Pascal’s Wager goes something like this:

You cannot prove the existence of God, but you also cannot prove that God doesn’t exist. Therefore, you may as well bet that he does.

If you’re a reasonable person, you recognize that the upside and the downside of believing or not believing are asymmetrical. If you wager that there is no God, and you are right, the reward is very little if anything upon death. But if you wager against the existence of God – and it turns out that God does exist – your downside is immense; eternal damnation for starters. Therefore, a wager that there is a God – and a life lived accordingly – is the only rational course of action.

It’s a weak argument for the existence of God because if you’re only betting (or pretending to believe), surely the Almighty would be able to see your gambit for what it is and damn you anyway. But let’s confine our discussion here to more earthly pursuits – namely, the right approach to tactical asset allocation for a retirement portfolio.

In our view, many market participants conduct tactical strategies as though they’re implementing the stock market version of Pascal’s Wager. By treating every dip in the market as though it’s worthy of a reaction, investors are “betting” that they are saving themselves and being proactive just in case the next bear market is about to begin. As I will show in this post, this belief-based approach is highly destructive to potential returns. Our answer to the tactical puzzle – the “when do we sell?” question – came about by asking the opposite one: How do we structure this to keep us from selling until we’d really want to be out?

First, a bit of background on our overall investment philosophy: We believe that less is more, that costs should be low and that markets work. While we don’t attempt to predict the future, we do analyze the present and calculate probabilities from the past. We prize evidence over excitement and durability over everything.

Our typical client portfolio is heavily invested in a low-turnover, low-cost, strategic asset allocation model that meets the objectives of the financial plan we’ve drafted for them. Alongside this asset allocation portfolio might be a specific weighting to our tactical strategy, which is called Goaltender. In our view, an optimal portfolio for wealthy individuals is predominantly strategic but contains a tactical overlay that acts as a hedge (or an emotional release valve) in times of real market stress. As AQR founder Cliff Asness says, “The great strategy you can’t stick with is obviously vastly inferior to the very good strategy you can stick with.” Our job as asset managers is to build and manage portfolios that our clients can stick with. We believe that the combination of strategic with tactical – if done correctly – can get the job done.

The problem with nearly every existing tactical solution we’ve looked at is that they actually want to trade. They love it, it’s their raison d’être. They’re actively looking for reasons to buy and sell, all the time. Unfortunately, this penchant for taking action stands in direct opposition to our responsibility as fiduciaries – it runs up large trading costs and amps up a client’s short-term capital gains taxes (in a best case scenario!). And these costs come before we even factor in management costs, hedging losses, etc.

And so, when we set about building our own tactical model, the central objective was to come up with reasons to trade as infrequently as possible – and to make every buy and sell count. In other words, our Goaltender strategy is a tactical model built by a wealth management firm for wealth management clients.

To demonstrate why having such a high hurdle for making buy and sell decisions is important, I had my firm’s director of research, Michael Batnick, run a backtest based on a hypothetical investor who reacts to every dip in the market. We’ll call it the “False Alarm” strategy.

Suppose he sold out a portfolio consisting of S&P 500 stocks every time his portfolio’s value dropped by 5%. Now, suppose he bought back in once the market was 1% higher from the point he had sold out at – in other words, the moment “the coast was clear” and stocks were rallying again. Had he been doing this systematically, he would have avoided many of the worst drawdowns throughout history. But he would also have chewed up his potential returns, with an annual gain of just 2.8% being the result of this behavior. He’s effectively turned his portfolio of stocks into a portfolio of bonds.

This is obviously an extreme example, but it is not very dissimilar to the way many tactical strategies work. There’s a recurring guest (character?) on financial TV who is the epitome of this kind of manic trading – he’s a seller on all dips and a buyer-backer after each recovery. One day, the “sell everything” call will work…until then, it’s a clown show.

We believe that a tactical strategy should, first and foremost, be built on the premise that some volatility simply must be endured. It should also encompass the reality that most 5% dips do not become full-blown bear markets. Using data since the inception of the S&P 500 in 1957, we make the following key observations:

- There have been 48 instances in which the S&P 500 was in a drawdown of 5% from all-time highs.

- In only 17 of those 48 instances did the drawdown extend to 10%.

- In only 9 of those 48 instances did the the drawdown extend to 20% or worse – in other words, the nine actual bear markets of the last six decades.

The bottom line is that 5% dips from all-time highs in the S&P 500 become bear markets less than 20% of the time. Said another way, it’s a false alarm more than 80% of the time.

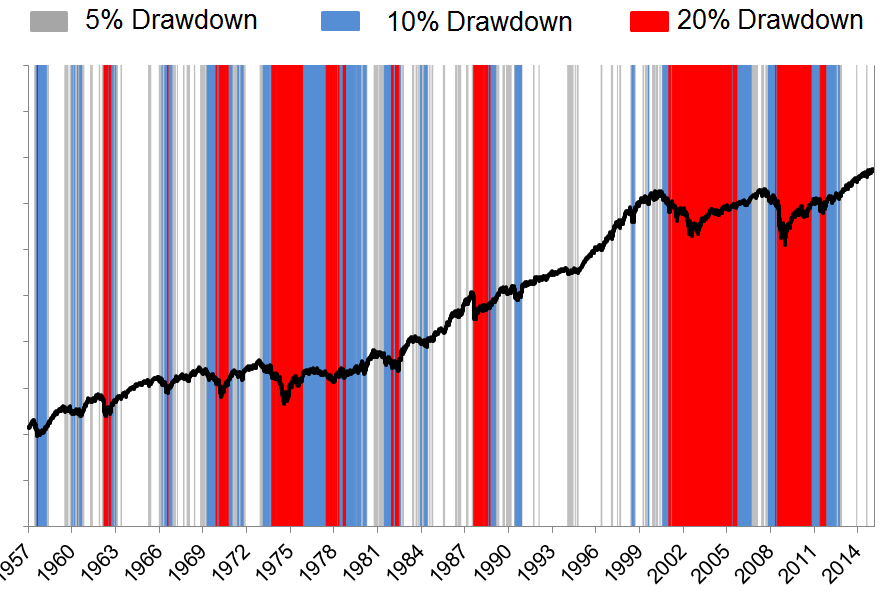

In the chart below, I’m showing you how often the S&P 500 is in drawdowns of greater than 5, 10 and 20% from all-time highs. The white space is when the S&P 500 is at or within 5% of all-time highs (my god, look at the 1990’s!).

You’ve probably never seen this data displayed quite this way so allow me to unpack it a bit…

On a daily basis, the S&P 500 trades at an all-time high 7% of the time and trades within 5% of an all-time high 36% of the time. This means that on 43% of all days, since the S&P 500’s inception, US large cap stocks were at or close to making new records. Anyone who tells you that new highs are abnormal or a reason to sell is a fool.

It should come as no surprise that investors have spent much of the recent bull market biting their fingernails given the “lost” decade that preceded it. Fortunately, it is an anomaly for the S&P 500 to spend that much time in red – or more than 20% from all-time highs. Other than the mid-1970’s, there’s really nothing similar to the post-millennial bear that’s left such a nasty scar on the collective psyche of the investor class. Most of the time, stocks are within 10% of record highs and being overly tactical becomes a cost rather than a benefit.

Our tactical methodology, then, is based on isolating the potential for when a 5% dip may become something more. We can’t predict in advance, obviously. We can calibrate our reaction, though, and we do so based entirely on price and trend inputs. Goaltender does not utilize emotion, instinct, opinion, narrative, gut feelings, political leanings or hopes and dreams.

Because Goaltender was built with our wealth management clients in mind, we’re forced to shrug off the routine dips that are a fact of life for the stock market. Minimizing normal market volatility is not the objective. By focusing our attention on the severe downtrends that our clients (rightly) fear, we hope to avoid the costs and taxes that the more trigger-happy tactical strategies inflict.

As the stock market fluctuates, the Pascals of the world may ask “Why not sell, just in case?” We’re looking for reasons not to.

***

If you think we can help you with your portfolio and financial planning, get in touch here.

Advisors: Ritholtz Wealth is now expanding. Get in touch about joining our team here.

As a reminder, nothing mentioned in the post above should be considered as advice or a solicitation to buy or sell any securities.

سكس اون لاين

[…]just beneath, are a lot of completely not associated web pages to ours, on the other hand, they are surely worth going over[…]

app for pc download

[…]Sites of interest we’ve a link to[…]

[…] almost never discuss our tactical asset allocation strategies publicly (two rare exceptions here and here) and even in this case I won’t be (can’t be) getting into any details. But […]

خرید طلا

Appreciating the time and energy you place into your blog and in depth info you offer. It is excellent to come across a site each once in a while that isn’t the identical undesirable rehashed information. Great study! I have saved your site and I’m int…

دوربین

Compose a lot more, thats all I have to say. Actually, it appears as even though you relied on the video to make your position. You clearly know what youre conversing about, why waste your intelligence on just publishing video clips to your site when y…

largerbox

Hi there would you mind permitting me know which webhost you’re employing? I’ve loaded your blog in 3 totally distinct browsers and I should say this website loads a good deal quicker then most. Can you suggest a very good hosting company at a trustwor…

دوربین

typically posts some amazingly intriguing things like this. If youre new to this internet site

مه پاش

Howdy would you head permitting me know which webhost you are making use of? I have loaded your blog in three entirely various browsers and I have to say this site masses a great deal a lot quicker then most. Can you recommend a great internet hosting…

خرید طلا

the time to study or get a appear at the content material or web-web sites we have connected to underneath the

دوربین

Fantastic story, reckoned we could mix many unrelated knowledge, nonetheless truly actually well worth using a look for, whoa did a single distinct grasp about Mid East has received a great deal a lot more problerms also

دوربین

Very good put up! We will be linking to this fantastic submit on our web site. Preserve up the very good writing.

porno

[…]usually posts some extremely interesting stuff like this. If you are new to this site[…]

دوربین

Thank you for some other excellent write-up. Exactly where else could just any individual get that variety of details in this kind of an best indicates of creating? I’ve a presentation up coming 7 days, and I am on the search for such info.

dagje uit

[…]always a big fan of linking to bloggers that I really like but do not get a great deal of link adore from[…]

Hot Summer Deals

[…]always a major fan of linking to bloggers that I love but really don’t get a lot of link love from[…]