It can’t possibly be. Companies are missing on revenue left and right. Economic data is coming in looking like ass. The Fed is hellbent on getting a rate hike in.

And yet, a new record high for the NYSE Composite as the week closed out. A setup that could portend the next leg higher after 10 months of consolidation. How? Why? Is it a trick? A ruse to suck in the last holdouts? Is this the thrust that pulls in the remaining Hussman AUM?

If the breakout is a head fake, it certainly is an elaborate one. Consider that the NYSE Composite is made up of over 2000 securities – all of which meet the stringent requirements of listing on the exchange. The index is comprised using a free-floating market cap methodology, so it’s broad and deep. And it’s just taken out resistance at a highly improbable moment if you’re reading the latest headlines. Relative strength is confirming. This thing wants higher:

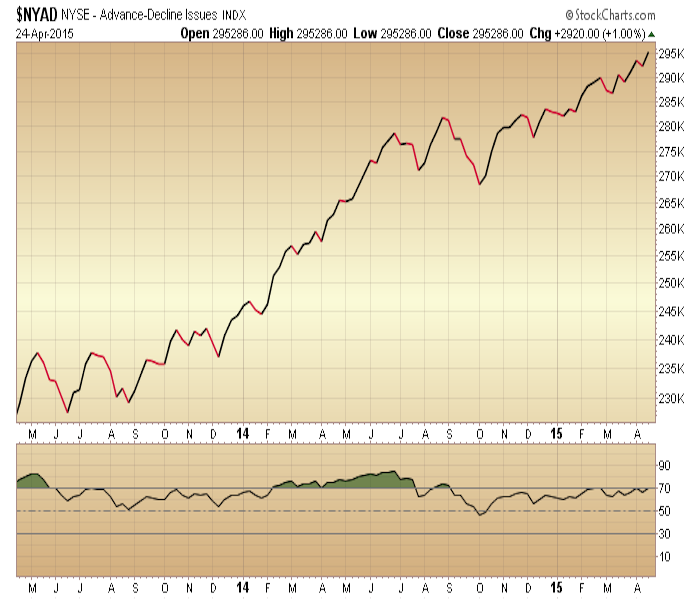

Also whipped up the below cumulative NYSE Comp advance/decline chart, which has already broken out, thanks in part to the foreign stocks and REITs that are leading ahead of the S&P this year:

So yes, it could be a trap. But if it is, someone should tell all the freely-traded issues involved to stop going higher.

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2015/04/26/if-this-is-a-head-fake-it-sure-is-an-elaborate-one/ […]