Paul Tudor Jones was born in 1954. In a new letter to his investors, he explains that the 1970’s investment atmosphere in which he spent his formative 20’s is probably responsible for his overarching investment style:

Jones, 63, began his career as a commodities trader in the cotton pits in the 1970s before transitioning to macro trading. He shot to notoriety after predicting the market crash of October 19, 1987, known as “Black Monday” when the Dow Jones dropped more than 22%.

“My only regret was that one of the unintended consequences of coming of age in those volatile times was learning to never want to own anything for the long run. Classic investing had a negative sign associated with it,” Jones wrote. “Bear markets were very rewarding since fear is a stronger emotion than hope and something can be torn down in fractions of the time it takes to build — whether that be a house, a reputation, or a bull market. Sometimes I almost wish I was a child of a different era as the ensuing 36-year bull market in equities was not something for which I was prepared or trained.”

Contrast this with the long-term bullishness of Warren Buffett, who was born in the 1930’s and believes in accumulating and waiting. Buffett’s formative years were in the raging secular bull market of the post-war 1950’s and early 1960’s when Berkshire was born.

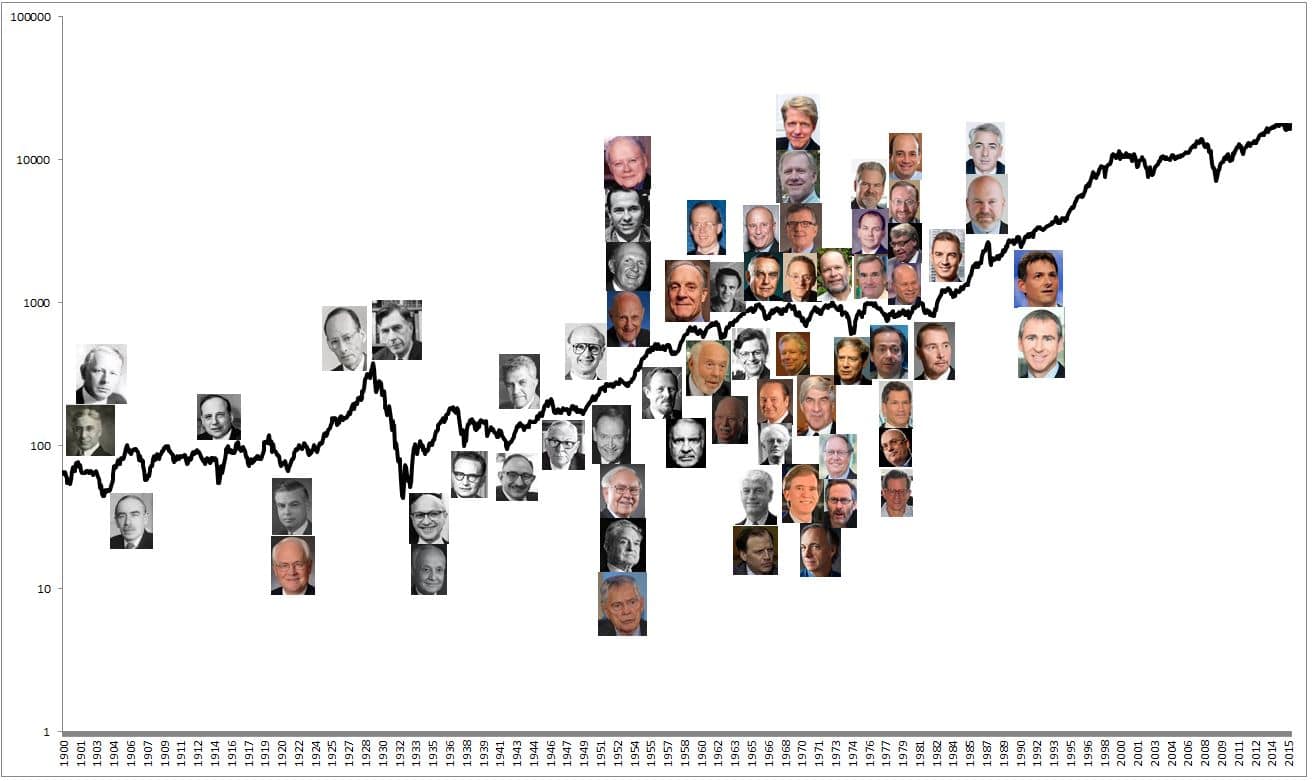

My partner Michael Batnick did a piece a little while back looking at the 67 greatest investment figures and when they were 22 years old. You may click the below to embiggen and visit his post to put names to these faces if you’d like.

Spend a moment thinking about what each environment above was like for a young investment professional trying to figure things out.

Does the period in which you spent your formative years play a role in your eventual investment philosophy, assuming you ever get around to developing one? You bet your ass it does. The first ten years of my career were bracketed on both sides by first the Dot Com Boom/Bust followed by the Great Financial Crisis just seven years later. I saw a century’s worth of madness inside of 10 years and two back-to-back 50% S&P crashes by the time I was 30. Maybe this is why I put such a heavy emphasis on the interplay between sentiment, psychology, investor behavior and returns in the work that I do.

If you’ve never seen this before, it’s insane. Albert King and Stevie Ray Vaughan, my god…

[…] Jones, 63, began his career as a commodities trader in the cotton pits in the 1970s before transitioning to macro trading. He shot to notoriety after predicting the market crash of October 19, 1… Source: http://thereformedbroker.com/2018/02/10/born-under-a-bad-sign/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2018/02/10/born-under-a-bad-sign/ […]

… [Trackback]

[…] Here you will find 16275 more Information on that Topic: thereformedbroker.com/2018/02/10/born-under-a-bad-sign/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2018/02/10/born-under-a-bad-sign/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2018/02/10/born-under-a-bad-sign/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2018/02/10/born-under-a-bad-sign/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2018/02/10/born-under-a-bad-sign/ […]

… [Trackback]

[…] There you can find 76767 more Info on that Topic: thereformedbroker.com/2018/02/10/born-under-a-bad-sign/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2018/02/10/born-under-a-bad-sign/ […]

… [Trackback]

[…] Here you will find 48863 additional Information on that Topic: thereformedbroker.com/2018/02/10/born-under-a-bad-sign/ […]