Earlier this morning we looked at the remarkable turnaround in emerging market fund flows, which went positive for the first time in 13 weeks.

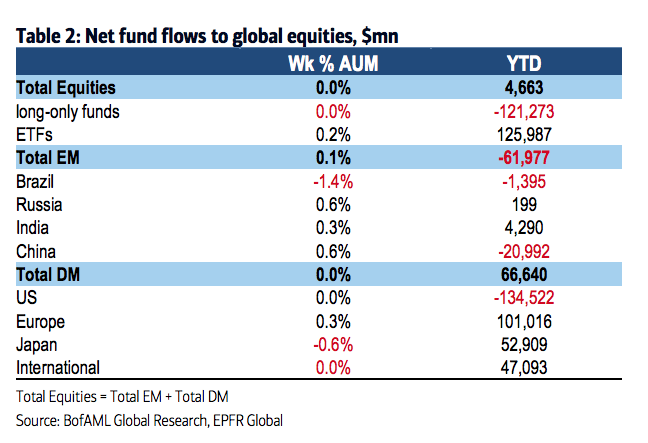

Below, a chart from Michael Hartnett’s BAML Flow Show report of the year-to-date scorecard for all equity regional categories. One grain of salt – last week also happened to be the first week of the 4th quarter, which means there’s definitely some rebalancing activity happening here – especially given the fact we’re talking about mutual funds and ETFs.

Equity Flows

Japan cracks: $1.6bn outflows (biggest 3w outflows since Nov’14)

EM is back: first inflows in 14 weeks ($0.7bn)

Europe defiant: $3.1bn inflows (inflows in 20 out of past 22 weeks)

US: muted $0.7bn inflows ($2.8bn ETF inflows vs $2.0bn mutual fund outflows)

Josh here – that year-to-date negative $121 billion number from long only equity mutual funds is unbelievable! And the nearly mirror image replacement into ETFs just below it! I predicted this three years ago (see: The end of mutual funds is coming – Fortune) but I’m still shocked to see it.

Source:

Go Ahead Junk…Make My Day

Bank of America Merrill Lynch – October 15th 2015

RT @ReformedBroker: Year-to-date:

$121 billion out of stock mutual funds

$125 billion into stock ETFs

http://t.co/8T4zUno2xO http://t.co…

RT @ReformedBroker: Year-to-date:

$121 billion out of stock mutual funds

$125 billion into stock ETFs

http://t.co/8T4zUno2xO http://t.co…

RT @ReformedBroker: Year-to-date:

$121 billion out of stock mutual funds

$125 billion into stock ETFs

http://t.co/8T4zUno2xO http://t.co…

RT @ReformedBroker: Year-to-date:

$121 billion out of stock mutual funds

$125 billion into stock ETFs

http://t.co/8T4zUno2xO http://t.co…

RT @ReformedBroker: Year-to-date:

$121 billion out of stock mutual funds

$125 billion into stock ETFs

http://t.co/8T4zUno2xO http://t.co…

RT @ReformedBroker: Year-to-date:

$121 billion out of stock mutual funds

$125 billion into stock ETFs

http://t.co/8T4zUno2xO http://t.co…

RT @ReformedBroker: Year-to-date:

$121 billion out of stock mutual funds

$125 billion into stock ETFs

http://t.co/8T4zUno2xO http://t.co…

RT @ReformedBroker: Year-to-date:

$121 billion out of stock mutual funds

$125 billion into stock ETFs

http://t.co/8T4zUno2xO http://t.co…

RT @ReformedBroker: Year-to-date:

$121 billion out of stock mutual funds

$125 billion into stock ETFs

http://t.co/8T4zUno2xO http://t.co…

El fin de los #fondosdeinversion ? Chart o’ the Day: Global Equity Fund Flow Scorecard http://t.co/r1fxnfSMnT

RT @asibiza1: “The great market rebalancing…” @ReformedBroker http://t.co/8s9tUe514P

RT @ReformedBroker: Year-to-date:

$121 billion out of stock mutual funds

$125 billion into stock ETFs

http://t.co/8T4zUno2xO http://t.co…

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2015/10/16/chart-o-the-day-global-equity-fund-flow-scorecard/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2015/10/16/chart-o-the-day-global-equity-fund-flow-scorecard/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2015/10/16/chart-o-the-day-global-equity-fund-flow-scorecard/ […]