“Show me the incentives and I will show you the outcome.”

That’s a Charlie Munger quote about how incentives drive nearly everything. I have come to accept this philosophy as one of the simplest, strongest heuristics through which to view nearly everything pertaining to human affairs. Nothing I’ve seen in my industry has ever contradicted it.

It’s why capitalism works but has periodic massive failures. It’s why socialism and communism never work, never have worked and never will work. The hedge fund manager Leon Cooperman has used his foundation to send 500 children in the Newark, NJ area to college with full scholarships. He told my partner Barry in a recent interview that he believes in “equality of opportunity, not equality of outcomes.” Lee’s a realist. He understands that leveling the playing field early on will help more than redistribution later, because an economy and a society require the right incentives.

Back in 2016, my friend Patrick O’Shaughnessy wrote about what happens when people in power demand a certain outcome and pay little heed as to how that outcome will be achieved…

In Vietnam, under French colonial rule, there was a rat problem. To solve the rat infestation, the French offered a bounty on rats, which could be collected by delivering a rat’s tail as proof of murder. Many bounties were paid out, but the rat problem didn’t improve. Officials soon noticed rats running around without tails–people were cutting off the tails and releasing the rats to breed, so as to increase the pool of potential bounty revenue for themselves.

The same thing happened in Colonial India: a bounty was offered on cobras because they were attacking people, which caused people to breed cobras for more bounties, and ultimately resulted in a higher cobra population when the bounty system was abandoned and the breeders released their now worthless snakes.

That’s from When Measures Become Targets and there’s a great lesson in there for anyone trying to set up good incentives for their employees or co-workers.

Wait til you hear about this animal…

Tracy Dewart tells Tara Siegel Bernard about what she discovered when she looked at the JPMorgan brokerage account being managed for her Alzheimer’s stricken elderly mother. From the New York Times:

After about six months, she learned that the account, worth roughly $1.3 million at the start of 2017, had been charged $128,000 in commissions that year — nearly 10 percent of its value, and about 10 times what many financial planners would charge to manage accounts that size.

In August 2017 alone, Mr. Rahn had sold two-thirds of the portfolio, or about $822,000, and then reinvested most of the proceeds, yielding about $47,600 in commissions, according to monthly financial statements and an analysis by Genesis Forensic Consulting, the firm Ms. Dewart’s lawyer hired.

This specific type of disgusting activity could only take place in the context of a transactional brokerage relationship with a client – wherein the more trades the broker places on the customer’s behalf, the more money he earns from the account. This is not to say that every single transactional broker is a villain or that every transactional brokerage account is a crime scene. I’ll simply say, having spent the last 20 years observing broker and advisor behavior firsthand, that the incentive system starts out in a misalignment to begin with, and then the worst people in the industry push it to the limit and beyond.

Start out with the wrong incentives and then it doesn’t take much for things to get incredibly f***ed up from there. The right incentives in a system are not impervious to abuse, they’ve just got a better built-in resistance. Nothing man-made is foolproof, and that includes compensation schemes and business models. But some start out as being much more game-able than others.

You should know that brokers are judged by how much gross commissions they generate. This number is called their “production” and internally these broker-dealer affiliated advisors are referred to as “producers.” The thing they “produce” is compensation for themselves and profits for the brokerage’s shareholders. The raw materials they use in order to “produce” their product is also known as your retirement savings. The brokers are treated better or worse within their firms based on how strong or weak their “production” is and how valuable they are to the branch. They are paid differing compensation based on their level of “production” and how much of which products they sell – bring us two mortgage loans and you get an extra 1% payout this month.

Nothing about their comp system has anything to do with client outcomes.

The guys aren’t all bad. But the incentive system sucks because the business model sucks.

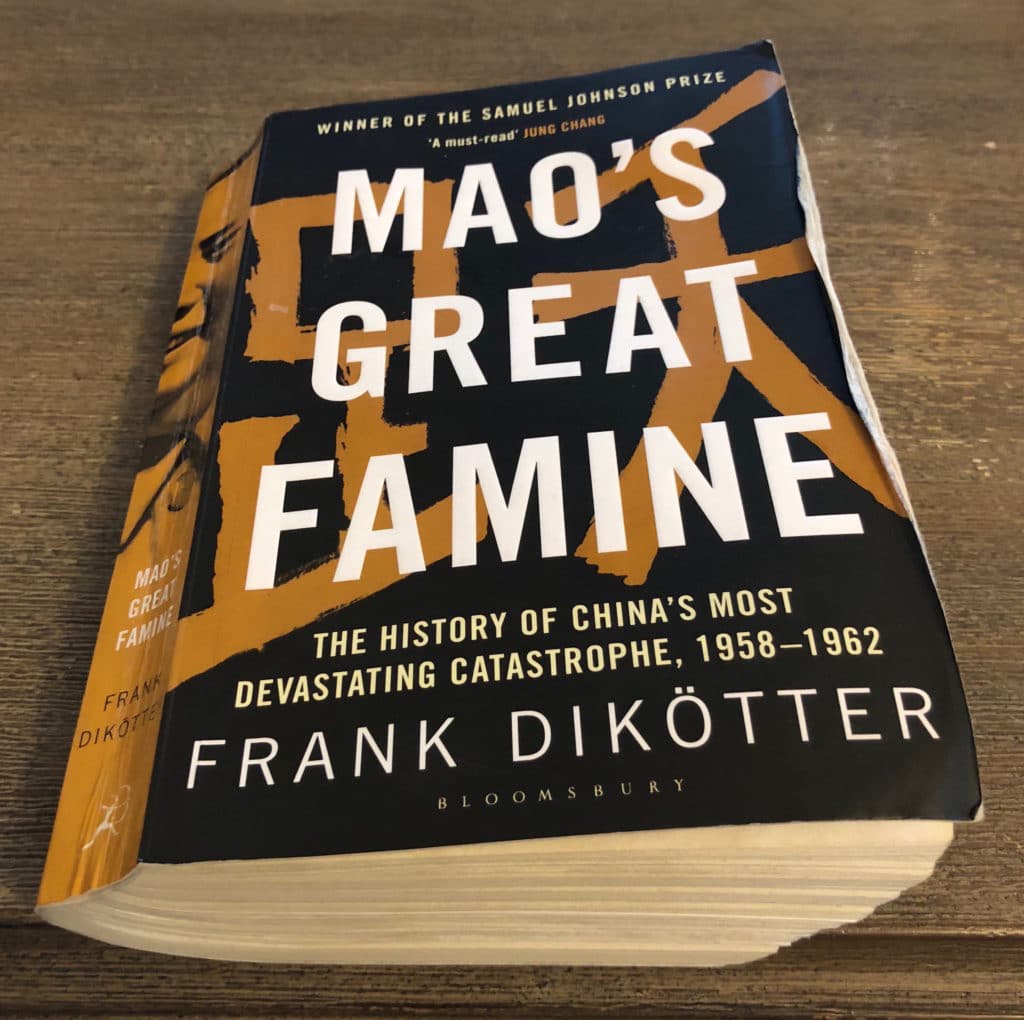

I recently finished a book about the worst, most catastrophic incentive system ever created. This is a very extreme example of misalignment carried out at the highest level of government in the most populous nation on earth.

Mao Zedung came to power in mid-20th century China and killed 45 million people by directing the entirety of the nation’s efforts toward a vain attempt at dethroning Great Britain’s economic supremacy. Russia was pursuing industrial victory over the United States and its Marxist neighbor to the East didn’t want to be outdone on the world’s stage. It sounds stupid, but that’s exactly what sparked a self-inflicted holocaust upon the Chinese people.

Chairman Mao killed more people with this push – known as The Great Leap Forward – than any other world leader in history, and he managed to do it in just four years. He didn’t mean to. But the incentives he set up, and the methods with which he enforced them, virtually guaranteed it.

Frank Dikötter, the author of Mao’s Great Famine, became the first historian in the world to have been granted access to primary source records from government vaults all over China. He uses these firsthand accounts from ministers and documentary evidence to reconstruct how such a horrific period in China’s history had been able to occur…

Thanks to the often meticulous reports compiled by the party itself, we can infer that between 1958 and 1962 by a rough approximation 6 to 8 per cent of the victims were tortured to death or summarily killed – amounting to at least 2.5 million people. Other victims were deliberately deprived of food or starved to death. Many more vanished because they were too old, weak or sick to work. People were killed selectively because they were rich, because they dragged their feet, because they spoke out or simply because they were not liked, for whatever reason, by the man who wielded the ladle at the canteen. Countless people were killed indirectly through neglect, as local cadres were under pressure to focus on figures rather than on people, making sure they fulfilled the targets they were handed by the top planners.

Incentives drove everything. Party officials in Beijing would announce their targets for things like steel production, agricultural quotas, land usage, water consumption, animal husbandry, ore mining and public works projects. Anyone questioning whether or not these targets were feasible was branded a “rightist” or a “conservative” or a traitor and was summarily drummed out of the party or jailed for insubordination. Or assassinated.

The numbers were sent out to party bosses in each province who then relayed them to cadres in each city, town and village. And those numbers better have been hit, or there would be hell to pay. Through some combination or violent coercion, starvation, torture, fraud, abuse and theft, the numbers would be hit and dutifully reported up the chain. After four years of this, ecological disaster had savaged every region in the country while millions starved and died on the side of the road, eating tree bark, shoe leather and even the thatched rooftops of their own homes.

A vision of promised abundance not only motivated one of the most deadly mass killings of human history, but also inflicted unprecedented damage on agriculture, trade, industry and transportation. Pots, pans and tools were thrown into backyard furnaces to increase the country’s steel output, which was seen as one of the magic markers of progress. Livestock declined precipitously, not only because animals were slaughtered for the export market but also because they succumbed en masse to disease and hunger – despite extravagant schemes for giant piggeries that would bring meat to every table. Waste developed because raw resources and supplies were poorly allocated, and because factory bosses deliberately bent the rules to increase output. As everyone cut corners in the relentless pursuit of higher output, factories spewed out inferior goods that accumulated uncollected by railway sidings. Corruption seeped into the fabric of life, tainting everything from soy sauce to hydraulic dams. The transportation system creaked to a halt before collapsing altogether, unable to cope with the demands created by a command economy. Goods worth hundreds of millions of yuan accumulated in canteens, dormitories and even on the streets, a lot of the stock simply rotting or rusting away. It would have been difficult to design a more wasteful system, one in which grain was left uncollected by dusty roads in the countryside as people foraged for roots or ate mud.

The incidents of raping, child abuse, mass murder, cannibalism, jailing, starving, torturing, stealing and more reported in the book are so overwhelming that there are chapters where you just have to set it down and take a deep breath.

There were 45 million premature deaths during and caused by the Great Leap Forward years between 1958 and 1962. This is according to a consensus among the historians who’ve studied archival material and statistics over the last six decades. There are some who believe that this incredibly large death toll may even be understating the tragedy, given that so many of the numbers have come directly from official party records and officials who had a vested interest in hiding it.

China believed it was ready to leap over the socialism practiced by the Soviet Union and go straight into full-on communism, complete with collectivist farms and central control of the economy on a scale never seen before. In order to establish a reputation of success abroad, Mao directed that massive quantities of materials and food be shipped to other Marxist nations around the world as either goodwill or collateral for borrowing. Grain and rice left China even as millions were collapsing from mass famine at home. Equipment and resources were shipped out even as Chinese workers were left without the needed tools to carry out their work or even construct shelters for themselves.

But the news of his own country’s suffering rarely made it to Mao’s doorstep because the entire incentive system was predicated on having him hear only the news that was favorable to what he already believed to be true.

This is an amazing book about human nature, economics and one of the biggest examples of mass delusion in the history of the world. The scale is unimaginable, I found myself gasping on every other page at the sheer numbers of the people involved.

I’ll close the same way I opened, with a Charlie Munger quote I wholeheartedly agree with…

“I think I’ve been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I’ve underestimated it. Never a year passes that I don’t get some surprise that pushes my limit a little farther.”

***

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]

[…] is there, and the incentives make very clear pressures. And as the excellent Charlie Munger claims, “show me the incentives and I will present you the […]

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]

[…] the potential is there, and the incentives create clear pressures. And as the great Charlie Munger says, “show me the incentives and I will show you the […]