Every year we have a recession in the first quarter and every year people get hysterical. And every year the economy rebounds into summer and the hysterics roll back their estimate cuts and their calls for economic demise.

Putting aside why economy-watchers are so easily fooled or confused after so many episodes of the same show, it’s worth understanding why this occurs.

Bank of America Merrill Lynch’s US economist Ethan Harris explains the quirks in the data that lead to this annual freak-out (emphasis mine):

The economy has a major seasonal recession in every 1Q and some of the secondary indictors that go into GDP are not seasonally adjusted…

Work at the Philadelphia Fed shows that over the past 30 years GDP growth has averaged 1.9% in 1Q and 3.0% in the rest of the year, suggesting about a percentage point downward bias in the quarter…The bottom-line from all of this is that bad seasonals probably sliced about 1.5% off of growth in 1Q and added about 0.5% to other quarters of the year…

…the pattern is not just a matter of a few years. Moreover, the story is also a lot more credible if there is a good narrative behind it. Here is that narrative.

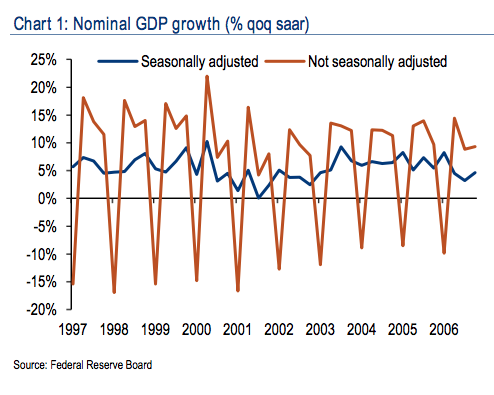

Every year there is a major drop in GDP in the first quarter as the holiday season ends and severe weather kicks in. How big is this recession? The government does not publish unadjusted data for real GDP, but there is unadjusted data for nominal GDP through 2006. Looking back over the 10 year period from 1997 to 2006 the seasonal drop in 1Q is huge and varies significantly from year to year. It typically plunges 10% on an unadjusted basis, requiring a huge upward adjustment of 14.9 to 21.1pp to correct the seasonal drop (Chart 1). Even a small error in this large and variable adjustment could create serious mismeasurement when we drill down to real GDP. The adjustment challenge for 1Q GDP is much higher than for other quarters and for other data. In the other three quarters of the year the seasonal adjustment lowers growth by about 5pp—or a third as much. And for payrolls the 1Q adjustment is only about half of that for GDP. Big adjustments create room for big errors.

Harris & Co go into an explanation that involves the various ingredients that go into a GDP measurement.

Many of the statistics are clean as they are kept and tabulated by a single party. But many are messy and prone to a lot of volatility (noise). Even worse – only some of the quarterly GDP recipe consists of seasonally-adjusted data, measured in year-over-year percentage change terms. Some of the inputs are not seasonally-adjusted and are, thus, apples-to-oranges. The combined effect of all these “odds and ends” in the report is a sort of mass confusion and the resulting poorly drawn conclusions as people attempt to make sense of it.

You can see the difference between seasonally-adjusted and raw data in the chart below:

And then on top of all of the mismatches in the statistics and the wide swings in forecasts, the weather really and truly does suck every year in Q1 – perhaps more than popular expectations allow for. It is a fact that the majority of the Northeast’s population was unable to leave the house for weeks on end throughout January and February during each of the last two years. Boston got 900 feet of snow. New Yorkers were not out shopping for cars or putting bids on houses in the 10-degree climate. No one in New Jersey was embarking on remodeling projects in an ice storm. They had a snow event so bad in Atlanta two winters ago it caused a 24-hour traffic jam, complete with abandoned cars and people sleeping through the night in a CVS. California had some of the wackiest weather in its wacky-weather history.

You’re welcome to dismiss it if you’d like.

So what to do? The suggestion is made that one should pay more attention to the monthly reports that offer more visibility and measurement consistency – like ISM manufacturing, new housing starts, vehicle sales and non-farm payrolls – for a true gauge of what’s really happening in the economy.

And then next year, when the annual Q1 recession happens again and we’re tearing our hair out in March/April, keep in mind that you’ve seen this show before. There’s a good chance it’s a rerun.

Source:

First is the worst

Bank of America Merrill Lynch – May 21st 2015

RT @ReformedBroker: IGNORE THE ANNUAL FIRST QUARTER RECESSION

http://t.co/8oXTYJAxrA http://t.co/SCzYVT48Mj

[…] Why you can safely ignore the Q1 slowdown. (thereformedbroker) […]

[…] 9) The Reformed Broker : Ignorez la récession du premier trimestre […]

[…] Some more on that mismatch in the seasonal correction of US GDP numbers http://thereformedbroker.com/2015/05/24/ignore-the-annual-first-quarter-recession/ […]

“Every year we have a recession in the first quarter and every year people get hysterical”. .http://t.co/vVPuAOxHUf

“Ignore the annual first quarter recession” #economy #feedly http://t.co/KmLw2fkr8c

Ignore the annual first quarter recession by @ReformedBroker http://t.co/qXal7EJjSO

Every year we have a recession in the first quarter and every year people get hysterical http://t.co/YpScNU2qxB

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2015/05/24/ignore-the-annual-first-quarter-recession/ […]

… [Trackback]

[…] There you can find 85066 more Info on that Topic: thereformedbroker.com/2015/05/24/ignore-the-annual-first-quarter-recession/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/05/24/ignore-the-annual-first-quarter-recession/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2015/05/24/ignore-the-annual-first-quarter-recession/ […]

… [Trackback]

[…] There you will find 38794 additional Info on that Topic: thereformedbroker.com/2015/05/24/ignore-the-annual-first-quarter-recession/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/05/24/ignore-the-annual-first-quarter-recession/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2015/05/24/ignore-the-annual-first-quarter-recession/ […]