The best thing about Wall Street’s annual S&P 500 targets is that they’re never right. The consensus is so far off the mark in most years that it’s almost hilarious that research departments still put these things out. At this stage in the game, professional investors don’t take them seriously at all. They just accept them like a Pennysaver newspaper in the driveway – that’s the price of owning a home, having nonsense dropped off in front of it once in awhile.

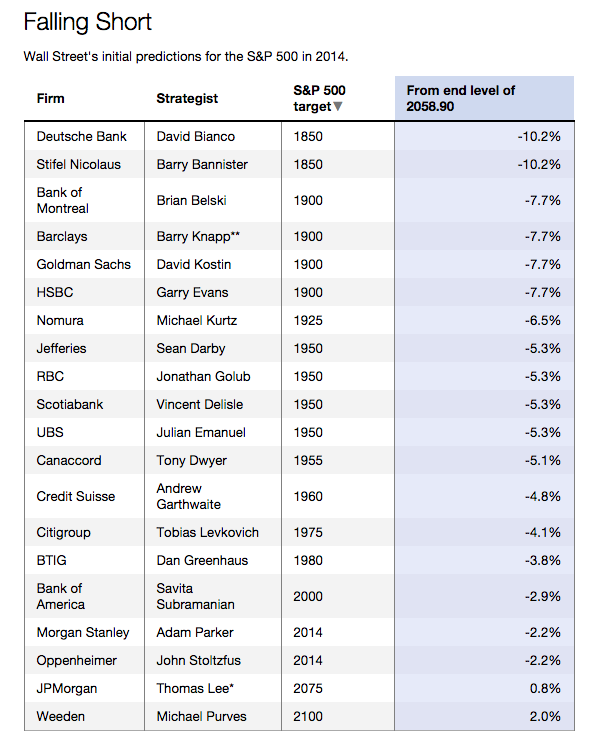

Just to give you a sense of how hard these year-end market calls are to make in January, here’s how the 2014 crop fared, courtesy of WSJ MoneyBeat:

But the media loves S&P 500 targets. Especially at the beginning of the year. It’s great fodder for conversation, even when the issuing strategist literally tells us on-air that getting the direction right is much more important (read: feasible?) than arriving anywhere near the actual target number.

But they can’t even get the direction right when it counts, in the aggregate, so best to ignore that too.

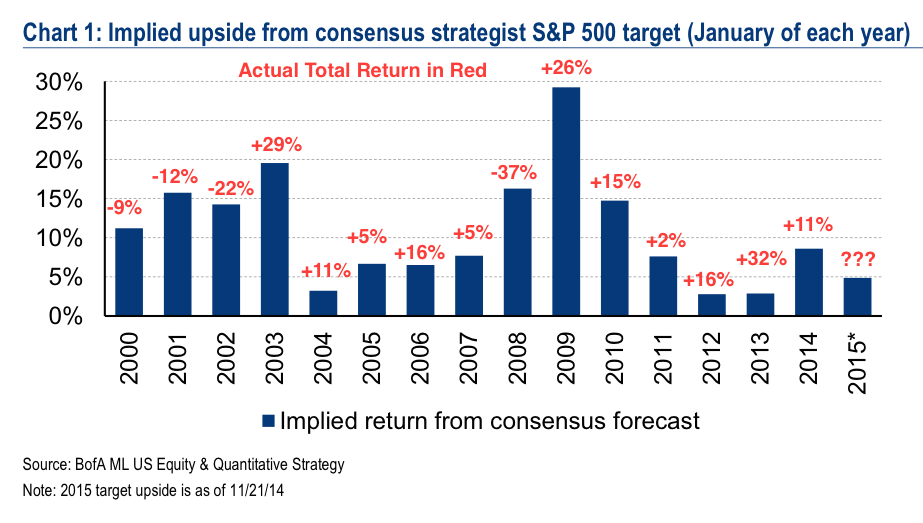

One of my favorite market analysts, Savita Subramanian, is out with Merrill’s official quant strategy outlook for 2015. In the report, she’s got a chart depicting what the Wall Street strategist consensus believed the market would do each year, based on the implied upside to their targets. Needless to say, it’s hilarious. I’ve posted her chart below with a minor annotation – I’ve added the actual total return for the S&P 500 each year on top of the consensus call implied upside…

First, let me just say that I do not post this to embarrass anyone issuing these targets – I get that it’s a part of their job, mostly from a marketing standpoint (they’ll say it’s about “framework” but I wrote a book on this so trust me). I also don’t mean to imply that I would be able to do much better. My own base case for 2014 last January was for a flat market, which we had going until as late as October. Oh well. It’s not the strategists’ fault that they cannot do this – it’s the fault of reality, because it cannot actually be done. Even if you get the earnings per share call right, you still cannot possibly guess the multiple we’ll pay on those earnings ahead of time because that part of the equation is driven solely by people’s sentiment, and people are insane.

But I do think it’s important to point out just how wrong The Street had been at several key junctures. Had you invested based on Wall Street’s beginning-of-year targets each year, modulating your risk-taking in one direction or the other, your results would have been horrific to say the least.

But anyway, let’s have some fun…

1. Let’s start with the implied upside of 10% plus a year in 2000, 2001 and 2002. Could strategists have divined the devastation wrought by the dot com collapse, the 80% decline of the Nasdaq, the twin earnings scandals of Enron and WorldCom, and then the tragic and unprecedented events of 9/11? To put it bluntly, no fucking way. The S&P began it’s “lost decade” with Wall Street looking for nothing but big upside during three years of negative returns.

2. In the comeback year of 2003, the consensus was very bullish, but by then its credibility was almost entirely shot. Pity, it was one of their best forecasts ever.

3. In 2008, The Street expected a big S&P 500 gain of 17% from January 1st and, instead, were treated to a massive decline of -37%. Yes, targets had moved around during the course of that year, but even still, this was a spread of implied-vs-actual wide enough to drive a truck through. By the way, the move-ability of targets as the year progresses is one of the other unintentionally hilarious things about the entire exercise. WSJ tells us that last year “strategists’ average target at the start of the second quarter was 1961; at the beginning of the third quarter, it was 1972; and at the onset of the fourth, it was 2057.” Seriously, what are you even doing?

4. In the post-crisis period, The Street’s strategists went from very bullish to increasingly less bullish with each passing year, based on the implied upside of their targets. This can be chalked up to the “Gambler’s Fallacy”, one of my very favorite cognitive biases to write about (see my post “New All Time Highs” from January 2014). The Gambler’s Fallacy can best be illustrated by the way in which people tend to play roulette or engage in betting on coin flips. Mathematically, each spin of the wheel or toss of the coin is independent of the one before and, as such, carries with it the same probability of landing on black or red, heads or tails. But when we see a streak of all black or all heads, we are prone to want to take the other bet – that mean reversion will spit out the opposite outcome on the next turn – red or tails. We do this with investing too. And so when analysts tally up the gains of one or two great market years, there is a tendency to pull their price targets back a bit. Even Wharton’s finest are susceptible to this fallacy, this itch to lean the other way when, in reality, one calendar-year’s returns are independent of those from the prior year. This explains the strategists’ muted expectations for 2013 (sub-5% returns!) after a 2012 that looked “as good as it gets.” Oops!

5. One other thing you may have noticed is the uniformly bullish consensus target for the market in every single year. Remember when I explained that Chief Strategists are largely in the marketing game. No one wants to invest with a firm that’s predicting losses for the asset class and bearish strategists have virtually no job security. Easier to be long and wrong with the consensus than to explain to a million firm customers why they’ve missed out on a giant rally. Remember: the US stock market has historically been positive in 3 out of every 4 years and, despite the financial crisis, it’s actually been higher during 11 out of the last 12 years – the logical posture for a strategist, keeping both career concerns and history in mind, is to be constructive at all times.

I ask you to remember this stuff anytime you come into contact with a Wall Street forecast for the S&P 500’s year-end gain. This call cannot be made in real life, despite all of the thinking and modeling and hard work that might go into it. But by all means, feel free to enjoy the entertainment aspect of the annual pageant. I know I do.

***

If you’re an investor who’s had enough of the follies of forecasting, my firm manages wealth and we’d love to see if there’s a good fit. Get in touch here.

RT @ReformedBroker: This is hot – Fun With Wall Street’s S&P 500 Targets

http://t.co/8jajwv3d1F http://t.co/8mE1vtIGuW

“Because… people are insane.” Somewhat boiled-down quote from @ReformedBroker on why predictions are futile http://t.co/veZdhlvXgN

Best was 10yr yield guesses for 2014 “@ReformedBroker Fun With Wall Street’s S&P 500 Targets

http://t.co/S1DjpiWAdv http://t.co/esn8fpglvm

RT @ReformedBroker: Fun With Wall Street’s S&P 500 Targets http://t.co/iLRQKyiAs1

RT @ReformedBroker: This is hot – Fun With Wall Street’s S&P 500 Targets

http://t.co/8jajwv3d1F http://t.co/8mE1vtIGuW

RT @DavidSchawel: The guy who was mocked the most, Tom Lee, was dead on with his S&P prediction for 2014 http://t.co/TPBDpqMHbw

RT @ReformedBroker: This is hot – Fun With Wall Street’s S&P 500 Targets

http://t.co/8jajwv3d1F http://t.co/8mE1vtIGuW

RT @ReformedBroker: This is hot – Fun With Wall Street’s S&P 500 Targets

http://t.co/8jajwv3d1F http://t.co/8mE1vtIGuW

RT @ReformedBroker: Fun With Wall Street’s S&P 500 Targets http://t.co/iLRQKyiAs1

RT @ReformedBroker: Fun With Wall Street’s S&P 500 Targets http://t.co/iLRQKyiAs1

RT @DavidSchawel: The guy who was mocked the most, Tom Lee, was dead on with his S&P prediction for 2014 http://t.co/TPBDpqMHbw

RT @ReformedBroker: This is hot – Fun With Wall Street’s S&P 500 Targets

http://t.co/8jajwv3d1F http://t.co/8mE1vtIGuW

RT @ReformedBroker: This is hot – Fun With Wall Street’s S&P 500 Targets

http://t.co/8jajwv3d1F http://t.co/8mE1vtIGuW

Fun With Wall Street’s S&P 500 Targets http://t.co/ezaTGcRgQz

RT @ReformedBroker: This is hot – Fun With Wall Street’s S&P 500 Targets

http://t.co/8jajwv3d1F http://t.co/8mE1vtIGuW