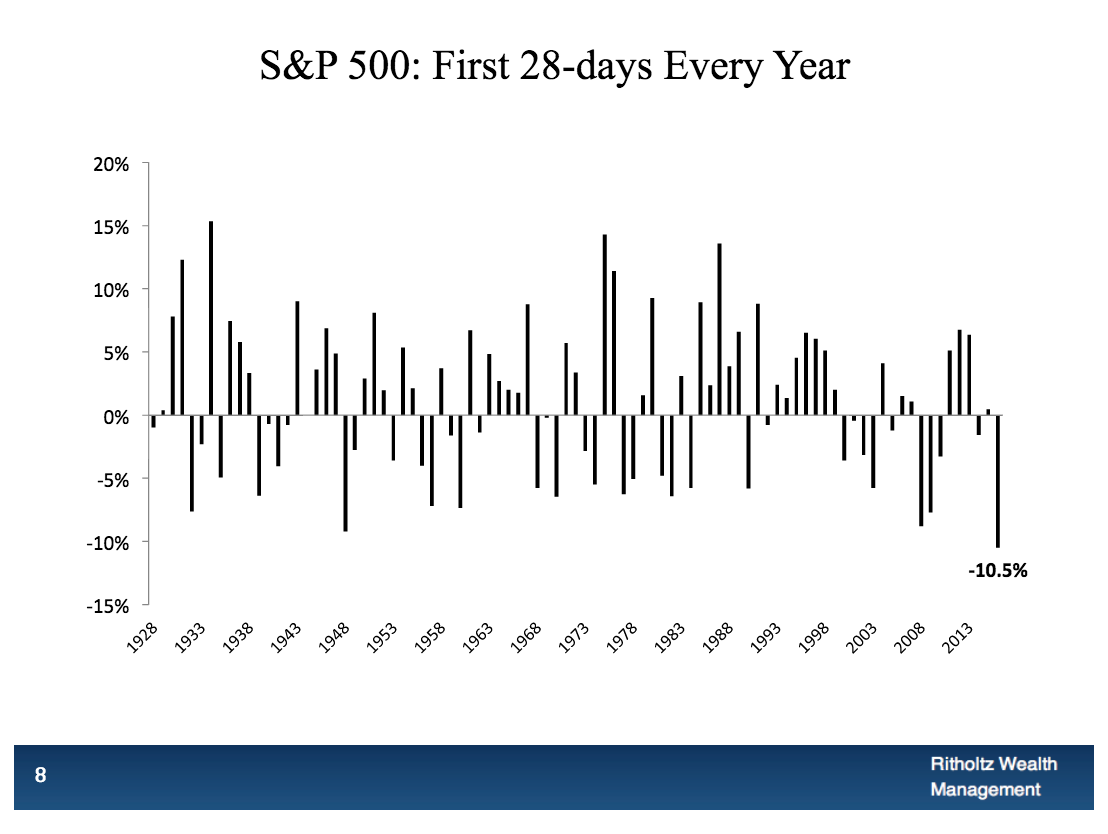

Think back to January. We had the worst start to a year for US stocks ever. EVER! For as far back as we have data.

Michael Batnick put together the below chart to illustrate how bad it was for our client-only conference call last night at Ritholtz Wealth Management:

Lots of people were using this little tidbit to scare you. They built it up into this thing where “As goes January, so goes the rest of 2016.” They told you to liquidate your 401(k)! They told you it was just the beginning.

Nothing’s more detrimental than the recency bias – and at that time, the recent situation for stocks was a bitch.

But, as it turns out, the way a stock market year starts out contains no useful information in terms of where a year will end. None. Zero. I want to show you something…

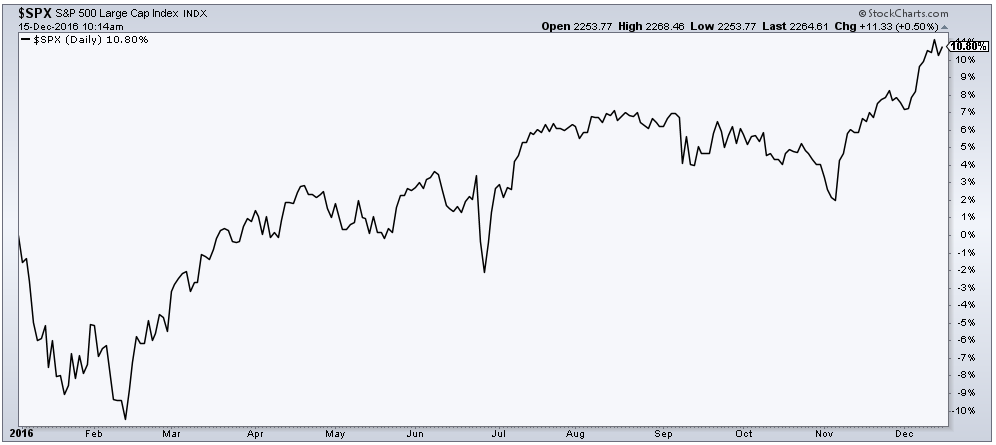

Here’s what happened with the S&P 500, after the worst start to a year in history – positive 10.8% not including dividends:

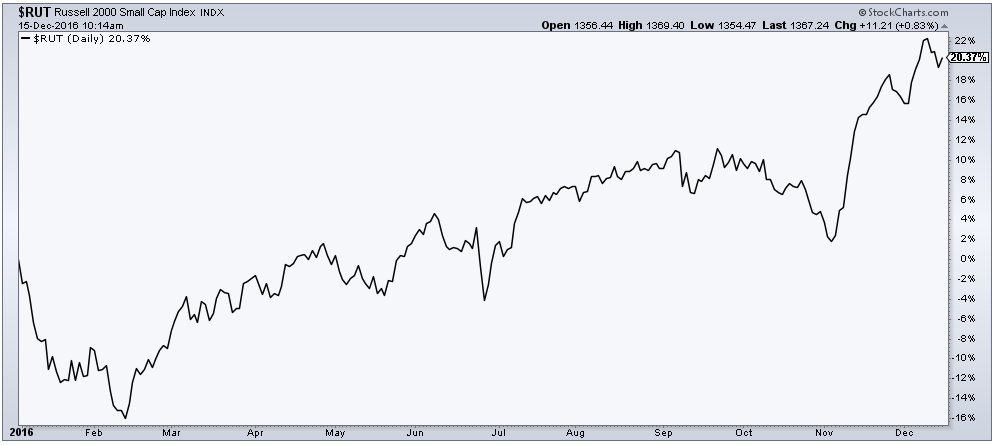

This next one is wild af. The Russell 2000 small cap index was down 17% in the first four weeks of the year! It was down almost 30% from its all-time high! Lots of talk about how “small caps are the canary in the coal mine.” Oops! The Russell 2000, after the worst start ever, is now up 20.5% for 2016 – also not including dividends!

Here is the Dow Transportation Average – another coal mine canary according to the old wives tales. The transports started January down 10%. They are now up an astounding 26% on the year. So much for that:

Finally, the other boogey man they like to frighten people with – the emerging markets stocks. EM began the first 28 days of the year down a menacing 14.2%. They are poised to finish the year up 10.5%:

It’s important to note that this happened in the absence of quantitative easing by the Fed and with the pace of US stock buybacks down substantially from the prior year. This also happened in the context of an “earnings recession” and with all of the uncertainty of the most rancorous election of our lifetime, slowing Chinese economic data, Brexit, a spike in European nationalism and all of the other horrible sh*t you could toss into the cauldron.

My message is not that we will always get a happy ending. Rather, it’s that the market will frequently twist and turn throughout the course of a year and do some very unexpected things, regardless of how the experts believe the headlines or risks “should be” interpreted by investors. This is because markets quickly price in current events and then move on to the next thing – this process happens at a pace that far exceeds our own abilities to make sense of the world.

2016 is another year in which the meteor somehow just missed the earth. Maybe in future years we won’t be so lucky. That’s why the game is so hard. Too hard to be played for 99% of us with any hope of ever winning.

“Paradoxically, when ‘dumb’ money acknowledges its limitations, it ceases to be dumb.”

– Warren Buffett, 1993 Berkshire Hathaway Shareholder Letter

***

If you’ve had enough of the noise, we can help you. Visit Ritholtz Wealth Management and get started on a new path for 2017 and beyond.

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2016/12/15/the-worst-start-to-a-year-ever/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2016/12/15/the-worst-start-to-a-year-ever/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2016/12/15/the-worst-start-to-a-year-ever/ […]