“Unprecedented.” I keep hearing that word.

The great 20th century fictional philosopher Inigo Montoya once remarked “You keep using that word. I do not think it means what you think it means.”

In 1918, one of the worst global pandemics in human history swept the globe and killed a great many people. The free world was at war with the Germans and prices exploded during the fighting and its aftermath.

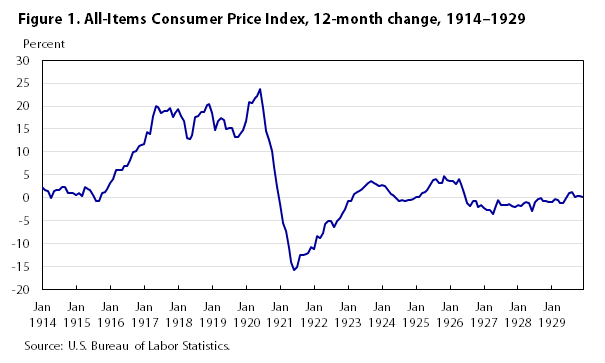

Bureau of Labor Statistics:

The World War I era and its aftermath, 1917–1920, then produced sustained inflation unmatched in the nation anytime since. Prices rose at an 18.5-percent annualized rate from December 1916 to June 1920, increasing more than 80 percent during that period.

Even a cursory examination of CPI component indexes of the World War I era reveals the breadth of price increases during that period: virtually every series shows sharp increases. Even the series that increased more slowly, such as housing and fuel, were half again more expensive in 1920 than they were in 1915. The prices of most foods, clothing, and dry goods more than doubled.

Your great great grandparents weren’t reading articles about the CPI every day because the CPI didn’t even exist until the early 20’s. And if it was published anywhere, it was for government officials and economists, not Fox News hosts.

And then, in 1920-1921, there was an 18 month recession that popped the bubble in rising prices and restored inflation to a more moderate pace. This moderation would set the table for one of the most important decades of innovation and economic progress ever.

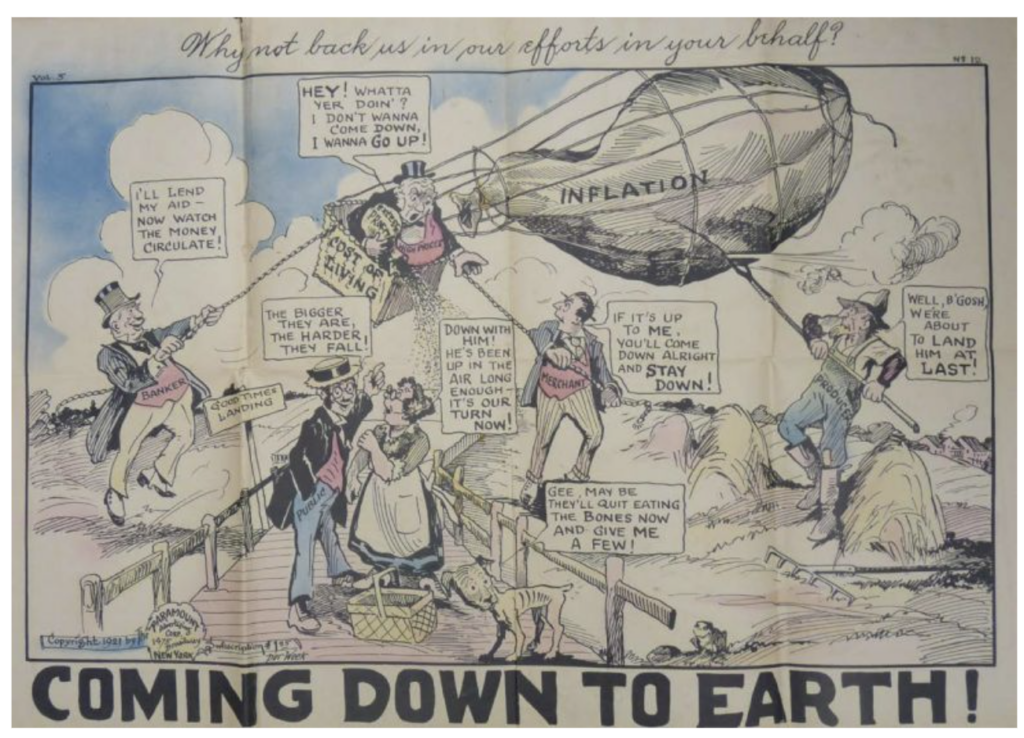

And lo, the people rejoiced as prices came down and the post-pandemic, post-war economy normalized. The below cartoon ran in a magazine during the fall of 1921, one hundred years ago today:

(cartoon via The Museum of American Finance)

A century goes by. Some stuff happens…

In 2020, one of the worst global pandemics in human history swept the globe and killed a great many people. The free world was at war with the virus and prices exploded during the fighting and its aftermath. Inflationary pressures arose as a result of inventory drawdowns, shuttered manufacturing and the shockwaves within the labor force from a year-long shutdown.

And then the war had stabilized the virus, as scientists and drug developers and policy makers gradually got the upper hand. Offices and stores and factories reopened and the people left their houses again in search of human connection, gainful employment, leisure and fun. Auto manufacturing and semiconductor shipments and oil drilling resumed and then prices in the economy started to (add your own ending to this sentence here…)