It’s Martin Luther King Day and I want to talk about the thing that I think is at the root of racial injustice – economic inequality. Why do some neighborhoods get policed differently than others? Money, power, respect. Some communities have these things in large supply, others don’t. We already know that economic opportunity is the answer. King himself explained this over and over again. We’re making progress on this front, but not enough and not swiftly enough.

During the Black Lives Matter marches that came through my town last summer, my daughter asked me a question: “Why is it even like this?” By which she means is all this inequality deliberate or being caused by something we can fix? Unfortunately, the roots run deep. Investors are familiar with compounding and the extraordinary effect this can have on returns: Gains multiplied by time. Gains on top of gains. It’s miraculous. Look at the stock market.

Well, the reverse can also be true. Negative compounding. If you’re born into a world that tells you you’re a second class citizen and restricts you from owning property, attaining education, getting high paying jobs, exercising your rights to vote – what will be the impact on your children? What about on their children? And their children’s children? Disadvantage – especially when it’s community-wide and endemic within society, enforced and reinforced at all levels and across every playing field – can compound too. And the effects of compounded disadvantage, given enough time, can become an inescapable tragedy. Unemployment, crime, broken families, drug abuse, alcoholism, depression, suicide, violence, infant mortality. Kids born into this reality only know what they see all around them. This has nothing to do with race. White communities in Appalachian coal country and various areas around the rust belt have been experiencing this phenomenon for decades.

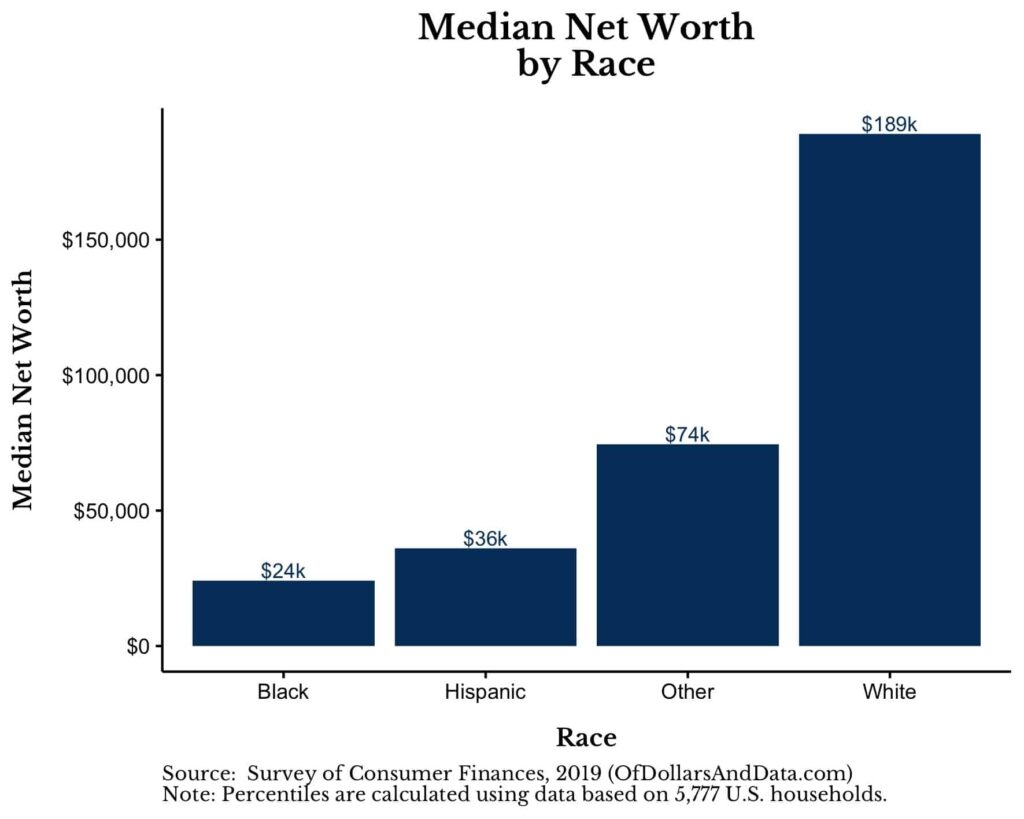

Here’s my colleague Nick Maggiulli on the gap between white families and everyone else:

It might be hard to believe, but the typical White household has eight times as much wealth ($189,000) as the typical Black household ($24,000) in the U.S.

For African Americans, the government policy decisions made toward the end of World War II – starting with the GI Bill – were basically an economic inequality super-spreader event. No piece of legislation in the last hundred years has been more disastrous or intentionally destructive of a specific community. You have to learn about it to even believe that something like could have happened. When over 1.2 million black veterans returned home from service, they weren’t expecting any special treatment. Regular treatment would have sufficed. Congress decided instead to largely exclude them from being able to attend college, buy a home, obtain a mortgage or do any of the things that would eventually pay massive dividends to the descendants of their white counterparts over the ensuing seven decades. The sum total of misery and unfairness that these policies ended up causing across the generations is so great that an actual dollar figure could neither be tabulated nor do it justice anyway.

Fostering the building of America’s middle class while deliberately leaving black Americans out of it is at the heart of so many of the problems we still face today. And if you don’t understand the cause of the problem, you’re not going to be helpful as we work to solve it.

Below is the audio of my podcast from last February where I examine these policy errors of the middle of the 20th Century in my attempt to answer my kids about why things are how they are. I hope you will learn something from it and pass it on to your friends and family who may still be uninformed on this topic.