Yesterday, thirty people were injured and three killed at a white supremacist demonstration in Charlottesville, Virginia.

Neo-Nazis, far-right militias, the Ku Klux Klan and other hate groups, emboldened by the Presidency that they believe they helped to bring about, are now marching out in the open – no hoods, no masks, no shame.

Just three generations ago, American boys and girls went off to war and died in the hundreds of thousands to defeat these evil ideologies. Fascism is at odds with liberty and freedom. We all agreed on this as a society once upon a time. As descendants of these World War II heroes, we now find ourselves, a scant seven decades later, re-fighting this war – on the streets of our towns, on the internet and, yes, in the halls of government.

On Wall Street, we have a term called trend. It’s a description of the direction a particular stock, bond, index or asset class is headed. An up-trend implies a price that is moving higher. A downtrend is a price that is clearly headed lower. The thing is, powerful trends that last a long time are prone to short periods of time during which they appear to reverse themselves.

We call these counter-trends.

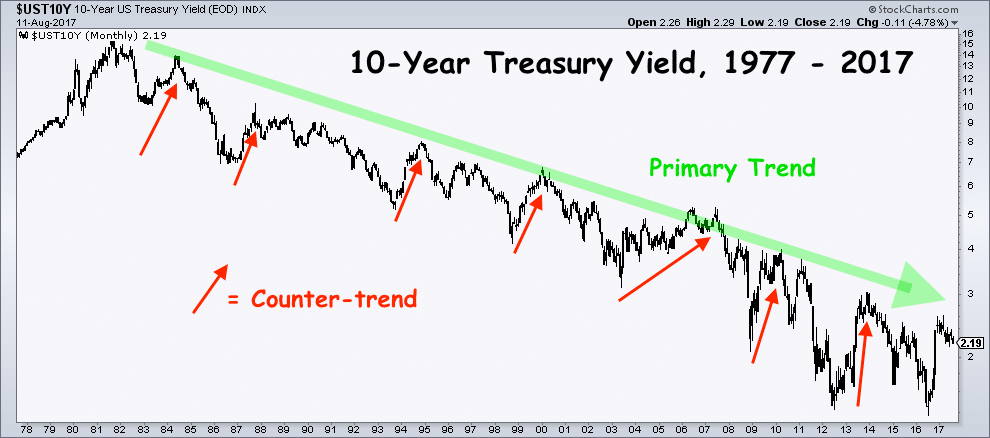

Counter-trends confuse people. They trick us into thinking that the prevailing trend itself has changed. In the chart below, you’ll see the yield on the 10-Year Treasury bond, which has been falling since the middle of 1981 or in a defined trend lower. But it hasn’t all been one smooth ride down. You can see several examples of counter-trends (red arrows) within the larger trend.

They call this relentless drop in interest rates “the great moderation.” It’s easy to see how obvious this trend is, but only with the benefit of hindsight. For investors in 1994, watching the counter-trend rally in interest rates, it would not have been so easy to believe that the primary trend was still intact. A sudden spike of 20% in the 10-Year Treasury’s interest rate took everyone by surprise and scared a lot of people who were suddenly looking at paper losses in their “safest” investments.

Counter-trends will do that. They’ll take us by surprise and shock the people who had grown accustomed to an established, prevailing trend.

The events of this weekend – and, frankly, this whole year – are as counter-trend as it gets. The resurgence of a lot of old, bad ideas – tolerance for mass pollution, ethnicity-based travel bans, state-sanctioned discrimination, misogyny and harassment, race-baiting and dog-whistling, Nazi and Klan propaganda as a tool of political expediency, the vilification of the free press, fascist demagoguery – all of this stuff sat on the junk heap of history for years. It’s like someone lifted a rock and out crawled all of the monstrous ideas our ancestors had spent decades slaying.

It can be discouraging. Disheartening. We’re fighting Nazis in 2017? Nazis?!?

Don’t be discouraged. Don’t be disheartened. This is not the prevailing trend. It’s just a counter-trend. We will win. They will lose. Just like the last time and the time before that. As Dr. Martin Luther King, Jr. said, “The arc of the moral universe is long, but it bends toward justice.” An arc is a trendline.

When you see a few dozen militant racists marching across a college campus with torches, you need to remember that there are 320 million people in the United States of America who revile them as much as you do. Who are disgusted and want no part of what they’re talking about. Every day, in all 50 states, people from all races and religions go to work with each other, shop at the same malls, drop their children off at the same schools and dream the same dreams for their families and their futures.

The only reason the hatred draws so much attention to itself is because of how exceedingly rare it is – outlier events, like counter-trends in the market, get a lot of attention because of their novelty, not because they are an ordinary occurrence.

The greater trend, the one that will ultimately be seen as the prevailing trend when this ugliness is behind us, is a great moderation of evils and extremism. We’ll have flare-ups like Charlottesville, and they will be upsetting. But they’re mere counter-trends bumping up against a larger reality: The world is becoming a better place, not a worse one. We are becoming less violent as a society, better educated and more inclusive. That’s the only trend worth focusing on, as opposed to the occasional missteps that seemingly send us backwards.

We are in a continual state of advancing, regardless of what a handful of miscreants would have you believe.

Yesterday’s response to the demonstration proves this. People of all backgrounds and colors and beliefs stood up to what they saw happening in their town. Religious people, working class people, educated people, Republicans and Democrats, people in their sixties and people in their twenties. Even kids. Especially kids.

And it is our kids who will ensure that the primary trend remains in force, for many years to come.

Teenagers standing up to a sea of white supremacists carrying torches.

Snowflakes my ass. pic.twitter.com/HbQXOlkjrt

— Downtown Josh Brown (@ReformedBroker) August 12, 2017

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2017/08/13/counter-trend/ […]