Over the last few weeks, the weakness in the Dow Jones Transportation Index – on both an absolute basis and relative to the Dow Industrials – has become the divergence du jour on everyone’s lips. It has replaced the divergence between small and large caps from 2014 as this year’s technical bogeyman (see: The New NEW Divergence). The chattering classes have opined that the transports are telling the real economic story while the industrials are kidding themselves – thus a recession / market top is nigh.

It’s always hilarious to hear non-technicians cite a Dow Theory non-confirmation as a reason to sell all your stocks, especially after they’ve gone to great lengths explaining why they don’t “believe in charts” to begin with. As though there’s a better way of gauging investor sentiment or behavior…

Anyway…

My friend Ari Wald, Oppenheimer Asset Management’s ace technician, explains a few things about Dow Theory that neophytes are probably unaware of or do not understand.

The first thing is that, despite the weakness in the transports lately, it’s actually still on a buy signal – there is no “neutral” reading for this indicator, it’s always either stop or go. Right now it’s still go (emphasis mine)…

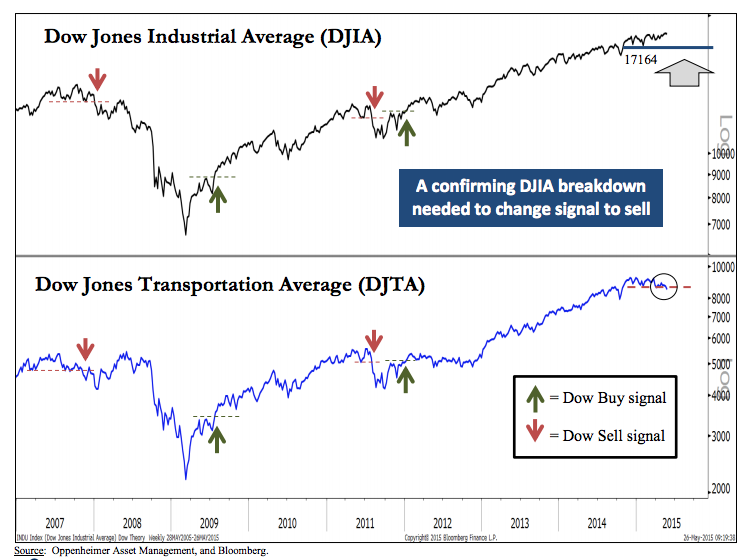

Dow Theory is either on a buy or sell signal at all times and is only reversed when the longstanding rules and definitions are met; otherwise, the current signal remains in place. The current signal has been on a buy signal since December 2011 and was last reaffirmed in December 2014. A bearish reversal would require 1) a lower high by at least one of the indexes and 2) then a breakdown by both.

It can be viewed as a potential warning that the DJTA did not make a new high in March (a divergent peak) and subsequently closed at a new low, but a sell signal will not be given unless the DJIA also closes below its late-January correction low at 17164. Until then, Dow Theory remains on a buy signal, by our analysis.

The second thing is that weak transports have historically represented a buy or hold signal for the S&P 500, rather than a sell signal…

Since 1929, the S&P 500 has tended to post stronger performance following a period of underperformance by the DJ Transportation Average (DJTA) vs. a period of DJTA outperformance.

In terms of the relative rate of change (R.O.C.) between the DJTA vs. the S&P 500, the S&P 500 has averaged gains of 2.2%, 4.7%, and 9.4% in the subsequent 13, 26, and 52 weeks when the 52-week R.O.C. is less than 0% (DJTA underperformance), vs. average gains of 1.4%, 2.4%, and 5.4%, respectively, when the R.O.C. is greater than or equal to 0%.

Our takeaway from this study is that DJTA performance is more of a coincident indicator, by outperforming near tops and underperforming near bottoms, rather than a leading one. We therefore view recent DJTA underperformance as the result of ongoing industry rotations rather than a harbinger of weakness for the S&P 500.

Josh here – Old wives’ tales about Dow Theory signals and such will always dominate the media because they make for really interesting commentary and content. Unfortunately, a lot gets lost in translation when people who don’t actually know what they’re talking about chime in, picking and choosing which aspects of a particular concept fit their talking points. Thankfully, people like Ari are around to bring the actual data back into the discussion.

We very well could end up with a down market this year, given how heavy things are feeling as we churn beneath all time record highs each month and progress for individual stocks tapers down to a small handful of leaders. But a Dow Theory signal to sell will likely be coincident with a pullback, rather than predictive of one.

Source:

Technical Analysis: Inflection Points

Oppenheimer Asset Management – June 1st 2015

RT @ReformedBroker: Two things you don’t understand about Dow Theory

via @AriWald

http://t.co/fjE0Korncl $DIA $IYT

Ari Wald: 2 things you don’t understand about Dow Theory http://t.co/YZOYDncFeY

RT @ReformedBroker: Two things you don’t understand about Dow Theory

via @AriWald

http://t.co/fjE0Korncl $DIA $IYT

RT @ReformedBroker: Two things you don’t understand about Dow Theory

via @AriWald

http://t.co/fjE0Korncl $DIA $IYT

RT @ReformedBroker: Two things you don’t understand about Dow Theory

via @AriWald

http://t.co/fjE0Korncl $DIA $IYT

RT @ReformedBroker: Two things you don’t understand about Dow Theory

via @AriWald

http://t.co/fjE0Korncl $DIA $IYT

RT @ReformedBroker: Two things you don’t understand about Dow Theory

via @AriWald

http://t.co/fjE0Korncl $DIA $IYT

RT @ReformedBroker: Ari Wald: 2 things you don’t understand about Dow Theory http://t.co/YZOYDncFeY

RT @ReformedBroker: Two things you don’t understand about Dow Theory

via @AriWald

http://t.co/fjE0Korncl $DIA $IYT

RT @ReformedBroker: Ari Wald: 2 things you don’t understand about Dow Theory http://t.co/YZOYDncFeY

RT @ReformedBroker: Two things you don’t understand about Dow Theory

via @AriWald

http://t.co/fjE0Korncl $DIA $IYT

RT @ReformedBroker: Two things you don’t understand about Dow Theory

via @AriWald

http://t.co/fjE0Korncl $DIA $IYT

RT @ReformedBroker: Two things you don’t understand about Dow Theory

via @AriWald

http://t.co/fjE0Korncl $DIA $IYT

RT @ReformedBroker: Ari Wald: 2 things you don’t understand about Dow Theory http://t.co/YZOYDncFeY

“Old wives’ tales about Dow Theory signals and such will always dominate the media”

http://t.co/DZxka6Jxdz