You have “Disruptrepreneur” in your profile?

Bro you got disrupted by two interest rate hikes. Maybe relax.

2021 was a high point for “disruptor” culture. If you were there and managed to get something out of it, that’s great. Most of us did. Hopefully, you were a seller and not a buyer. Hopefully, whatever you took out, you’re currently in the process of protecting now that reality has begun to assert itself once again. Whatever we just went through, it won’t be repeated for quite awhile.

Money was literally free. Actually, it was cheaper than free. If you understand the SPAC structure, then you know that, in reality, sponsors were actually being paid to buy companies – that’s called “the promote”. You would announce a SPAC, take it public (other people’s money) and then get up to a 20% stake in whatever company you acquired, handed to you, just for using your name to raise the capital and bullshitting your way through a “due diligence” process. And it was truly glorious. Only in 2021 could thousands of people convince millions of strangers to buy into this idea – give me cash, no questions asked, and I will do something brilliant with it. Wall Street’s underwriting and listing machine made you think you were special. They got paid to make you feel that way. “You really should have a SPAC – with your pedigree and connections? It’s a slam dunk, you’re the man!”

A thousand SPACs. Billions of dollars. Most of it now up in smoke. There’s almost nothing left in the wreckage. The highest profile SPACs are now featured daily on the 52 week low list. The average SPAC is now, de facto, a full-blown penny stock.

The Clubhouse chatrooms are an abandoned shopping mall, tumbleweeds rolling through the parking lot.

The TikTok-ers who helped to sell all this “trader lifestyle” nonsense are pivoting to macro calls and inflation memes.

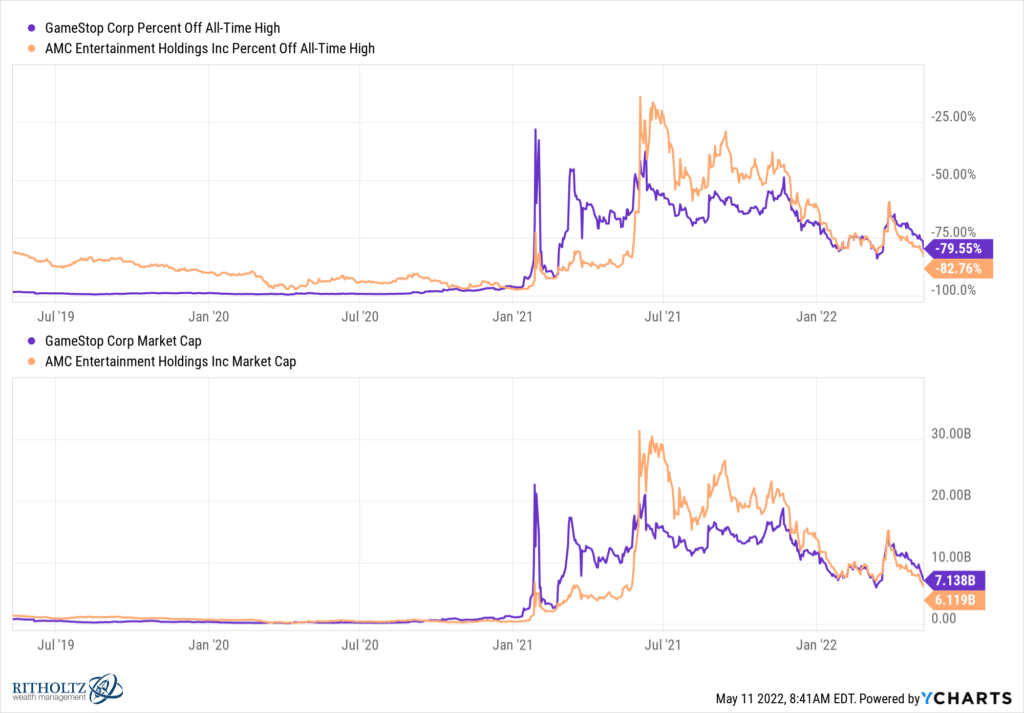

GameStop and AMC are reverting back down to the market caps their fundamentals have earned.

The heroes of the bubble aren’t tweeting as much these days. They’ve learned, the hard way, that the crowd isn’t their friend. The public is only with you when you’re winning. When you start losing, they don’t walk away and lose interest. They stick around and throw tomatoes. Adoration turns to hate, not apathy, on the way down. The love and adoration was rented. Then the meter ran out.

The media is agnostic. Whether you are rising or falling, you have value to their enterprise. They’re not sentimental. It’s dollars and cents. They don’t care if you’re on the way up or on the way down – so long as your name in a headline gets clicks and shares. You are an engagement booster and engagement is oil. They can get you to be loved and then get you to become hated once they’ve introduced you to the public. They get paid for writing about you and referencing you now that you’re “a name”. They will be your best friend until the public sentiment turns, and then they will dutifully escort you to the gallows. It’s not emotional for the press, it’s just how it works. They’re already grooming the next “name” – it’s an assembly line and the line don’t stop for anyone or anything. Today’s media didn’t invent this, they’re just carrying on a very old tradition. It’s been this way since papyrus.

Stick around, though. Hang in there. You may even get a subsequent love-hate cycle sometime down the road if you can stay out of the public eye long enough for people to forget why they know you but still recall your name and face. “Oh I remember that guy…”

This is a good time for self-reflection. Maybe you weren’t a business genius all this time. Maybe you just stumbled into a moment where capital was free and flowing like wine at a wedding. Maybe you just were fortunate enough to have had the right roommate at Stanford or met some of the right people during Y Combinator orientation week and were clever enough to have bunny-hopped aboard their IPO. It’s cool. Lots of success stories start this way – right time, right place, right connections. Maybe just try to be more aware of that before tweeting out your next thought leadership thread. A little humbling is good for everyone (you can take my word on this). It’s an opportunity to learn from. Makes you a better version of yourself.

People who have been up and down on this ride tend to be more likable when you meet them later in life. There’s nothing likable about a 28 year old know-it-all who’s never encountered a setback in his life.

Be likable. Learn from the current environment. Don’t curse your bad luck or wonder why this is happening to you. Be grateful for the Ups you’ve experienced and thankful for the lessons you’re about to receive during the Downs. The clarity of who your real friends are and what your true value is in this world. You’re being liberated from a giant, cosmic lie. The smoke is clearing. Your eyes are open.

Disruptor, welcome to your own personal disruption. Use it.

***

We talked about Gen Z’s first stock market crash on WAYT last night. You can watch it here:

[…] Source link […]

[…] Source link […]

[…] Sometimes we include links to online retail stores. If you click on one and make a purchase we may receive a small commission. Source link […]

[…] Source link […]

[…] Source link […]

[…] Source link […]

[…] Source […]

[…] (Joshua Brown) Chart of the Day […]

[…] in your profile? Bro, you bought disrupted by two rate of interest hikes. Perhaps loosen up. (Reformed Dealer) see additionally When Individuals Cease Believing In Unicorns, Worry and Loathing Return to Tech […]

[…] in your profile? Bro, you bought disrupted by two rate of interest hikes. Possibly calm down. (Reformed Dealer) see additionally When Individuals Cease Believing In Unicorns, Worry and Loathing Return to Tech […]

[…] in your profile? Bro, you bought disrupted by two rate of interest hikes. Perhaps chill out. (Reformed Dealer) see additionally When Folks Cease Believing In Unicorns, Worry and Loathing Return to Tech […]

[…] in your profile? Bro, you bought disrupted by two rate of interest hikes. Possibly calm down. (Reformed Broker) see additionally When Individuals Cease Believing In Unicorns, Worry and Loathing Return to Tech […]