Quick disclaimer: I’m not an economist and I don’t really care about economics at all except as it relates to the investment markets in which I earn my living. As my friend Stephen Weiss likes to say, if you’re attempting to trade based on economic reports, you’re going to need a second job to make back your all losses. That said, there’s no need to turn a blind eye toward all the ways in which economic trends manifest themselves in the markets as investment trends. The Chase for Yield, the Relentless Bid and the corporate buyback binge are three au courrant examples of this worth mentioning.

Okay, let’s get into it.

For all the talk about this being the year of breakout economic growth (finally), thus far we’ve seen few real signs of it.

The good news is, the employment situation is showing concrete improvement, contrary to the declinist narrative that’s become so embedded in everything we read these days. Scott Minerd, the chief investment officer at Guggenheim Partners, informs us that we’re at an almost eight-year high for job openings in America…

The Job Openings and Labor Turnover Survey showed that the number of job openings waiting to be filled in the United States rose by 289,000 to 4.5 million in April — the highest since September 2007 — as employers sought more workers to satisfy demand in a growing economy. As those positions get filled in the coming months, we can expect a dip in the U.S. unemployment rate.

I hope he’s right about this leading to a dip in overall unemployment. It should also produces a rising wages scenario – stagnant worker pay being what many economists regard as the missing ingredient for the recovery and the one thing that could really juice us out and above the 2% growth rate regime we’ve been locked into for five years now.

Paradoxically, the moment higher wages begin to show up for the first time in a decade, the stock market may actually get a jolt to the downside! This is because, at first blush, the most notable impact of increasing salaries will be a negative one: the contraction of corporate profit margins (which have been hovering at a record peak for years). My best guess is that, after the initial shock of declining profit margins wears off, markets will reassess. Later on, a tighter (and more expensive) labor market would be recognized as an overall positive for stocks and the economy as it would translate into higher sales and more demand for goods and services, which would offset the declines in margins in the minds of investors.

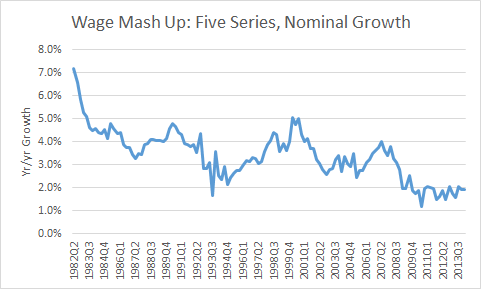

But there’s no sign that any of this is happening yet anyway. This is probably a concern for later this year or 2015 if anything. Below is a chart from Jared Bernstein, in which he mashes up five important data series to come up with one signal for wage pressure (or the lack thereof) at the current moment:

(from a principal components analysis of five different and pretty diverse, compensation/wage series):

Employment Cost Index: Hourly Compensation

Employment Cost Index: Hourly Wages

Productivity Series: Hourly Compensation

Median Weekly Earnings, Full-time Workers

Average Hourly Earnings, Production, Non-Supervisory Workers

Josh here – robust wage growth is probably among the most unexpected outcomes for the second half of 2014 and beyond. Almost no one even believes such a thing would even be possible (let alone probable). We’re all still mentally living in Pikettyland, where the wealth gap can only continue to widen and the current trend toward breakaway global aristocracy is unstoppable.

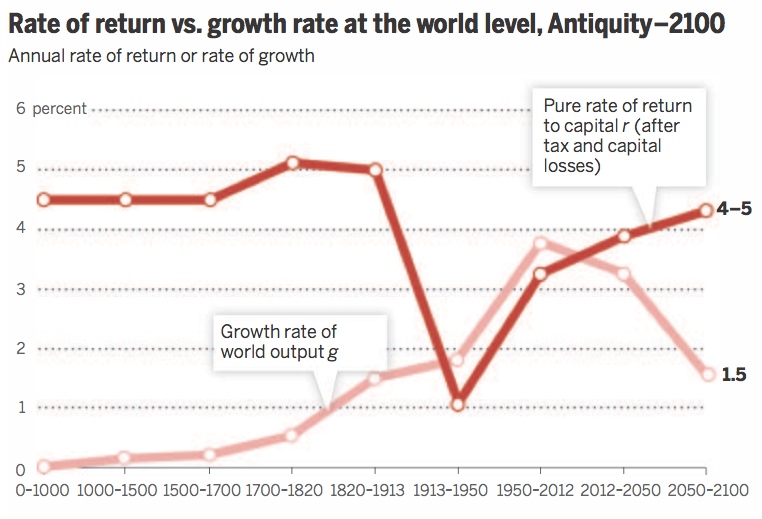

Very few people are imagining a scenario in which the workers start seeing pay increases while capital markets do nothing or even decline a bit – which would represent a a cessation in the widening gap between wealthy and working class. It would also represent a trend change (or at least a momentary flattening) in the expected curve that Thomas Piketty so eloquently illustrates here (via Forbes):

Currently, the richest 10% control 71% of wealth and take home 48% of income. While the former value isn’t unprecedented, the latter is, and when it’s accompanied with the expected widening in the gap of r > g over the coming decades, we can expect to see the top 10% control more wealth than ever before.

Let’s come back to earth for a moment…

The big economic story of the summer so far is the rising prices regular folks are now observing for food and drink.

After cutting prices in the summer of 2013, Starbucks is once again raising them – your Talls and Ventis are going to cost between 5 and 20 cents more beginning this Tuesday and prices for the chain’s grocery store coffee products are also going up – by as much as a dollar a package. We’re also seeing higher gas prices (partially caused by Iraq’s civil war) as well as record high prices for poultry, fish, beef, pork and a whole host of other consumable commodities. This comes as Core CPI – consumer prices ex-food and gasoline – also increased at 2.1% in May, the fastest rate of growth in more than a year and above the low end of the Federal Reserve’s stated target range.

You better believe that if the current trend continues, workers are going to demand (and likely receive) more from their employers. It may not begin at the small business level – where employers are tussling with their new health care costs and higher taxes personally. But do Fortune 500 companies have a leg to stand on in terms of worker compensation, given their record setting cash hoards? They do not.

If I had to guess where the wages scale would be tipping first, I’d point there.

But is there enough urgency for this to happen spontaneously, in any noticeable way?

Not yet.

.

tnx for info!!

.

áëàãîäàðþ!

… [Trackback]

[…] Here you will find 92795 more Information on that Topic: thereformedbroker.com/2014/06/23/what-if-wages-rise/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/06/23/what-if-wages-rise/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/06/23/what-if-wages-rise/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/06/23/what-if-wages-rise/ […]

… [Trackback]

[…] Here you will find 33074 additional Information to that Topic: thereformedbroker.com/2014/06/23/what-if-wages-rise/ […]

… [Trackback]

[…] There you can find 80499 more Info on that Topic: thereformedbroker.com/2014/06/23/what-if-wages-rise/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2014/06/23/what-if-wages-rise/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2014/06/23/what-if-wages-rise/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/06/23/what-if-wages-rise/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/06/23/what-if-wages-rise/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2014/06/23/what-if-wages-rise/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/06/23/what-if-wages-rise/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2014/06/23/what-if-wages-rise/ […]