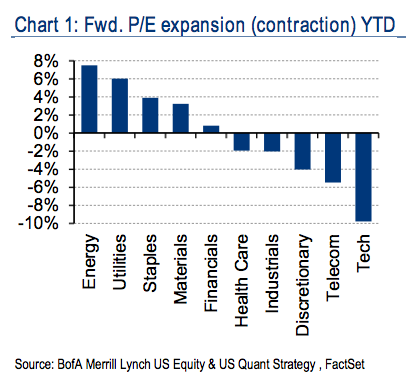

In this morning’s Equity and Quant Strategy note, Bank of America Merrill Lynch’s Savita Subramanian makes the case that not all US stocks have grown more expensive in the first half of this year, despite the S&P’s 5% gain. In fact, she believes that the sectors where companies benefit from high interest rates still represent the areas of higher implied upside – whether interest rates rise or not, because of their lower multiples vs the overall market.

P/E expansion not broad-based: 5/10 sectors cheaper vs. 12/31/13

While we often hear concern that the market has grown expensive, our work

continues to suggest otherwise: over half of the valuation metrics we track suggest

the S&P 500 is trading below historical average levels. And

multiple expansion this year has not been broad-based: in fact, just five of the ten

sectors have seen their forward P/E ratios expand, led by Energy (which is still

inexpensive vs. history). In contrast, Tech, Telecom, Discretionary, Industrials and

Health Care have all seen their P/E’s contract year-to-date.

The strategists says that even if rates do not rise in the second half (the firm believes they will), the pain trade would still be higher for the rate-sensitive sectors given what they’re being priced for (low growth / low rate environment) at the moment.

Source:

Just in case rates don’t rise…

Bank of America Merrill Lynch – June 18th 2014

[…] a tip of the iceberg! Apart from the array of job positions available in the highly lucrative oil sector, the agricultural sector is yearning for both skilled and unskilled workers and investors too. The […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]

… [Trackback]

[…] Here you can find 80820 more Info to that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]

… [Trackback]

[…] There you will find 17707 additional Information on that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2014/06/18/chart-o-the-day-pe-expansion-by-sector/ […]