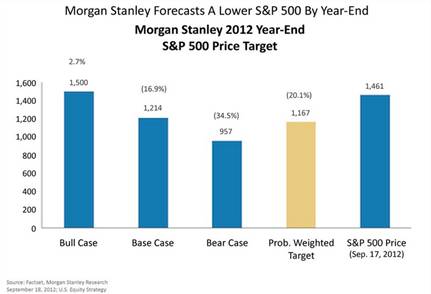

Morgan Stanley however is digging in their heels for a pullback…

“We’ve been told that laughter is best medicine. We were also told that Facebook was a bargain at $38 a share. One is true.” (Michael J. Fox at the Grammys)

Even with the sharp drop in its share price, Facebook remains a richly valued bet on the company’s ability to wring a lot of revenue from a huge and potentially fickle user base. Facebook’s mobile woes aren’t likely to go away. Stay away from the stock. It could be heading to the mid-teens. (Barrons)

800 pound gorilla sighted in S.W. Florida with a $1 billion checkbook…

Blackstone, one of the nation’s largest private-equity firms, plans to buy as many as 15,000 homes in Tampa Bay over the next three years, many of them foreclosures, capitalizing on decimated home prices and growing rents. The shopping spree, and those of half a dozen other big investment firms and hedge funds, could radically change the local home landscape, as big-money brokers compete with first-time buyers and mom-and-pop landlords over homes in tight supply. “It’s a land grab unlike anything we’ve ever seen,” said Peter Murphy, CEO of Home Encounter, the largest manager of rental homes in Tampa Bay. “You’re going to drive through parts of town and all of it is going to be institutionally owned.” But it’s also a big gamble on a shift in the American psyche, away from home ownership and toward home renting: cheaper, easier and with less risk of financial ruin.(TampaBayTimes)

Great move for the THEIR economy = Sweden cutting its Corporate Income Tax to 22% from 26.3%…

…Mr. Reinfeldt called the corporate income tax “probably the most harmful tax of all” because it hits job creation and business investment. Corporate income taxes almost invariably lead to double taxation, as the profits taxed at the corporate level tend to be taxed again when they are distributed as dividends or realized as capital gains on business ownership. (WSJ)

Elsewhere overseas, U.S. athletes might have a difficult time winning gold in 2016…

Guido Mantega, Brazil’s finance minister, has sharply criticized the U.S. Federal Reserve’s decision to roll out more quantitative easing as protectionist, saying it would have little positive economic effect for the U.S. but potentially drastic consequences for the rest of the world, including reigniting the “currency wars”. “It has to be understood that there are consequences,” Mr. Mantega told the Financial Times in an interview on Thursday. The Fed’s QE3 program would “only have a marginal benefit [in the U.S.] as there is already no lack of liquidity . . . and that liquidity is not going into production”. Instead, it was depressing the dollar and aimed at boosting U.S. exports, he said. (FT)

Tweets of the week:

- @ParHedge: My favorite paired trade: Long insanity and short common sense

- @ShawnaOhm: Chicago symphony orchestra musicians on strike. I’m starting to think it’s something in the water.

- @darrenrovell: If Vince Young is broke, he has spent $7,000 A DAY (after taxes) from the day he signed w/the Titans in ’06 thru today.

If you are a student of continual improvement, here is a movie for you…

Once you decide on your occupation… you must immerse yourself in your work. You have to fall in love with your work. Never complain about your job. You must dedicate your life to mastering your skill. That’s the secret of success… and is the key to being regarded honorably. (Jiro Ono) (Amazon – Jiro Dreams of Sushi)

Now combine hard work with being in the right place at the right time…

Harvard University’s graduates are earning less than those from the South Dakota School of Mines & Technology after a decade-long commodity bull market created shortages of workers as well as minerals. Those leaving the college of 2,300 students this year got paid a median salary of $56,700… At Harvard, where tuition fees are almost four times higher, they got $54,100. Those scheduled to leave the campus in Rapid City, South Dakota, in May are already getting offers, at a time when about one in 10 recent U.S. college graduates is out of work. “It doesn’t seem to be too hard to get a job in mining,” said Jaymie Trask, a 22-year-old chemical-engineering major who was offered a post paying more than $60,000 a year at Freeport- McMoRan (FCX) Copper & Gold Inc. “If you work hard in school for four or five years, you’re pretty much set.” (Bloomberg)

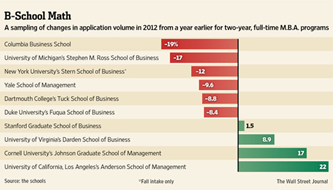

MBA programs look to be the wrong place to be as application counts are showing a 22%

decline for 2012…

(WSJ)

But Chinese students are excited to get an MBA as they are now 1/5 of all GMAT test takers…

(WSJ)

Many thanks to NASA for inspiring 35 years of kids to finish their math and science homework…

(500PX)

Finally, from a reader traveling in China last week: Photographic evidence of a knocked off 361 Capital mutual fund retail center. We have no affiliation whatsoever with the salesman in the black tank top on the right.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2012/09/25/361-capital-weekly-research-briefing-15/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/09/25/361-capital-weekly-research-briefing-15/ […]

… [Trackback]

[…] There you will find 91079 more Info to that Topic: thereformedbroker.com/2012/09/25/361-capital-weekly-research-briefing-15/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/09/25/361-capital-weekly-research-briefing-15/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/09/25/361-capital-weekly-research-briefing-15/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2012/09/25/361-capital-weekly-research-briefing-15/ […]

… [Trackback]

[…] Here you will find 5051 additional Info on that Topic: thereformedbroker.com/2012/09/25/361-capital-weekly-research-briefing-15/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2012/09/25/361-capital-weekly-research-briefing-15/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2012/09/25/361-capital-weekly-research-briefing-15/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2012/09/25/361-capital-weekly-research-briefing-15/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/09/25/361-capital-weekly-research-briefing-15/ […]