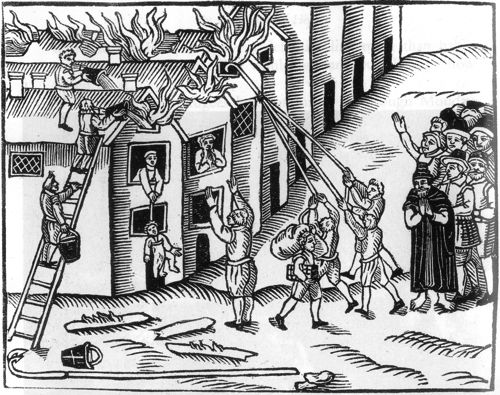

The Great Fire of London began at a bakery in Pudding Lane on September 2nd, 1666. A few hundred houses caught flame in the vicinity and then the wind took the fire east, burning everything in its path. The first thing Londoners did was try pouring buckets of water on the burning buildings. This didn’t work so the next thing they attempted was escape, a crush of humanity piling up along the Thames waiting for boats to get them clear of the inferno.

By September 4th, it became clear that escape for everyone would be impossible. The fire had to be brought under control immediately to save lives, not just property. The king ordered a firebreak, which involved pulling down all of the houses in the fire’s path using hooked poles. When that process proved not to be fast enough, the king ordered a massive gunpowder explosion – akin to blowing up a neighborhood with a bomb – so as to save the rest of the city.

After four days of fighting the blaze, they had finally succeeded. Only one-fifth of the city’s buildings were still standing, with an estimated 13,000 private dwellings either burned to the ground or deliberately destroyed. Miraculously, historical records indicate that only six people died.

200 years later, the residents of Chicago would not be so lucky after Mrs. O’Leary’s cow kicked over a kerosene lamp. We’re told by Harper’s that the Great Chicago Fire of October, 1871, “burned for 29 hours, cutting a destructive swath through 17,450 buildings on 73 miles of streets, leaving an estimated 300 people dead, 100,000 homeless, and $192 million worth of property destroyed.” Temperatures reportedly reached levels “high enough to disintegrate stone into powder and granite into lime, melt iron (2000º F) and steel (2500º F), and explode trees from their own heated resin.”

The windy conditions for which the city is famous made the fire nearly impossible to contain. The only reason the South Side was saved was that the order finally came down to make a firebreak. City officials commanded that buildings be blasted with dynamite to create some space in which the fire could peter out rather than spread further.

Last week, Chinese stock market officials attempted to douse the flames of investor panic with increased liquidity and with words. Neither approach worked, the panic spread the crash intensified. This week, they called for a firebreak. Halting thousands of stocks from trading to contain the panic, while simultaneously issuing new rules prohibiting executive stock sales and new IPOs. They’ll do some long-term damage with those measures, to be sure, but their hope is to bring the flames under control and then sort the damage out later.

The firebreak may have worked, at least temporarily. After a 32% crash in Mainland Chinese stocks, some 1600 or so issues simply ceased to trade. The 600 stocks that did manage to open in the last session bounced hard, the biggest one day jump for the Chinese market since 2009.

Maybe a bit of distance and time from the fire of the last few weeks will cool the Chinese trading populace off enough so that rational behavior can take hold. That’s certainly the hope of the regulators. Or perhaps not. Kevin Ferry doesn’t believe the market participants in China are actually investors in the first place, just gamblers. What happens in the next few days will be extremely important.

FIREBREAK

http://t.co/1Kf1j46CAp $SSEC $FXI $EWH

Firebreak http://t.co/aIfvaNe5QS #Uncategorized @ReformedBroker

Firebreak http://t.co/tpnwiWyAT4

@ReformedBroker Just read Firebreak. Just Great Writing and a good parable too!

http://t.co/tMcqtcdDUe

Firebreak http://t.co/gQFGGXIL2L Maybe a bit of distance and time from the fire of the last few weeks will cool the Chinese trading popul…

RT @ReformedBroker: Firebreak http://t.co/tpnwiWyAT4

RT @ReformedBroker: Firebreak http://t.co/tpnwiWyAT4

RT @ReformedBroker: Firebreak http://t.co/tpnwiWyAT4

Firebreak http://t.co/JFIod7HPTQ

[…] Joshua Brown: Firebreak […]

When blowing something up is the same as saving it. @reformedbroker http://t.co/SzEdHb4t0y

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2015/07/09/firebreak-2/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2015/07/09/firebreak-2/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2015/07/09/firebreak-2/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2015/07/09/firebreak-2/ […]