I collect shares of businesses. Been doing it since my late teens. Not always successfully. I use a certain type of non fungible token called a stock certificate for this. I never lay hands on the certificate, it’s in digital form, living somewhere in the multiverse. A company called DTC makes sure the shares I’ve bought are the shares I get. And then I hold them. Sometimes I will trade them for digital dollars that I also don’t ever see or touch, but then soon after I am trading those dollars for another pile of virtual stock certificates. People will say “You’re crazy, why would you want to buy a fraction of a company you will never touch and hold in your hands?” And I’m like “You just don’t understand.”

My portfolio of virtual business ownership tokens also entitles me to actual business ownership in the not-online world. Like, for example, I own shares of a real estate investment trust, which is a type of NFT that owns land and property and is required to pay out 90% of the rental income all that land and property generates. They pay it out to me and the other people who have fractional ownership in the trust. And not only is it cool that I have the shares in the virtual realm, but it’s also kind of cool that I can go see the actual buildings we own in towns and cities all over America. If I want to, I can touch them. I can know that they are there, standing, operating, taking in cash and paying it out. The best part is that I don’t have to worry about whether or not this token will still be cool enough for someone else to want to buy it from me. I get the cashflows and distributions from it so long as I maintain my ownership of it.

I bought some layer one protocols a long, long time ago that have appreciated substantially in value. These include tradeable, online-viewable certificates denoting my ownership in the projects known as Apple, Amazon, Alphabet, Berkshire Hathaway, JPMorgan and Nvidia. These are protocols that began as corporations but eventually became platforms – the base layer upon which millions of other businesses have been built. From one day to the next, they go in and out of favor and can sometimes lose their cool factor for years on end. But they produce cashflows and I own certificates that entitle me to a piece of those cashflows, forever, for as long as these certificates continue to trade on the digital exchanges in which they are listed. Unfortunately, they don’t have cool kitty cat avatars or blurry jpegs of zombies associated with them. That’s okay, it’s my own private collection and I’m not displaying it on Twitter for strangers to like it anyway. It’s very hard to convince me to part with one of these base layer protocol ownership certificates given how important they are to the ecosystem everyone else is building upon.

Now, you might be saying to yourself “Why would this idiot be wasting his money collecting ownership in digital stock certificates and the cashflows of businesses when he could be buying up the drawings of Ukrainian college students?” I acknowledge, there really aren’t any great answers for this. Perhaps I will catch on at some point, but I’m old school. Maybe I just have bad taste in collectibles.

Some people like to collect baseball cards and others prefer comic books. There are collectors of stamps, rare automobiles, rock n’ roll memorabilia, antique furniture, old books, vintage jewelry, autographed jerseys and even pretty rocks pulled out of the ground and polished to a high shine. Lately, there are collectors of images that others have hand-drawn or generated via software. They have to compete to collect these images with speculators who are not sentimental and are only there to turn a small dollar amount into a large one by buying and selling. Some of the collectors became collectors because, as the values of their images rose, so too did their own self-regard. Some collectors have become so intertwined with the images they’ve purchased, that the images have become a part of their identity – “I’m the guy that bought this picture on the internet for a much lower price than I could sell it for today.”

For some collectors, collecting isn’t enough. They need everyone around them – friends, family or strangers, it matters not – to be aware of their collection too. They must evangelize the beneficence of their having collected and admonish those who were not smart enough to have done so for themselves. “My work isn’t done here until everyone on earth acknowledges my sagacity in acquiring this monkey NFT at $36,000 before someone else acquired a similar monkey NFT for $91,000. You will bend the knee to me when next we meet on Virgin Twitter.”

And that’s cool, I guess. Everyone has their own taste in things they enjoy collecting and their own way of expressing it. My mother-in-law loves porcelain and glass elephants. She isn’t talking about them day and night in a discord somewhere or changing the photo ID on her driver’s license to her prized elephant figurine. They just sit on a shelf and make her happy.

I like to collect the cashflows of the best businesses in the world. I pile them up high in my accounts, adding to them when values fall, automatically buying more when dividends and distributions are paid out. My collection gets larger every year. I can’t touch it. I can’t hold it. It’s virtual, it’s digital, it lives in the online environment created by the brokerage firms and exchanges. There are many collections like it, but this one is mine. I count up the cashflows coming my way when I’m in a bad mood and that makes me happy again. I think everyone should collect the things that make them happy.

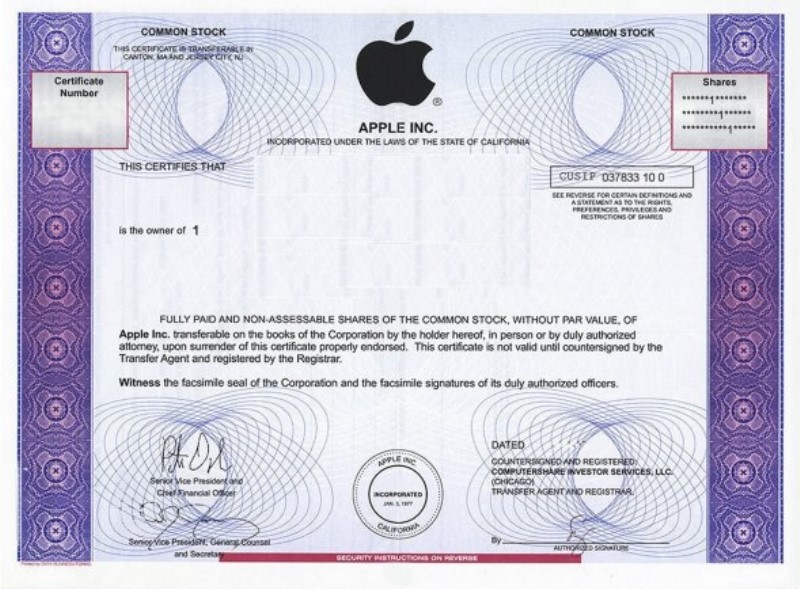

Here is a replica of one of my favorite NFTs. It’s a stock certificate representing actual ownership in the current and future cashflows of the most profitable company in the history of earth. The certificate is digital, but there is a record of my ownership of it on an immutable custody chain. It’s pretty sweet:

Follow me on Polywork, for some reason.