Savita’s group at Bank of America Merrill Lynch assesses the damage after week 5 of earnings season, noting that the bottom-line earnings for the S&P 500 represented a 5% gain over consensus estimates going into the reports.

The Quant and Equity Strategy team notes that “61% of companies have beaten on EPS, 47% have beaten on sales and 35% have beaten on both…While sales beats individually are still below average, the proportion of companies beating on EPS is well above average, and the proportion beating on both metrics is in-line with the long-term average.”

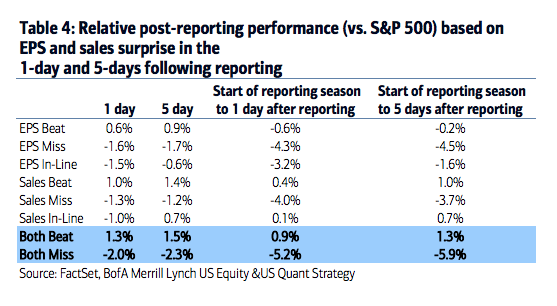

But the companies that missed their numbers were treated far more harshly than the beaters were rewarded…

Misses punished more than beats rewarded

From the start of earnings season through the day after reporting, companies that beat on EPS and sales outperformed by just 1ppt, while those that missed on both underperformed by over 5ppt. Misses were punished the most within Energy and Industrials, where stocks that missed lagged by 11ppt and 8ppt, respectively, over that period. Some of the biggest post-reporting selloffs this earnings season came from either crowded or momentum stocks that posted weak results or outlooks – we believe this could be an early signal of risk to continued uptrends, and that a change in leadership is likely (especially with the Fed slated to tighten next month)

Source:

Earnings season update

Bank of America Merrill Lynch – August 10th 2015

Chart o’ the Day: a punishing season for earnings misses… (http://t.co/fmKOOQntdD)

RT @ReformedBroker: Chart o’ the Day: a punishing season for earnings misses http://t.co/R070mx6G15

RT @ReformedBroker: Chart o’ the Day: a punishing season for earnings misses http://t.co/R070mx6G15

Chart o’ the Day: a punishing season for earnings misses by @ReformedBroker http://t.co/hQg1J54ZTq

US earnings season: the proportion of companies beating on EPS is well above average but earnings misses punished http://t.co/Iyy5Ay3Oy6

RT @ReformedBroker: Chart o’ the Day: a punishing season for earnings misses http://t.co/R070mx6G15

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2015/08/11/chart-o-the-day-a-punishing-season-for-earnings-misses/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2015/08/11/chart-o-the-day-a-punishing-season-for-earnings-misses/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2015/08/11/chart-o-the-day-a-punishing-season-for-earnings-misses/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2015/08/11/chart-o-the-day-a-punishing-season-for-earnings-misses/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2015/08/11/chart-o-the-day-a-punishing-season-for-earnings-misses/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2015/08/11/chart-o-the-day-a-punishing-season-for-earnings-misses/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/08/11/chart-o-the-day-a-punishing-season-for-earnings-misses/ […]